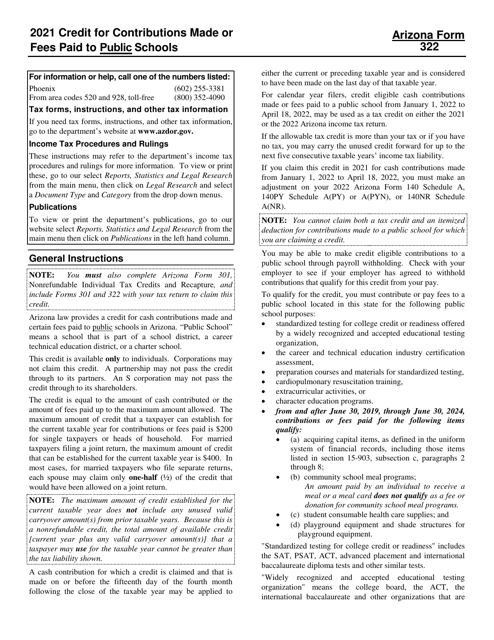

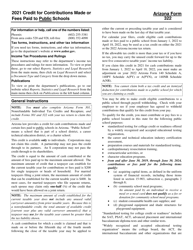

This version of the form is not currently in use and is provided for reference only. Download this version of

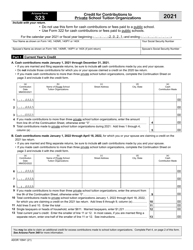

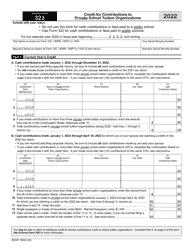

Instructions for Arizona Form 322, ADOR10941

for the current year.

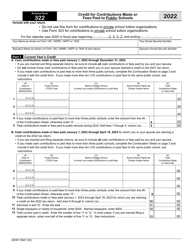

Instructions for Arizona Form 322, ADOR10941 Credit for Contributions Made or Fees Paid to Public Schools - Arizona

This document contains official instructions for Arizona Form 322 , and Form ADOR10941 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 322 (ADOR10941) is available for download through this link.

FAQ

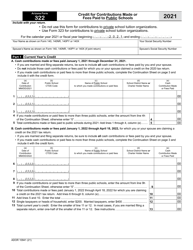

Q: What is Arizona Form 322?

A: Arizona Form 322 is the form used to claim the Credit for Contributions Made or Fees Paid to Public Schools in Arizona.

Q: Who can use Arizona Form 322?

A: Individuals or married couples who made contributions or paid fees to public schools in Arizona can use Arizona Form 322.

Q: What is the purpose of Arizona Form 322?

A: The purpose of Arizona Form 322 is to claim a tax credit for contributions or fees paid to public schools in Arizona.

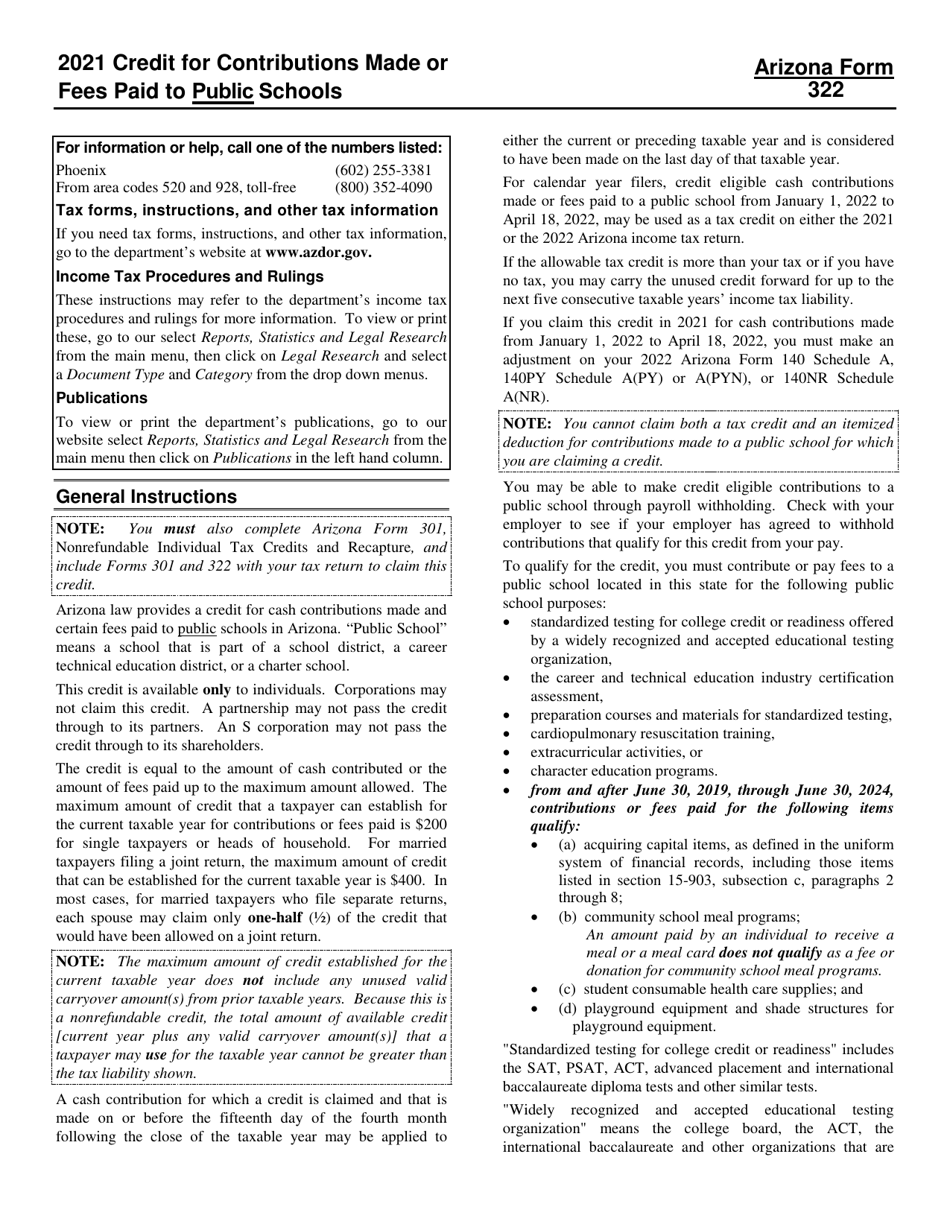

Q: What types of contributions or fees are eligible for the credit?

A: Contributions or fees made to Arizona public schools for extracurricular activities, character education programs, or qualified organizations that support public schools are eligible for the credit.

Q: What is the maximum credit amount that can be claimed?

A: The maximum credit amount that can be claimed on Arizona Form 322 is $400 for single filers and $800 for married couples filing jointly.

Q: Are there any income limitations to claim the credit?

A: No, there are no income limitations to claim the credit for contributions or fees paid to public schools in Arizona.

Q: Can the credit be carried forward or transferred?

A: No, the credit cannot be carried forward or transferred to future years.

Q: How do I file Arizona Form 322?

A: Arizona Form 322 can be filed with your Arizona state income tax return.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.