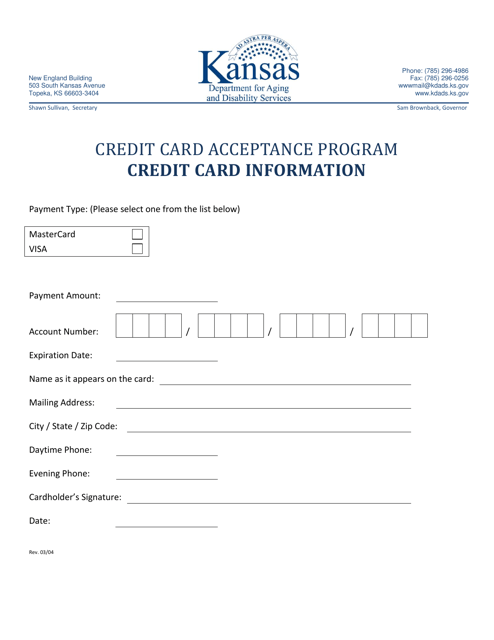

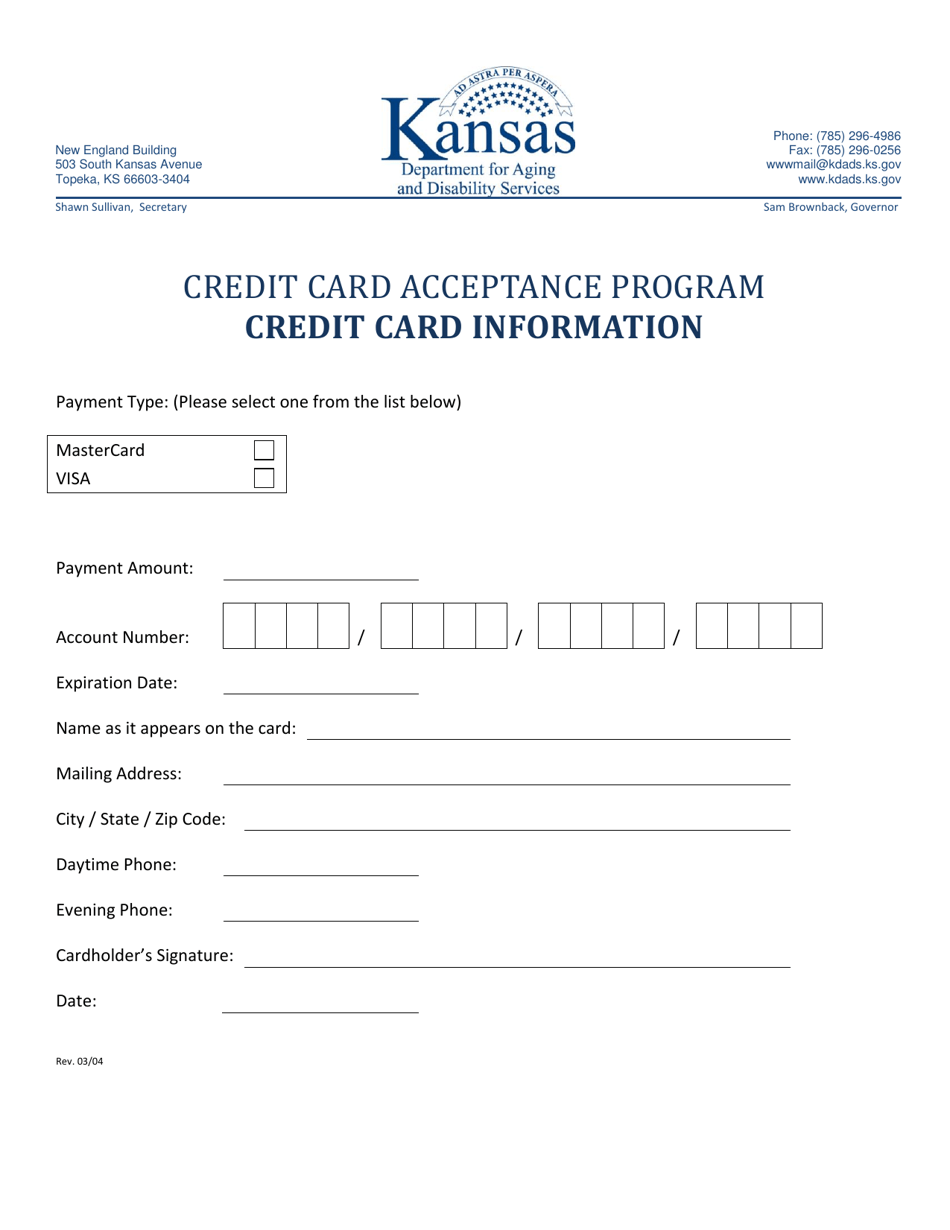

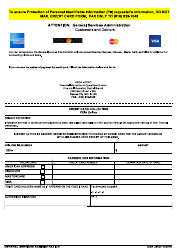

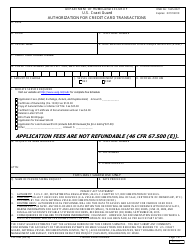

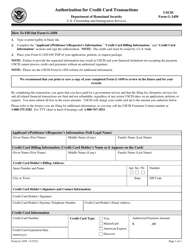

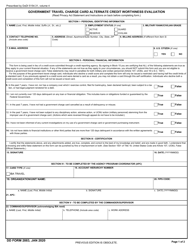

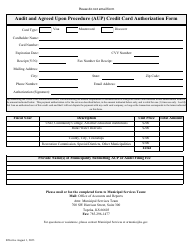

Credit Card Information - Credit Card Acceptance Program - Kansas

Credit Card Information - Credit Card Acceptance Program is a legal document that was released by the Kansas Department for Aging and Disability Services - a government authority operating within Kansas.

FAQ

Q: What is a Credit Card Acceptance Program?

A: A Credit Card Acceptance Program is a service provided by financial institutions that allows businesses to accept credit card payments from customers.

Q: Why is it important for businesses in Kansas to have a Credit Card Acceptance Program?

A: Having a Credit Card Acceptance Program allows businesses in Kansas to expand their customer base and offer convenient payment options to their customers.

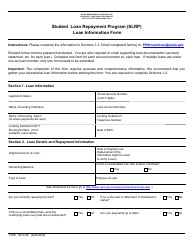

Q: How can businesses in Kansas apply for a Credit Card Acceptance Program?

A: Businesses in Kansas can apply for a Credit Card Acceptance Program through their preferred financial institution or by contacting credit card processing companies.

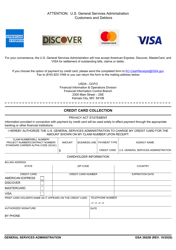

Q: What types of credit cards are typically accepted in Credit Card Acceptance Programs?

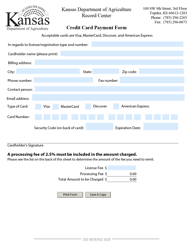

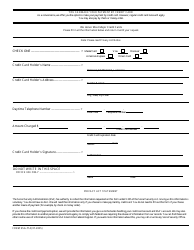

A: Credit Card Acceptance Programs usually accept major credit card brands such as Visa, Mastercard, American Express, and Discover.

Q: Are there any fees associated with Credit Card Acceptance Programs?

A: Yes, businesses typically pay processing fees for each credit card transaction processed through a Credit Card Acceptance Program.

Q: Are there any regulations or guidelines for businesses in Kansas regarding Credit Card Acceptance Programs?

A: Yes, businesses in Kansas need to comply with the Payment Card Industry Data Security Standard (PCI DSS) to ensure the security of credit card data.

Q: What are the benefits of having a Credit Card Acceptance Program for businesses in Kansas?

A: Benefits of having a Credit Card Acceptance Program include increased sales, improved cash flow, convenience for customers, and the ability to compete in today's digital economy.

Q: Can small businesses in Kansas also have a Credit Card Acceptance Program?

A: Yes, small businesses in Kansas can also have a Credit Card Acceptance Program. Many financial institutions and credit card processing companies offer solutions specifically tailored for small businesses.

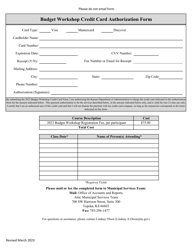

Q: What are some considerations for businesses in Kansas when choosing a Credit Card Acceptance Program?

A: Some considerations include the processing fees, ease of use, security features, customer support, and compatibility with the business's existing point-of-sale infrastructure.

Q: Are there any potential risks associated with Credit Card Acceptance Programs?

A: While Credit Card Acceptance Programs provide convenience, there is a risk of fraud and data breaches. It is important for businesses to implement proper security measures to mitigate these risks.

Form Details:

- Released on March 1, 2004;

- The latest edition currently provided by the Kansas Department for Aging and Disability Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department for Aging and Disability Services.