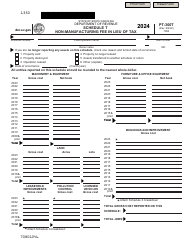

This version of the form is not currently in use and is provided for reference only. Download this version of

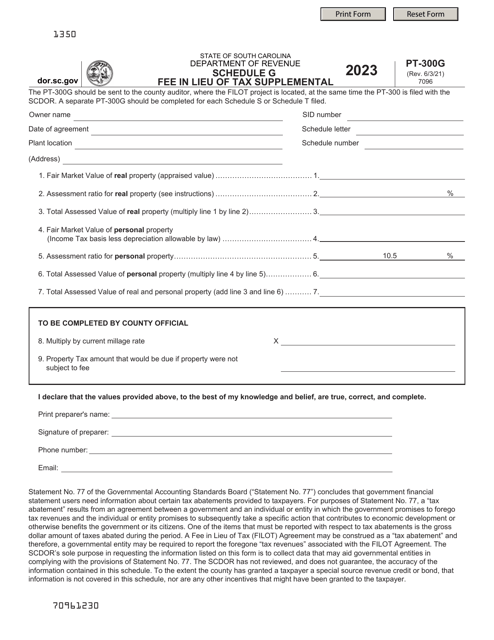

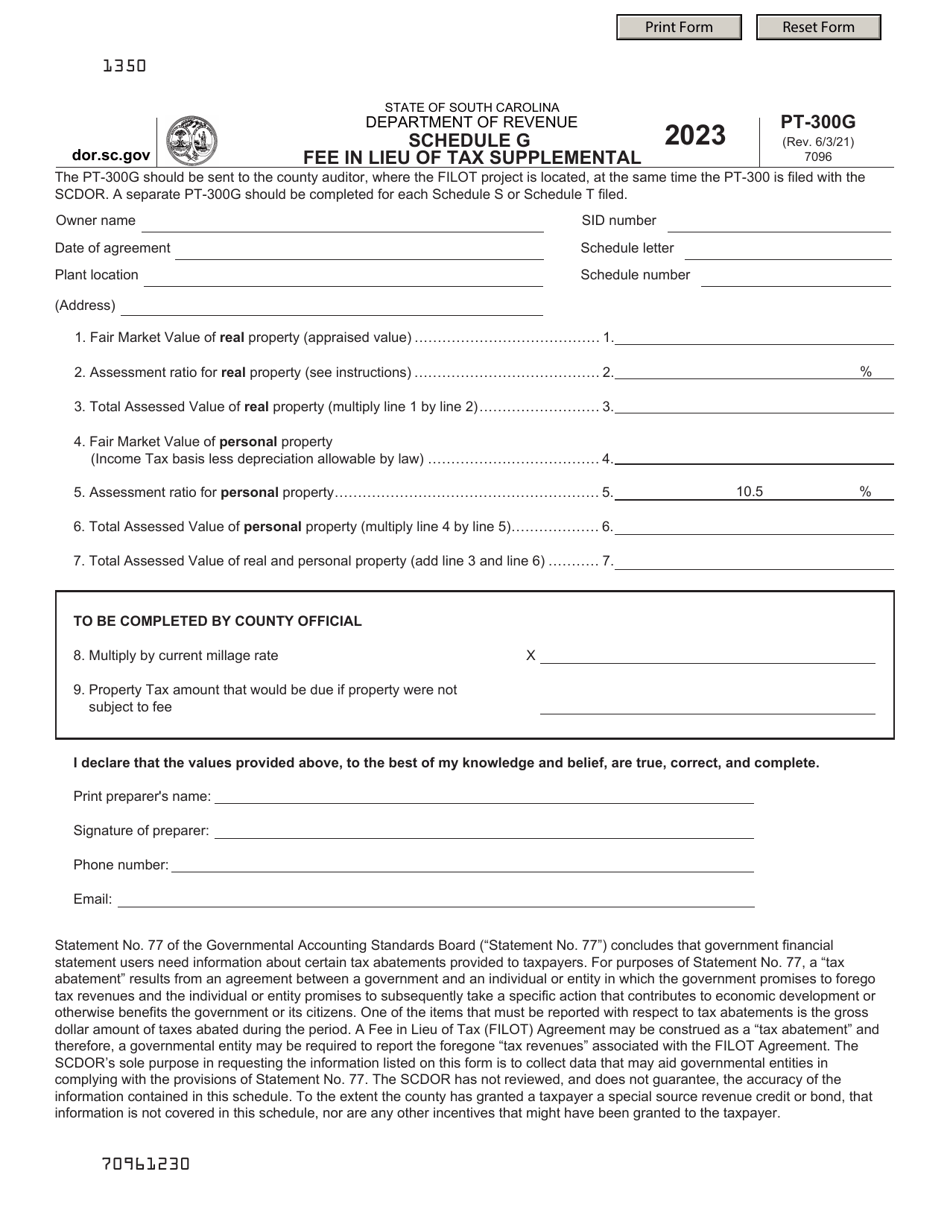

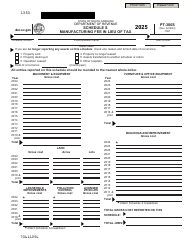

Form PT-300G Schedule G

for the current year.

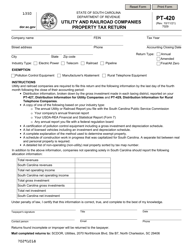

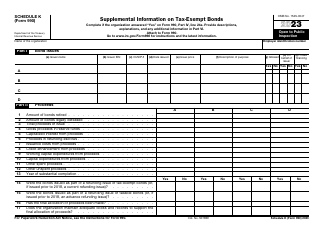

Form PT-300G Schedule G Fee in Lieu of Tax Supplemental - South Carolina

What Is Form PT-300G Schedule G?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PT-300G Schedule G?

A: The Form PT-300G Schedule G is a supplemental form used in South Carolina to report the Fee in Lieu of Tax.

Q: What is the Fee in Lieu of Tax?

A: The Fee in Lieu of Tax is a special tax arrangement that allows certain businesses to pay a negotiated fee instead of regular property taxes.

Q: Who needs to file the Form PT-300G Schedule G?

A: Businesses that have a Fee in Lieu of Tax agreement in South Carolina need to file the Form PT-300G Schedule G.

Q: What information is required on the Form PT-300G Schedule G?

A: The Form PT-300G Schedule G requires information about the business, including the property ID, the fee calculation, and any adjustments.

Form Details:

- Released on June 3, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-300G Schedule G by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.