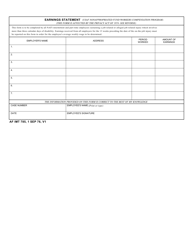

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

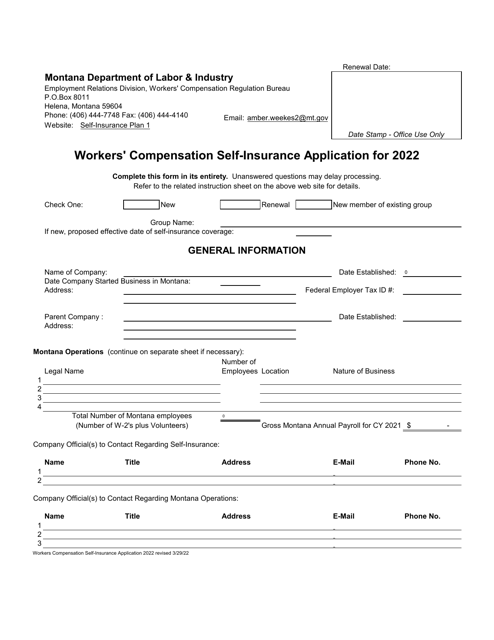

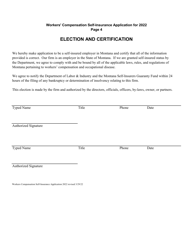

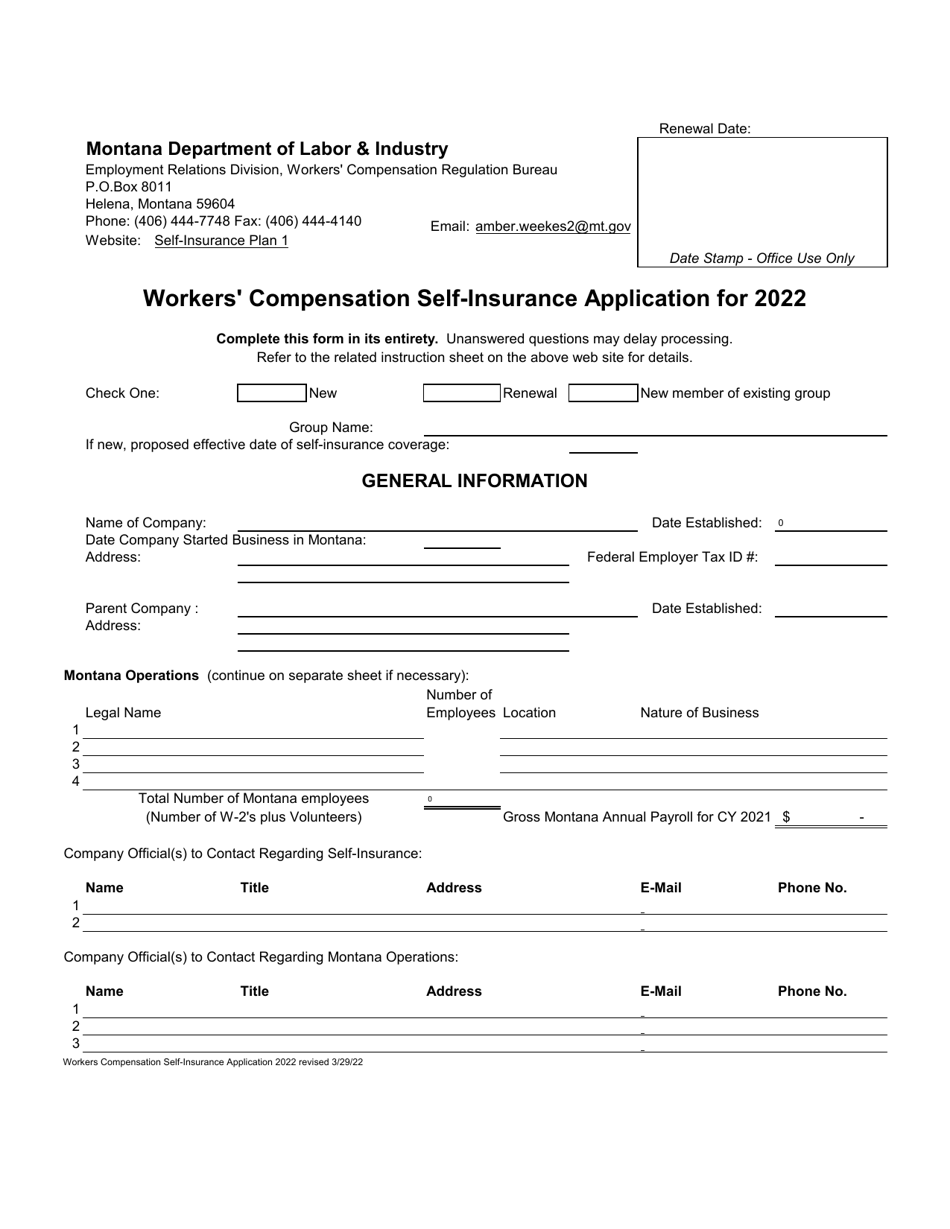

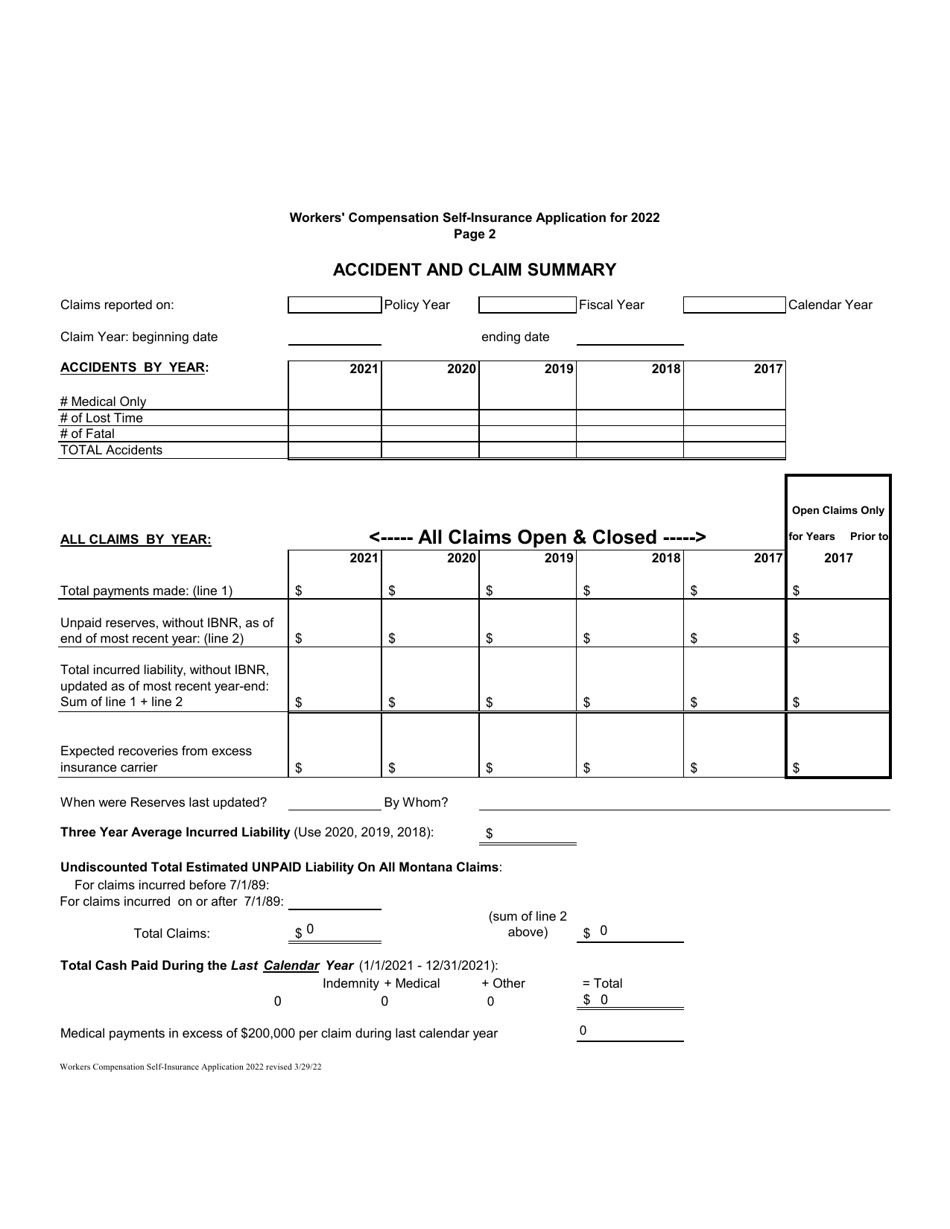

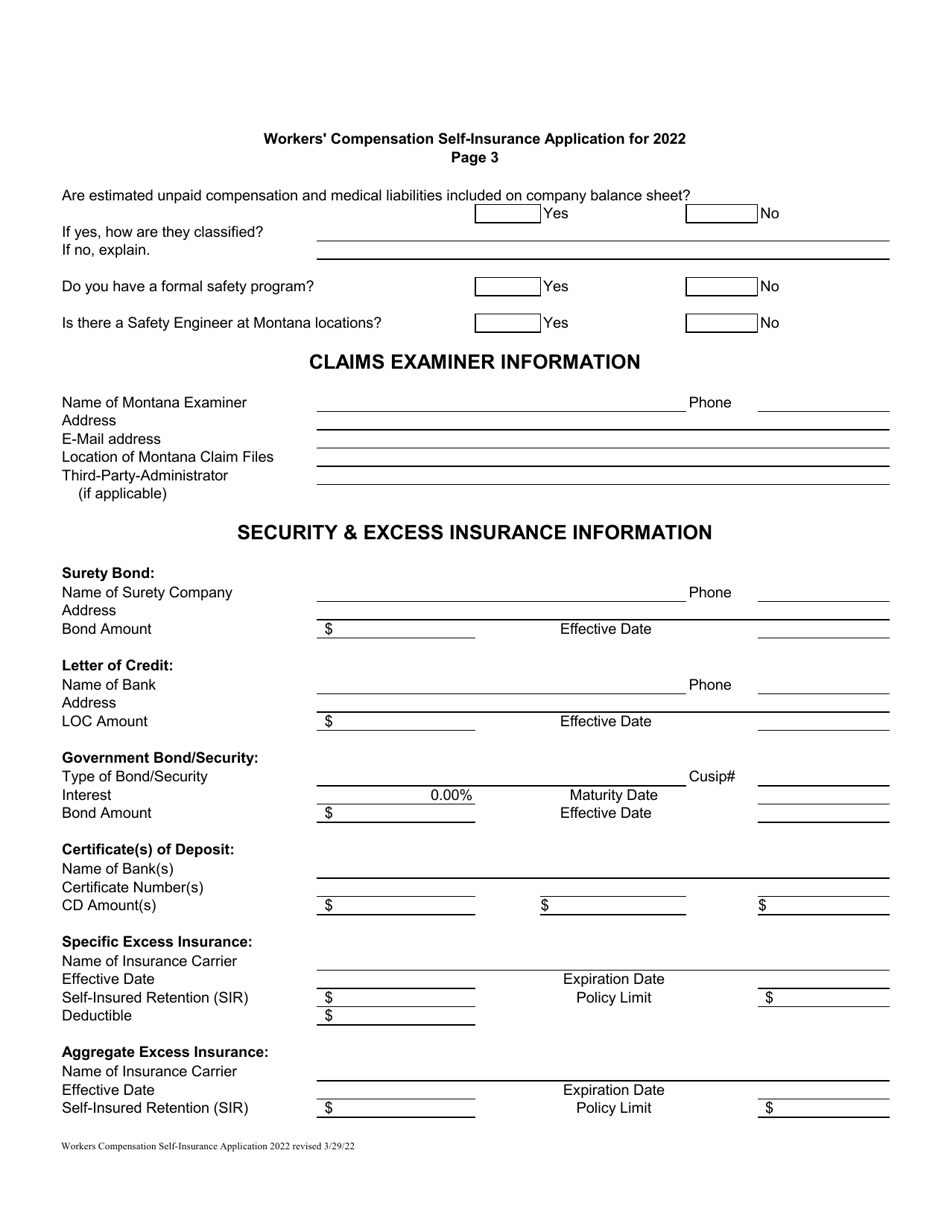

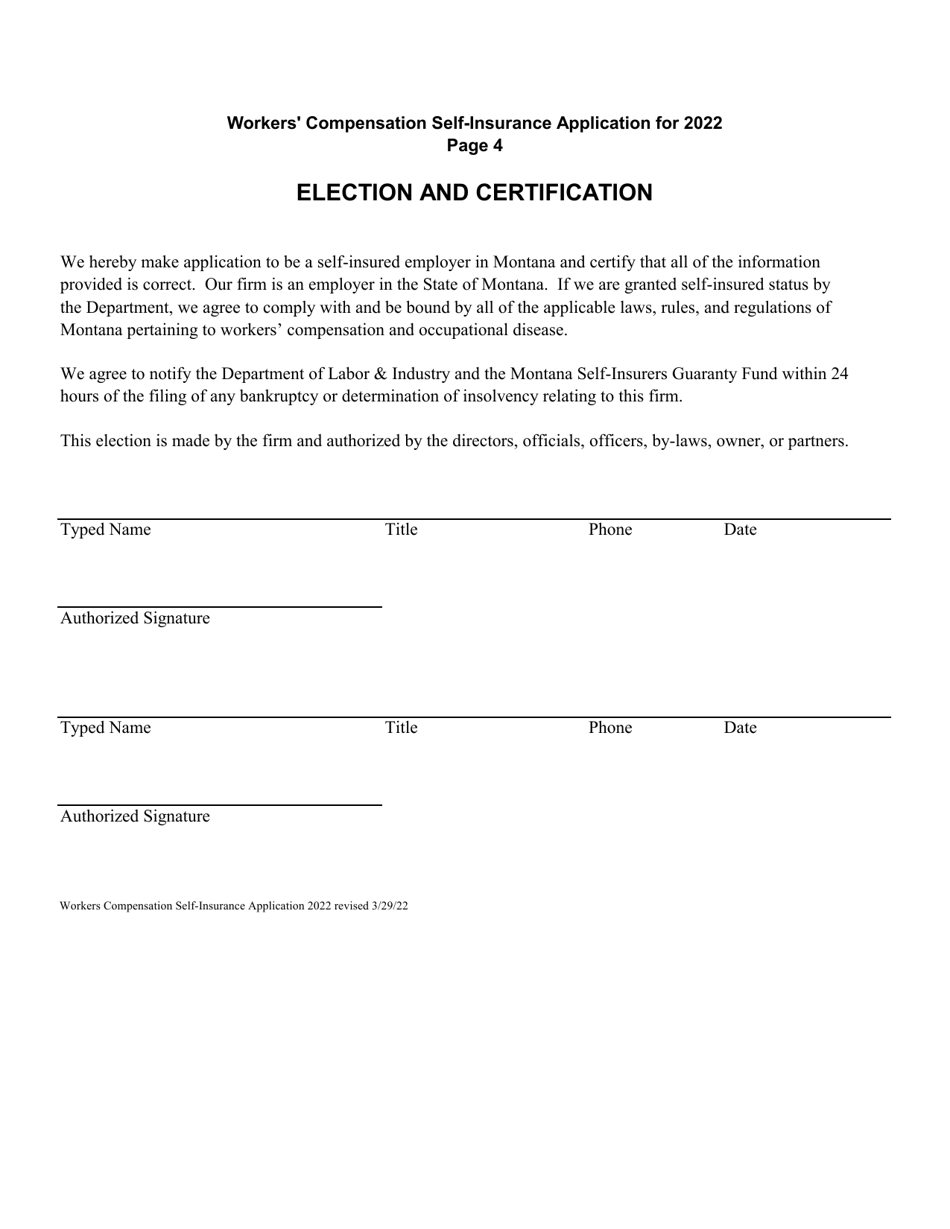

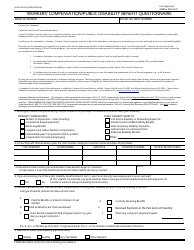

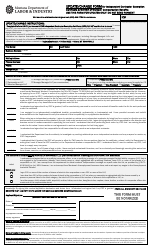

Workers' Compensation Self-insurance Application - Montana

Workers' Compensation Self-insurance Application is a legal document that was released by the Montana Department of Labor and Industry - a government authority operating within Montana.

FAQ

Q: What is a Workers' Compensation Self-insurance Application?

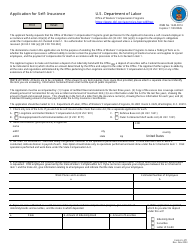

A: A Workers' Compensation Self-insurance Application is a form used by businesses in Montana to apply for the ability to self-insure their workers' compensation coverage instead of purchasing it from an insurance carrier.

Q: Why would a business want to self-insure their workers' compensation coverage?

A: Businesses may choose to self-insure their workers' compensation coverage to have more control over the claims process and potentially save money on premiums.

Q: Who is eligible to self-insure their workers' compensation coverage in Montana?

A: In Montana, businesses must meet certain financial and operational requirements set by the state in order to be eligible for self-insurance.

Q: What are some of the requirements to be eligible for self-insurance in Montana?

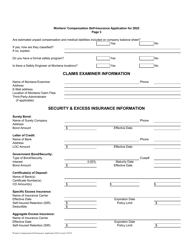

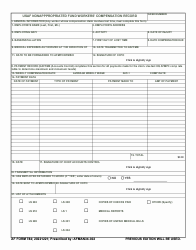

A: Some of the requirements to be eligible for self-insurance in Montana include having a net worth of at least $1 million, maintaining a substantial business presence in the state, and demonstrating the ability to pay future claims.

Q: How can a business apply for workers' compensation self-insurance in Montana?

A: To apply for workers' compensation self-insurance in Montana, businesses must complete and submit the Workers' Compensation Self-insurance Application form to the Montana Department of Labor and Industry.

Q: Are there any fees associated with applying for workers' compensation self-insurance in Montana?

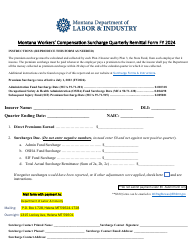

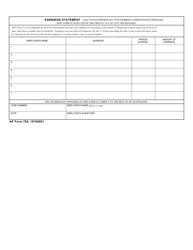

A: Yes, there are fees associated with applying for workers' compensation self-insurance in Montana. The application fee is $2500, and an annual renewal fee is also required.

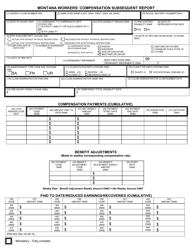

Q: Are there any ongoing requirements for businesses that self-insure their workers' compensation coverage in Montana?

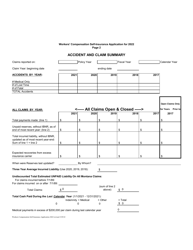

A: Yes, there are ongoing requirements for businesses that self-insure their workers' compensation coverage in Montana, including filing annual financial statements and maintaining appropriate levels of security for claims payment.

Q: Can a business lose its ability to self-insure its workers' compensation coverage in Montana?

A: Yes, a business can lose its ability to self-insure its workers' compensation coverage in Montana if it fails to meet the ongoing financial and operational requirements or if it fails to pay claims in a timely manner.

Form Details:

- Released on March 29, 2022;

- The latest edition currently provided by the Montana Department of Labor and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Labor and Industry.