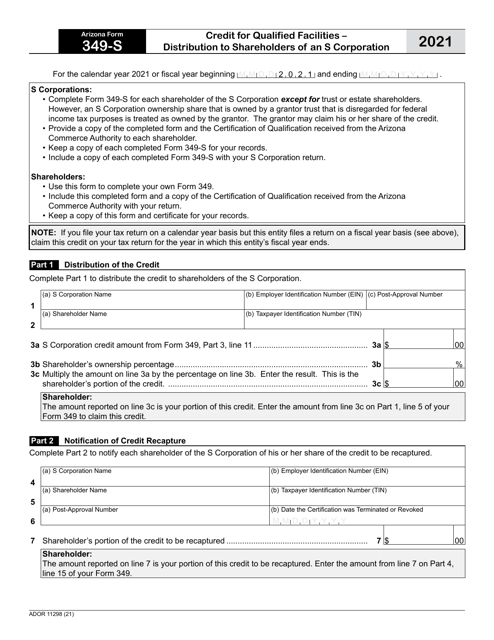

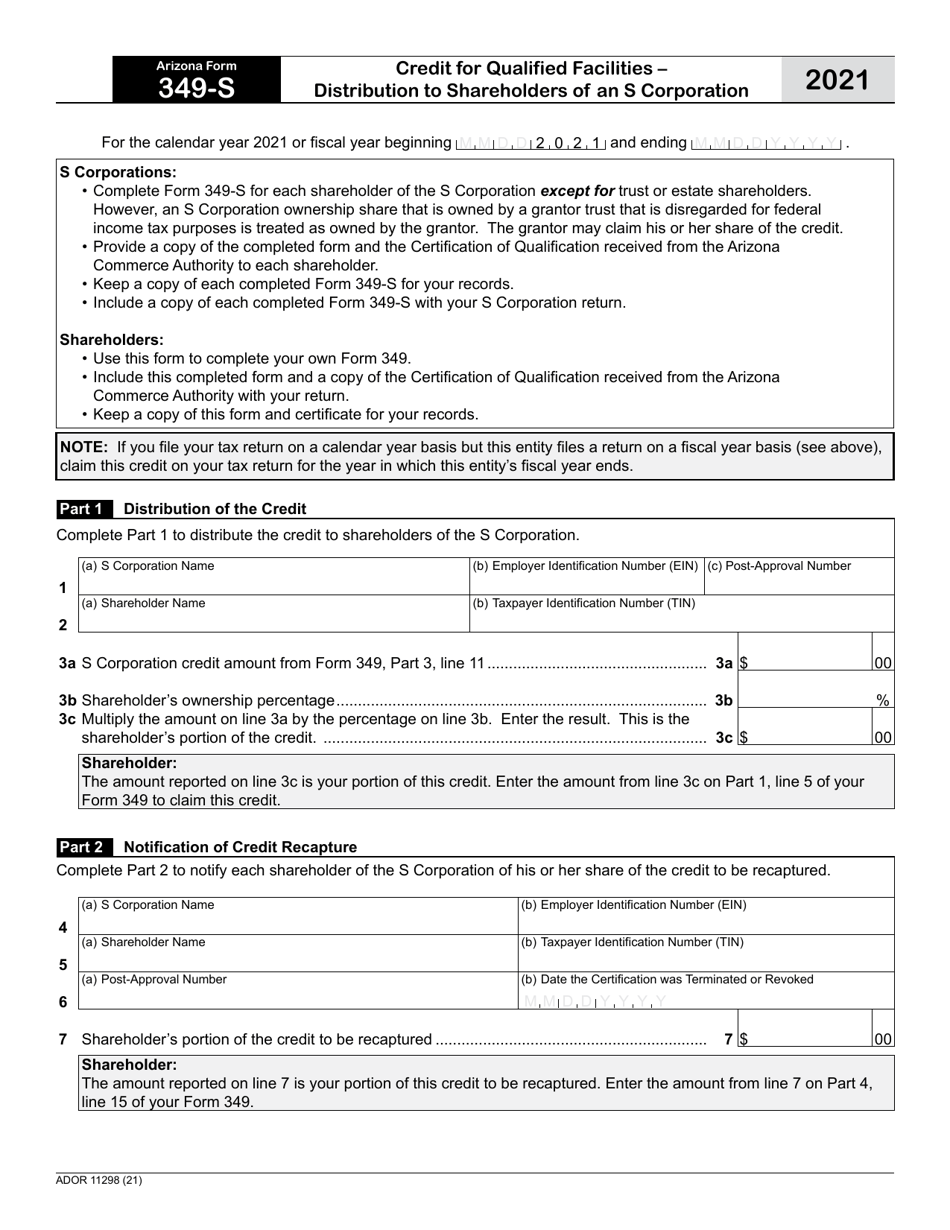

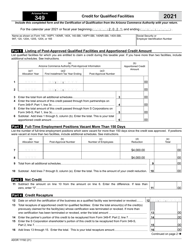

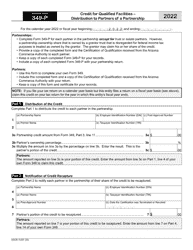

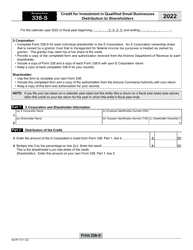

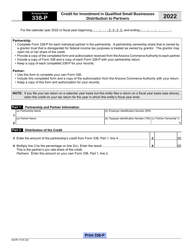

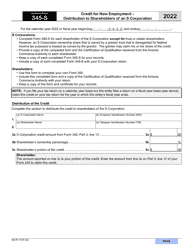

Arizona Form 349-S (ADOR11298) Credit for Qualified Facilities - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 349-S (ADOR11298)?

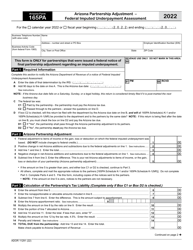

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 349-S?

A: Arizona Form 349-S is a form used for claiming the Credit for Qualified Facilities - Distribution to Shareholders of an S Corporation in Arizona.

Q: Who can use Arizona Form 349-S?

A: The form is used by S Corporations in Arizona to claim a credit related to qualified facilities.

Q: What is the purpose of the Credit for Qualified Facilities - Distribution to Shareholders?

A: The purpose of this credit is to encourage investment in certain qualified facilities.

Q: What information is required to complete Arizona Form 349-S?

A: To complete the form, you will need to provide information about the qualified facility, the distribution to shareholders, and other required details.

Q: When is the deadline to file Arizona Form 349-S?

A: The deadline to file Arizona Form 349-S is the same as the due date for Arizona corporate income tax returns, which is the 15th day of the 4th month following the close of the tax year.

Q: Is there a fee to file Arizona Form 349-S?

A: No, there is no fee to file Arizona Form 349-S.

Q: Can I file Arizona Form 349-S electronically?

A: Yes, Arizona Form 349-S can be filed electronically through the Arizona Department of Revenue's e-file system.

Q: Are there any other forms or attachments required to be submitted with Arizona Form 349-S?

A: No, there are no additional forms or attachments required to be submitted with Arizona Form 349-S.

Q: What should I do if I need help completing Arizona Form 349-S?

A: If you need assistance with completing Arizona Form 349-S, you can contact the Arizona Department of Revenue directly or consult a tax professional.

Form Details:

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 349-S (ADOR11298) by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.