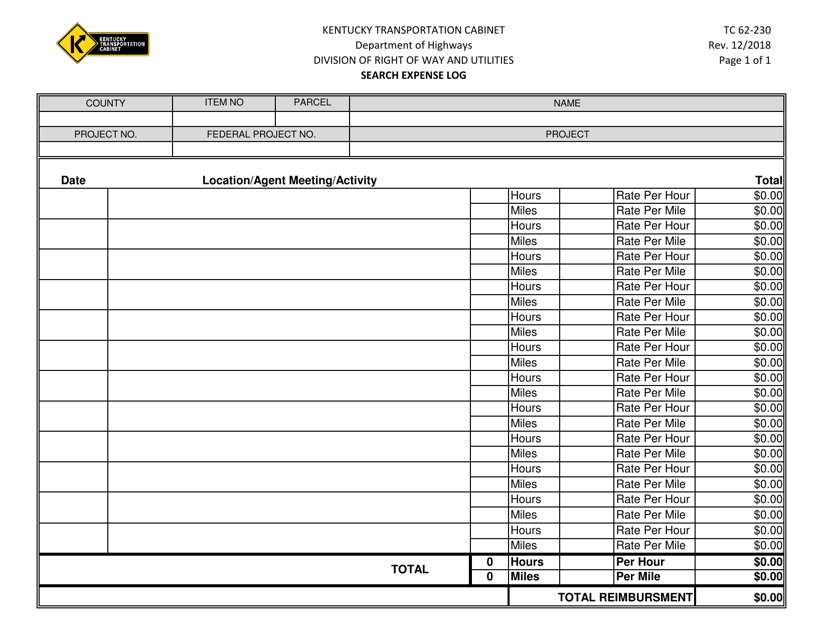

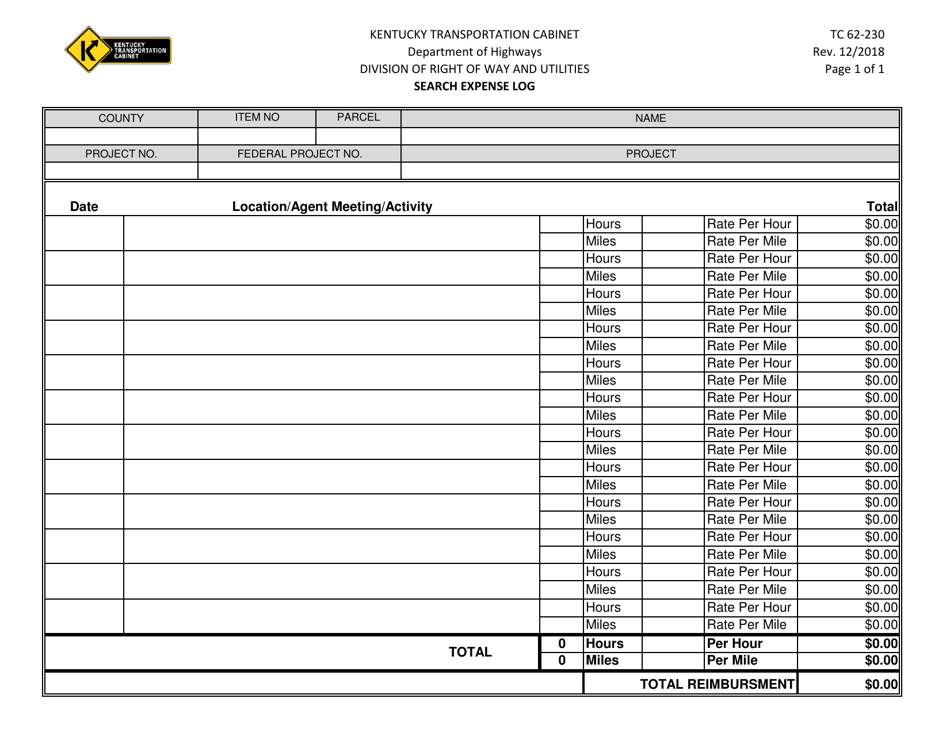

Form TC-62-230 Search Expense Log - Kentucky

What Is Form TC-62-230?

This is a legal form that was released by the Kentucky Transportation Cabinet - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-62-230?

A: Form TC-62-230 is an Expense Log used in Kentucky.

Q: What is the purpose of Form TC-62-230?

A: The purpose of Form TC-62-230 is to keep track of expenses.

Q: Who needs to use Form TC-62-230?

A: Anyone in Kentucky who wants to track their expenses can use Form TC-62-230.

Q: Is Form TC-62-230 specific to a certain type of expenses?

A: No, Form TC-62-230 can be used to track any type of expenses.

Q: Is Form TC-62-230 available in paper format?

A: Yes, you can print out a paper copy of Form TC-62-230.

Q: Are there any instructions for filling out Form TC-62-230?

A: Yes, the Kentucky Department of Revenue provides instructions for filling out Form TC-62-230.

Q: Do I need to submit Form TC-62-230 with my tax return?

A: No, you do not need to submit Form TC-62-230 with your tax return. It is for your own recordkeeping purposes.

Q: Can I use Form TC-62-230 for business expenses?

A: Yes, you can use Form TC-62-230 to track both personal and business expenses.

Q: Is Form TC-62-230 only for residents of Kentucky?

A: No, anyone can use Form TC-62-230 to track their expenses, but it is specific to Kentucky tax laws.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Kentucky Transportation Cabinet;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-62-230 by clicking the link below or browse more documents and templates provided by the Kentucky Transportation Cabinet.