This version of the form is not currently in use and is provided for reference only. Download this version of

Form 42-020 Schedule F, G

for the current year.

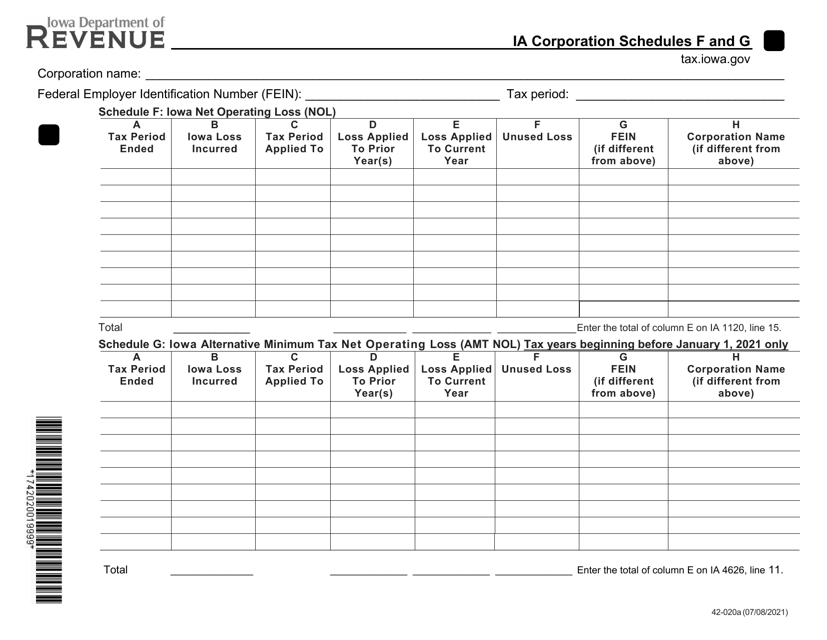

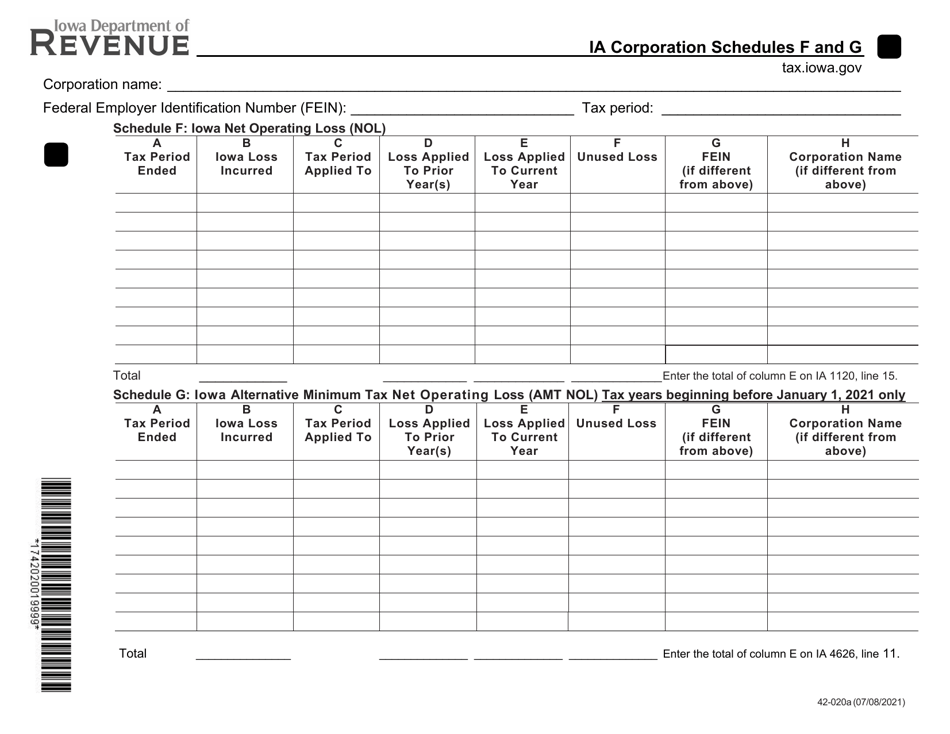

Form 42-020 Schedule F, G Iowa Net Operating Loss - Iowa

What Is Form 42-020 Schedule F, G?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

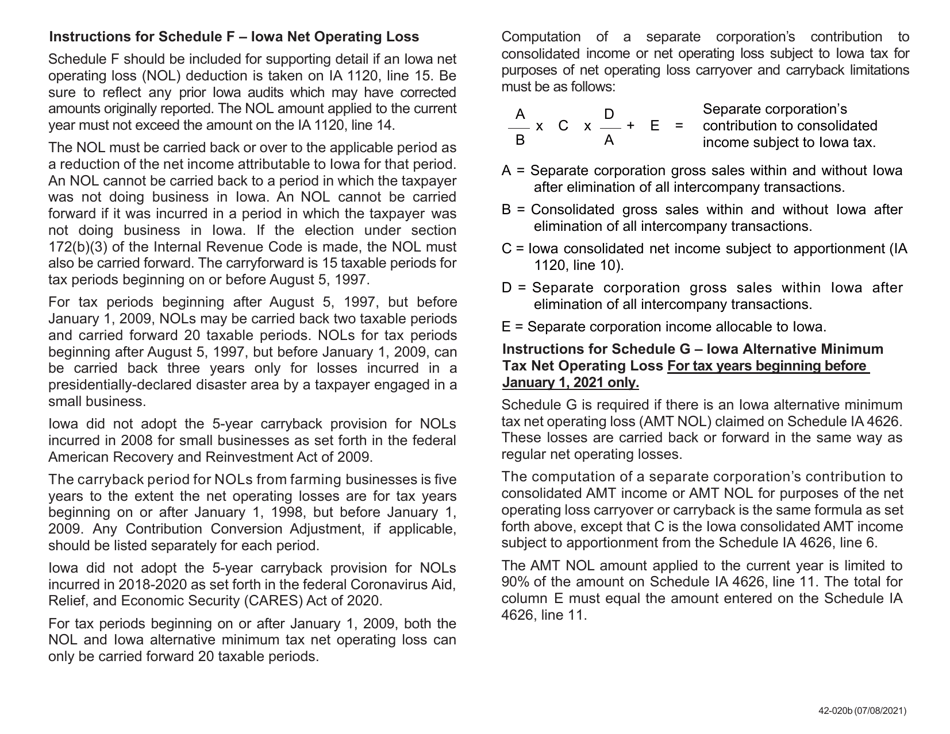

Q: What is Form 42-020 Schedule F, G?

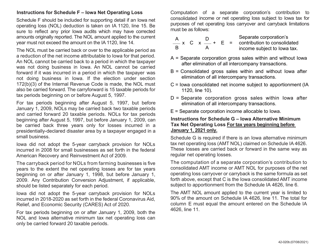

A: Form 42-020 Schedule F, G is a document used in Iowa to calculate the net operating loss for Iowa taxes.

Q: What is a net operating loss?

A: A net operating loss occurs when a business's allowable deductions exceed its taxable income.

Q: Why is it important to calculate the net operating loss?

A: Calculating the net operating loss is important because it can be carried forward or back to offset future or past taxable income.

Q: Who needs to file Form 42-020 Schedule F, G?

A: Individuals or businesses in Iowa that have a net operating loss and want to carry it forward or back for tax purposes.

Q: Is there a deadline for filing Form 42-020 Schedule F, G?

A: The deadline for filing Form 42-020 Schedule F, G is the same as the deadline for filing Iowa income tax returns, which is generally April 30th.

Form Details:

- Released on July 8, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42-020 Schedule F, G by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.