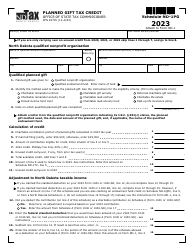

This version of the form is not currently in use and is provided for reference only. Download this version of

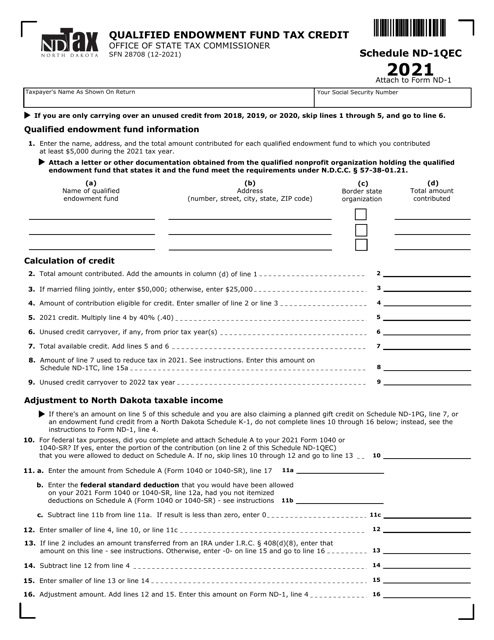

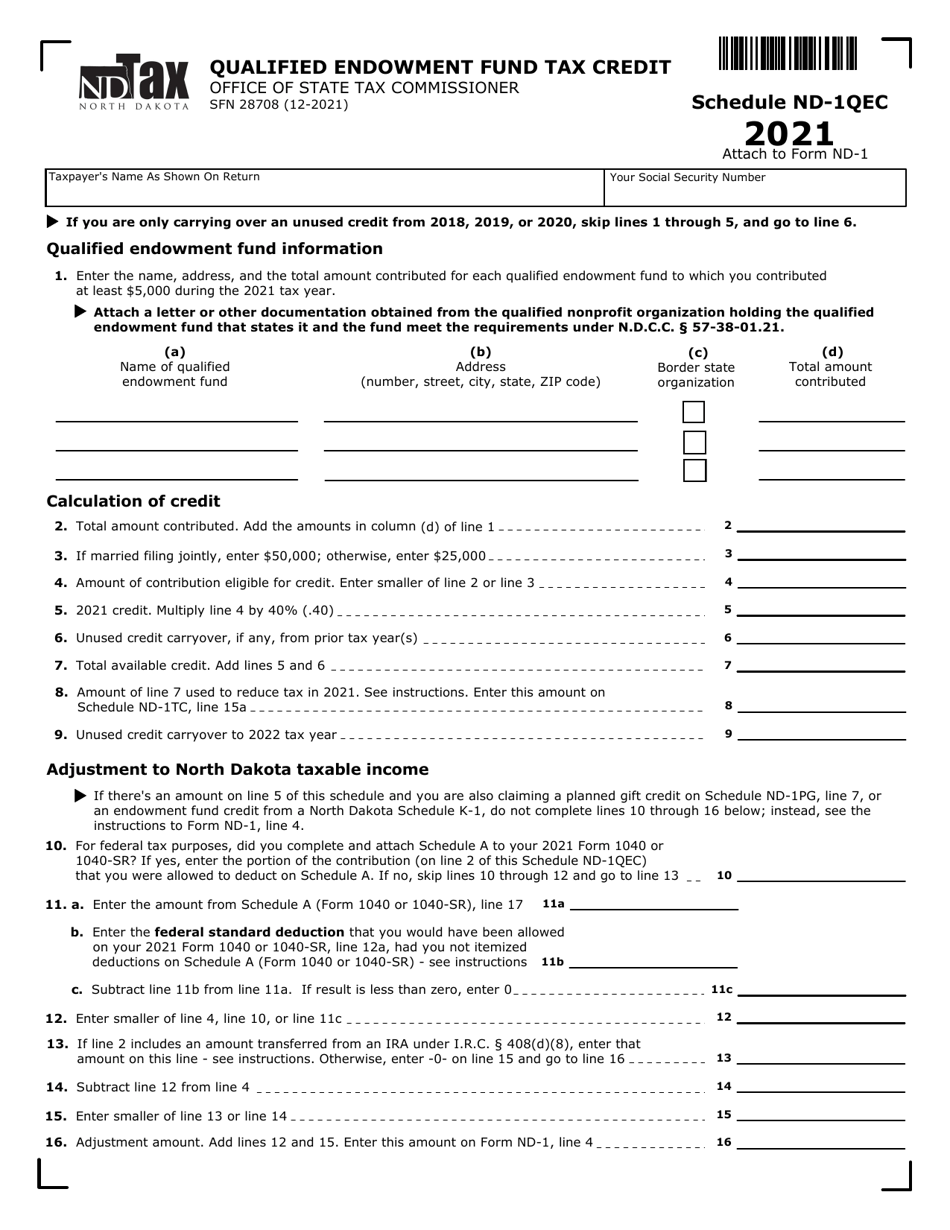

Form SFN28708 Schedule ND-1QEC

for the current year.

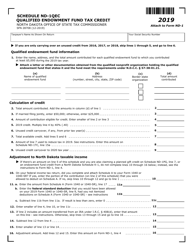

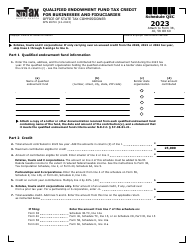

Form SFN28708 Schedule ND-1QEC Qualified Endowment Fund Tax Credit - North Dakota

What Is Form SFN28708 Schedule ND-1QEC?

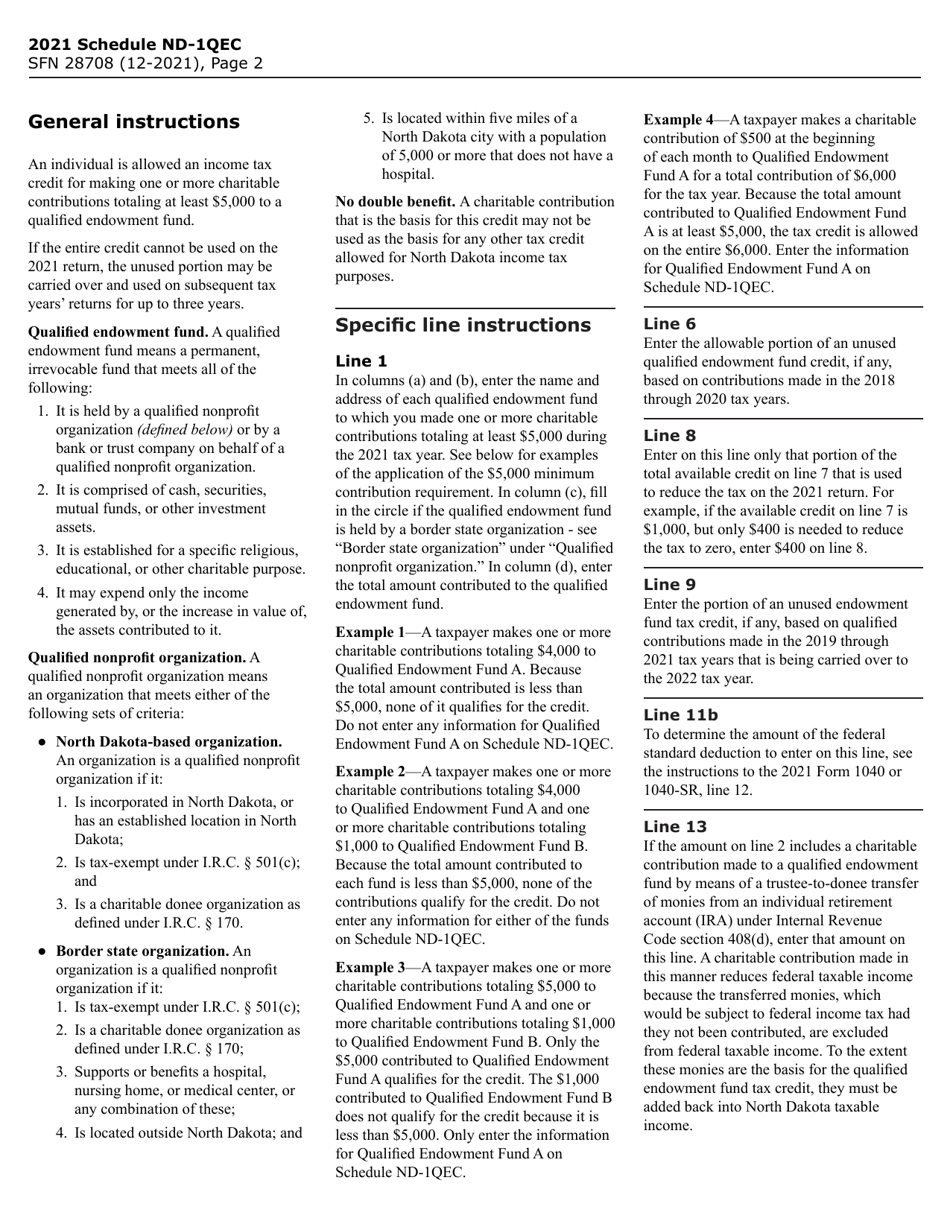

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SFN28708 Schedule ND-1QEC?

A: The Form SFN28708 Schedule ND-1QEC is a schedule used in North Dakota to claim the Qualified Endowment Fund Tax Credit.

Q: What is the Qualified Endowment Fund Tax Credit?

A: The Qualified Endowment Fund Tax Credit is a tax credit available in North Dakota for contributions made to qualified endowment funds.

Q: Who can claim the Qualified Endowment Fund Tax Credit?

A: Individuals and businesses that make contributions to qualified endowment funds in North Dakota can claim the tax credit.

Q: How can I claim the Qualified Endowment Fund Tax Credit?

A: To claim the tax credit, you must complete Form SFN28708 Schedule ND-1QEC and include it with your North Dakota tax return.

Q: What are qualified endowment funds?

A: Qualified endowment funds are funds established to provide permanent financial support for nonprofit organizations or public institutions. Contributions to these funds may be eligible for the tax credit.

Q: What is the purpose of the Qualified Endowment Fund Tax Credit?

A: The tax credit is intended to incentivize donations to qualified endowment funds, which can help support charitable organizations and public institutions in North Dakota.

Q: Is there a limit to the amount of the tax credit?

A: Yes, there is a limit to the amount of the tax credit that can be claimed. The specific limit may vary each year, so it is important to check the current tax laws or consult with a tax professional.

Q: Are there any eligibility requirements to claim the tax credit?

A: Yes, there may be eligibility requirements to claim the tax credit, such as minimum contribution amounts or specific types of organizations that qualify. It is important to review the instructions for Form SFN28708 Schedule ND-1QEC and consult with a tax professional if needed.

Q: Can I claim the tax credit if I made contributions to endowment funds in other states?

A: No, the Qualified Endowment Fund Tax Credit is specific to contributions made to qualified endowment funds in North Dakota only.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28708 Schedule ND-1QEC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.