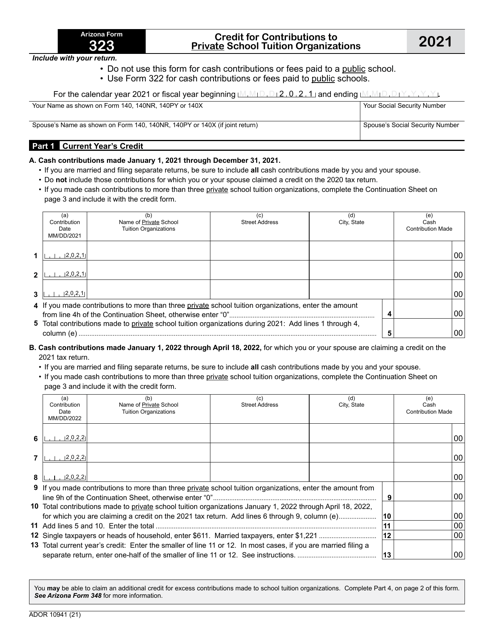

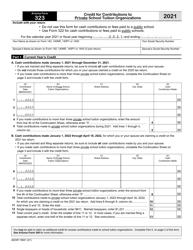

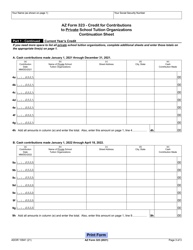

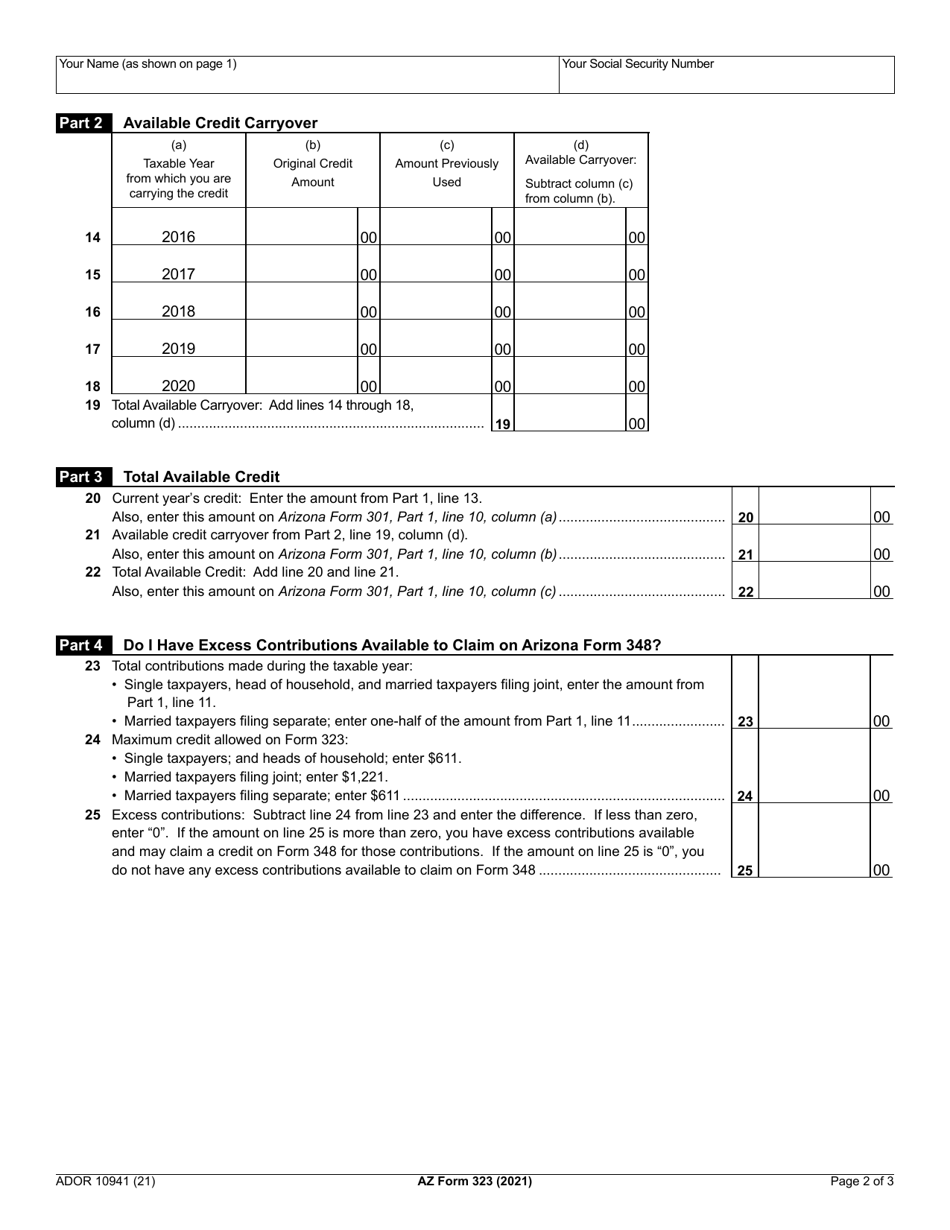

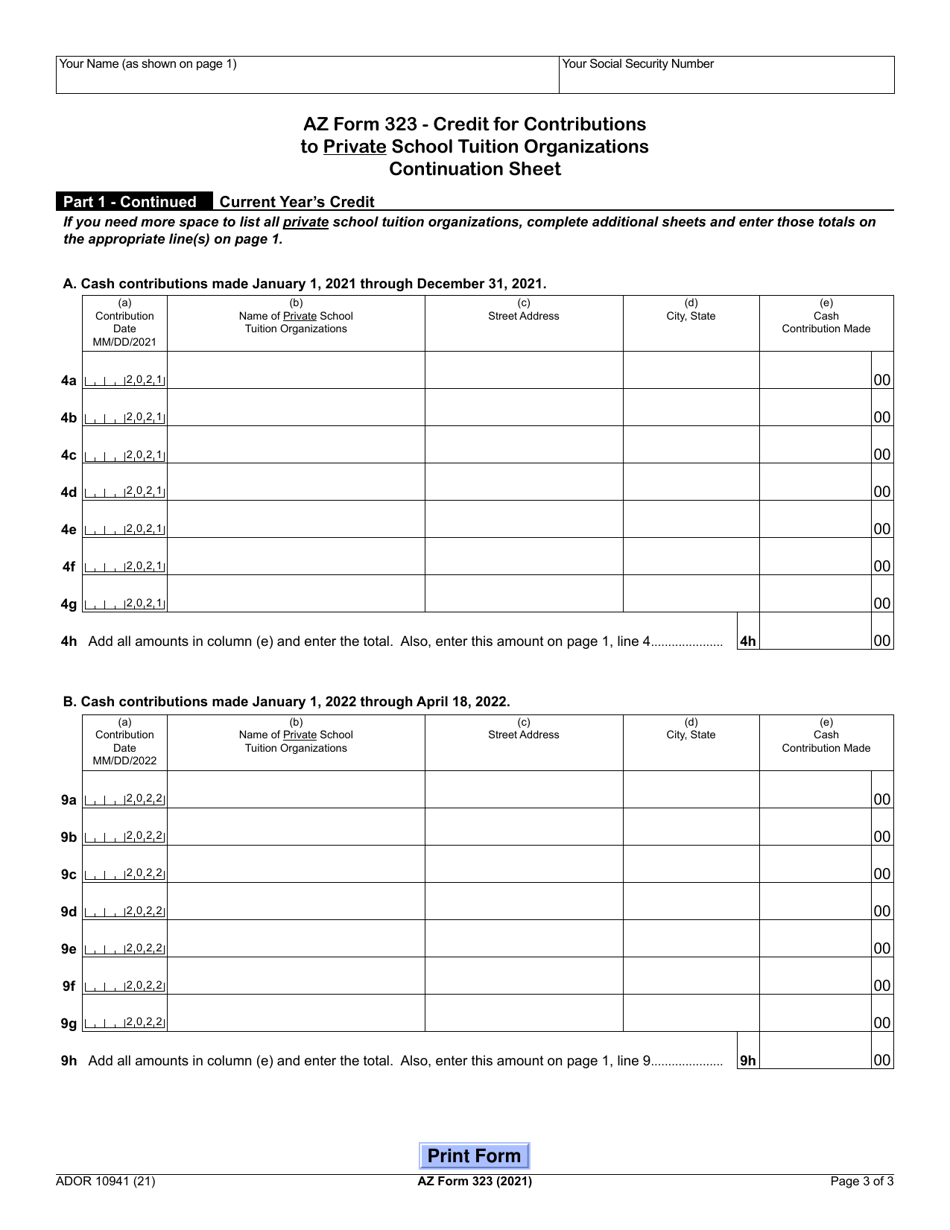

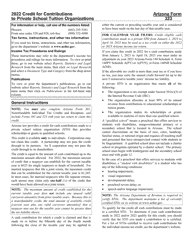

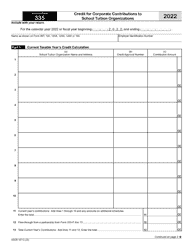

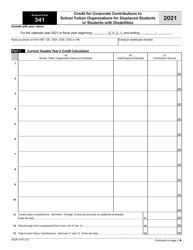

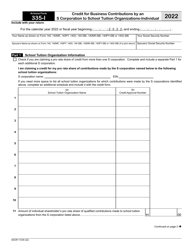

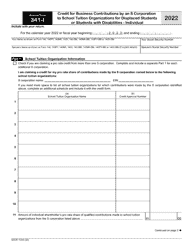

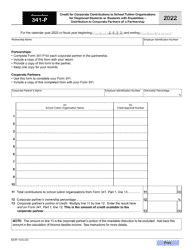

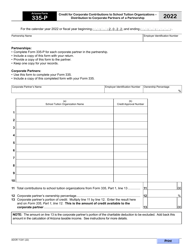

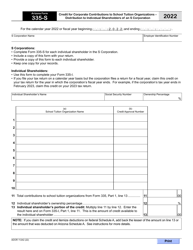

Arizona Form 323 (ADOR10941) Credit for Contributions to Private School Tuition Organizations - Arizona

What Is Arizona Form 323 (ADOR10941)?

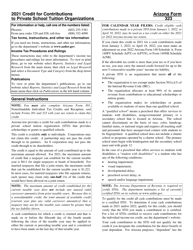

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 323?

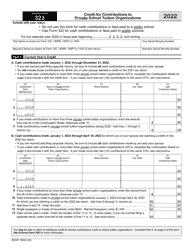

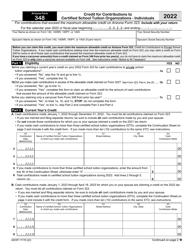

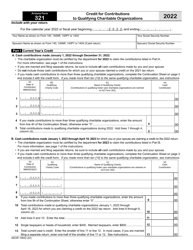

A: Arizona Form 323 is a tax form used in Arizona to claim the Credit for Contributions to Private School Tuition Organizations.

Q: What is the purpose of Arizona Form 323?

A: The purpose of Arizona Form 323 is to provide a tax credit for contributions made to private school tuition organizations in Arizona.

Q: Who can claim the credit on Arizona Form 323?

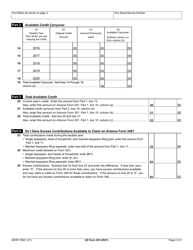

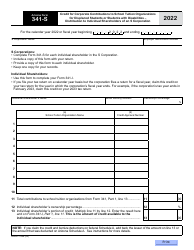

A: Individuals or corporations who make contributions to private school tuition organizations in Arizona can claim the credit on Arizona Form 323.

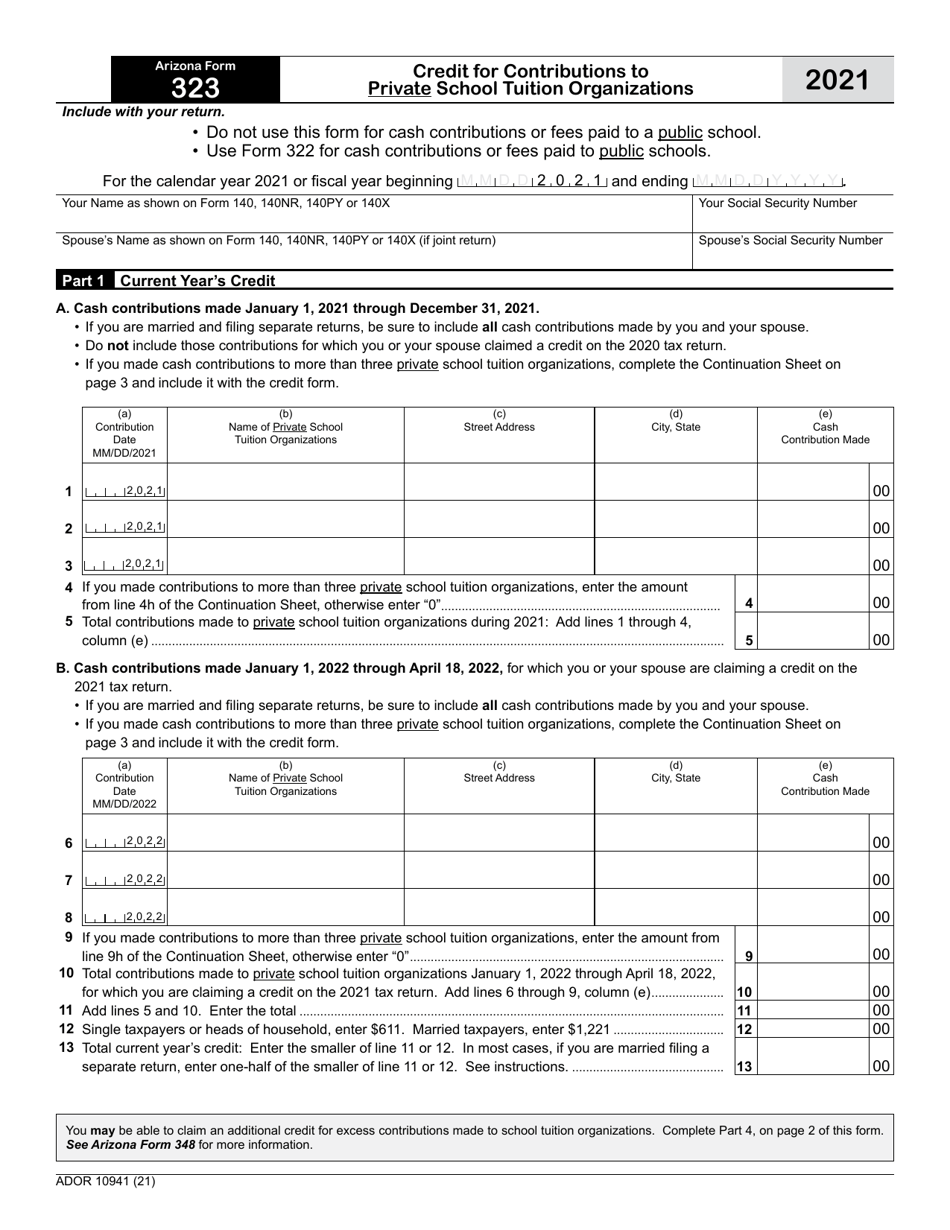

Q: What is the maximum credit allowed on Arizona Form 323?

A: The maximum credit allowed on Arizona Form 323 depends on the filing status of the taxpayer. For individuals, the maximum credit is $1,135 for single filers and $2,269 for married filing jointly. For corporations, the maximum credit is 20% of the contributed amount.

Q: How do I file Arizona Form 323?

A: Arizona Form 323 can be filed electronically or by mail. The completed form should be submitted to the Arizona Department of Revenue along with any required documentation.

Q: When is the deadline to file Arizona Form 323?

A: The deadline to file Arizona Form 323 is typically April 15th of the following year, coinciding with the individual incometax filing deadline in Arizona.

Q: Are contributions to private school tuition organizations tax deductible?

A: No, contributions made to private school tuition organizations in Arizona are not tax deductible.

Q: Is Arizona Form 323 only for Arizona residents?

A: Yes, Arizona Form 323 is specifically for Arizona residents who have made contributions to private school tuition organizations in the state.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 323 (ADOR10941) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.