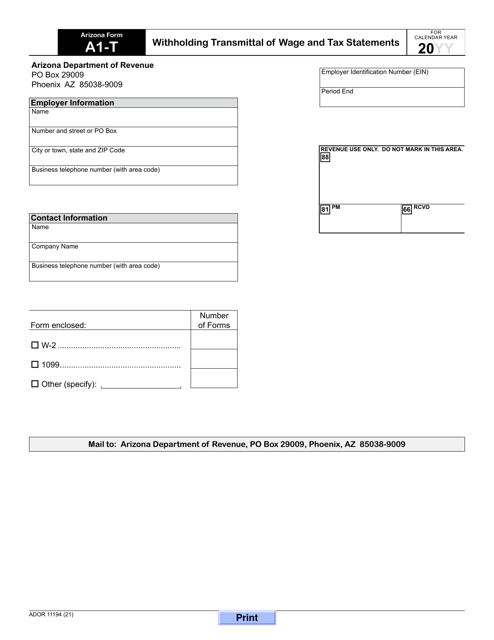

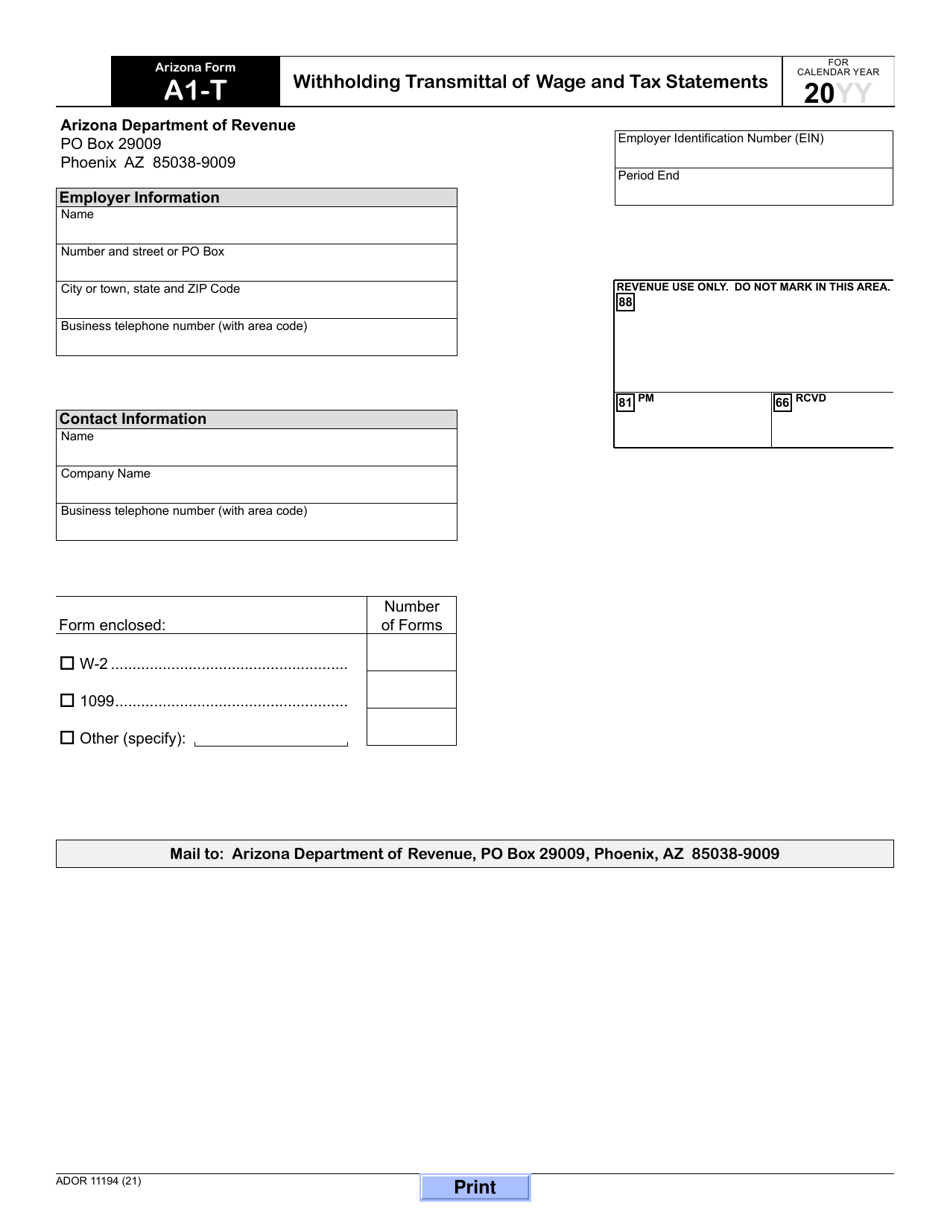

Form A1-T (ADOR11194) Withholding Transmittal of Wage and Tax Statements - Arizona

What Is Form A1-T (ADOR11194)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form A1-T?

A: Form A1-T is the Withholding Transmittal of Wage and Tax Statements form used in Arizona.

Q: What is the purpose of Form A1-T?

A: The purpose of Form A1-T is to transmit the wage and tax statements (W-2, 1099) to the Arizona Department of Revenue.

Q: Who needs to file Form A1-T?

A: Employers in Arizona who are required to withhold state income tax from wages or make payments that are subject to withholding must file Form A1-T.

Q: When is Form A1-T due?

A: Form A1-T is due by February 28th or by the last day of the month following the end of the quarter, whichever comes first.

Q: Are there any penalties for not filing Form A1-T?

A: Yes, failure to file Form A1-T or filing it late may result in penalties imposed by the Arizona Department of Revenue.

Q: Is Form A1-T the same as Form A1-R?

A: No, Form A1-T is used for transmitting wage and tax statements, while Form A1-R is used for reconciling Arizona withholding.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A1-T (ADOR11194) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.