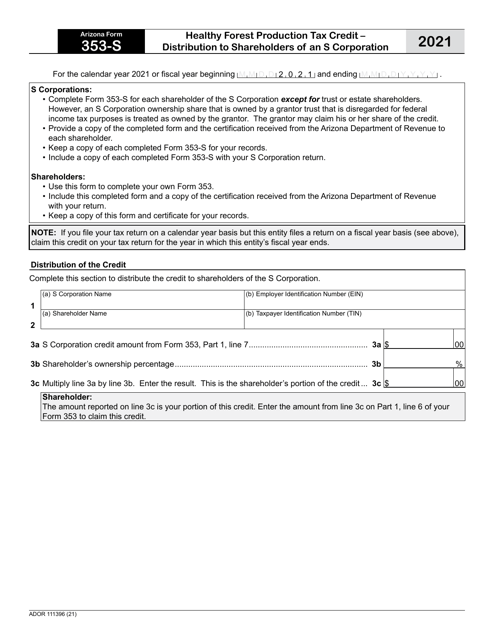

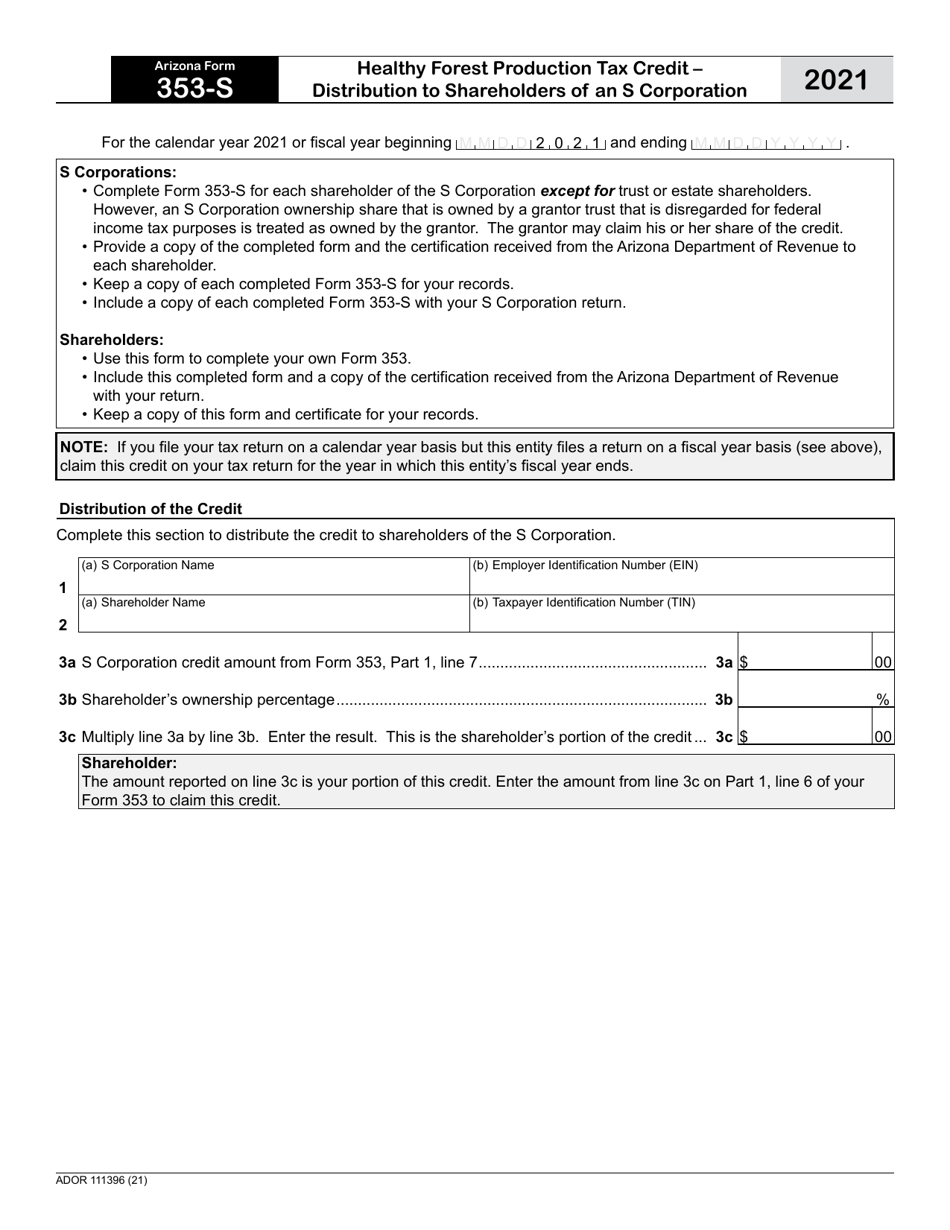

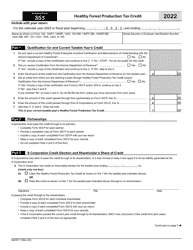

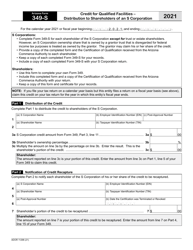

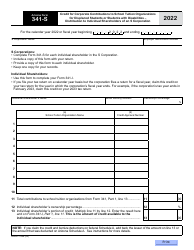

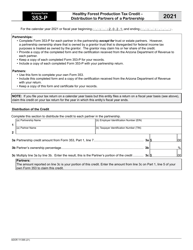

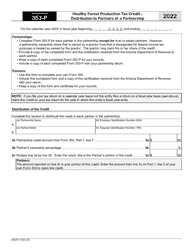

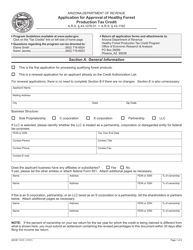

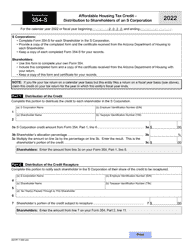

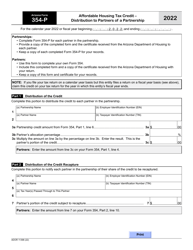

Arizona Form 353-S (ADOR111396) Healthy Forest Production Tax Credit - Distribution to Shareholders of an S Corporation - Arizona

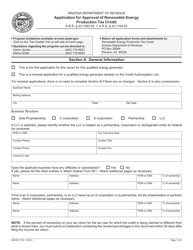

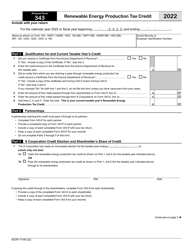

What Is Arizona Form 353-S (ADOR111396)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 353-S?

A: Arizona Form 353-S is a form used for claiming the Healthy Forest Production Tax Credit.

Q: What is the Healthy Forest Production Tax Credit?

A: The Healthy Forest Production Tax Credit is a tax credit available to S corporations in Arizona that engage in qualified forest management activities.

Q: Who is eligible for the Healthy Forest Production Tax Credit?

A: S corporations in Arizona that engage in qualified forest management activities are eligible for the Healthy Forest Production Tax Credit.

Q: What are qualified forest management activities?

A: Qualified forest management activities include activities such as reforestation, prevention of forest fires, and wildlife habitat improvement.

Q: How do I claim the Healthy Forest Production Tax Credit?

A: To claim the Healthy Forest Production Tax Credit, S corporations need to complete and file Arizona Form 353-S with the Arizona Department of Revenue.

Q: Is there a deadline for filing Arizona Form 353-S?

A: Yes, Arizona Form 353-S must be filed by the due date of the S corporation's Arizona income tax return.

Q: Are there any specific requirements or documentation needed to claim the Healthy Forest Production Tax Credit?

A: Yes, S corporations need to provide documentation that demonstrates their engagement in qualified forest management activities, such as receipts and records of expenses.

Q: What is the purpose of the Healthy Forest Production Tax Credit?

A: The purpose of the Healthy Forest Production Tax Credit is to incentivize and support responsible forest management practices in Arizona.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 353-S (ADOR111396) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.