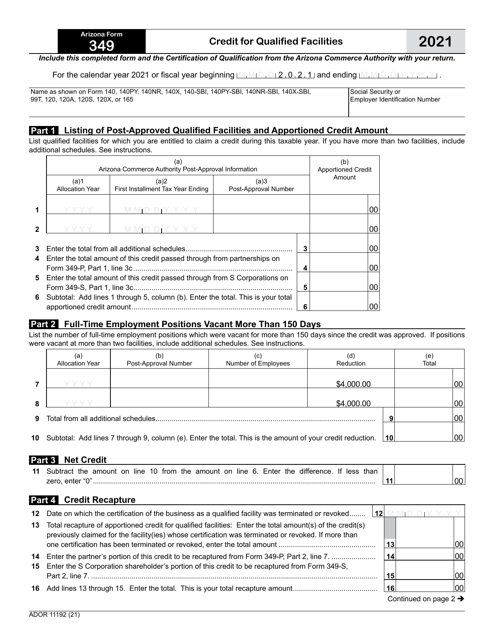

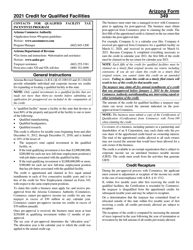

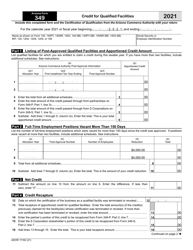

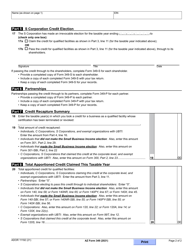

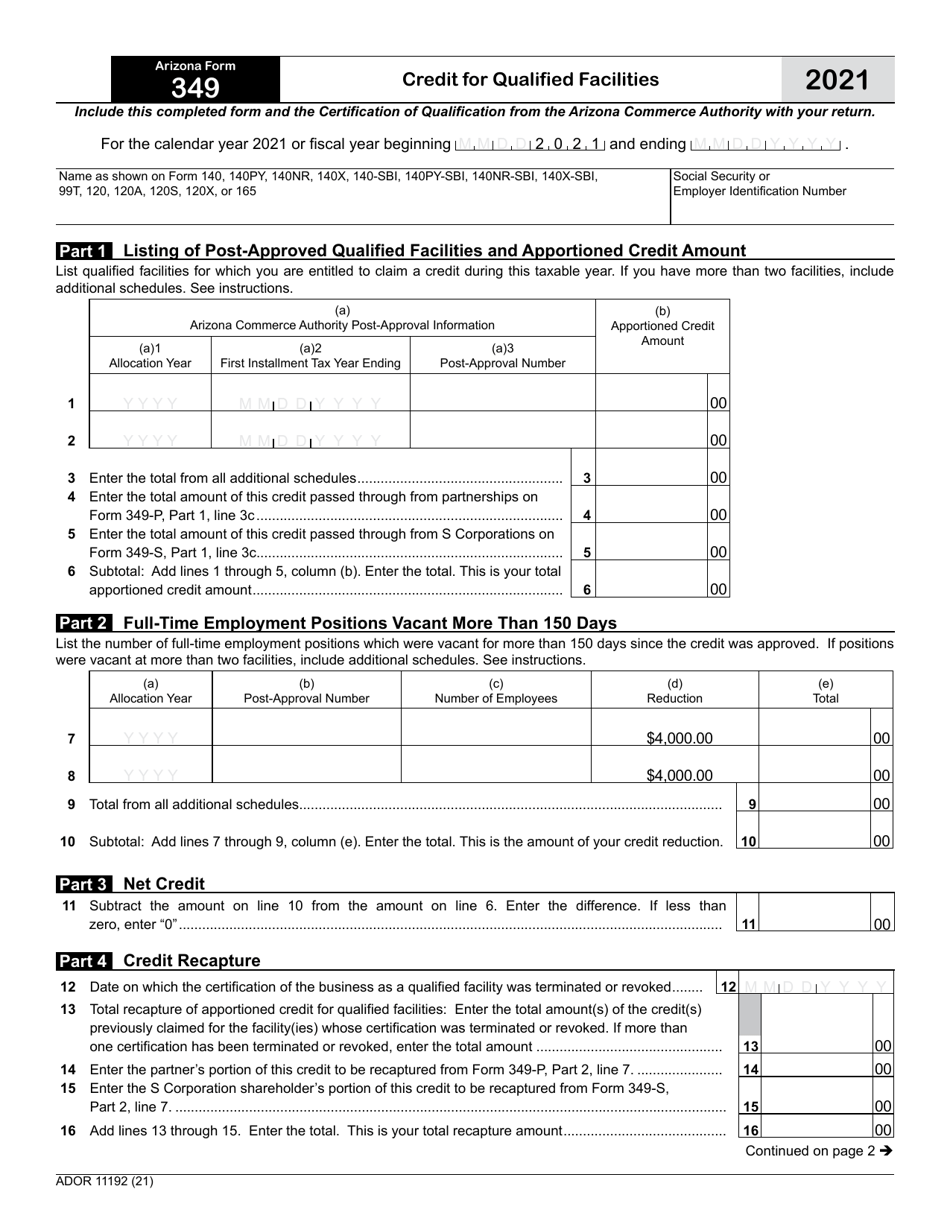

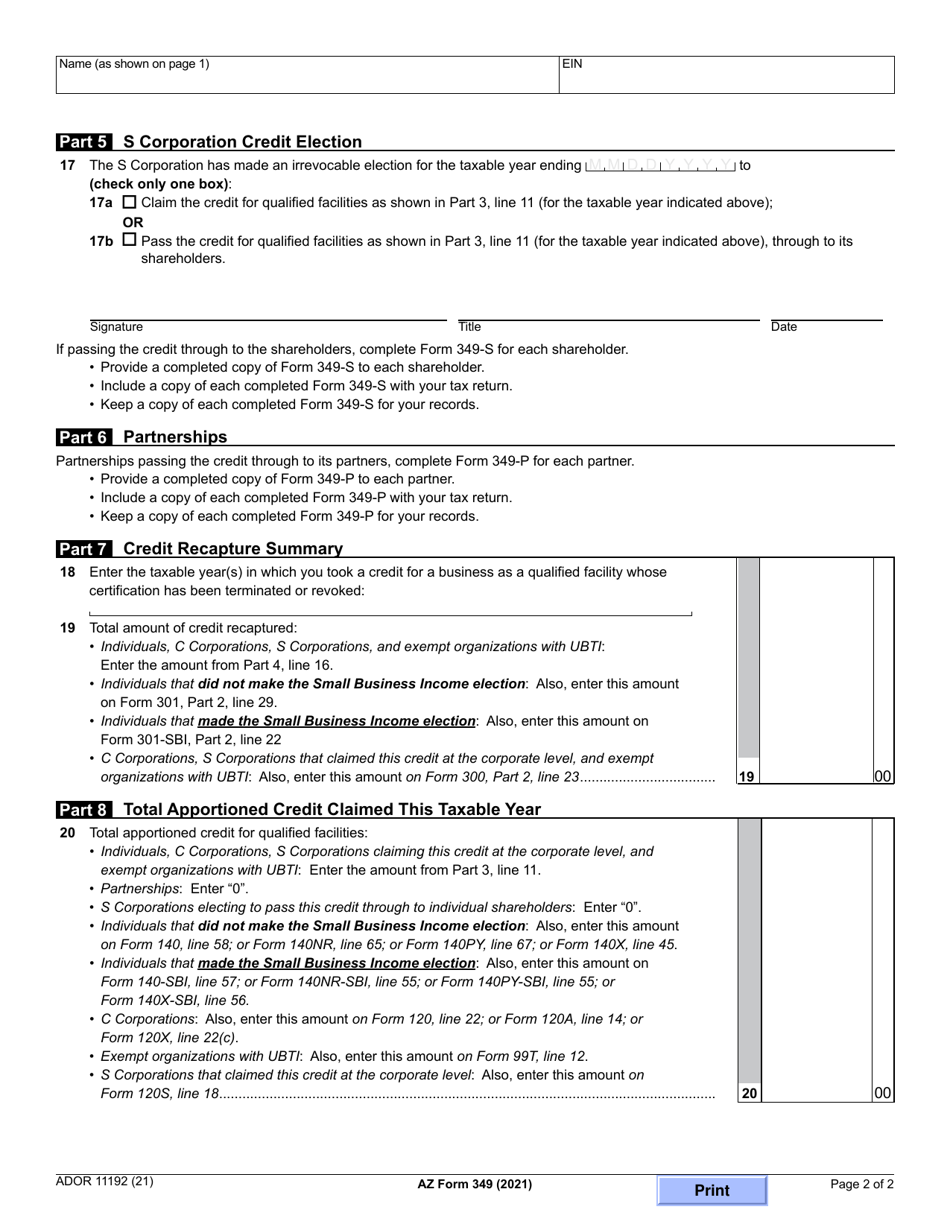

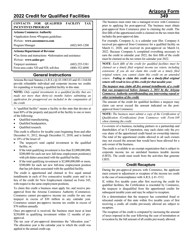

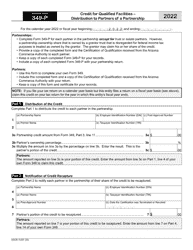

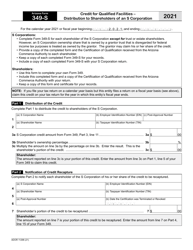

Arizona Form 349 (ADOR11192) Credit for Qualified Facilities - Arizona

What Is Arizona Form 349 (ADOR11192)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 349?

A: Arizona Form 349 is a form issued by the Arizona Department of Revenue (ADOR) for claiming the Credit for Qualified Facilities in Arizona.

Q: Who is eligible to claim the Credit for Qualified Facilities?

A: Taxpayers who own or lease a qualified facility in Arizona and meet the eligibility criteria can claim the Credit for Qualified Facilities.

Q: What is the purpose of the Credit for Qualified Facilities?

A: The purpose of the Credit for Qualified Facilities is to promote economic growth and development in Arizona by providing tax incentives to businesses.

Q: What is a qualified facility?

A: A qualified facility is a facility that meets certain criteria set by the Arizona Department of Revenue, such as job creation, capital investment, and location.

Q: How do I claim the credit?

A: To claim the credit, you need to complete and file Arizona Form 349 with the Arizona Department of Revenue.

Q: Is there a deadline for filing Arizona Form 349?

A: Yes, Arizona Form 349 must be filed on or before the due date of your Arizona income tax return.

Q: What documentation do I need to support my claim?

A: You will need to provide documentation such as lease agreements, payroll records, and proof of capital investment to support your claim for the Credit for Qualified Facilities.

Q: How much credit can I claim?

A: The amount of credit you can claim depends on various factors, such as the number of jobs created, the amount of capital investment, and the location of the qualified facility.

Q: Can the credit be carried forward or refunded?

A: Yes, any unused credit can be carried forward for up to five years, and in some cases, the credit may be refundable.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 349 (ADOR11192) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.