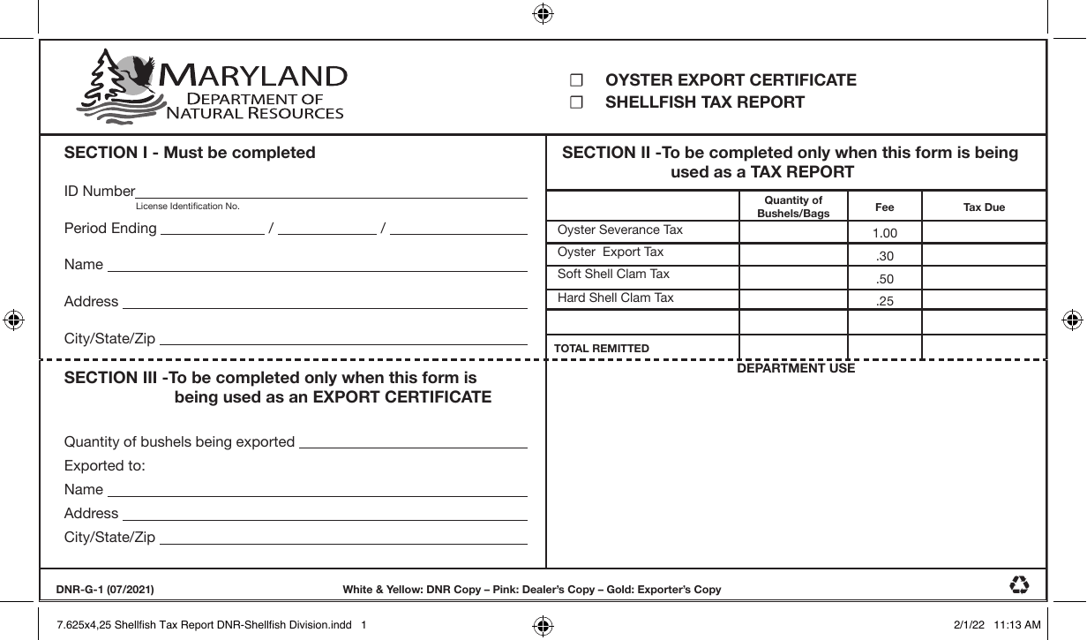

Form DNR-G-1 Shellfish Dealer Tax Report - Maryland

What Is Form DNR-G-1?

This is a legal form that was released by the Maryland Department of Natural Resources - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DNR-G-1 Shellfish Dealer Tax Report?

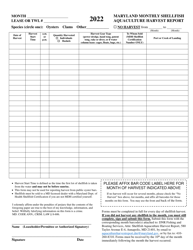

A: The Form DNR-G-1 Shellfish Dealer Tax Report is a specific tax form that shellfish dealers in Maryland are required to fill out.

Q: Who needs to fill out the Form DNR-G-1 Shellfish Dealer Tax Report?

A: All shellfish dealers in Maryland are required to fill out this tax report.

Q: What is the purpose of the Form DNR-G-1 Shellfish Dealer Tax Report?

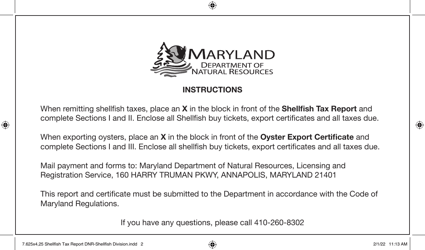

A: The Form DNR-G-1 Shellfish Dealer Tax Report is used to report and pay taxes on shellfish purchases made by the dealer.

Q: How often do shellfish dealers need to file the Form DNR-G-1 Shellfish Dealer Tax Report?

A: Shellfish dealers in Maryland need to file this tax report on a monthly basis.

Q: What information do I need to provide on the Form DNR-G-1 Shellfish Dealer Tax Report?

A: On this tax report, you will need to provide information such as your business details, the quantity and value of shellfish purchased, and calculate the tax due.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Maryland Department of Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DNR-G-1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Natural Resources.