This version of the form is not currently in use and is provided for reference only. Download this version of

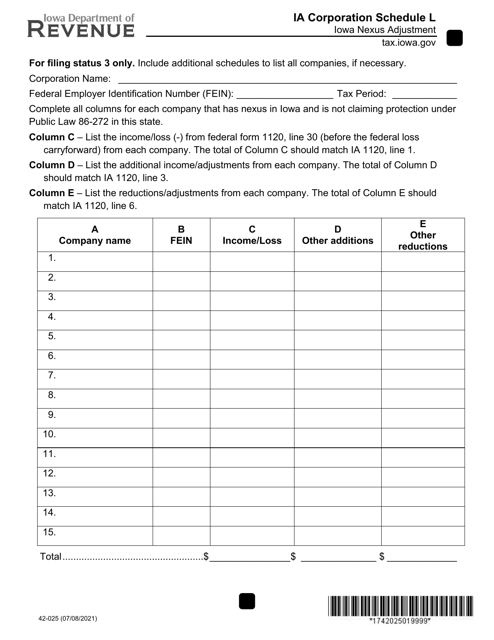

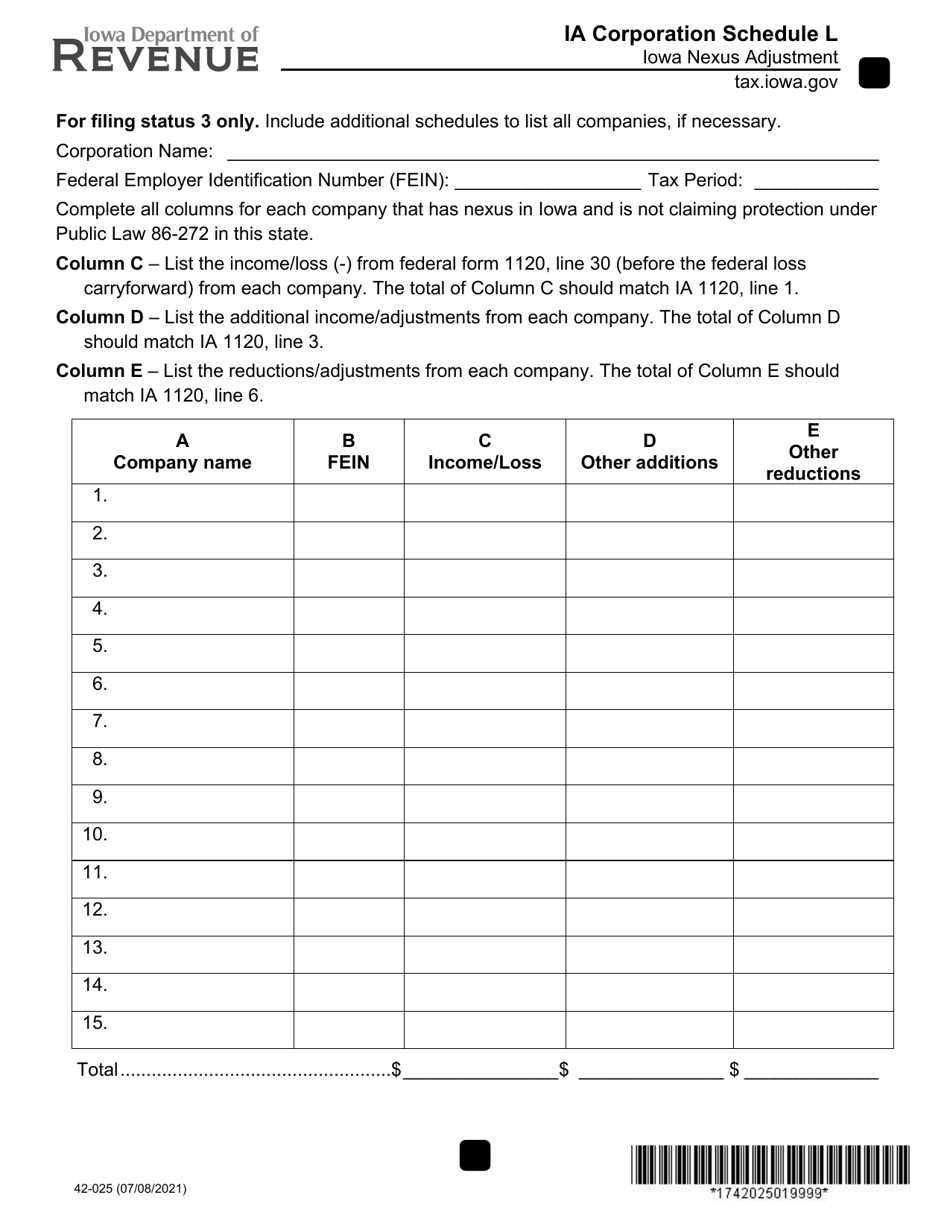

Form 42-025 Schedule L

for the current year.

Form 42-025 Schedule L Iowa Nexus Adjustment - Iowa

What Is Form 42-025 Schedule L?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 42-025 Schedule L?

A: Form 42-025 Schedule L is an Iowa Nexus Adjustment form.

Q: What is Iowa Nexus?

A: Iowa Nexus refers to the minimum level of business activity that must be present in Iowa for a company to be subject to Iowa's tax laws.

Q: When should I use form 42-025 Schedule L?

A: You should use form 42-025 Schedule L if your business has nexus in Iowa and needs to make adjustments to its income.

Q: What are the adjustments made on form 42-025 Schedule L?

A: The adjustments made on form 42-025 Schedule L include, but are not limited to, apportionment adjustments, nexus adjustments, and other modifications required by Iowa law.

Q: Are there any penalties for not filing form 42-025 Schedule L?

A: Yes, there may be penalties for not filing form 42-025 Schedule L or for filing it incorrectly. It is important to accurately report your Iowa Nexus Adjustment to avoid any penalties.

Q: Can I e-file form 42-025 Schedule L?

A: Yes, you can e-file form 42-025 Schedule L through the Iowa Department of Revenue's eFile & Pay system.

Q: Is form 42-025 Schedule L used for both individuals and businesses?

A: Form 42-025 Schedule L is typically used by businesses, not individuals. However, individuals may need to complete parts of the form if they have business income that needs to be adjusted for Iowa Nexus.

Q: What other documents should I include with form 42-025 Schedule L?

A: You may need to include supporting documents such as financial statements, tax returns, and other relevant records when filing form 42-025 Schedule L.

Form Details:

- Released on July 8, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42-025 Schedule L by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.