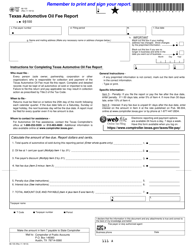

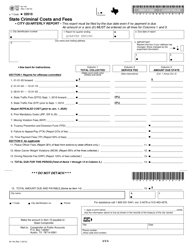

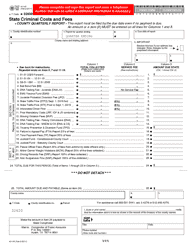

This version of the form is not currently in use and is provided for reference only. Download this version of

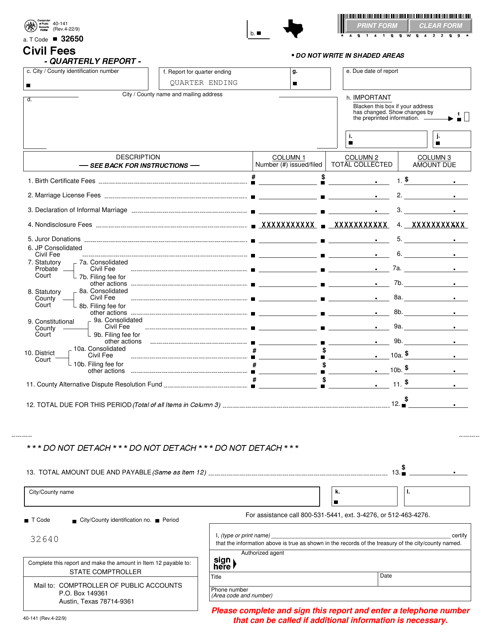

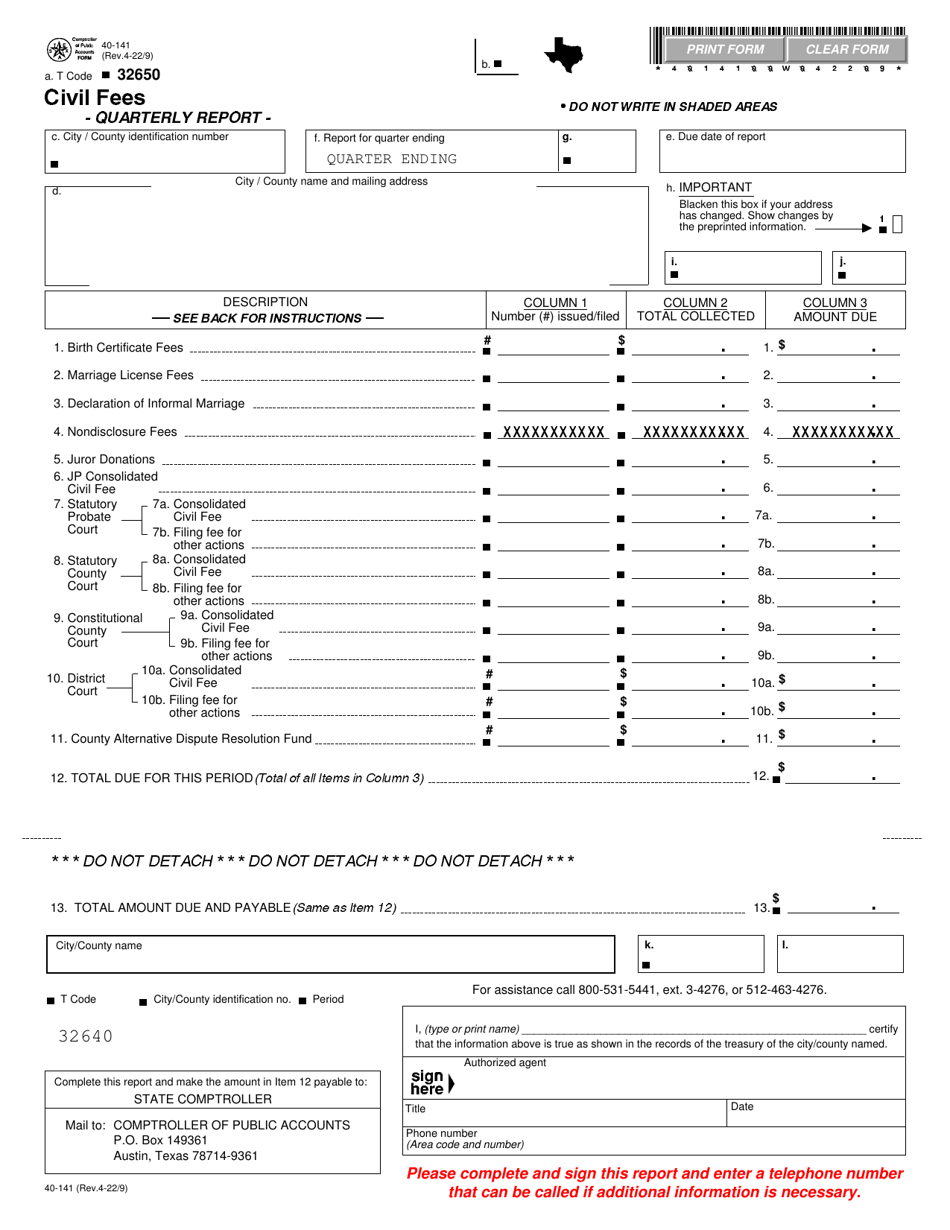

Form 40-141

for the current year.

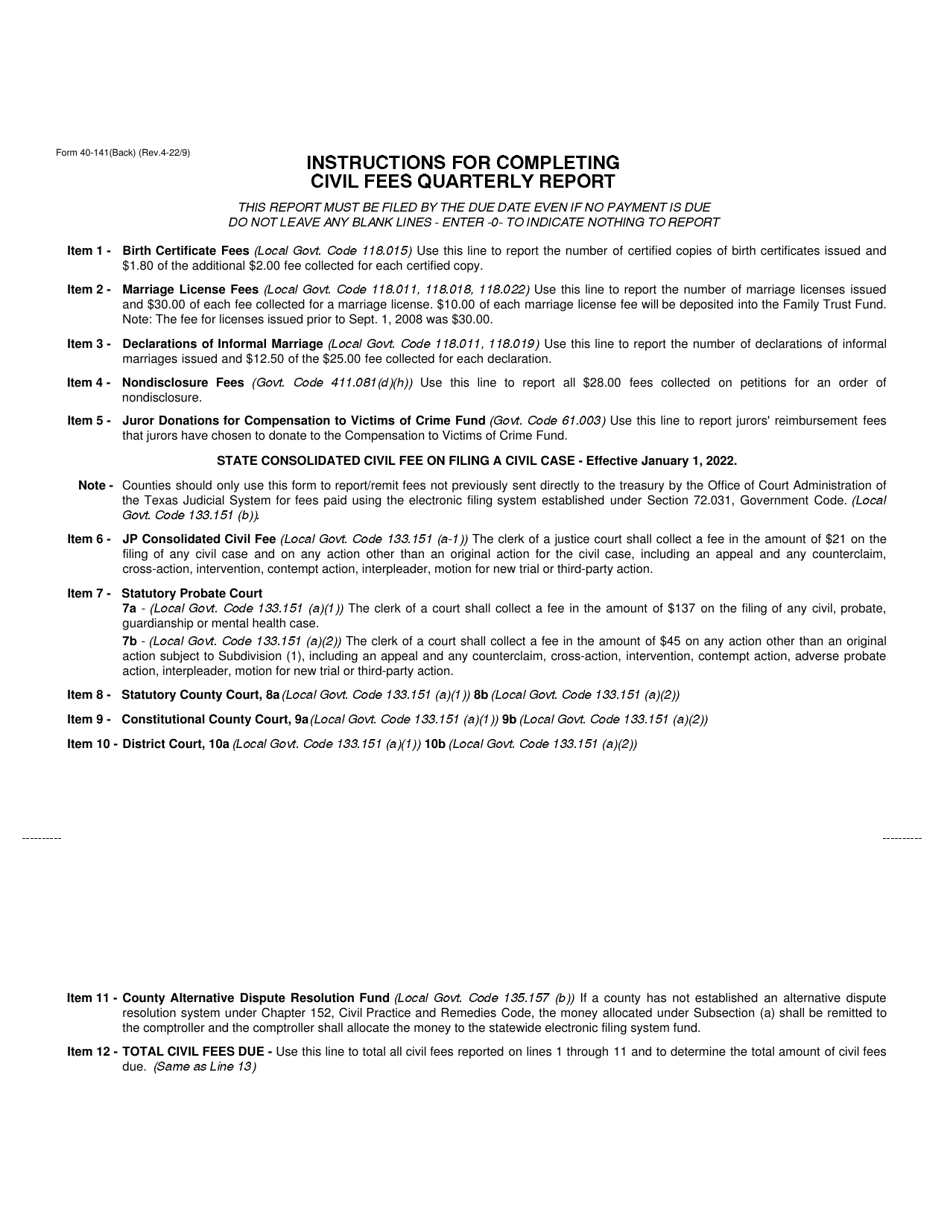

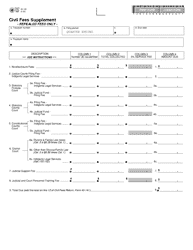

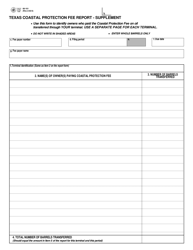

Form 40-141 Civil Fees Quarterly Report - Texas

What Is Form 40-141?

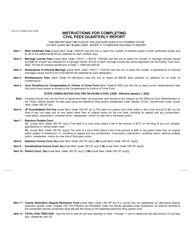

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-141?

A: Form 40-141 is the Civil Fees Quarterly Report used in Texas.

Q: Who needs to file Form 40-141?

A: This form needs to be filed by individuals or businesses that collect civil fees in Texas.

Q: What is the purpose of Form 40-141?

A: The purpose of this form is to report the amount of civil fees collected during a specific quarter.

Q: How often do you need to file Form 40-141?

A: Form 40-141 should be filed quarterly.

Q: Are there any fees associated with filing Form 40-141?

A: There are no fees associated with filing this form.

Q: What happens if I don't file Form 40-141?

A: Failure to file Form 40-141 may result in penalties or late fees imposed by the Texas Comptroller of Public Accounts.

Q: Is Form 40-141 specific to Texas?

A: Yes, Form 40-141 is specific to Texas and is used to report civil fees collected within the state.

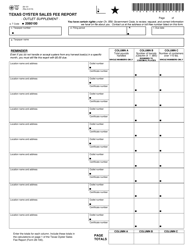

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-141 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.