This version of the form is not currently in use and is provided for reference only. Download this version of

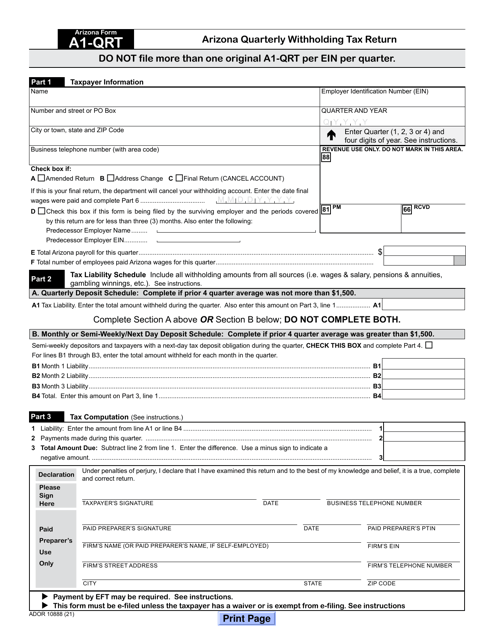

Arizona Form A1-QRT (ADOR10888)

for the current year.

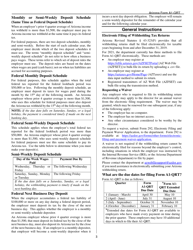

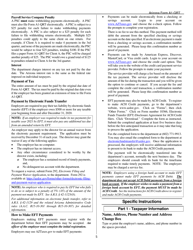

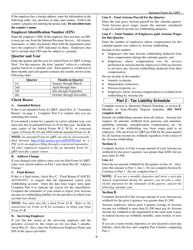

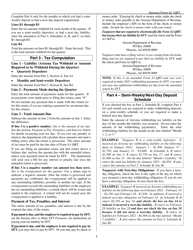

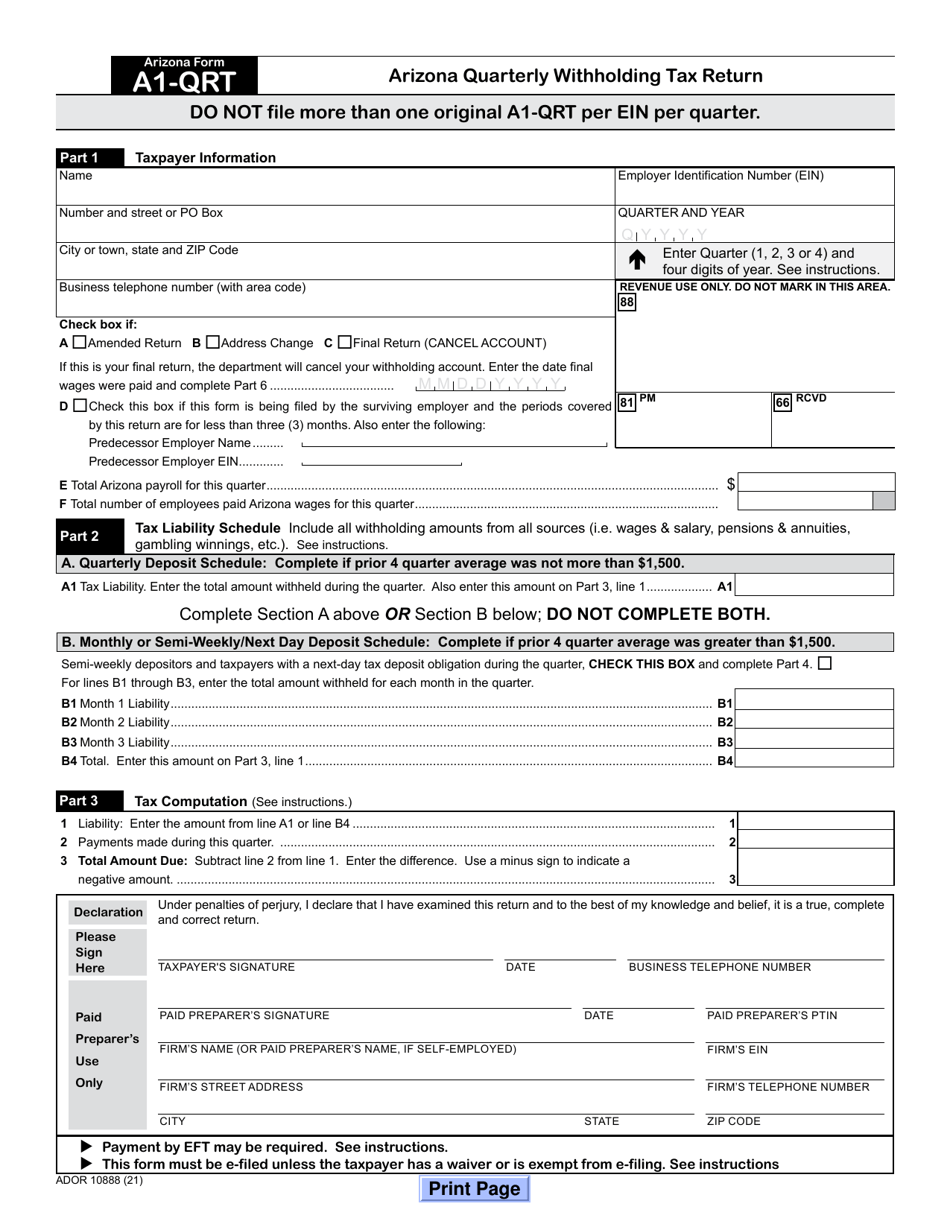

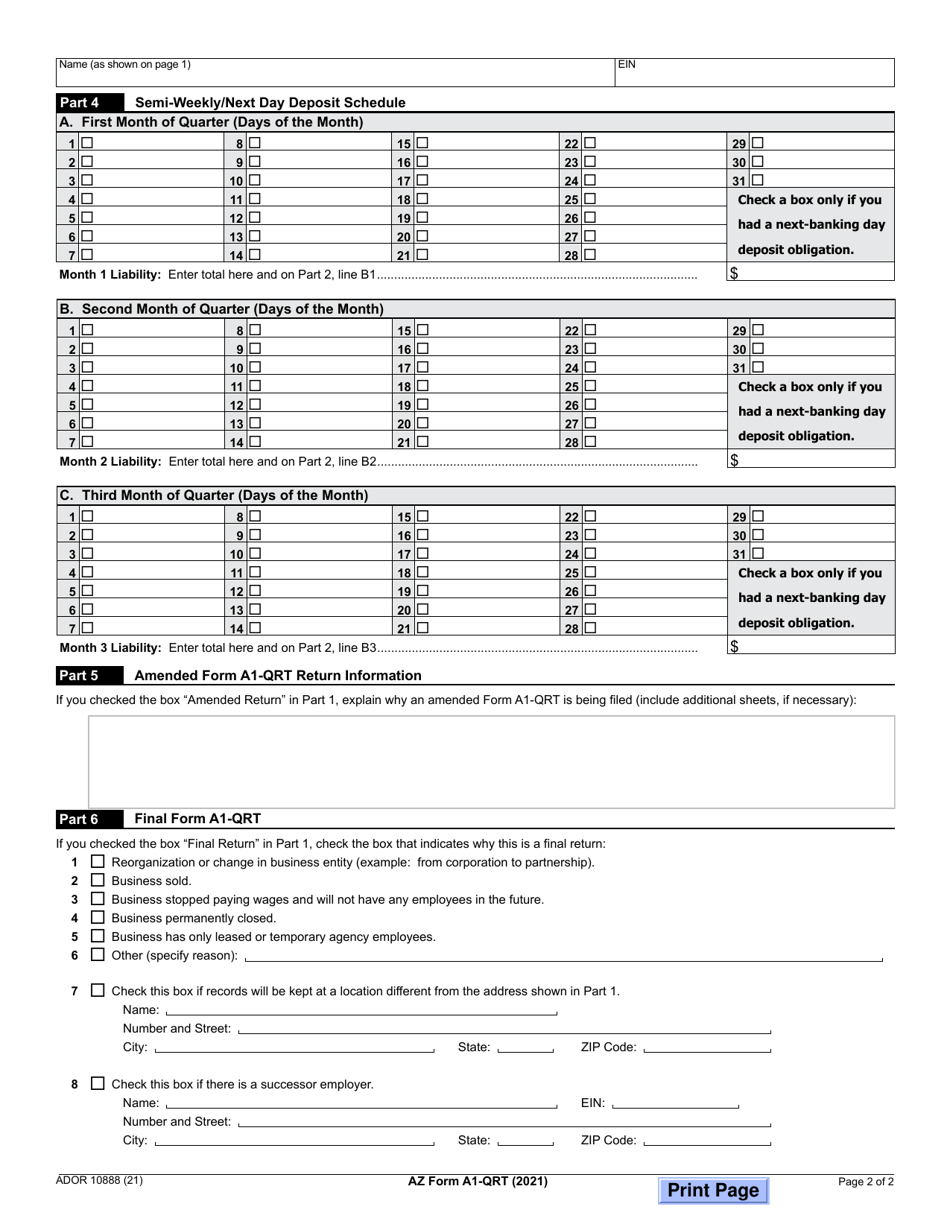

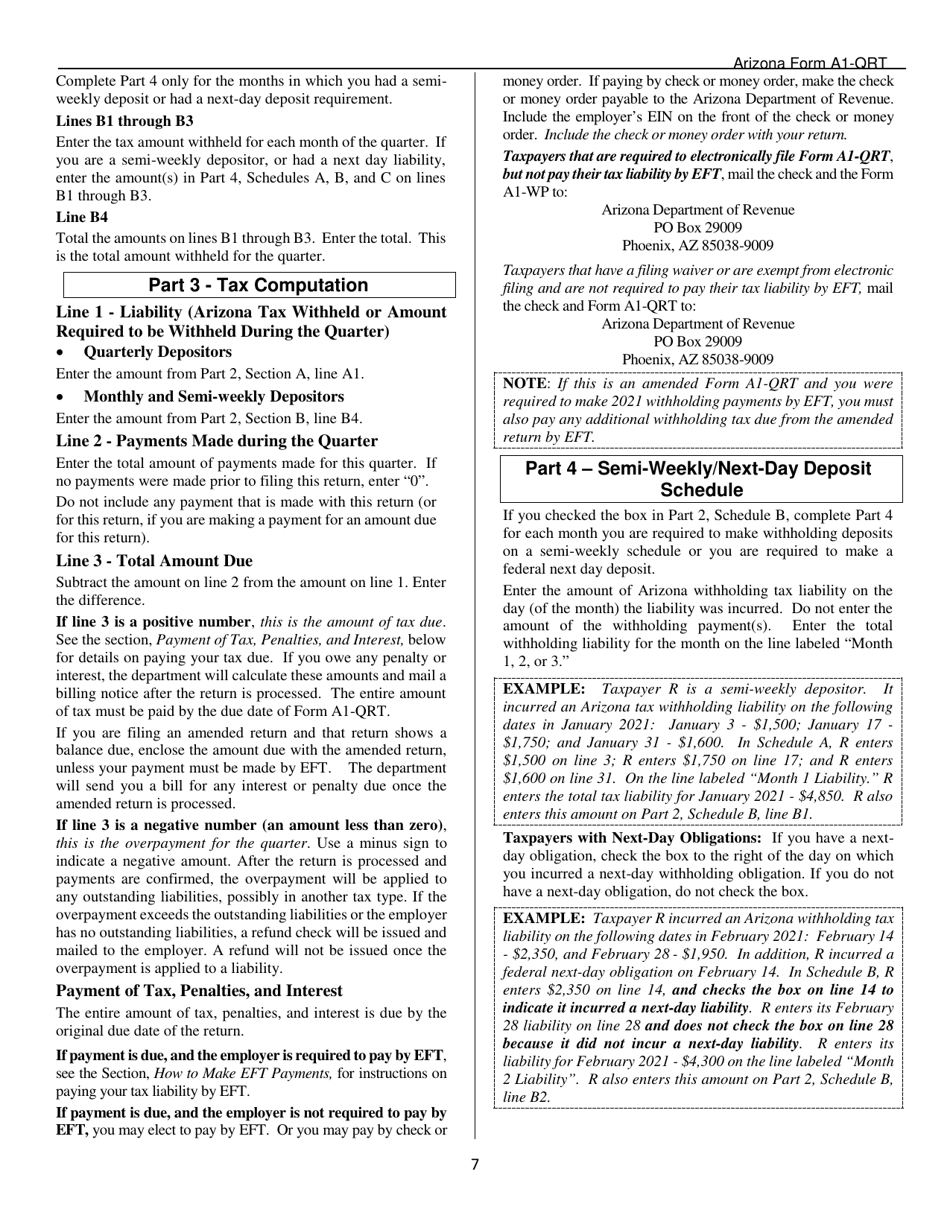

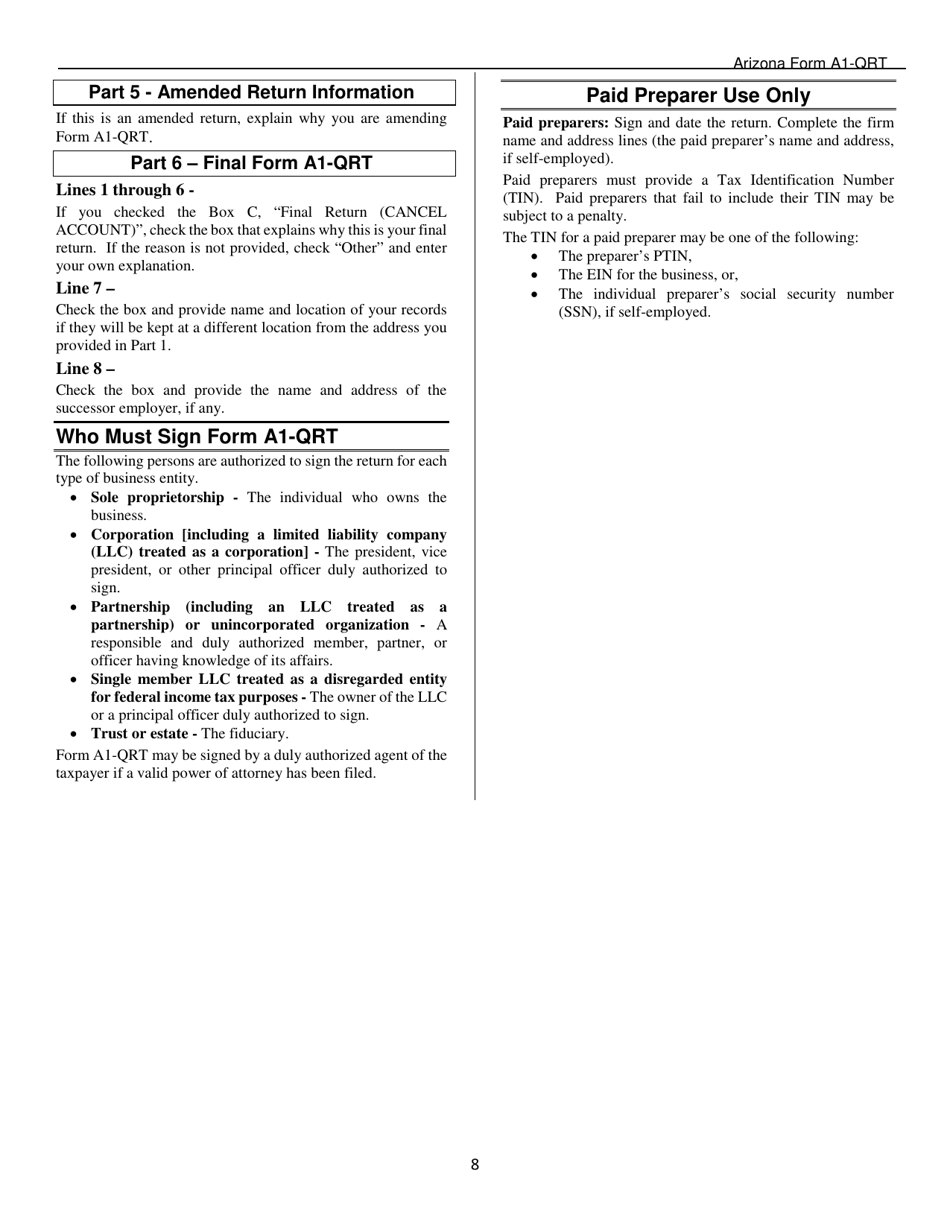

Arizona Form A1-QRT (ADOR10888) Arizona Quarterly Withholding Tax Return - Arizona

What Is Arizona Form A1-QRT (ADOR10888)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

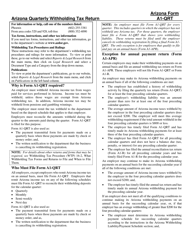

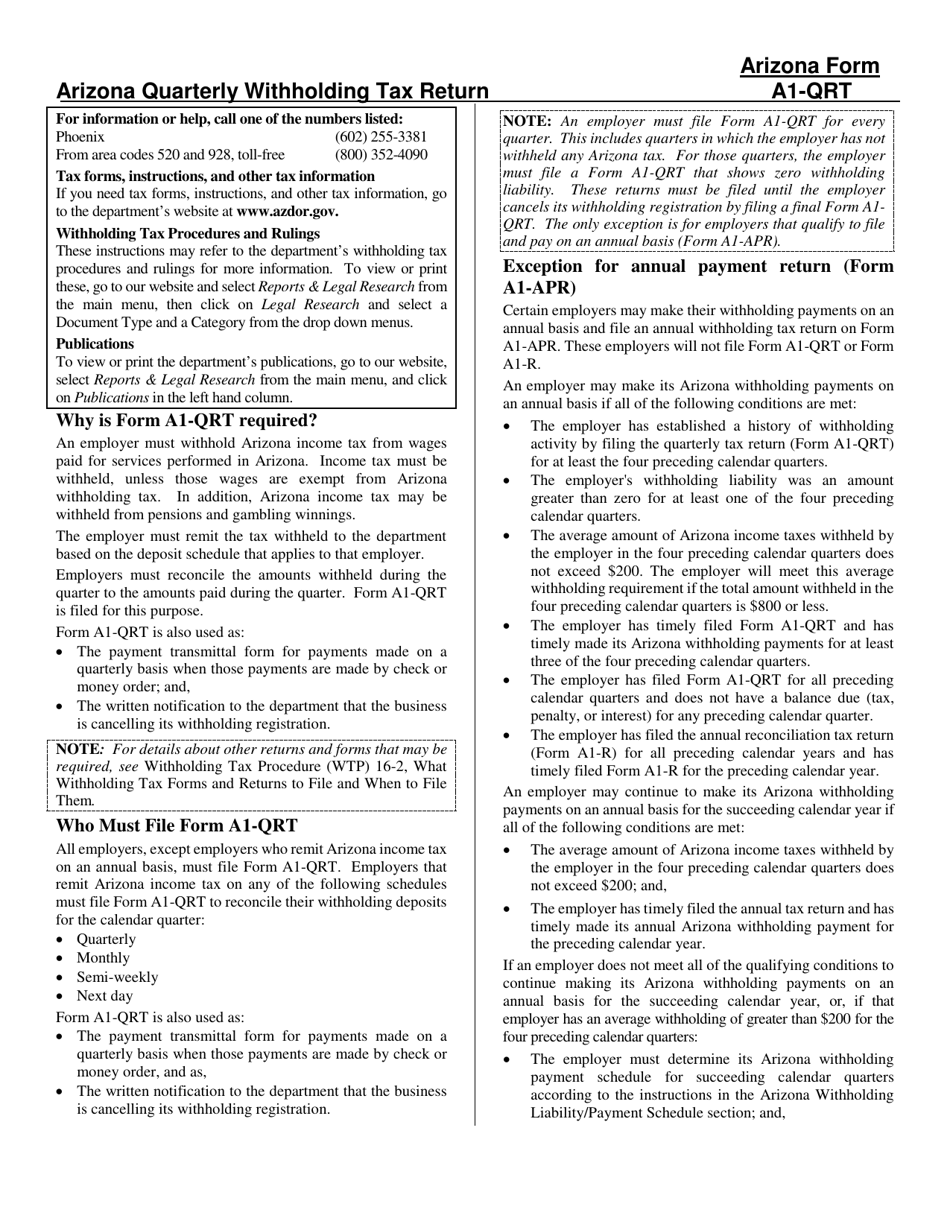

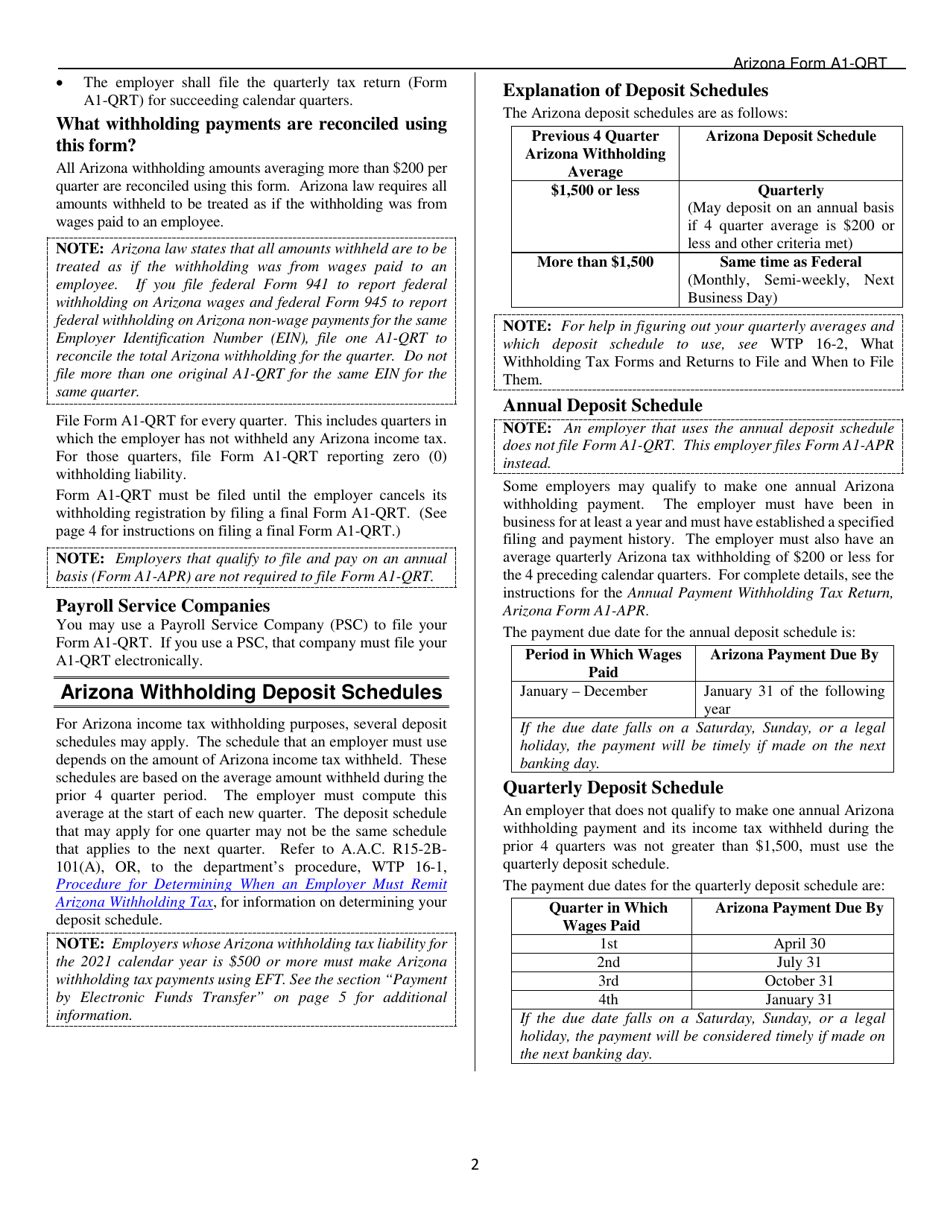

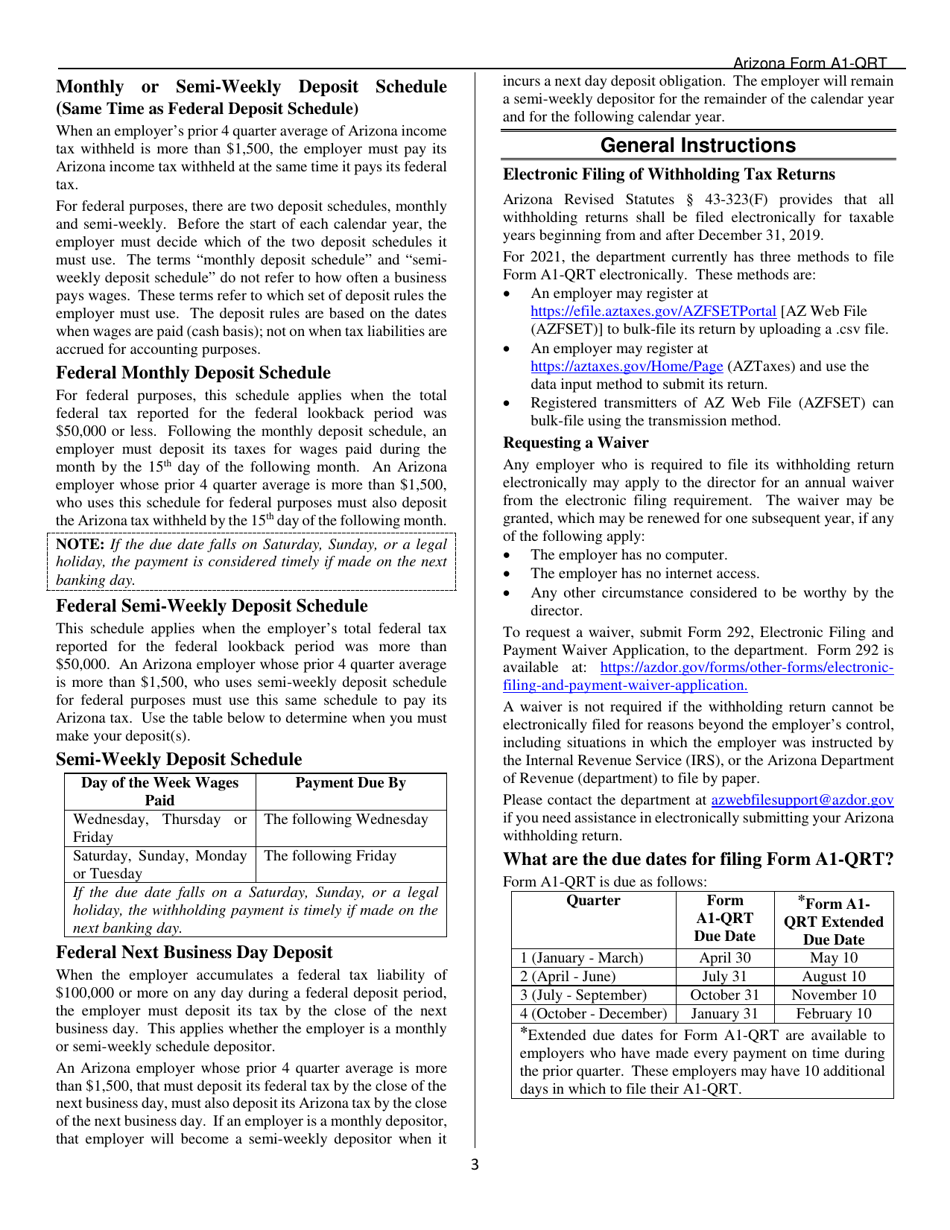

Q: What is the Arizona Form A1-QRT?

A: The Arizona Form A1-QRT is the Quarterly Withholding Tax Return for Arizona.

Q: Who needs to file the Arizona Form A1-QRT?

A: Employers in Arizona who have employees subject to Arizona withholding tax need to file the Arizona Form A1-QRT.

Q: What is the purpose of the Arizona Form A1-QRT?

A: The purpose of the Arizona Form A1-QRT is to report and remit withheld taxes from employees' wages to the Arizona Department of Revenue.

Q: When is the deadline for filing the Arizona Form A1-QRT?

A: The deadline for filing the Arizona Form A1-QRT is on or before the last day of the month following the end of each calendar quarter.

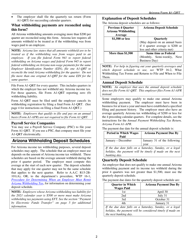

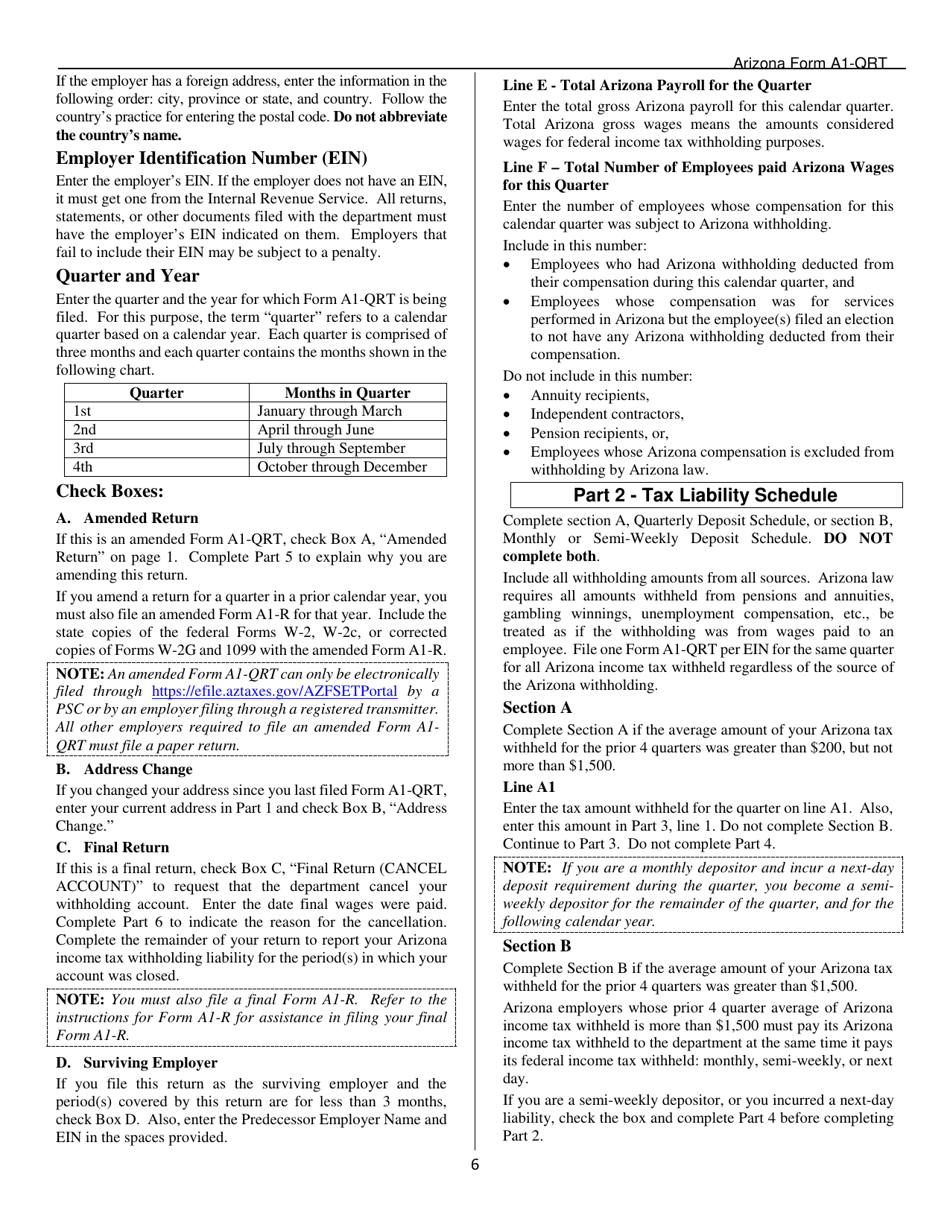

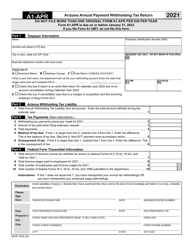

Q: What information do I need to complete the Arizona Form A1-QRT?

A: You will need to provide information such as the total number of employees, total wages subject to withholding tax, and the amount of taxes withheld.

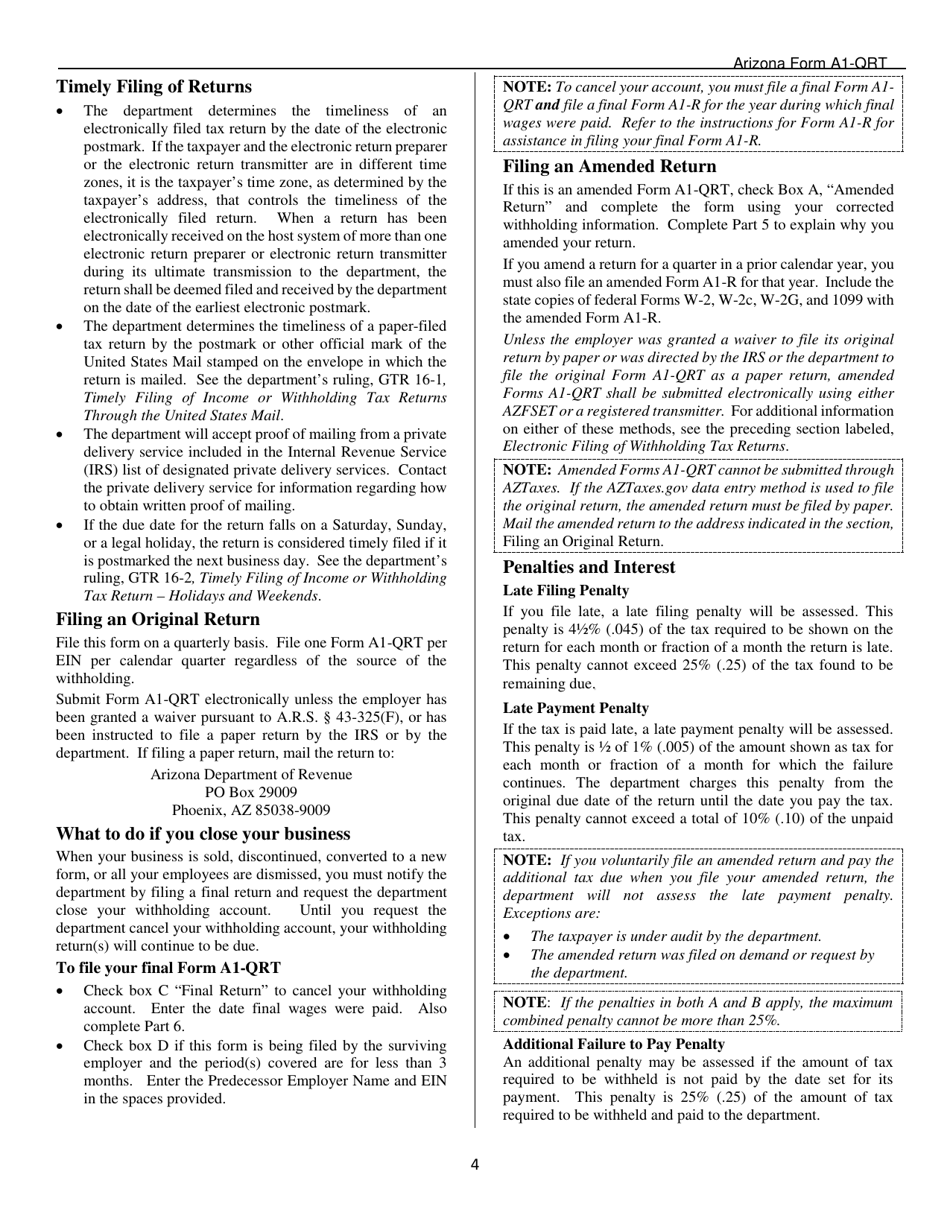

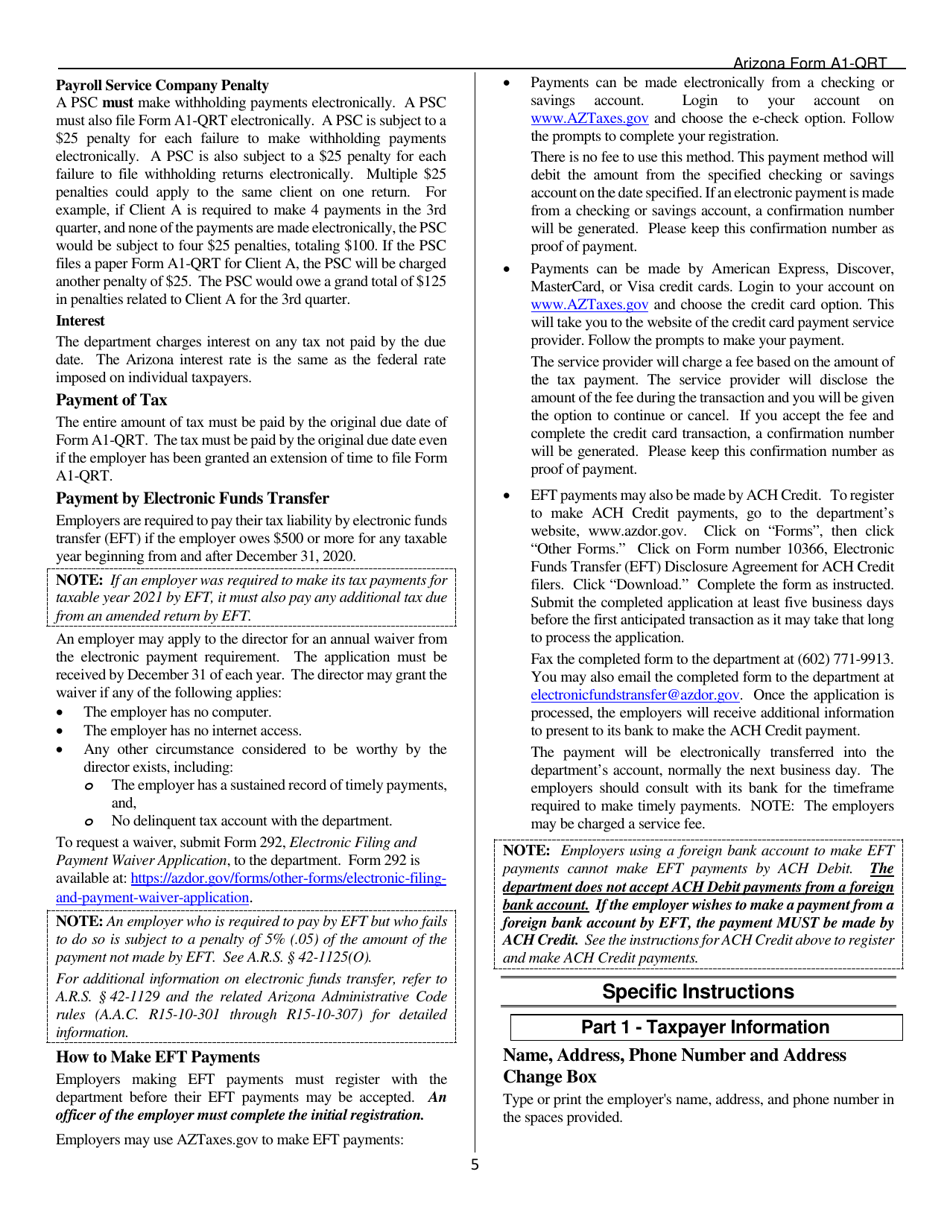

Q: Are there any penalties for late or non-filing of the Arizona Form A1-QRT?

A: Yes, there are penalties for late or non-filing of the Arizona Form A1-QRT. It is important to file and pay the withheld taxes on time to avoid penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-QRT (ADOR10888) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.