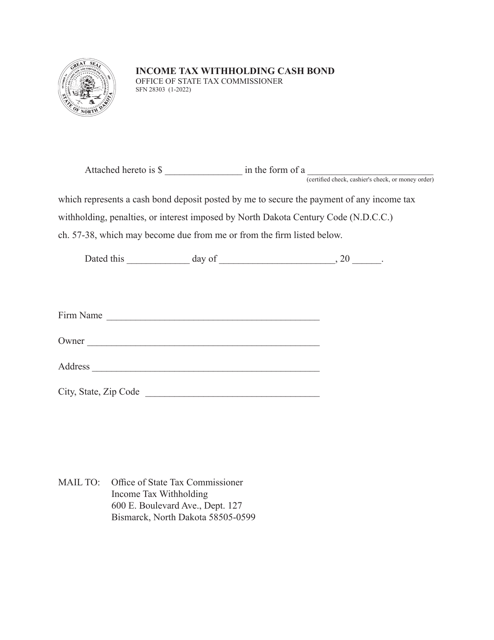

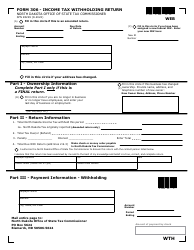

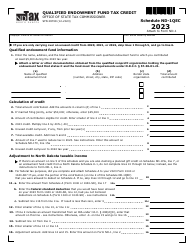

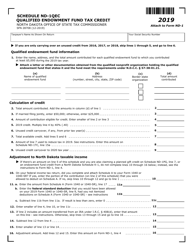

Form SFN28303 Income Tax Withholding Cash Bond - North Dakota

What Is Form SFN28303?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SFN 28303?

A: SFN 28303 is the form used for income tax withholdingcash bond specifically for North Dakota.

Q: Who needs to fill out SFN 28303?

A: Individuals or businesses who are required to post a cash bond for income tax withholding in North Dakota.

Q: What is the purpose of the SFN 28303?

A: The purpose of SFN 28303 is to provide a cash bond as security for any potential tax liability that may arise.

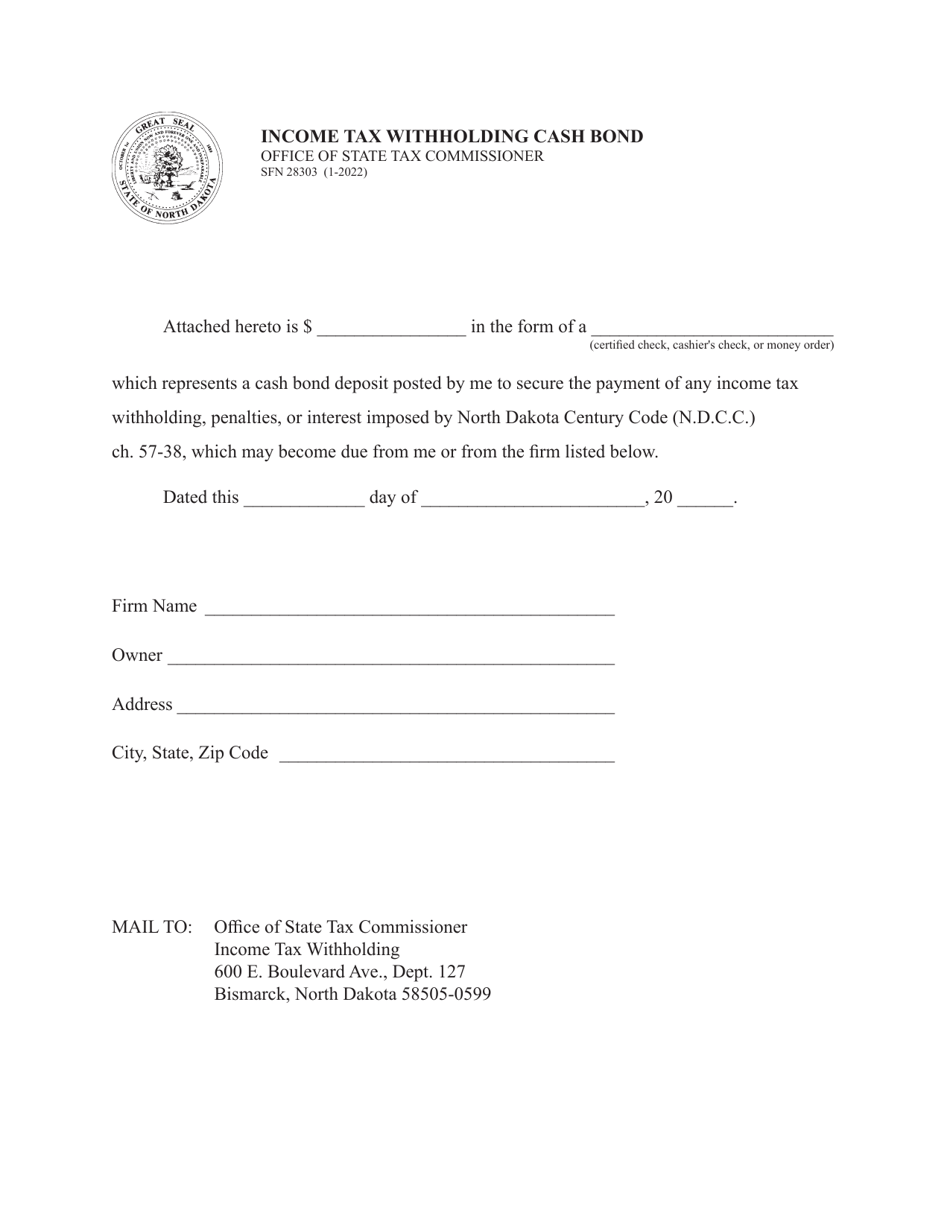

Q: What information is required on SFN 28303?

A: The form requires the taxpayer's name, social security number or taxpayer identification number, and the amount of the cash bond.

Q: Is there a deadline for submitting SFN 28303?

A: Yes, the form must be submitted prior to the due date for filing the tax return.

Q: Is the cash bond refundable?

A: Yes, the cash bond will be refunded if there is no tax liability or once any outstanding taxes are paid.

Q: Are there any alternatives to a cash bond for income tax withholding?

A: Yes, taxpayers may also post other forms of security, such as a surety bond or a letter of credit.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28303 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.