This version of the form is not currently in use and is provided for reference only. Download this version of

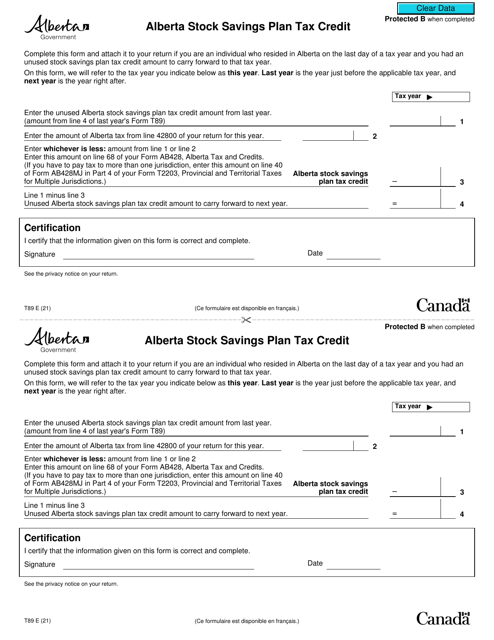

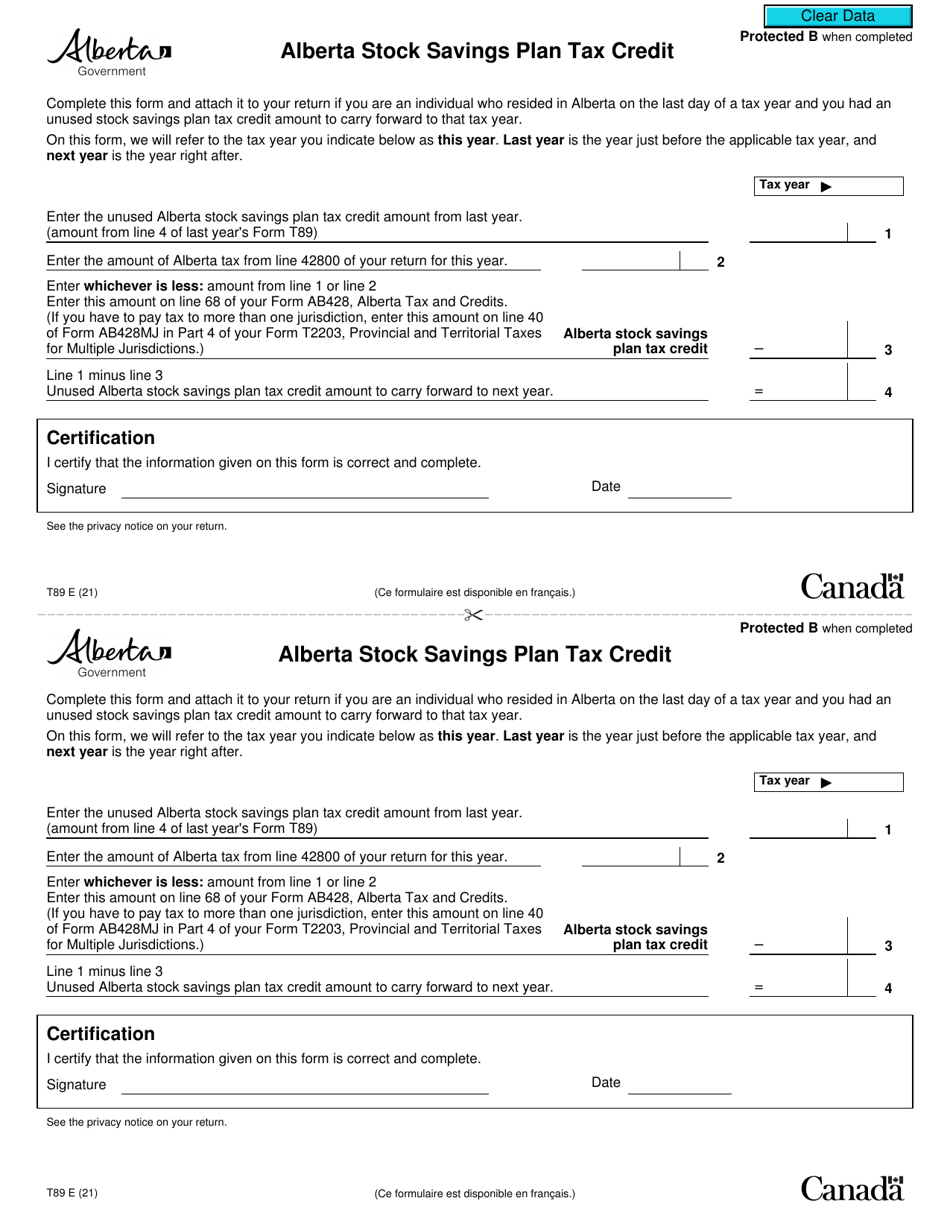

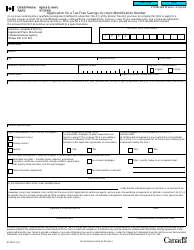

Form T89

for the current year.

Form T89 Alberta Stock Savings Plan Tax Credit - Canada

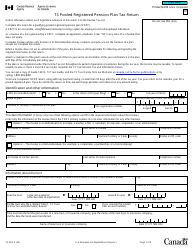

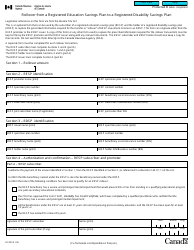

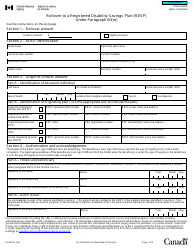

Form T89 Alberta Stock Savings Plan Tax Credit is used in Canada to claim the tax credit available for contributions made to the Alberta Stock Savings Plan (ASSP). It allows individuals to deduct a portion of their eligible contributions from their taxable income. This tax credit encourages investment in Alberta-based corporations and promotes economic growth within the province.

FAQ

Q: What is Form T89?

A: Form T89 is a tax form used in Canada.

Q: What is the Alberta Stock Savings Plan?

A: The Alberta Stock Savings Plan is a savings plan available in the province of Alberta in Canada.

Q: What is the tax credit for the Alberta Stock Savings Plan?

A: The tax credit for the Alberta Stock Savings Plan is claimed using Form T89.

Q: Who is eligible for the tax credit?

A: Residents of Alberta who contribute to the Alberta Stock Savings Plan are eligible for the tax credit.

Q: How do I claim the tax credit?

A: You can claim the tax credit by completing Form T89 and including it with your income tax return.

Q: What is the purpose of the tax credit?

A: The tax credit encourages residents of Alberta to save and invest in the Alberta Stock Savings Plan.