This version of the form is not currently in use and is provided for reference only. Download this version of

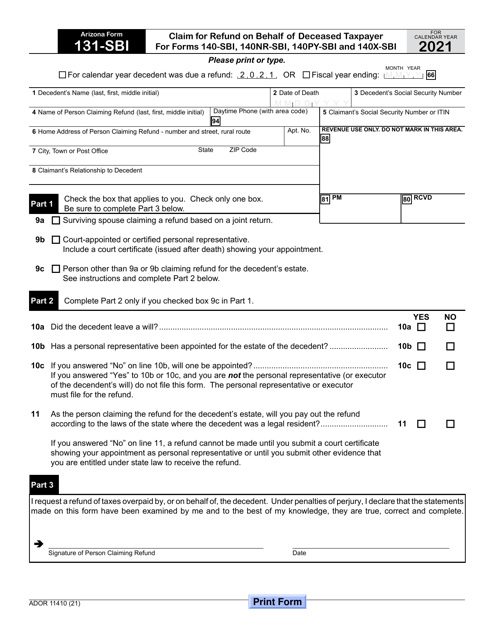

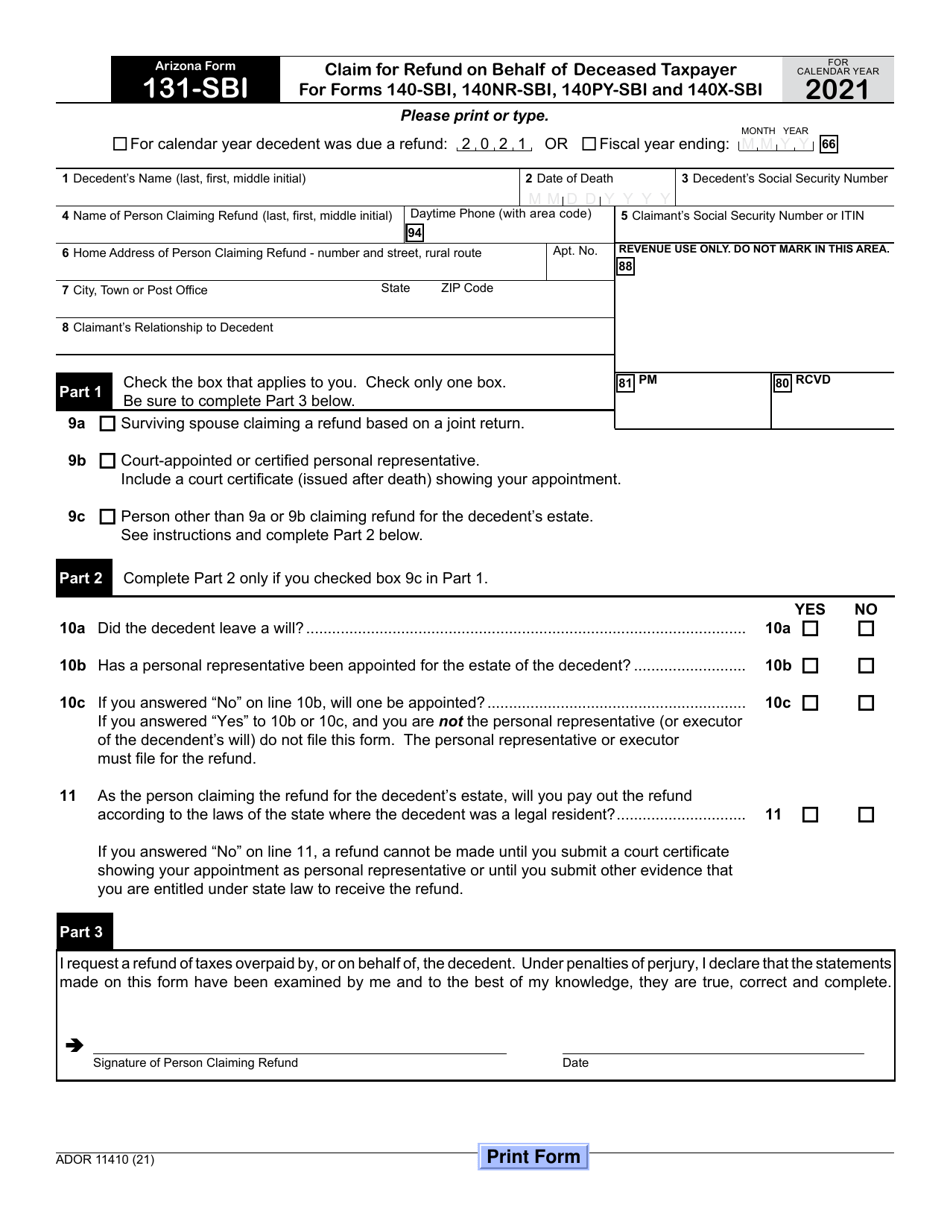

Arizona Form 131-SBI (ADOR11410)

for the current year.

Arizona Form 131-SBI (ADOR11410) Claim for Refund on Behalf of Deceased Taxpayer for Forms 140-sbi, 140nr-Sbi, 140py-Sbi and 140x-Sbi - Arizona

What Is Arizona Form 131-SBI (ADOR11410)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 131-SBI?

A: Form 131-SBI is a claim for refund on behalf of a deceased taxpayer for forms 140-SBI, 140NR-SBI, 140PY-SBI, and 140X-SBI in Arizona.

Q: Who can file Form 131-SBI?

A: Form 131-SBI can be filed by a representative of the deceased taxpayer, such as an executor or administrator of the estate.

Q: What is the purpose of Form 131-SBI?

A: The purpose of Form 131-SBI is to claim a refund on behalf of a deceased taxpayer for certain Arizona tax forms.

Q: Which tax forms can Form 131-SBI be used for?

A: Form 131-SBI can be used for forms 140-SBI, 140NR-SBI, 140PY-SBI, and 140X-SBI in Arizona.

Q: What information is required on Form 131-SBI?

A: Form 131-SBI requires information about the deceased taxpayer, the representative filing the claim, and details of the refund being claimed.

Q: Are there any deadlines for filing Form 131-SBI?

A: Yes, Form 131-SBI should be filed within three years from the original due date of the tax return or within two years from the date of overpayment, whichever is later.

Q: Can a refund be claimed for a deceased taxpayer in Arizona?

A: Yes, a refund can be claimed for a deceased taxpayer in Arizona using Form 131-SBI.

Q: Who should sign Form 131-SBI?

A: The representative filing the claim on behalf of the deceased taxpayer should sign Form 131-SBI.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 131-SBI (ADOR11410) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.