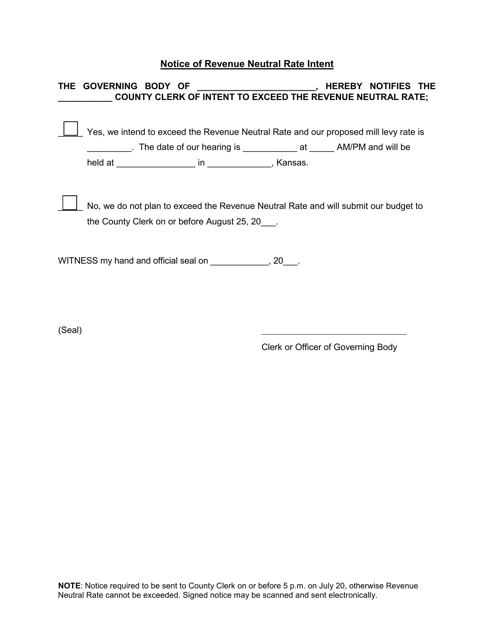

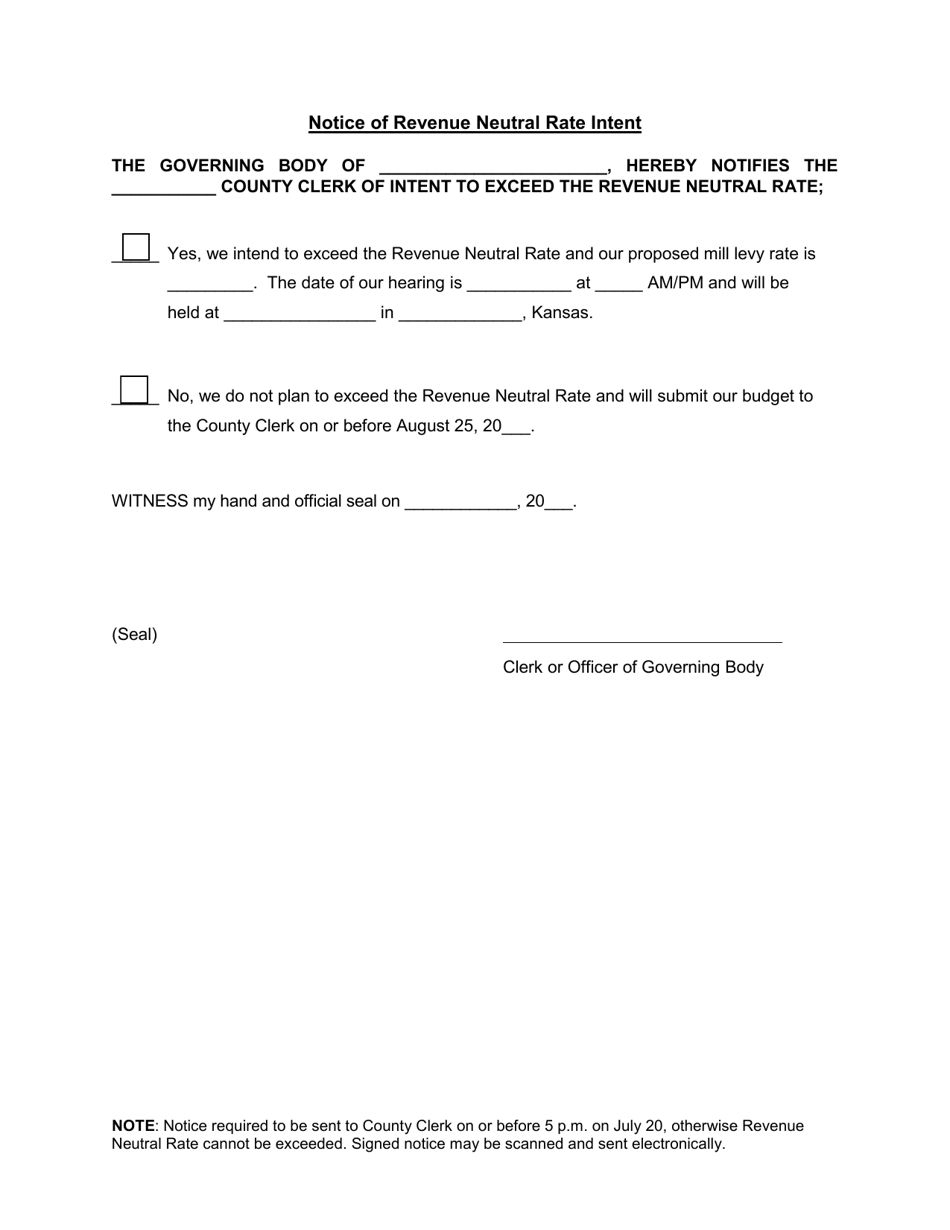

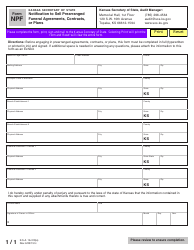

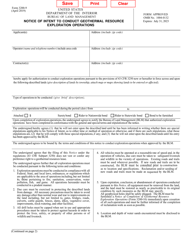

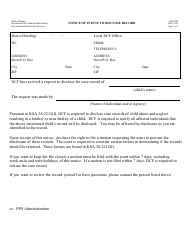

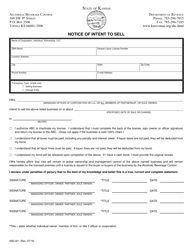

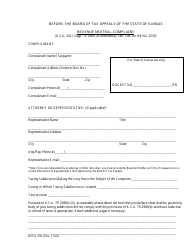

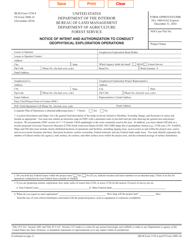

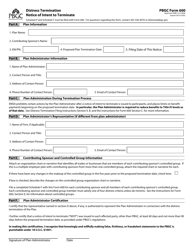

Notice of Revenue Neutral Rate Intent - Kansas

Notice of Revenue Neutral Rate Intent is a legal document that was released by the Kansas Department of Administration - a government authority operating within Kansas.

FAQ

Q: What is the Notice of Revenue Neutral Rate Intent?

A: The Notice of Revenue Neutral Rate Intent is a statement published by the state of Kansas indicating their intention to maintain a revenue-neutral rate.

Q: What does revenue-neutral rate mean?

A: A revenue-neutral rate means that the state aims to generate the same amount of revenue as the previous year, without increasing or decreasing taxes overall.

Q: Why does Kansas issue a Notice of Revenue Neutral Rate Intent?

A: Kansas issues this notice to inform residents and businesses about their commitment to maintaining a revenue-neutral rate and to provide transparency in their tax policies.

Q: What is the purpose of maintaining a revenue-neutral rate?

A: Maintaining a revenue-neutral rate ensures that the state does not collect more taxes from its residents and businesses without clear justification.

Q: What are the benefits of a revenue-neutral rate?

A: A revenue-neutral rate provides stability and predictability in tax planning for individuals and businesses, as well as ensuring that the government does not collect more revenue than necessary.

Q: Will taxes increase or decrease with a revenue-neutral rate?

A: A revenue-neutral rate aims to keep taxes at the same level as the previous year, so there should be no noticeable increase or decrease in taxes.

Q: Does the Notice of Revenue Neutral Rate Intent guarantee no tax changes?

A: While the notice indicates the intention to maintain a revenue-neutral rate, it does not guarantee that there will be no changes in specific taxes or tax policies.

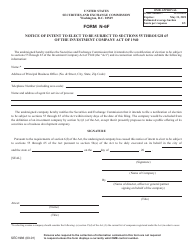

Form Details:

- The latest edition currently provided by the Kansas Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.