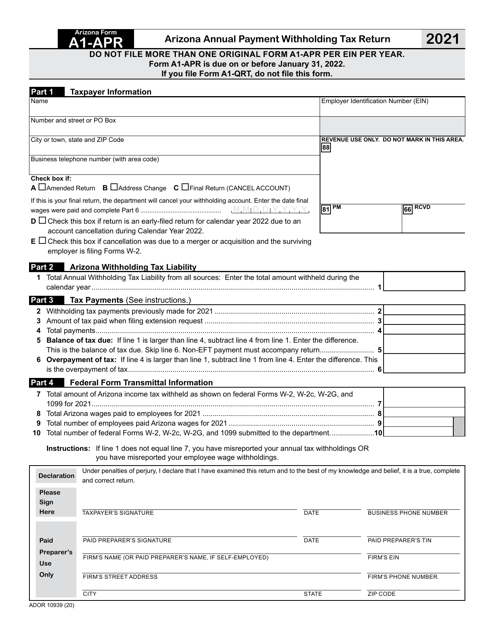

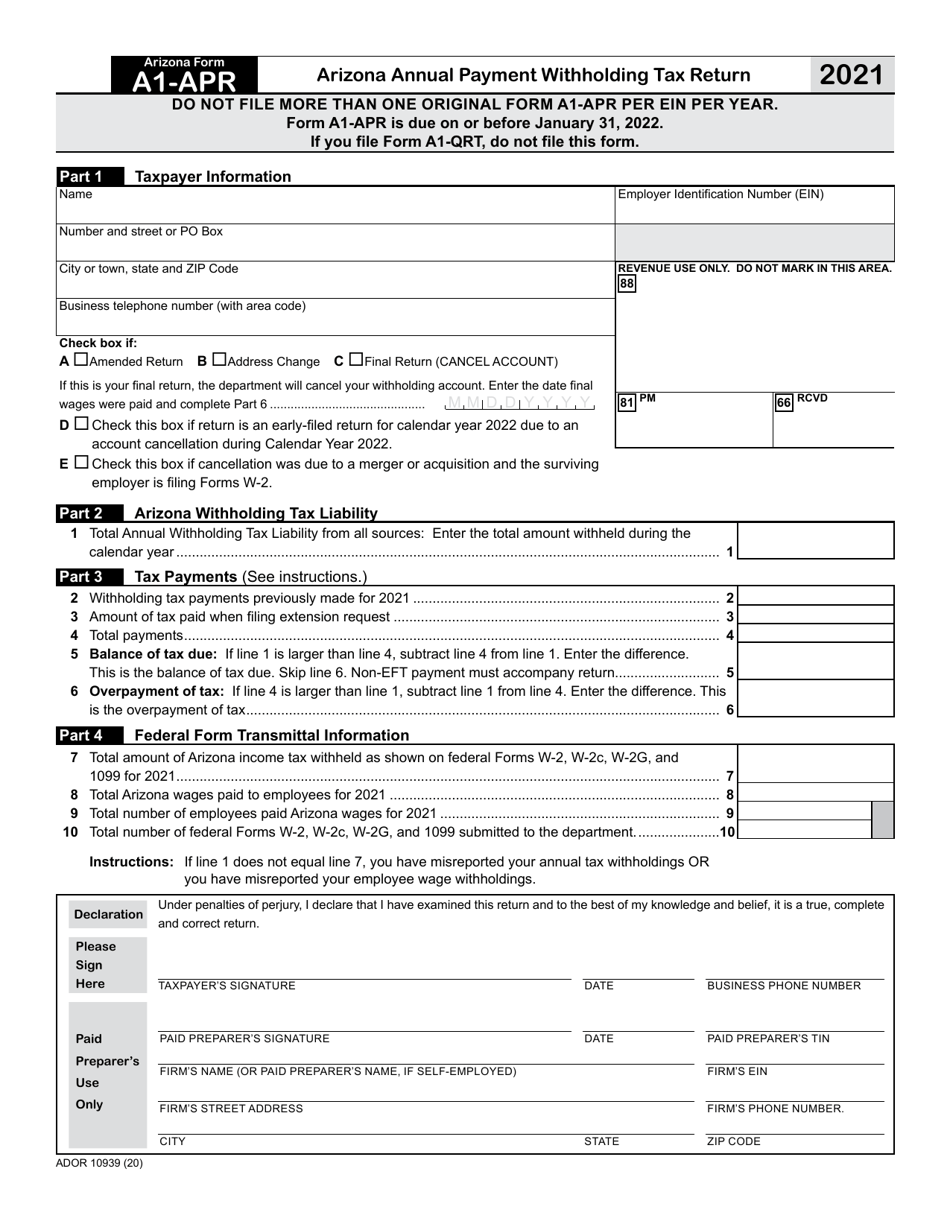

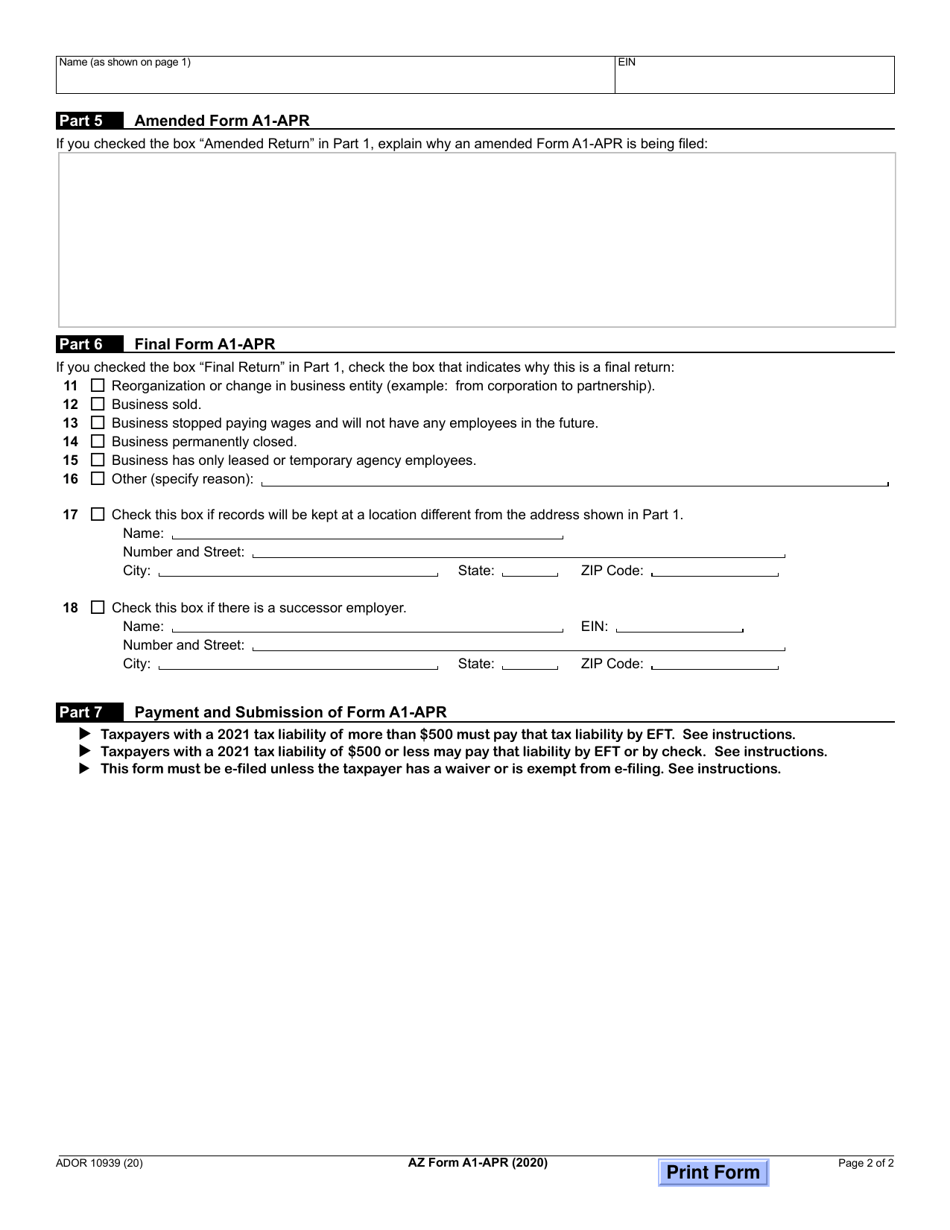

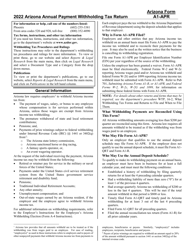

Arizona Form A1-APR (ADOR10939) Arizona Annual Payment Withholding Tax Return - Arizona

What Is Arizona Form A1-APR (ADOR10939)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Arizona Form A1-APR?

A: The Arizona Form A1-APR is the Annual Payment Withholding Tax Return for Arizona.

Q: Who needs to file the Arizona Form A1-APR?

A: Employers in Arizona who withhold taxes from their employees' wages need to file the Arizona Form A1-APR.

Q: What is the purpose of the Arizona Form A1-APR?

A: The purpose of the Arizona Form A1-APR is to report and pay annual withholding taxes to the Arizona Department of Revenue.

Q: When is the deadline to file the Arizona Form A1-APR?

A: The deadline to file the Arizona Form A1-APR is on or before January 31st of each year.

Q: Are there any penalties for late or incomplete filing of the Arizona Form A1-APR?

A: Yes, there are penalties for late or incomplete filing of the Arizona Form A1-APR. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-APR (ADOR10939) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.