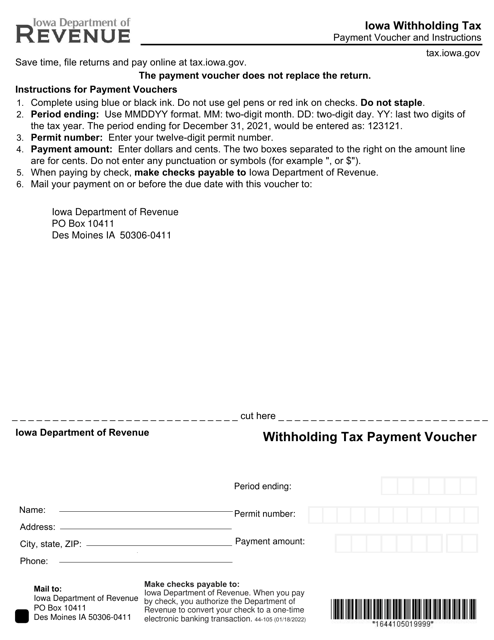

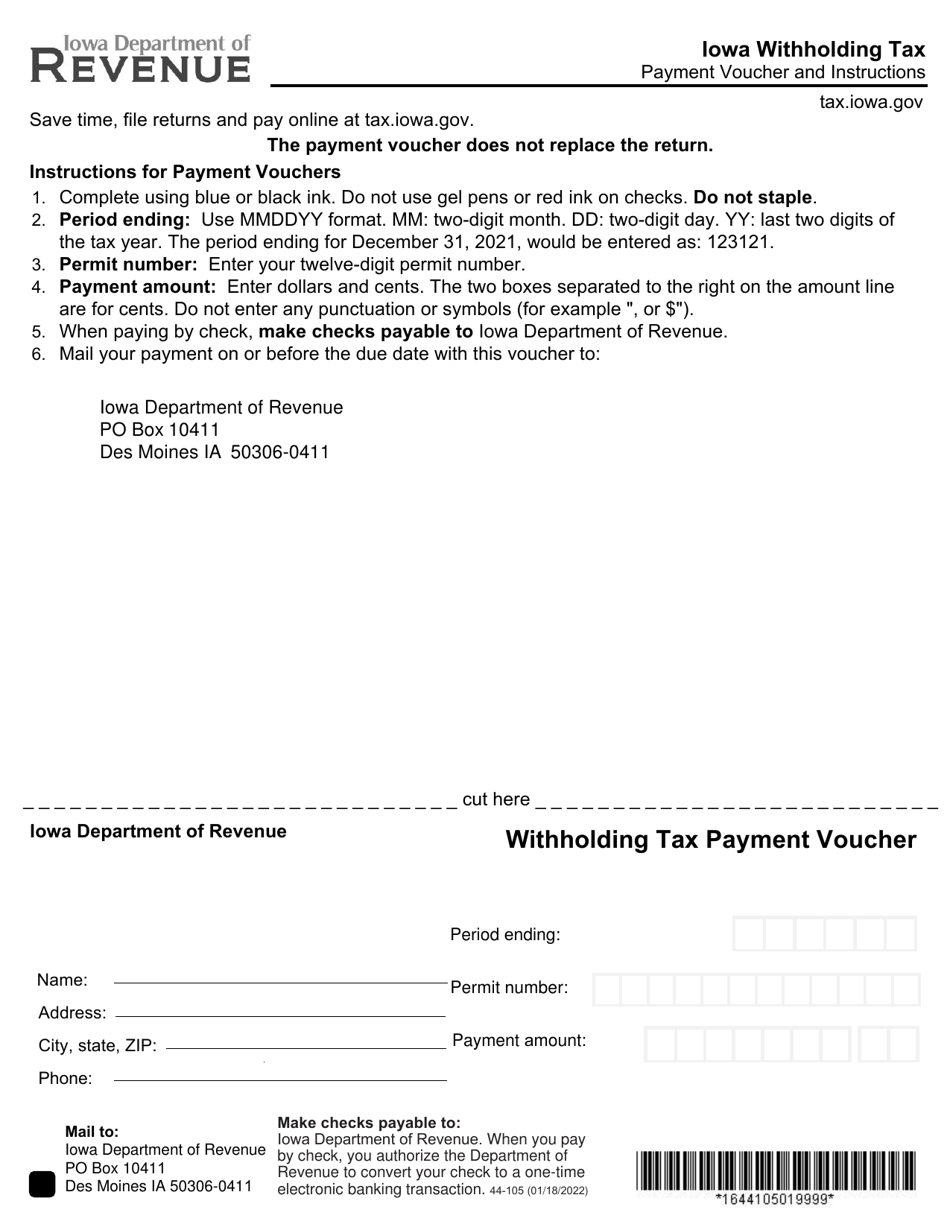

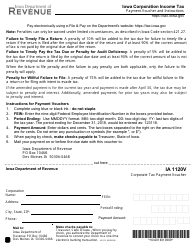

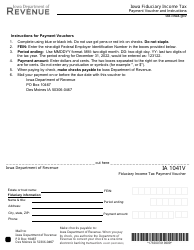

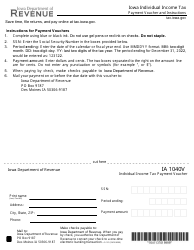

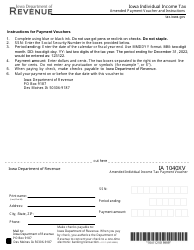

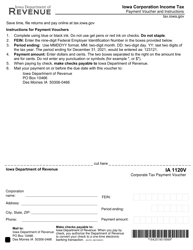

Form 44-105 Withholding Tax Payment Voucher - Iowa

What Is Form 44-105?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 44-105?

A: Form 44-105 is the Withholding Tax Payment Voucher for Iowa.

Q: What is the purpose of Form 44-105?

A: The purpose of Form 44-105 is to report and pay withholding taxes.

Q: Who needs to use Form 44-105?

A: Employers who have employees in Iowa and are required to withhold state income taxes need to use Form 44-105.

Q: When is Form 44-105 due?

A: Form 44-105 is due on a monthly or quarterly basis, depending on the employer's withholding tax liability.

Q: What information do I need to complete Form 44-105?

A: You will need your employer identification number, the total amount of Iowa income tax withheld, and the payment information.

Q: Can I file Form 44-105 electronically?

A: Yes, you can file Form 44-105 electronically if you have an Iowa withholding tax account.

Q: What happens if I don't file Form 44-105 or pay the withholding taxes?

A: Failure to file Form 44-105 or pay the withholding taxes can result in penalties and interest charges.

Q: Are there any exemptions or credits available for withholding taxes in Iowa?

A: Yes, there may be exemptions or credits available for certain situations. You should consult the Iowa Department of Revenue for more information.

Form Details:

- Released on January 18, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 44-105 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.