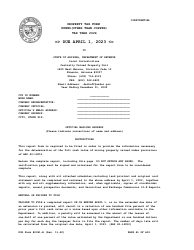

This version of the form is not currently in use and is provided for reference only. Download this version of

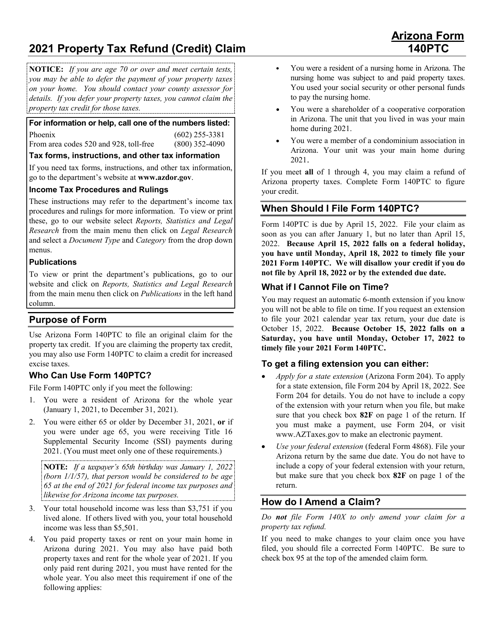

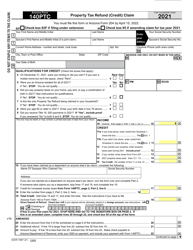

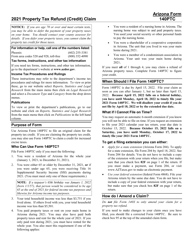

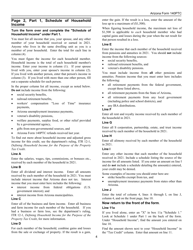

Instructions for Arizona Form 140PTC, ADOR10567

for the current year.

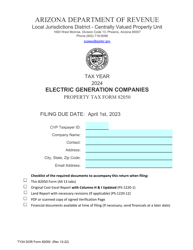

Instructions for Arizona Form 140PTC, ADOR10567 Property Tax Refund (Credit) Claim - Arizona

This document contains official instructions for Arizona Form 140PTC , and Form ADOR10567 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 140PTC (ADOR10567) is available for download through this link.

FAQ

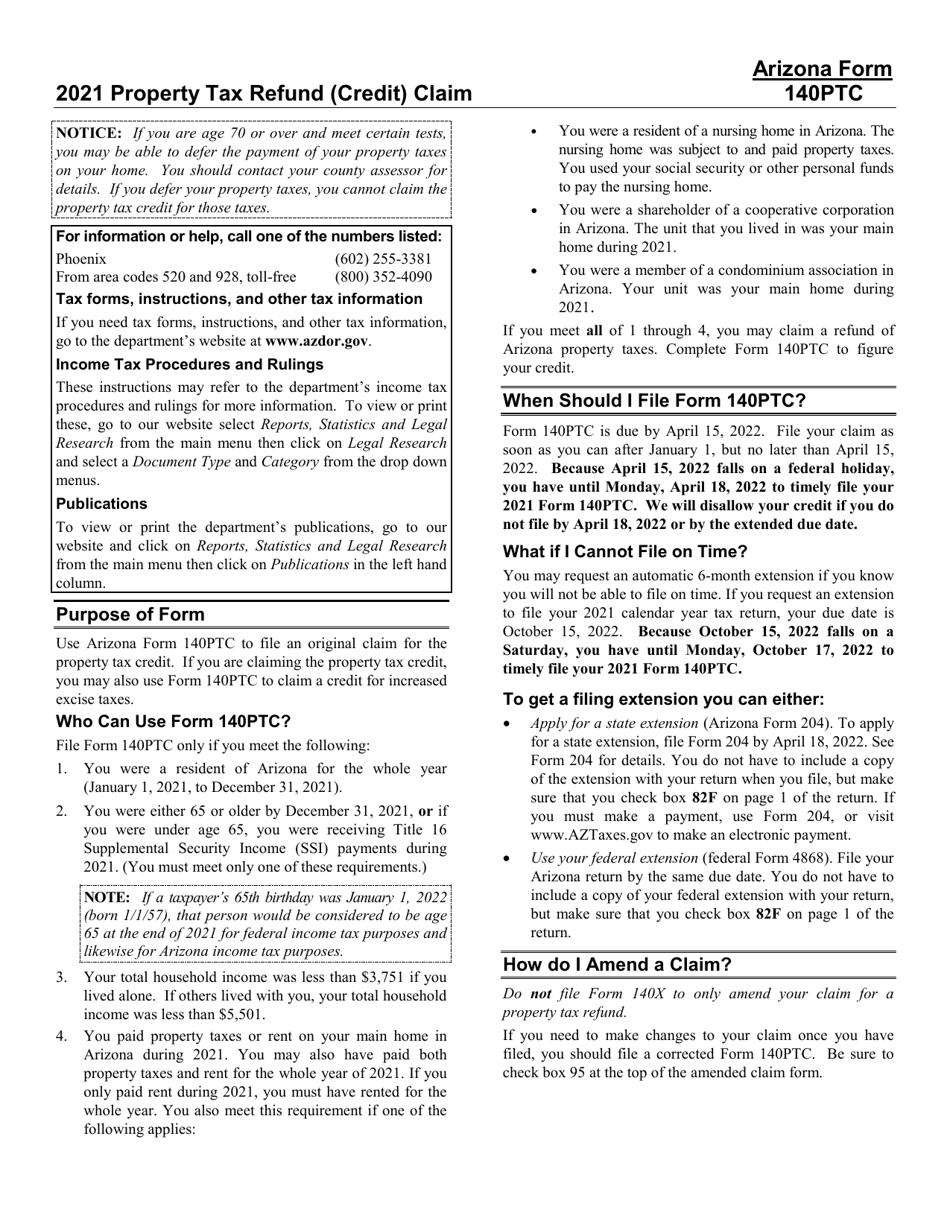

Q: What is Arizona Form 140PTC?

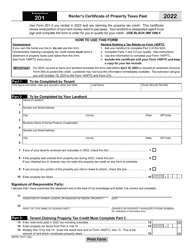

A: Arizona Form 140PTC is a form used to claim a property tax refund (credit) in Arizona.

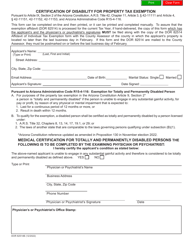

Q: Who can use Arizona Form 140PTC?

A: Arizona residents who paid property taxes on their primary residence in the previous year may use Form 140PTC.

Q: What is the purpose of Arizona Form 140PTC?

A: The purpose of the form is to request a refund or credit for property taxes paid on a primary residence.

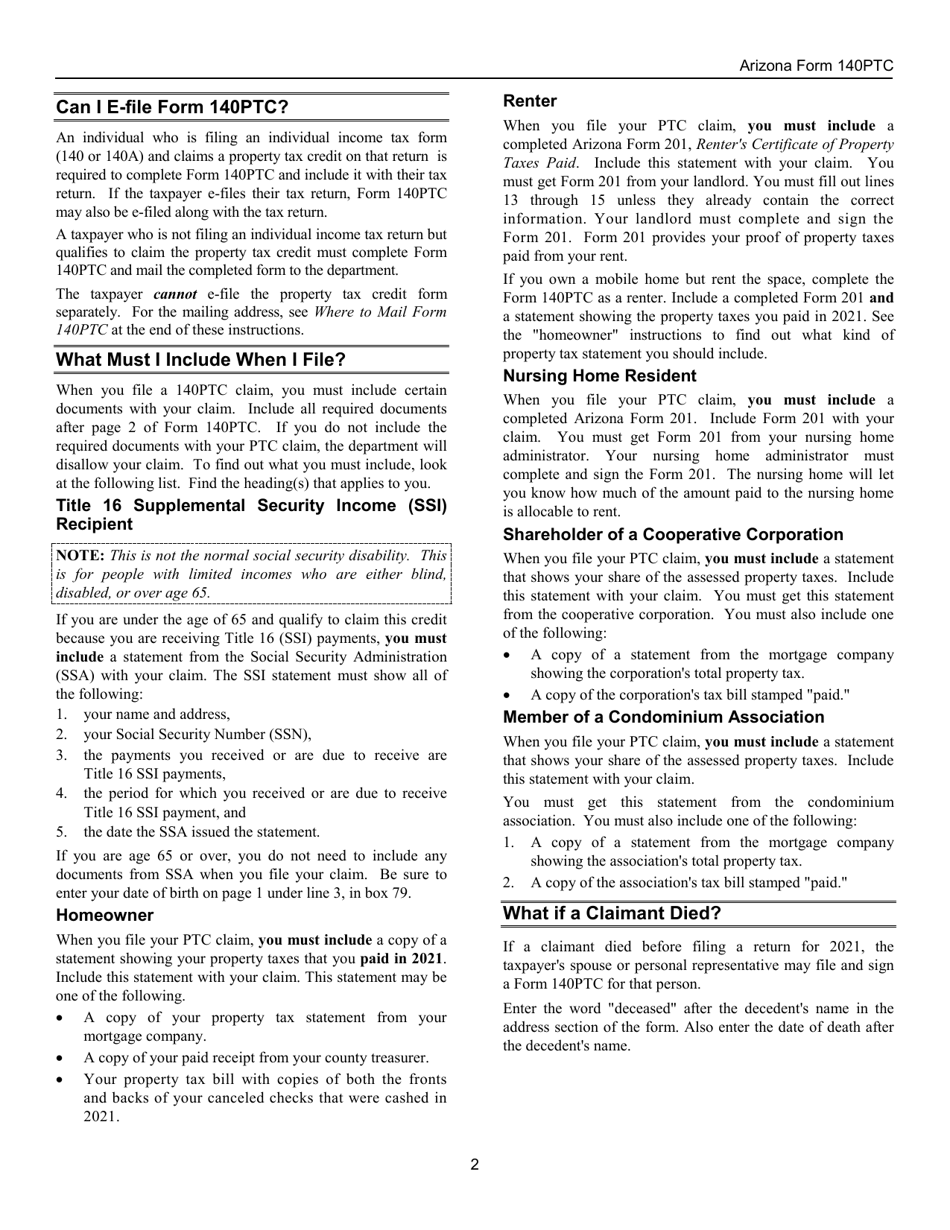

Q: What information do I need to complete Arizona Form 140PTC?

A: You will need information such as your social security number, property tax statements, and proof of residency.

Q: When is the deadline to file Arizona Form 140PTC?

A: The deadline to file Form 140PTC is April 15th of the following year.

Q: What should I do if I have questions about Arizona Form 140PTC?

A: If you have any questions about Form 140PTC, you should contact the Arizona Department of Revenue for assistance.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.