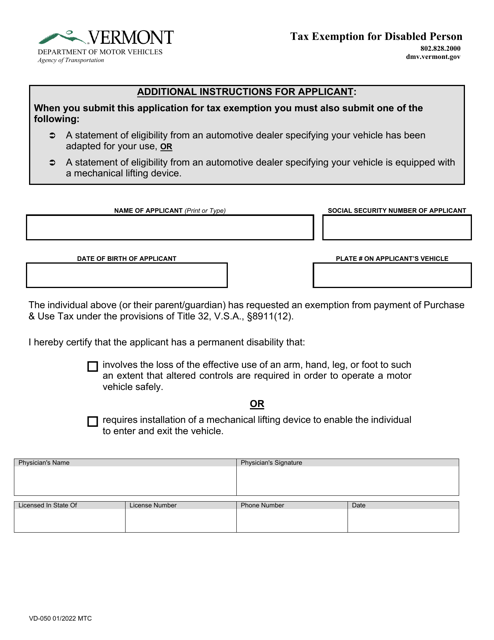

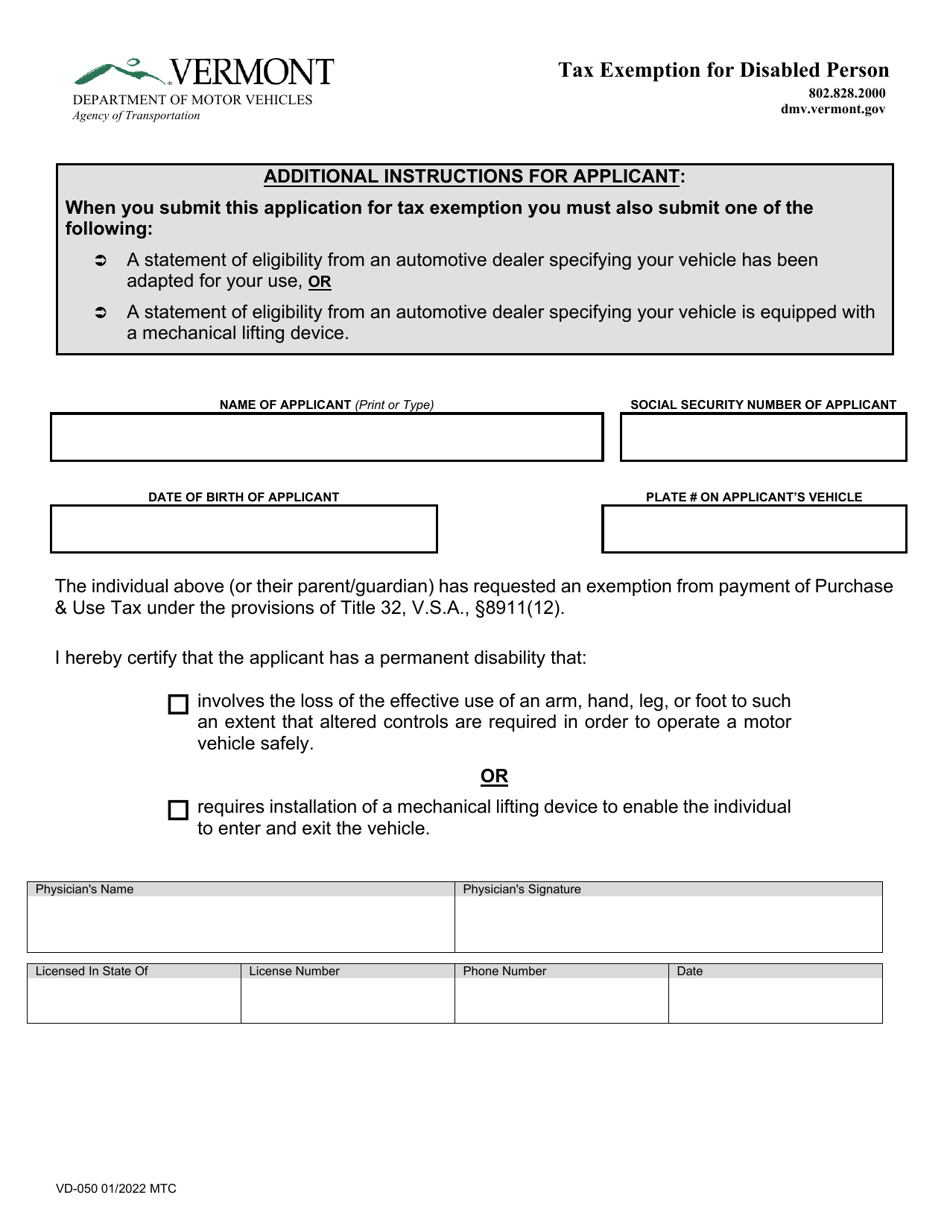

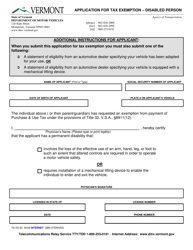

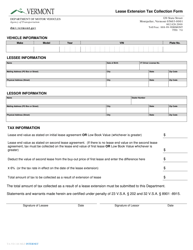

Form VD-050 Tax Exemption for Disabled Person - Vermont

What Is Form VD-050?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

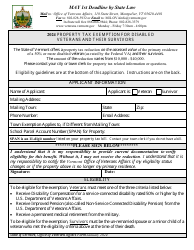

Q: What is Form VD-050?

A: Form VD-050 is a tax exemption form for disabled persons in Vermont.

Q: Who is eligible for tax exemption with Form VD-050?

A: Disabled persons who meet the criteria specified in the form are eligible for tax exemption.

Q: What are the criteria for tax exemption with Form VD-050?

A: The criteria include being a disabled person as defined by the form, being a resident of Vermont, and meeting the income requirements.

Q: What types of taxes are eligible for exemption with Form VD-050?

A: The form allows for exemption from property taxes and sales and use taxes.

Q: Is there a deadline for filing Form VD-050?

A: Yes, the form must be filed on or before April 15th of the tax year for which you are seeking exemption.

Q: Can I claim tax exemption for previous years with Form VD-050?

A: No, the form can only be used to claim tax exemption for the current tax year.

Q: Are there any exceptions to the income requirements for tax exemption?

A: Yes, there are exceptions for certain veterans and surviving spouses.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VD-050 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.