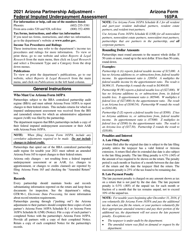

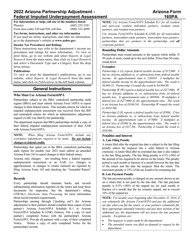

This version of the form is not currently in use and is provided for reference only. Download this version of

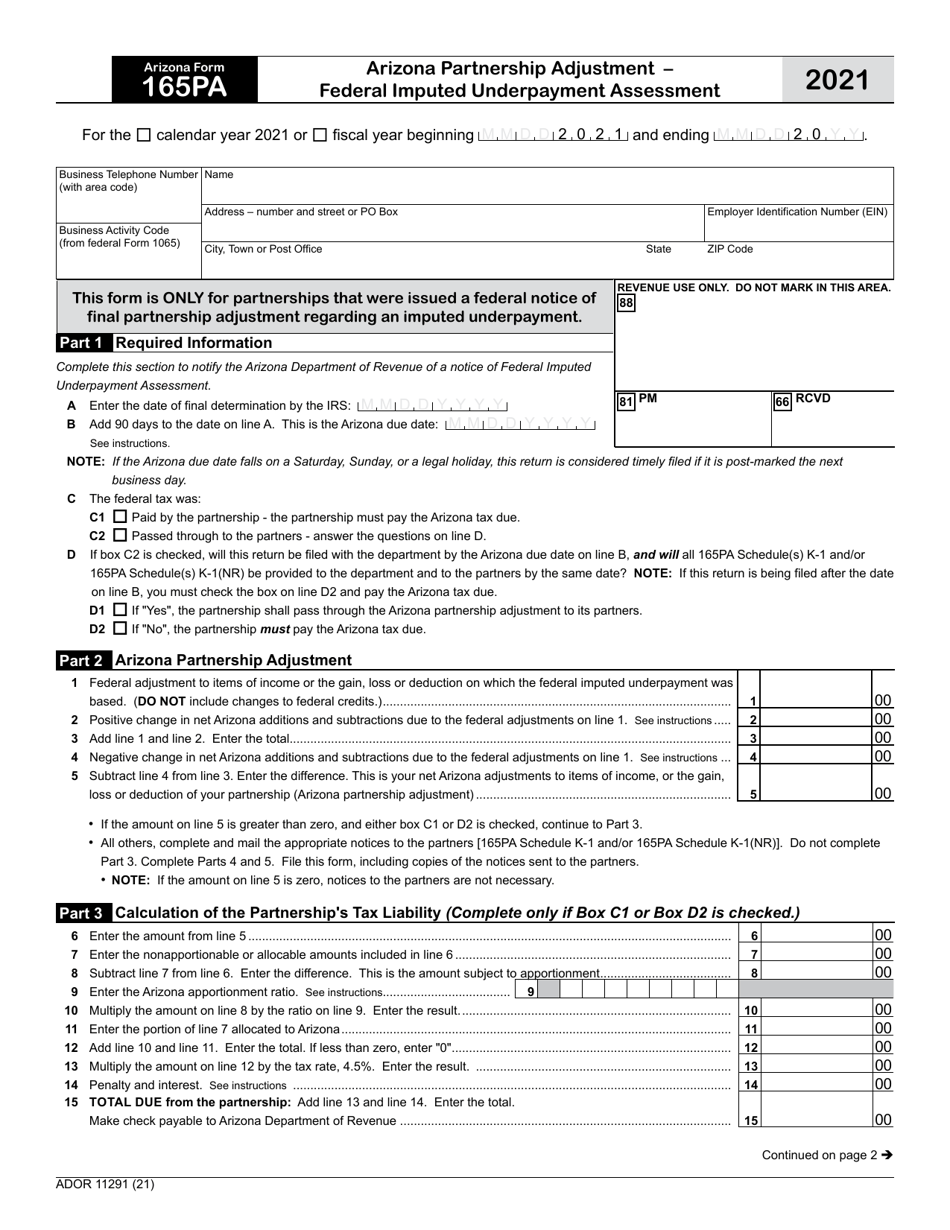

Arizona Form 165PA (ADOR11291)

for the current year.

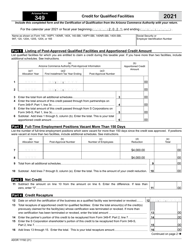

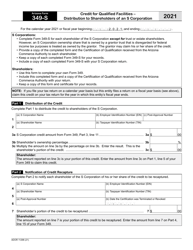

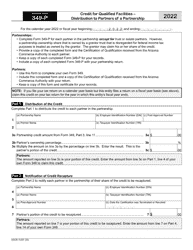

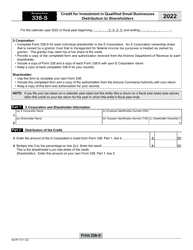

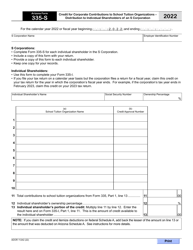

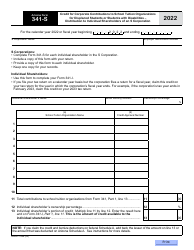

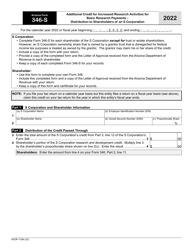

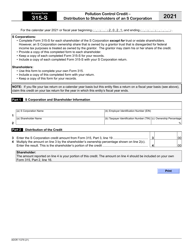

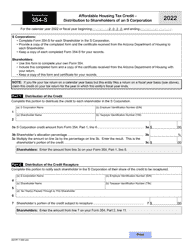

Arizona Form 165PA (ADOR11291) Credit for Qualified Facilities - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 165PA (ADOR11291)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

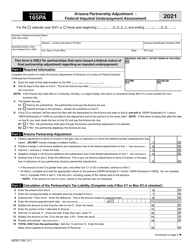

Q: What is Arizona Form 165PA?

A: Arizona Form 165PA is a tax form.

Q: What does ADOR11291 stand for?

A: ADOR11291 is the form number for Arizona Form 165PA.

Q: What is the purpose of Arizona Form 165PA?

A: The purpose of the form is to claim a credit for qualified facilities.

Q: Who can use Arizona Form 165PA?

A: S corporations in Arizona can use this form.

Q: What is the credit for qualified facilities?

A: The credit is a tax incentive provided by the state of Arizona for certain types of facilities.

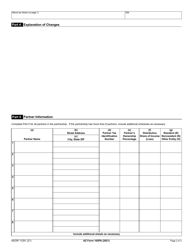

Q: What is meant by 'distribution to shareholders'?

A: A distribution to shareholders refers to the payment of profits or dividends to the owners of an S corporation.

Q: What is an S corporation?

A: An S corporation is a type of business entity that is treated as a pass-through entity for tax purposes.

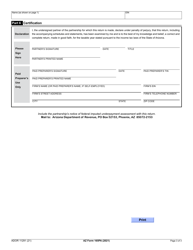

Q: Is Arizona Form 165PA specific to Arizona residents?

A: Yes, the form is specific to residents of Arizona.

Q: What should I do if I have questions about Arizona Form 165PA?

A: If you have questions, you should contact the Arizona Department of Revenue for assistance.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 165PA (ADOR11291) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.