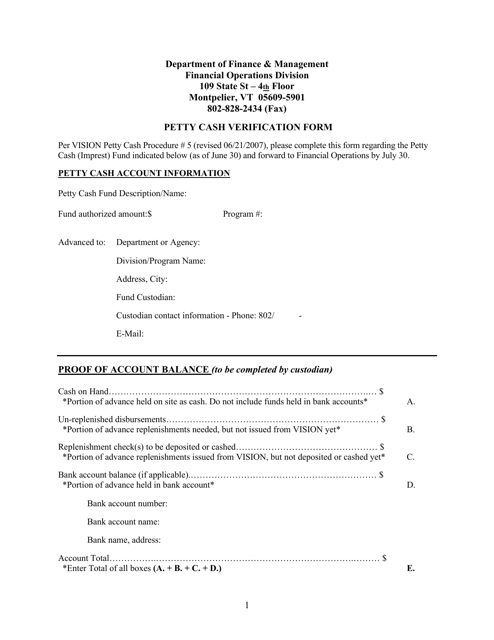

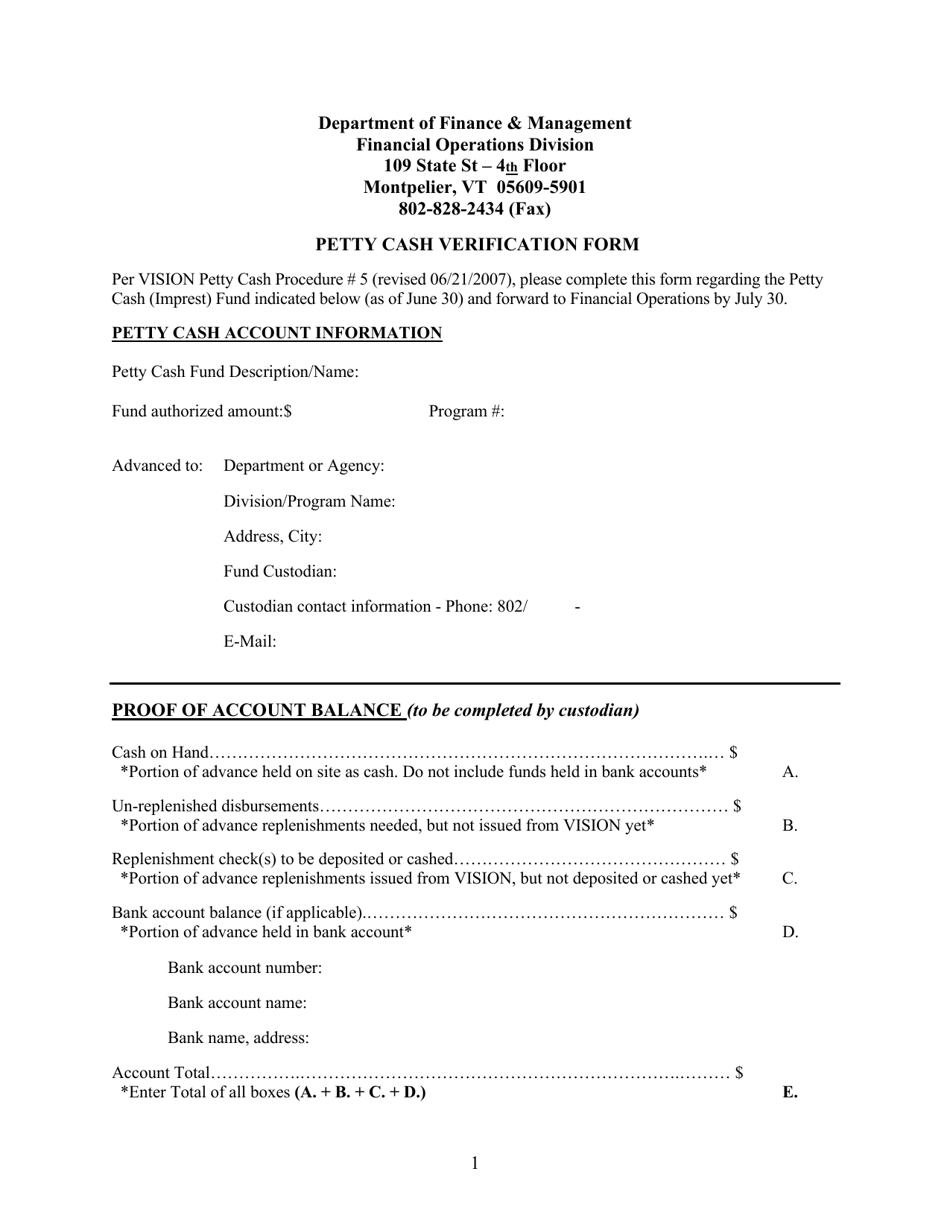

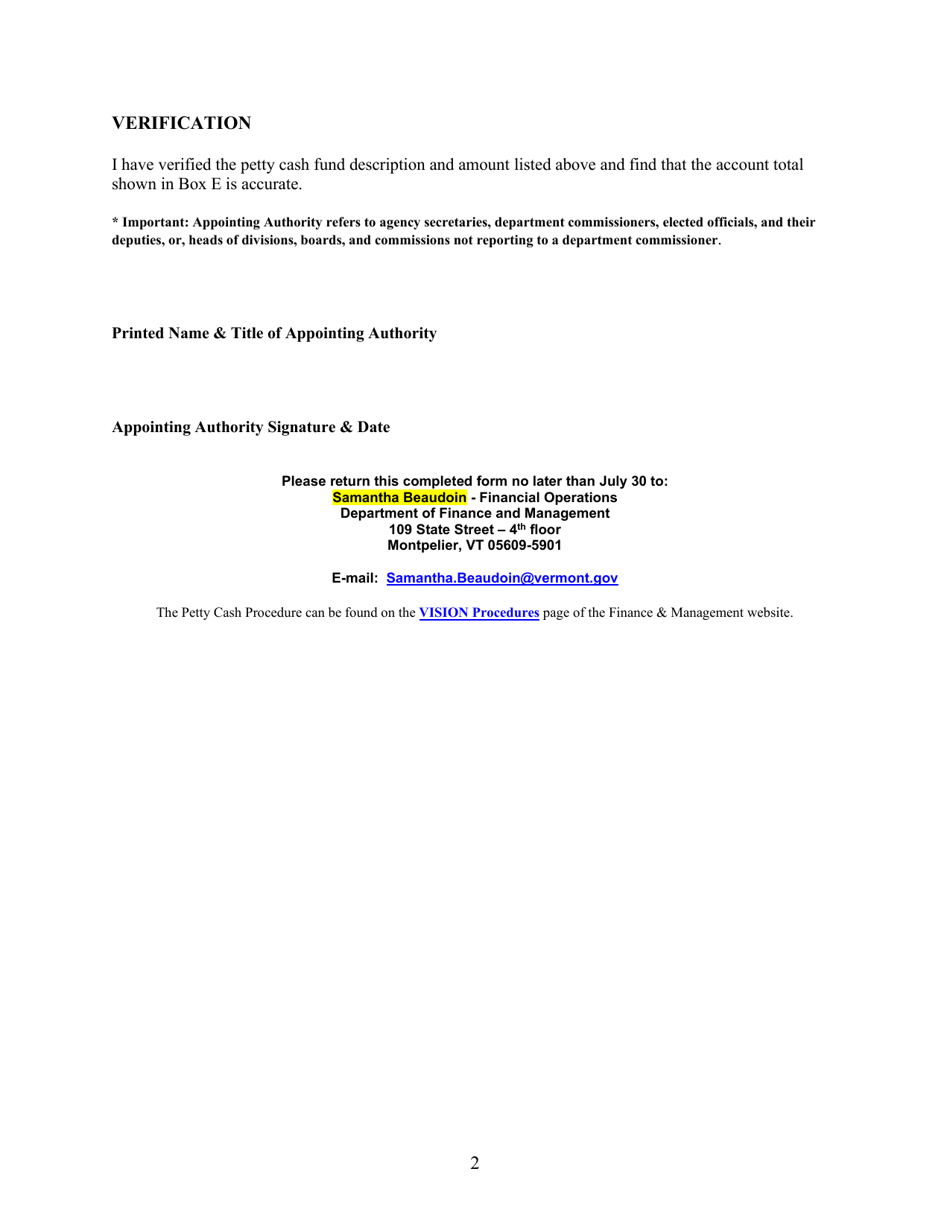

Petty Cash Verification Form - Vermont

Petty Cash Verification Form is a legal document that was released by the Vermont Department of Finance & Management - a government authority operating within Vermont.

FAQ

Q: What is a petty cash verification form?

A: A petty cash verification form is a document used to reconcile and verify the amount of cash kept on hand for small business expenses.

Q: Why is a petty cash verification form important?

A: A petty cash verification form is important because it helps to ensure that the amount of cash in the petty cash fund matches the records, preventing any discrepancies or potential loss.

Q: How often should a petty cash verification form be completed?

A: A petty cash verification form should be completed on a regular basis, typically every week or month, depending on the frequency of small cash transactions.

Q: What information is included in a petty cash verification form?

A: A petty cash verification form typically includes details such as the date, starting cash balance, receipts for expenses, ending cash balance, and any discrepancies or overages/shortages.

Q: Who is responsible for completing a petty cash verification form?

A: The person designated as the custodian of the petty cash fund is responsible for completing the petty cash verification form.

Q: What should be done in case of a discrepancy or shortage in the petty cash fund?

A: If there is a discrepancy or shortage in the petty cash fund, the custodian should investigate and report it to the appropriate supervisor or manager immediately.

Q: Can receipts be used as proof of expenses in a petty cash verification form?

A: Yes, receipts should be attached to the petty cash verification form as proof of valid expenses.

Q: Are there any legal requirements for maintaining petty cash?

A: While there may not be specific legal requirements for petty cash, it is important to maintain accurate records and follow internal controls to prevent fraud or misuse of funds.

Q: Is petty cash subject to taxation?

A: Petty cash is generally not subject to taxation, as it is typically used for small business expenses that are already deductible.

Q: What happens if there is an overage in the petty cash fund?

A: If there is an overage in the petty cash fund, it should be recorded as additional income and added to the starting cash balance for the next period.

Form Details:

- The latest edition currently provided by the Vermont Department of Finance & Management;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Finance & Management.