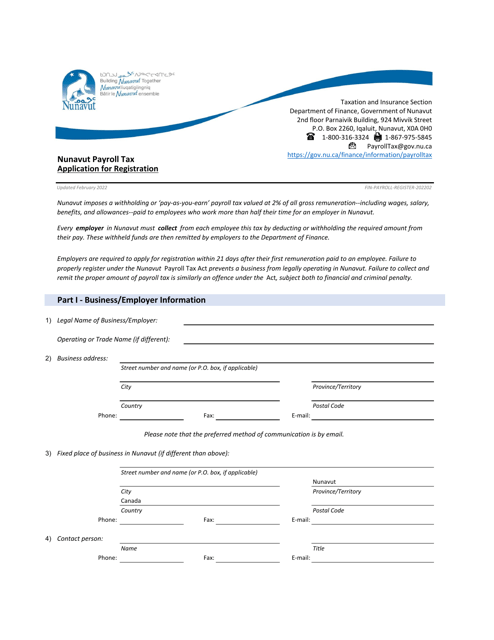

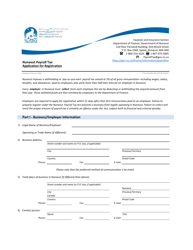

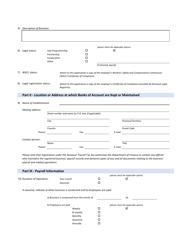

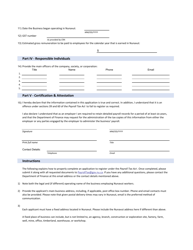

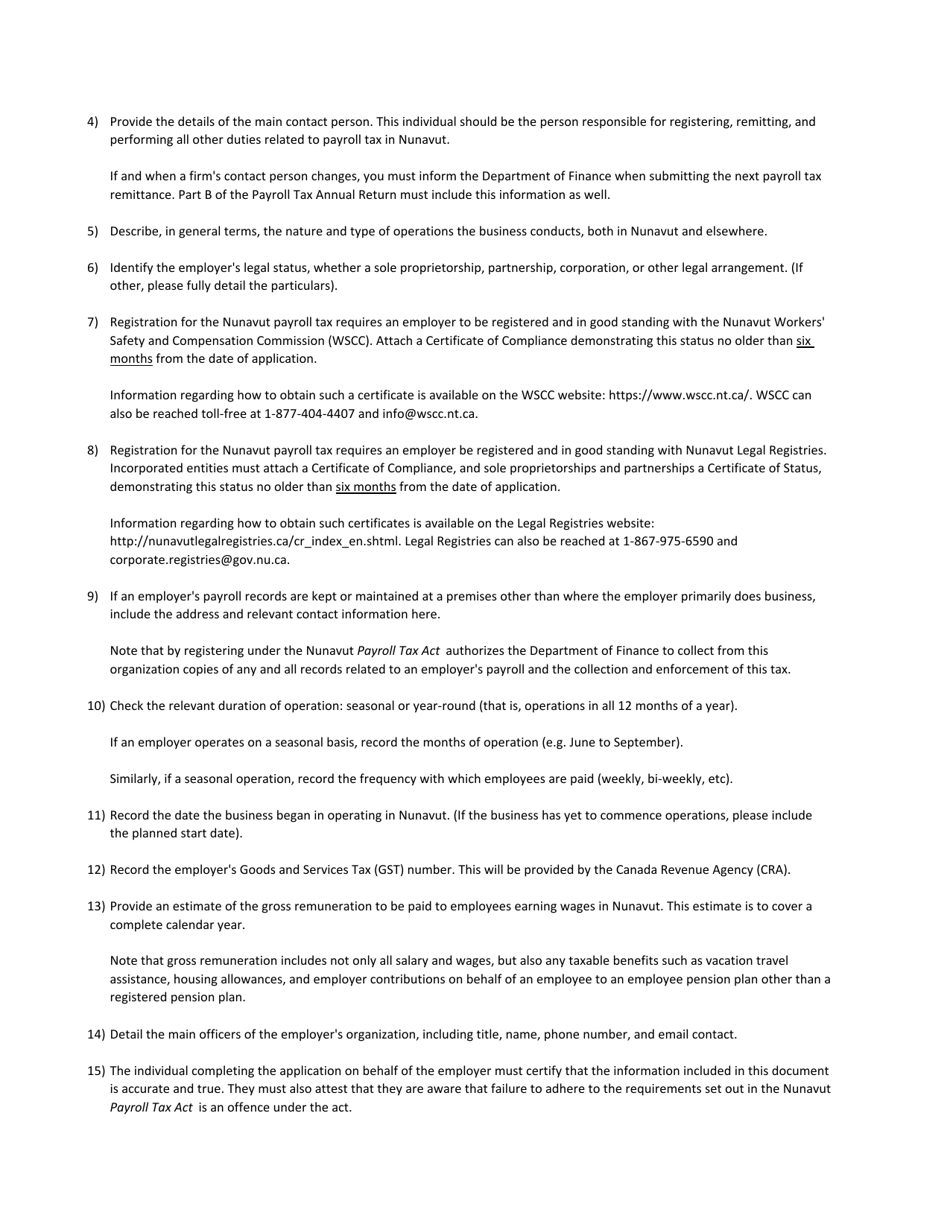

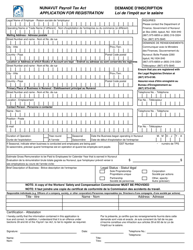

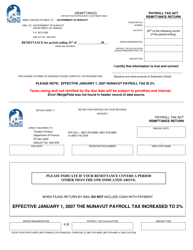

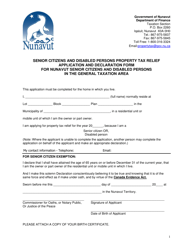

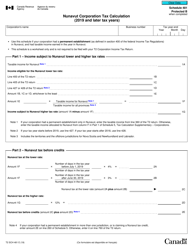

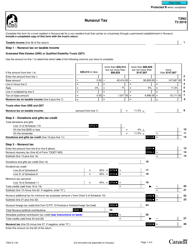

Nunavut Payroll Tax Application for Registration - Nunavut, Canada

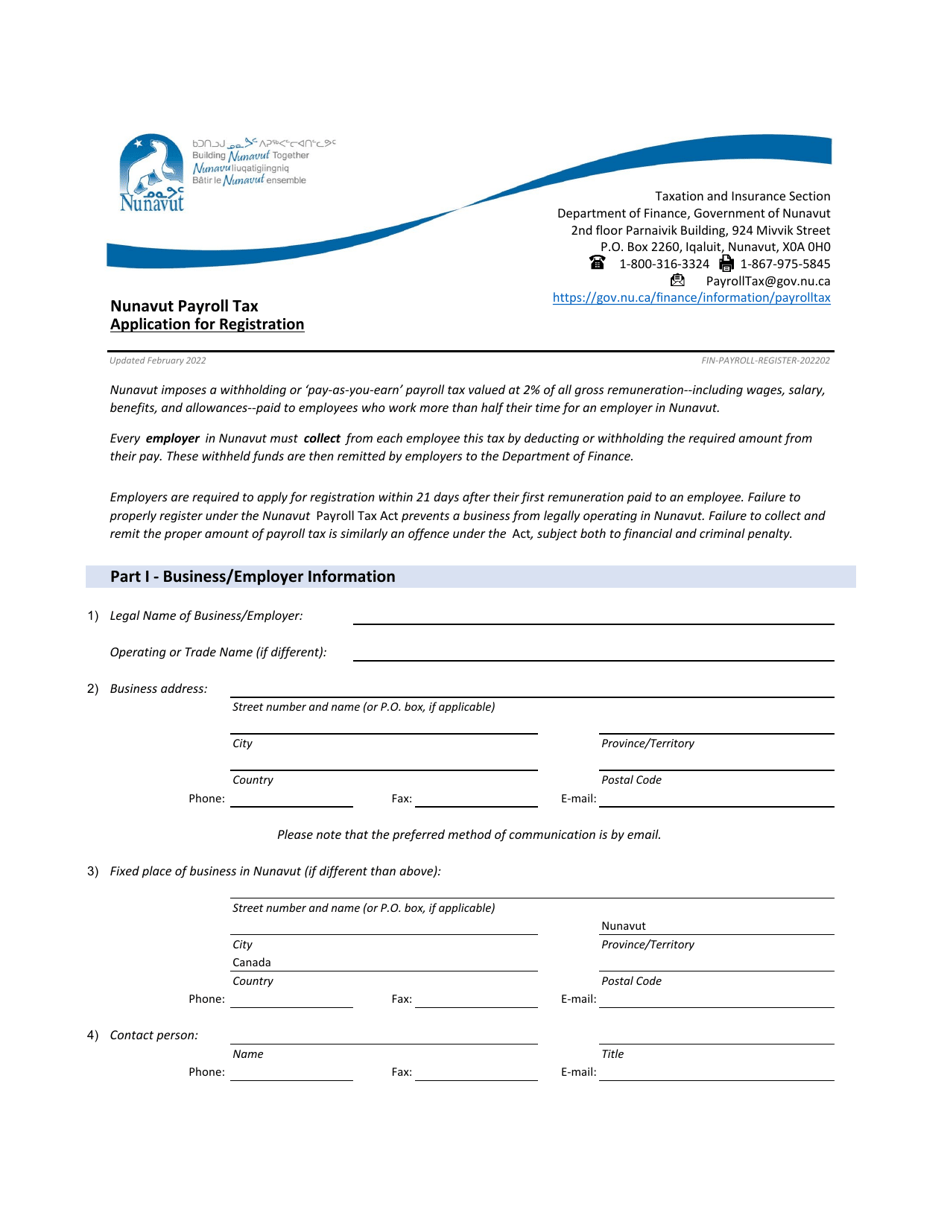

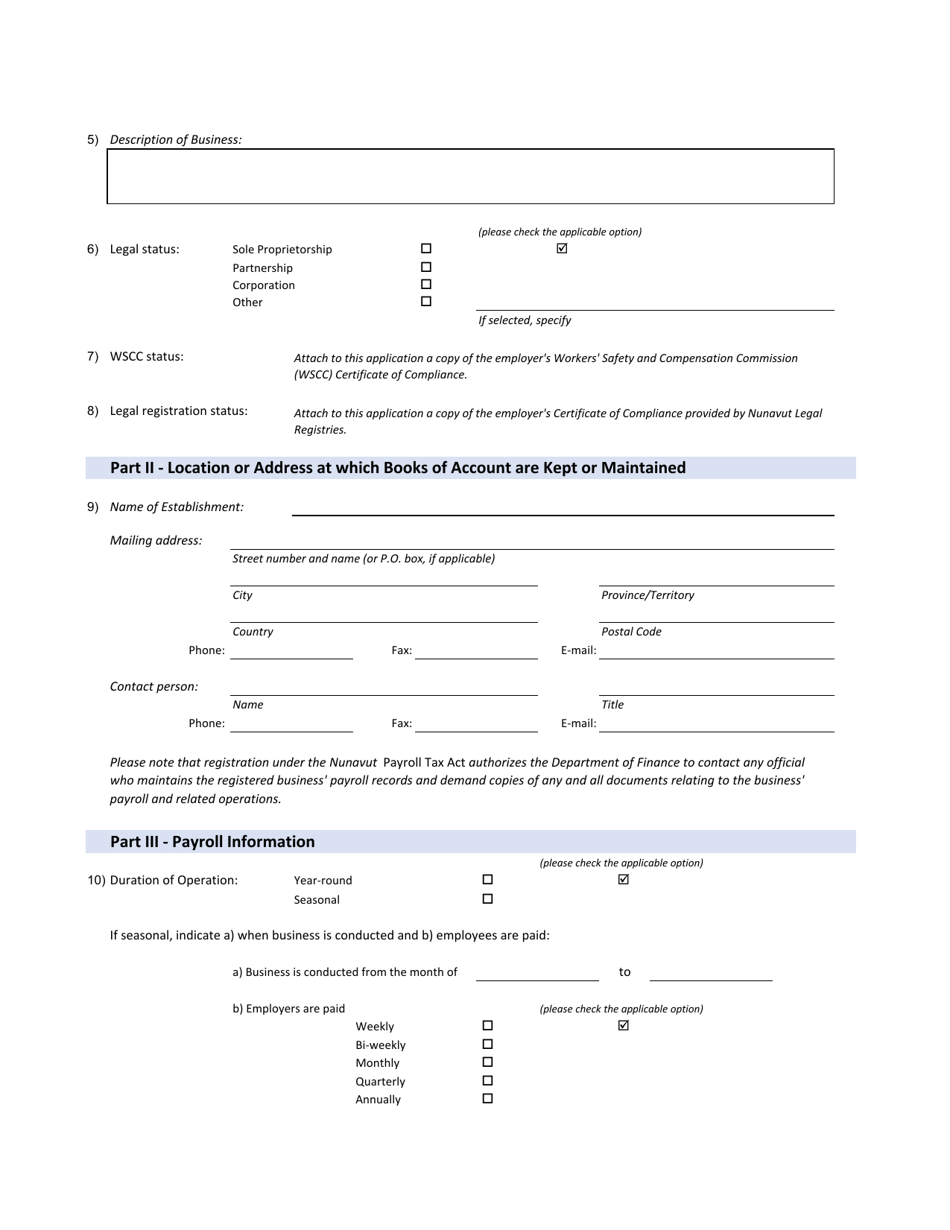

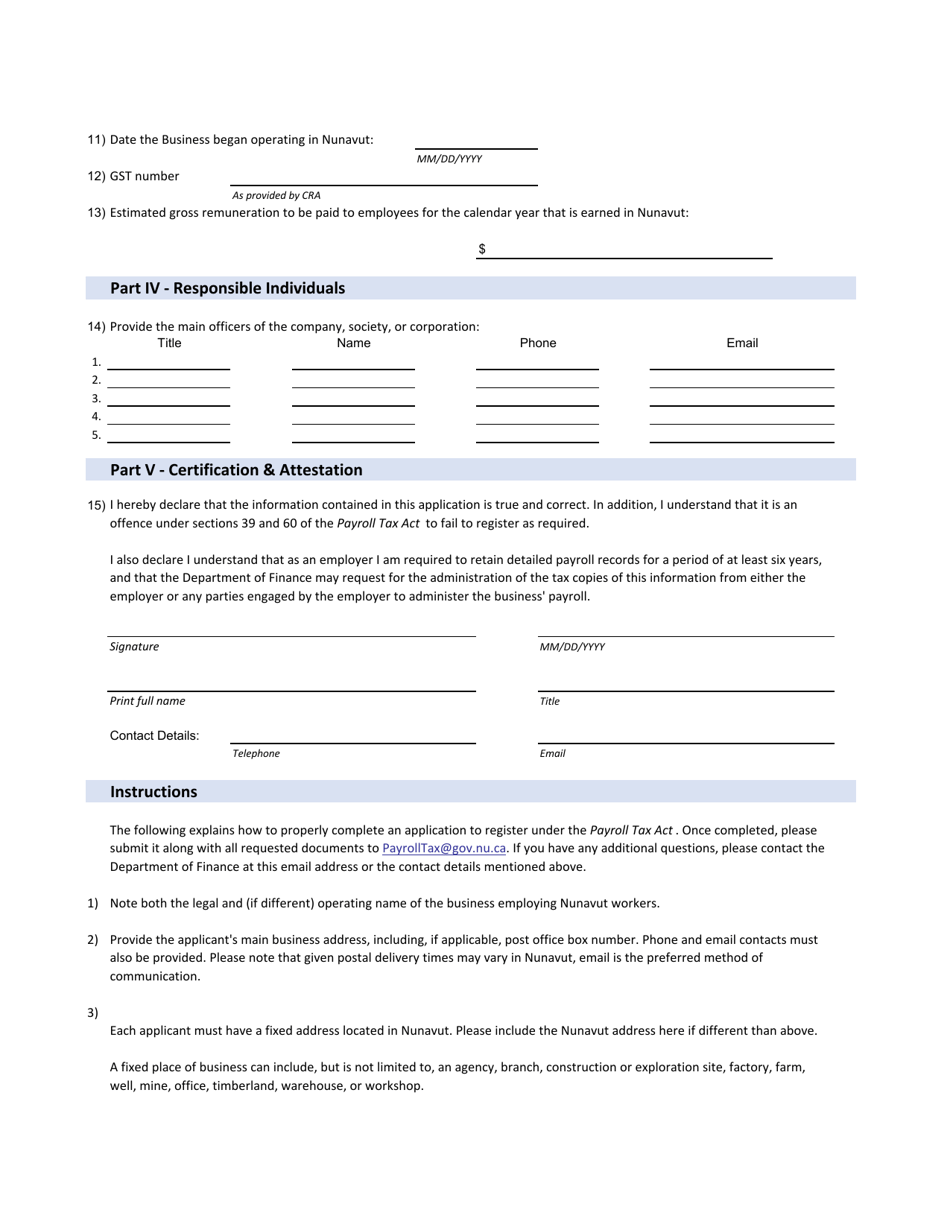

The Nunavut Payroll Tax Application for Registration is a form used in Nunavut, Canada for employers to register for the Nunavut payroll tax program. The payroll tax is a tax imposed on employers based on the wages they pay to employees.

The employer or their authorized representative files the Nunavut payroll tax application for registration.

FAQ

Q: What is the Nunavut Payroll Tax?

A: The Nunavut Payroll Tax is a tax imposed by the government of Nunavut, Canada on employers and employees based on their payroll expenses.

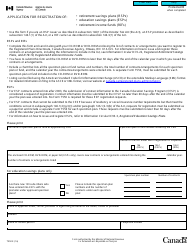

Q: Who should apply for registration?

A: Employers who have payroll expenses in Nunavut should apply for registration.

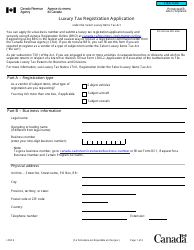

Q: How can I apply for registration?

A: You can apply for registration by completing the application form provided by the government of Nunavut.

Q: Are there any exemptions from the Nunavut Payroll Tax?

A: Yes, certain employers such as registered charities and non-profit organizations may be exempt from the tax. You should consult the government of Nunavut for more information.

Q: When is the deadline for registration?

A: The deadline for registration is typically the end of February each year. However, you should check with the government of Nunavut for the specific deadline for the current year.

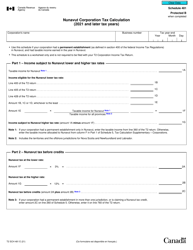

Q: What are the consequences of not registering for the Nunavut Payroll Tax?

A: Failing to register for the Nunavut Payroll Tax or pay the tax when required may result in penalties and interest charges.

Q: Can I appeal a decision regarding my payroll tax registration?

A: Yes, you have the right to appeal a decision regarding your payroll tax registration. You should contact the government of Nunavut for more information on the appeals process.