This version of the form is not currently in use and is provided for reference only. Download this version of

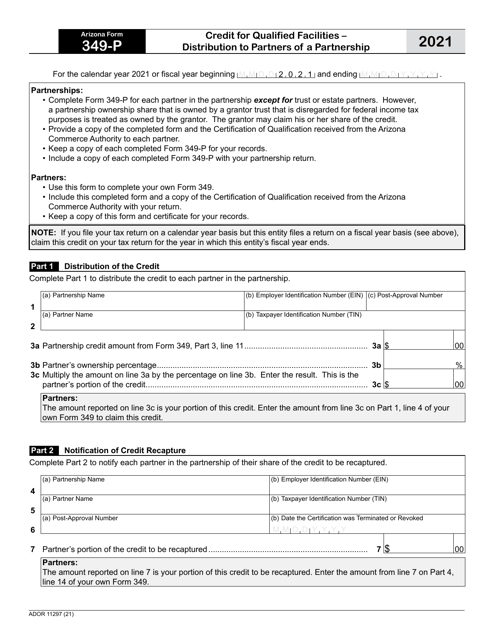

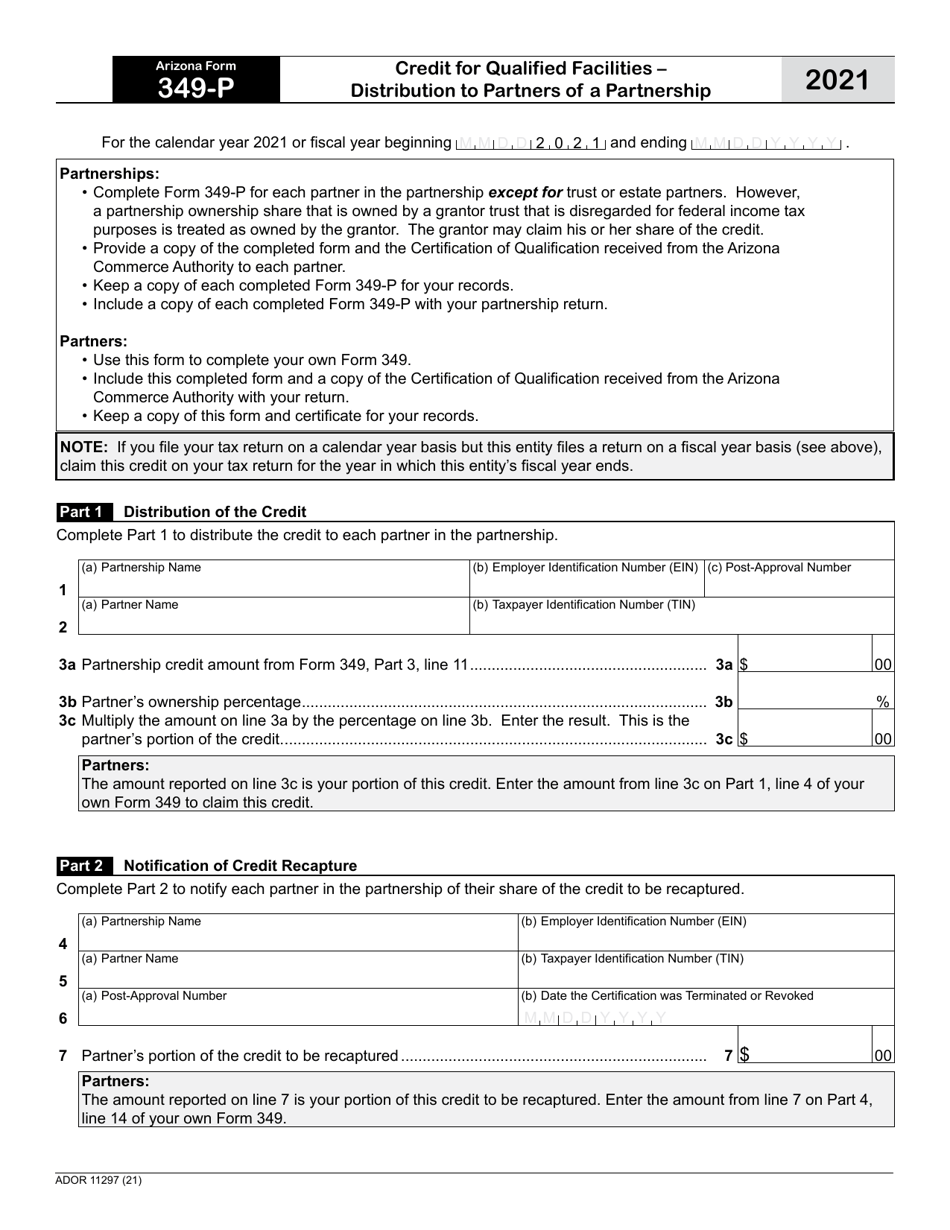

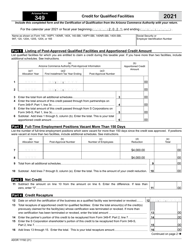

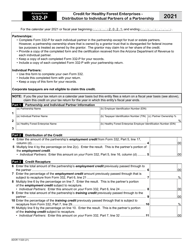

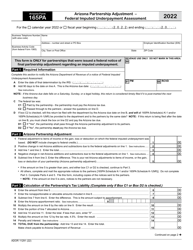

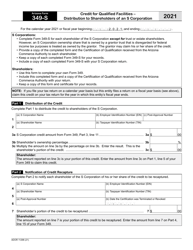

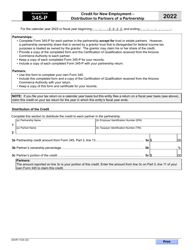

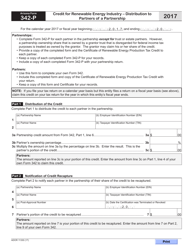

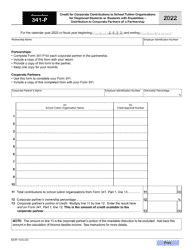

Arizona Form 349-P (ADOR11297)

for the current year.

Arizona Form 349-P (ADOR11297) Credit for Qualified Facilities - Distribution to Partners of a Partnership - Arizona

What Is Arizona Form 349-P (ADOR11297)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 349-P?

A: Arizona Form 349-P is the form used to claim the Credit for Qualified Facilities - Distribution to Partners of a Partnership in Arizona.

Q: What is the purpose of Arizona Form 349-P?

A: The purpose of Arizona Form 349-P is to claim the credit for qualified facilities distributed to partners of a partnership in Arizona.

Q: Who needs to file Arizona Form 349-P?

A: Partnerships in Arizona that have distributed the credit for qualified facilities to their partners need to file Arizona Form 349-P.

Q: What is the credit for qualified facilities?

A: The credit for qualified facilities is a tax credit available in Arizona for certain qualified investments in facilities.

Q: Can individuals claim the credit for qualified facilities?

A: No, the credit for qualified facilities is generally claimed by partnerships and passed on to their partners.

Q: Are there any requirements to be eligible for the credit?

A: Yes, there are specific eligibility criteria that must be met to qualify for the credit for qualified facilities.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 349-P (ADOR11297) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.