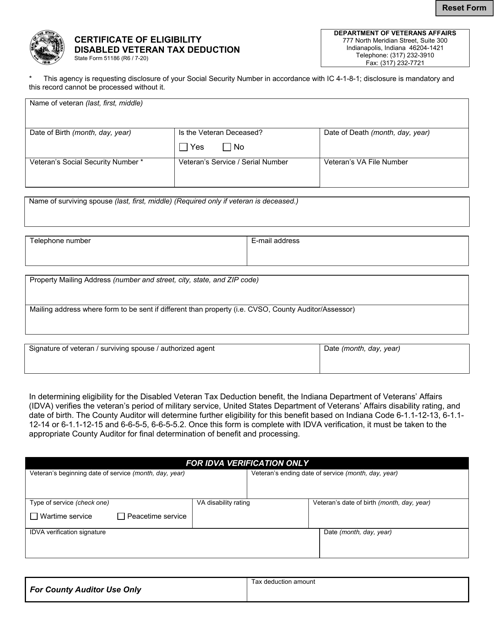

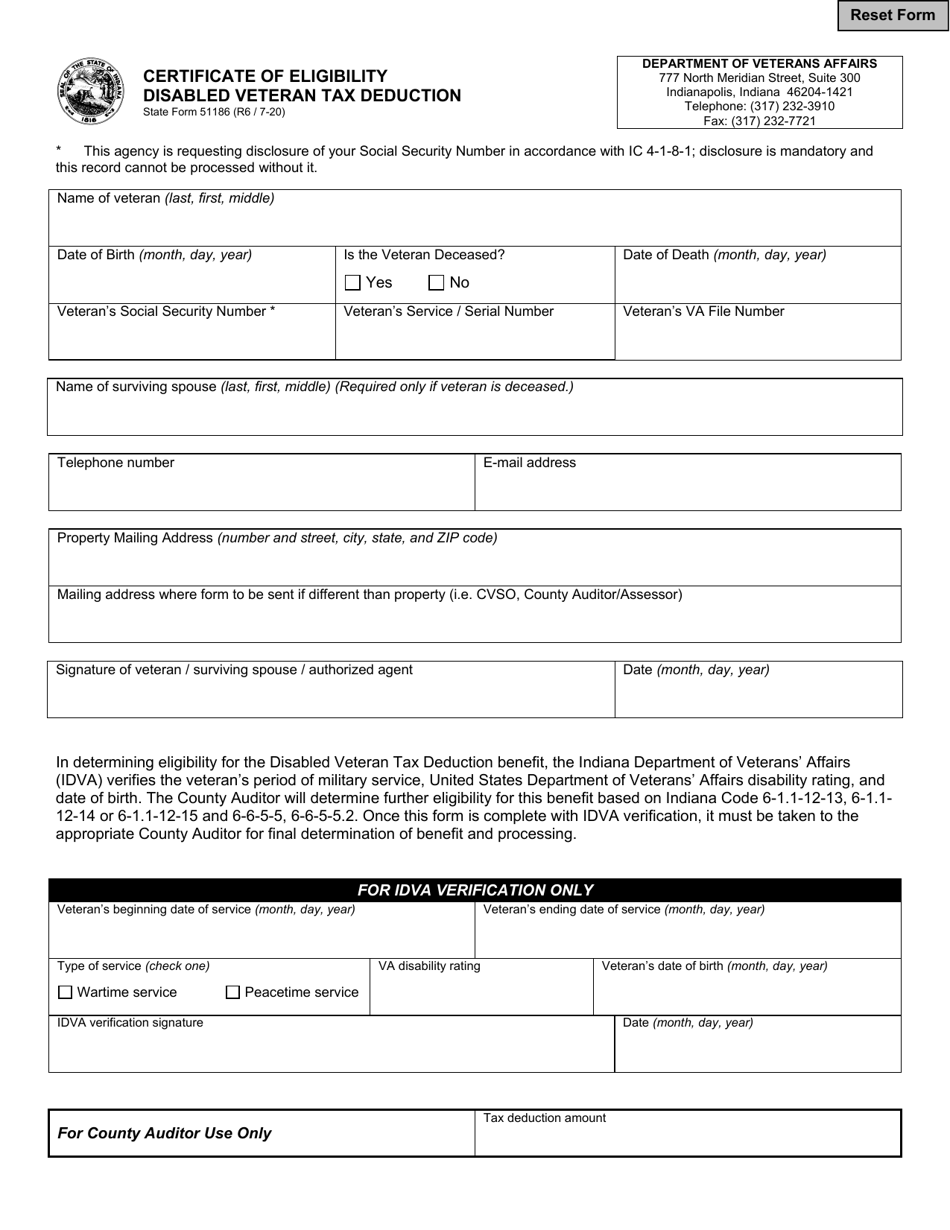

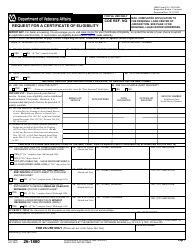

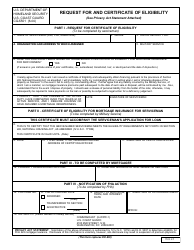

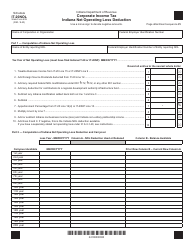

State Form 51186 Certificate of Eligibility Disabled Veteran Tax Deduction - Indiana

What Is State Form 51186?

This is a legal form that was released by the Indiana Department of Veterans Affairs - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51186?

A: Form 51186 is the Certificate of Eligibility for the Disabled Veteran Tax Deduction in Indiana.

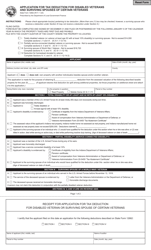

Q: Who is eligible for the Disabled Veteran Tax Deduction in Indiana?

A: Disabled veterans who meet certain criteria are eligible for the tax deduction.

Q: What is the purpose of Form 51186?

A: Form 51186 is used to certify a disabled veteran's eligibility for the tax deduction.

Q: Can I claim the Disabled Veteran Tax Deduction in Indiana if I am not a disabled veteran?

A: No, only disabled veterans are eligible for this tax deduction.

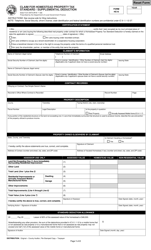

Q: Are there any other tax deductions available for disabled veterans in Indiana?

A: Yes, there may be additional tax deductions or benefits available for disabled veterans in Indiana. It is recommended to consult with a tax professional or the Indiana Department of Revenue for more information.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Indiana Department of Veterans Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51186 by clicking the link below or browse more documents and templates provided by the Indiana Department of Veterans Affairs.