This version of the form is not currently in use and is provided for reference only. Download this version of

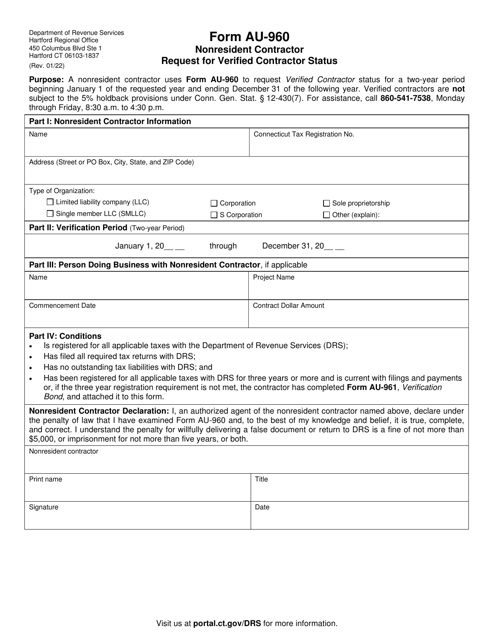

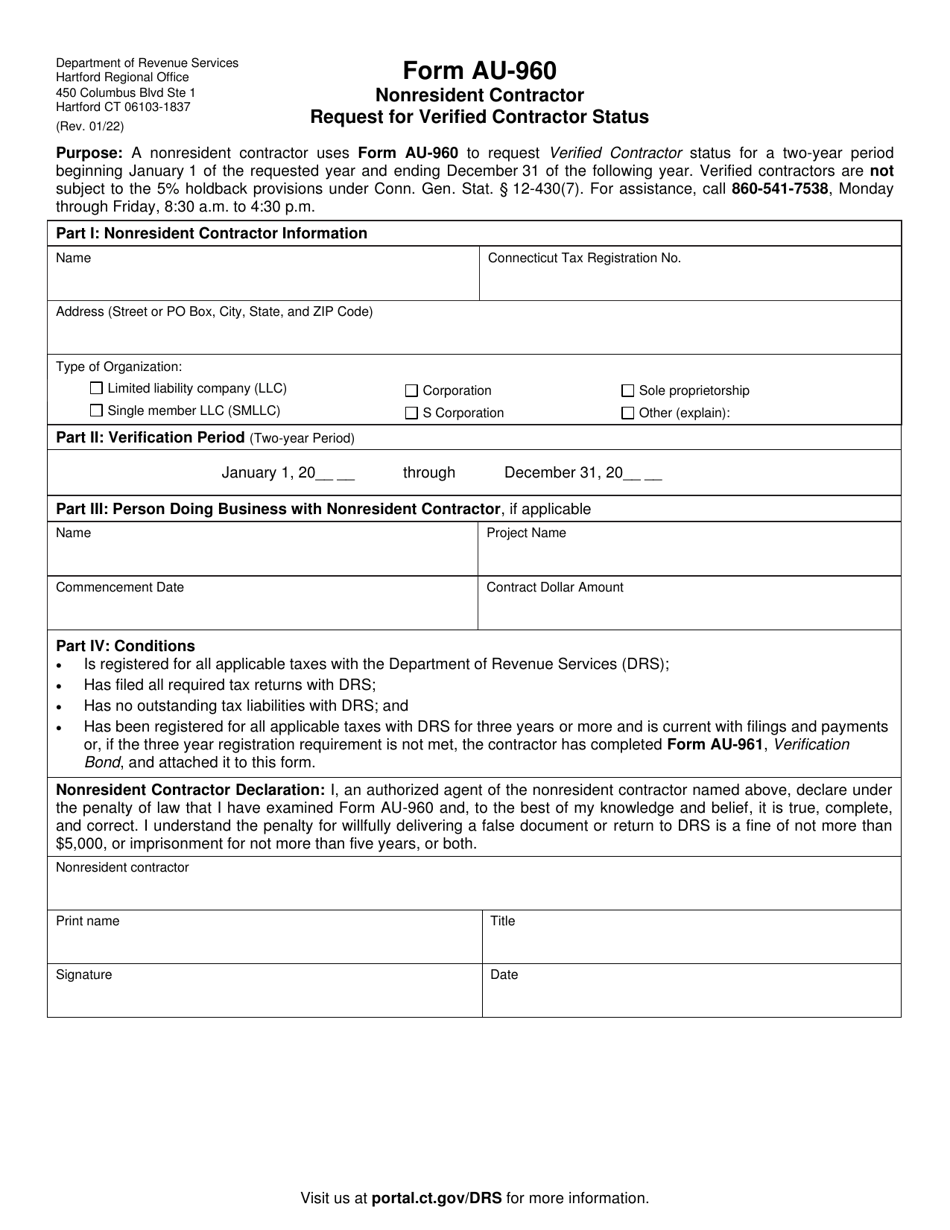

Form AU-960

for the current year.

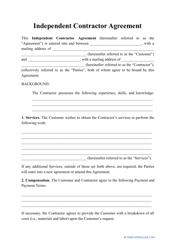

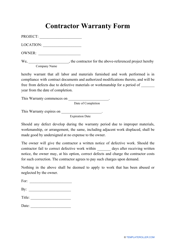

Form AU-960 Nonresident Contractor Request for Verified Contractor Status - Connecticut

What Is Form AU-960?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-960?

A: Form AU-960 is a form used by nonresident contractors to request verified contractor status in Connecticut.

Q: Who should use Form AU-960?

A: Nonresident contractors who wish to work in Connecticut must use Form AU-960 to request verified contractor status.

Q: What is verified contractor status?

A: Verified contractor status is a designation that allows nonresident contractors to work in Connecticut without having to withhold Connecticut income tax from their earnings.

Q: What information is required on Form AU-960?

A: Form AU-960 requires information such as the contractor's name, business address, federal employer identification number (FEIN), and a declaration of estimated gross receipts.

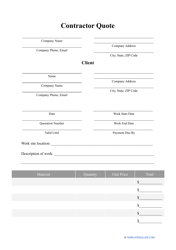

Q: Are there any filing fees for Form AU-960?

A: No, there are no filing fees for Form AU-960.

Q: How long does it take to process Form AU-960?

A: The processing time for Form AU-960 may vary, but you should allow for sufficient time before starting any work in Connecticut.

Q: What happens after I submit Form AU-960?

A: After you submit Form AU-960, the Connecticut Department of Revenue Services will review your application and notify you of your verified contractor status.

Q: How long is verified contractor status valid for?

A: Verified contractor status is valid for one year. You must renew your verified contractor status annually.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-960 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.