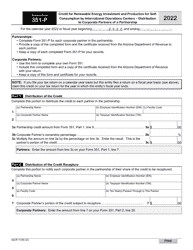

This version of the form is not currently in use and is provided for reference only. Download this version of

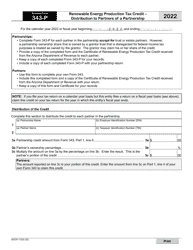

Arizona Form 318-P (ADOR11325)

for the current year.

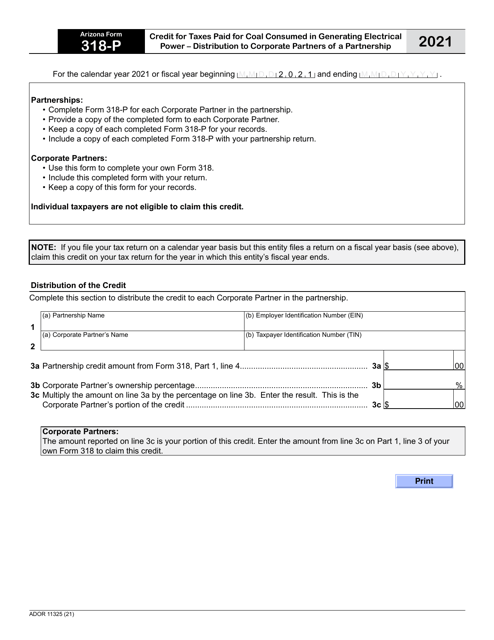

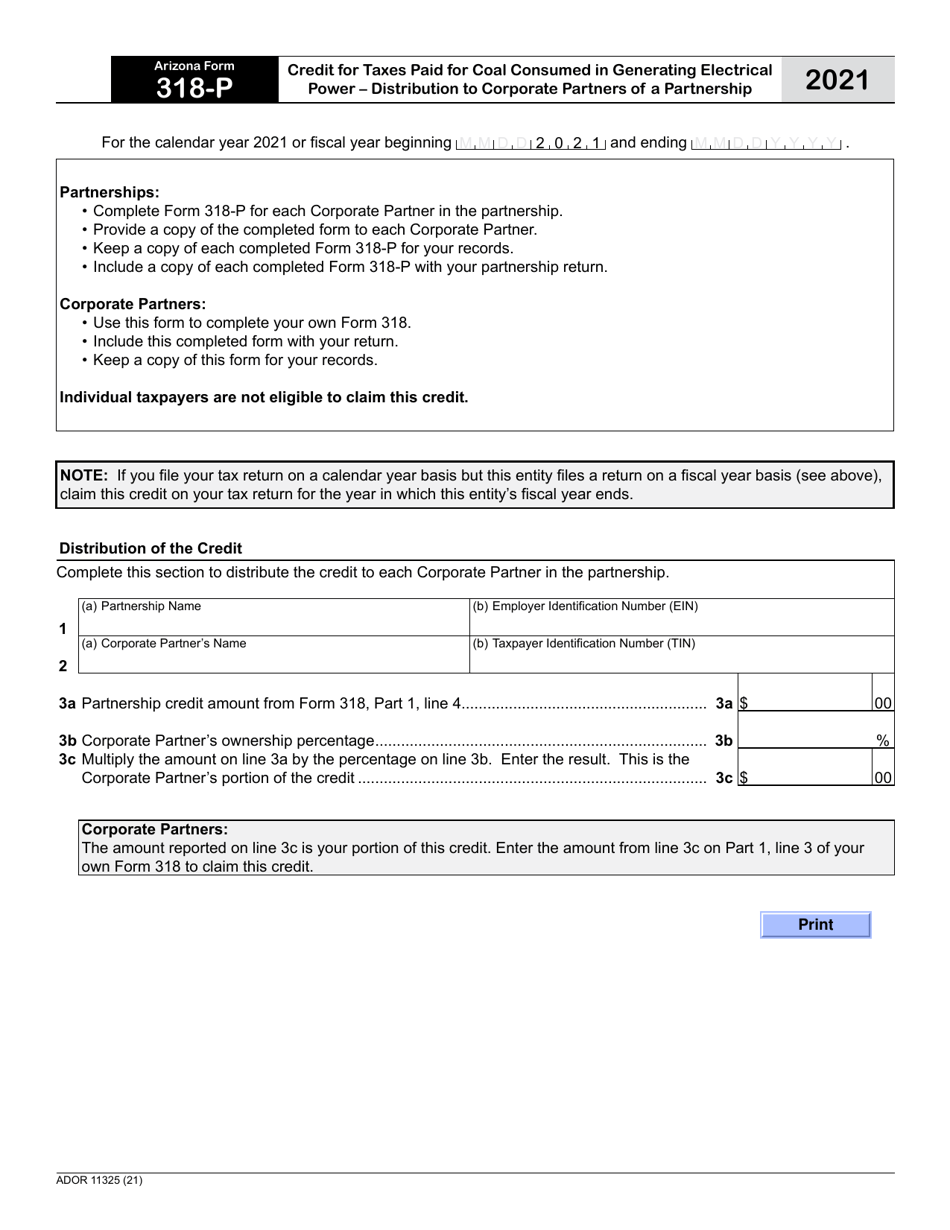

Arizona Form 318-P (ADOR11325) Credit for Taxes Paid for Coal Consumed in Generating Electrical Power - Distribution to Corporate Partners of a Partnership - Arizona

What Is Arizona Form 318-P (ADOR11325)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 318-P?

A: Arizona Form 318-P is a tax form used to claim a credit for taxes paid for coal consumed in generating electrical power.

Q: Who can use Arizona Form 318-P?

A: Arizona Form 318-P is used by corporate partners of a partnership to report and distribute the credit for taxes paid for coal consumed in generating electrical power.

Q: What is the purpose of Arizona Form 318-P?

A: The purpose of Arizona Form 318-P is to distribute the credit for taxes paid for coal consumed in generating electrical power among the corporate partners of a partnership.

Q: Do I need to file Arizona Form 318-P as an individual taxpayer?

A: No, Arizona Form 318-P is specifically for corporate partners of a partnership. Individual taxpayers do not need to file this form.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 318-P (ADOR11325) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.