This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 131, ADOR10412

for the current year.

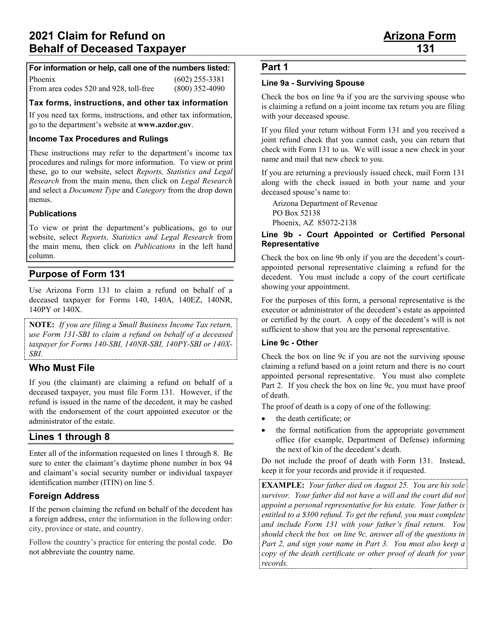

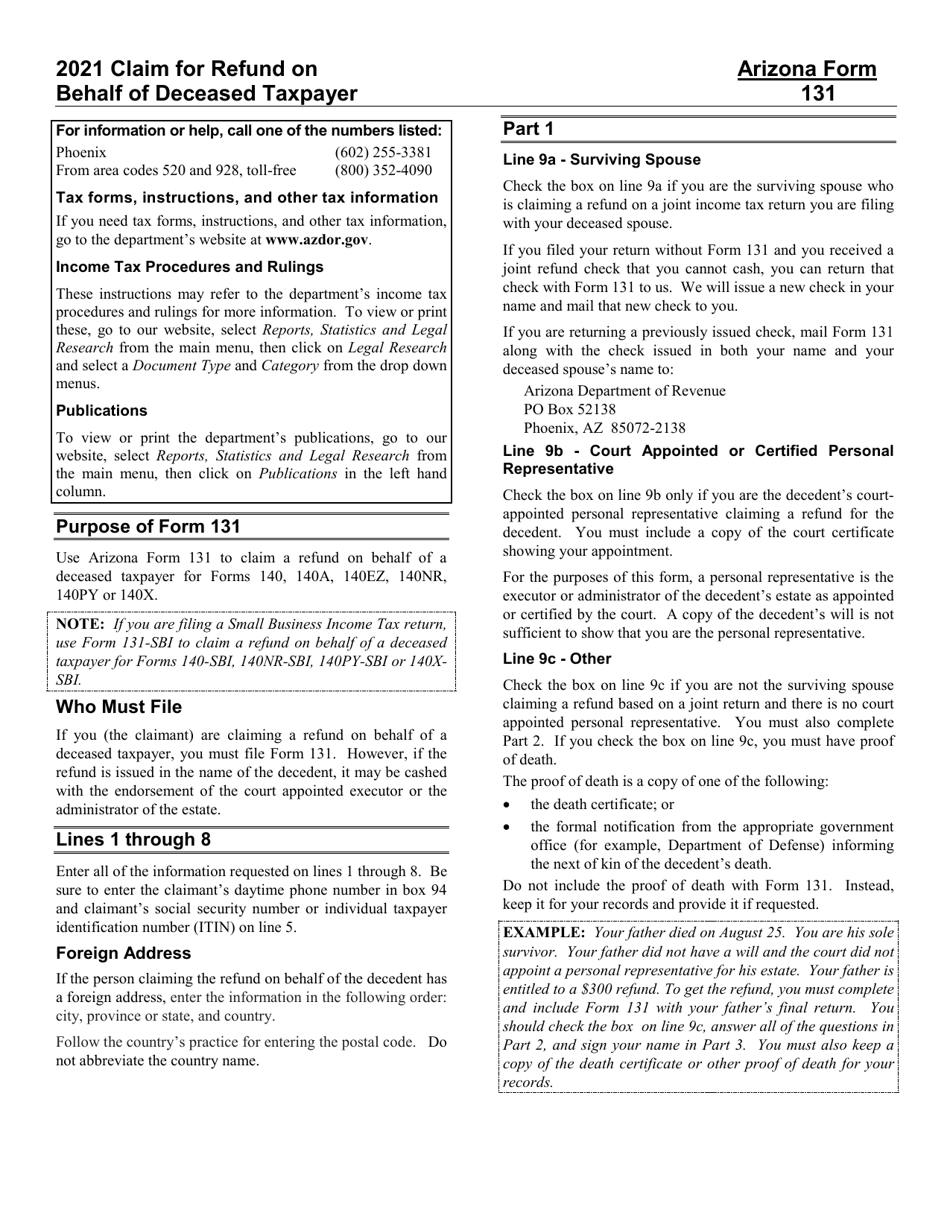

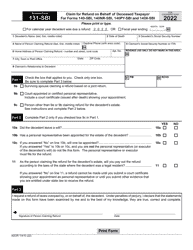

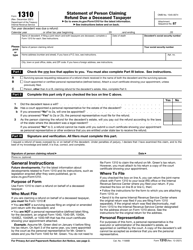

Instructions for Arizona Form 131, ADOR10412 Claim for Refund on Behalf of Deceased Taxpayer - Arizona

This document contains official instructions for Arizona Form 131 , and Form ADOR10412 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 131 (ADOR10412) is available for download through this link.

FAQ

Q: What is Arizona Form 131?

A: Arizona Form 131 is the ADOR10412 Claim for Refund on Behalf of Deceased Taxpayer - Arizona.

Q: What is this form used for?

A: This form is used to claim a refund on behalf of a deceased taxpayer in Arizona.

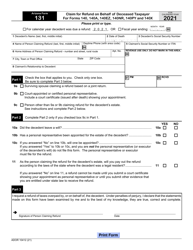

Q: Who can file this form?

A: The executor, administrator, or legal representative of the deceased taxpayer's estate can file this form.

Q: What information is required on this form?

A: The form requires information about the deceased taxpayer, the person filing the claim, and any supporting documentation.

Q: Is there a deadline for filing this form?

A: Yes, the form must be filed within 3 years from the date of the taxpayer's death or within the time remaining for filing a refund claim, whichever is later.

Q: Is there a fee for filing this form?

A: No, there is no fee for filing this form.

Q: What should I do after completing the form?

A: After completing the form, make sure to attach any required supporting documentation and submit it to the Arizona Department of Revenue.

Q: Can I file this form electronically?

A: No, Arizona Form 131 cannot be filed electronically. It must be submitted by mail.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.