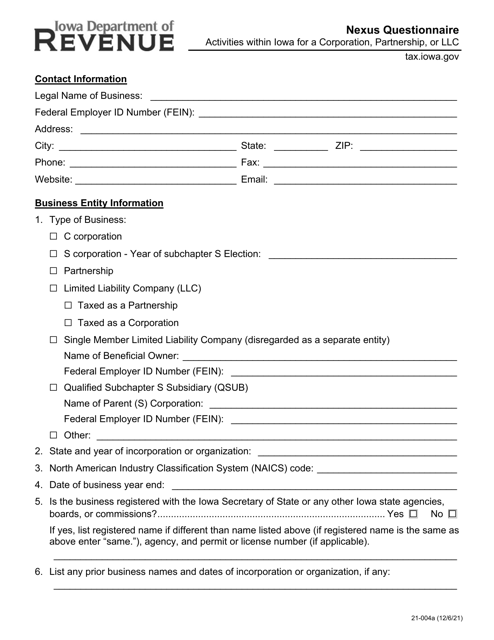

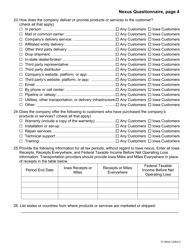

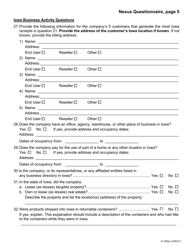

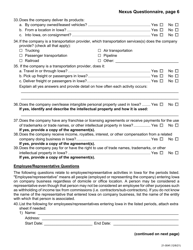

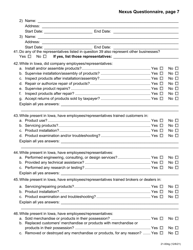

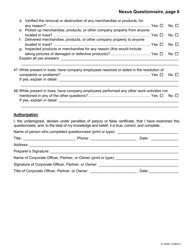

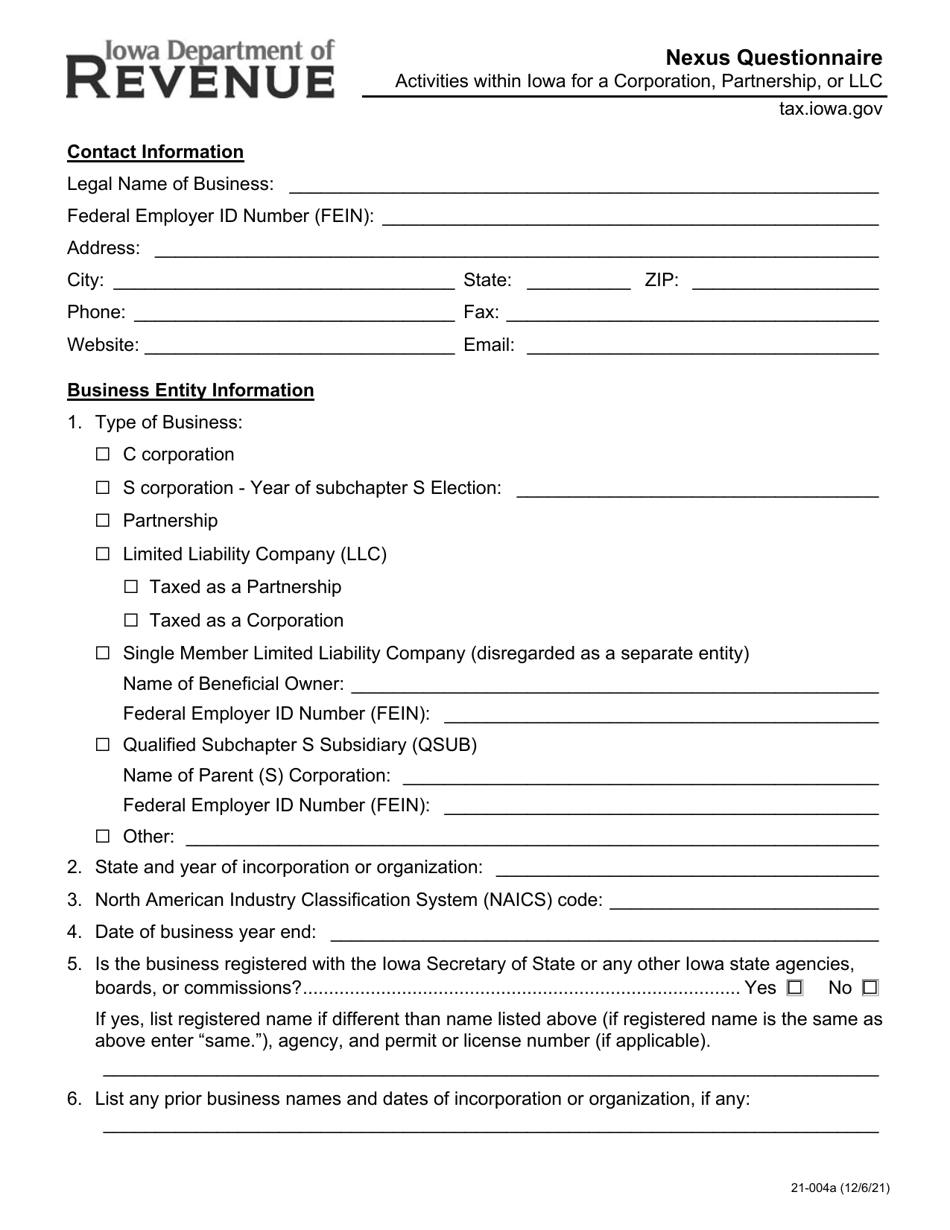

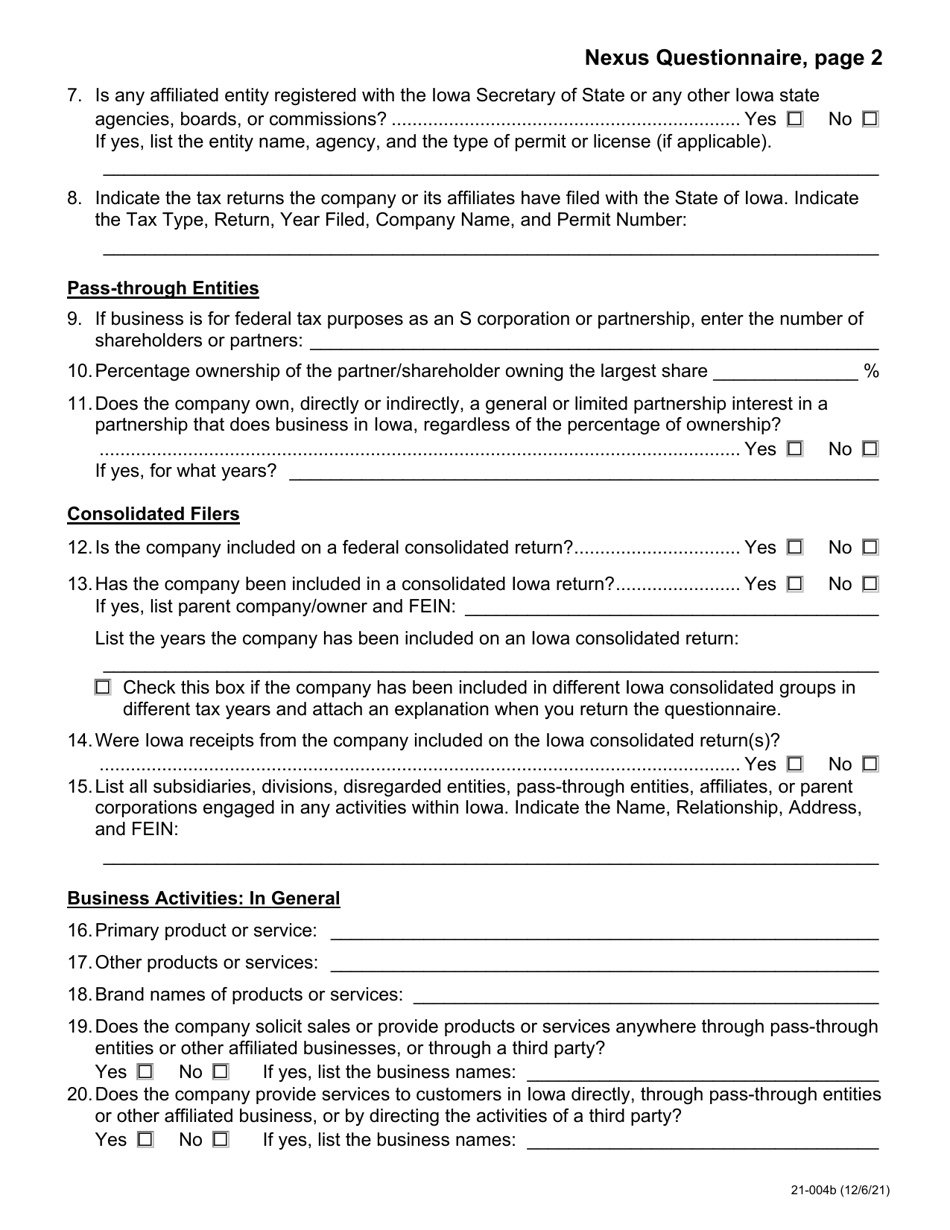

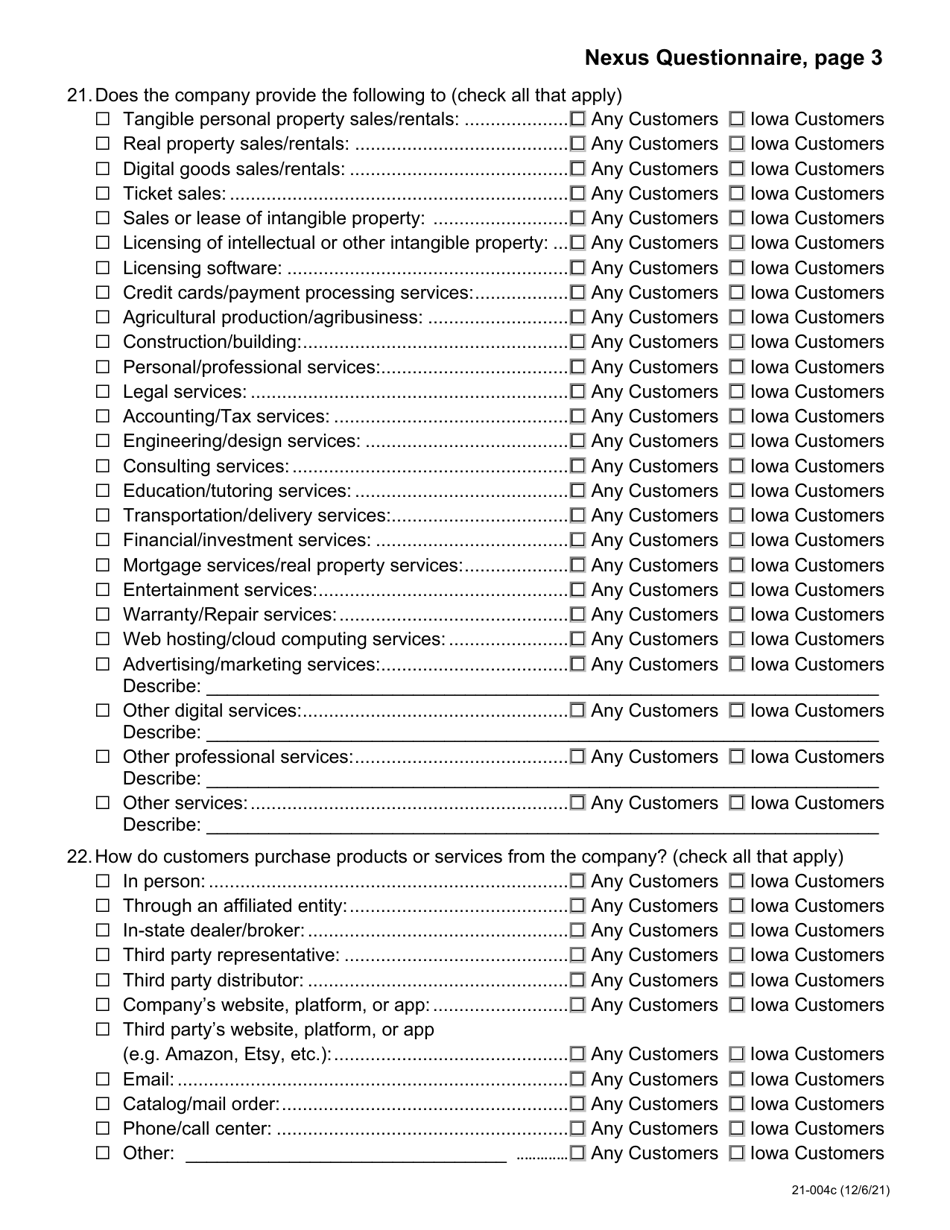

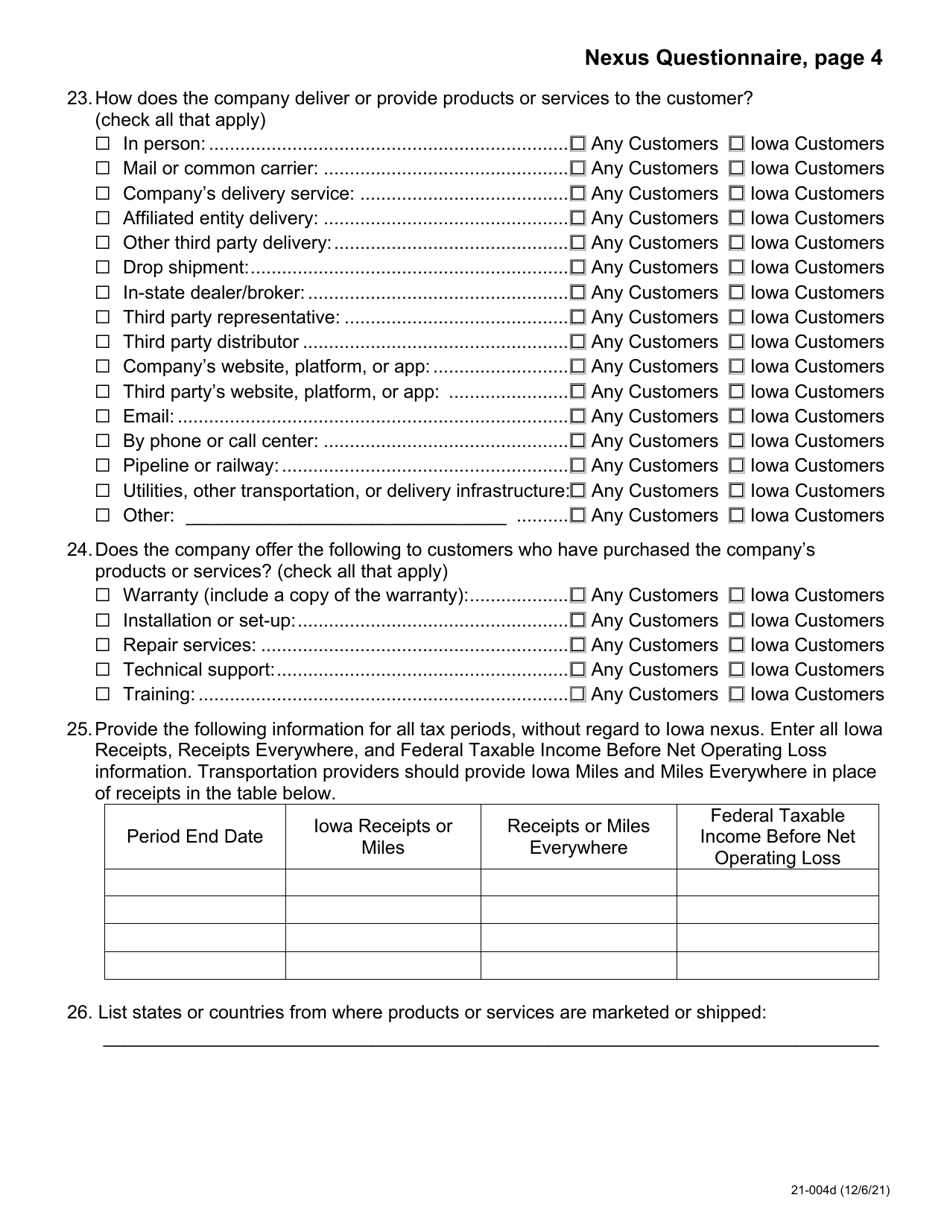

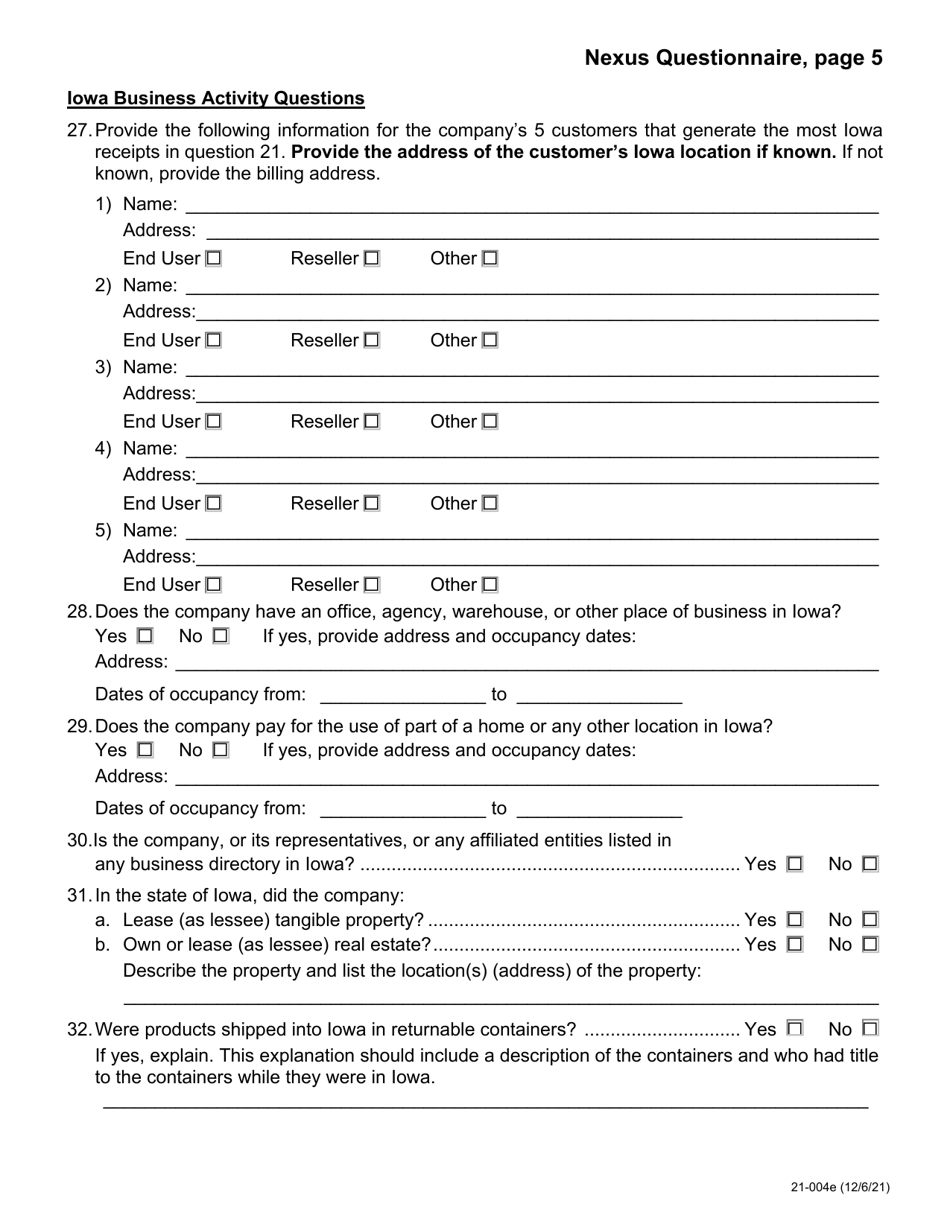

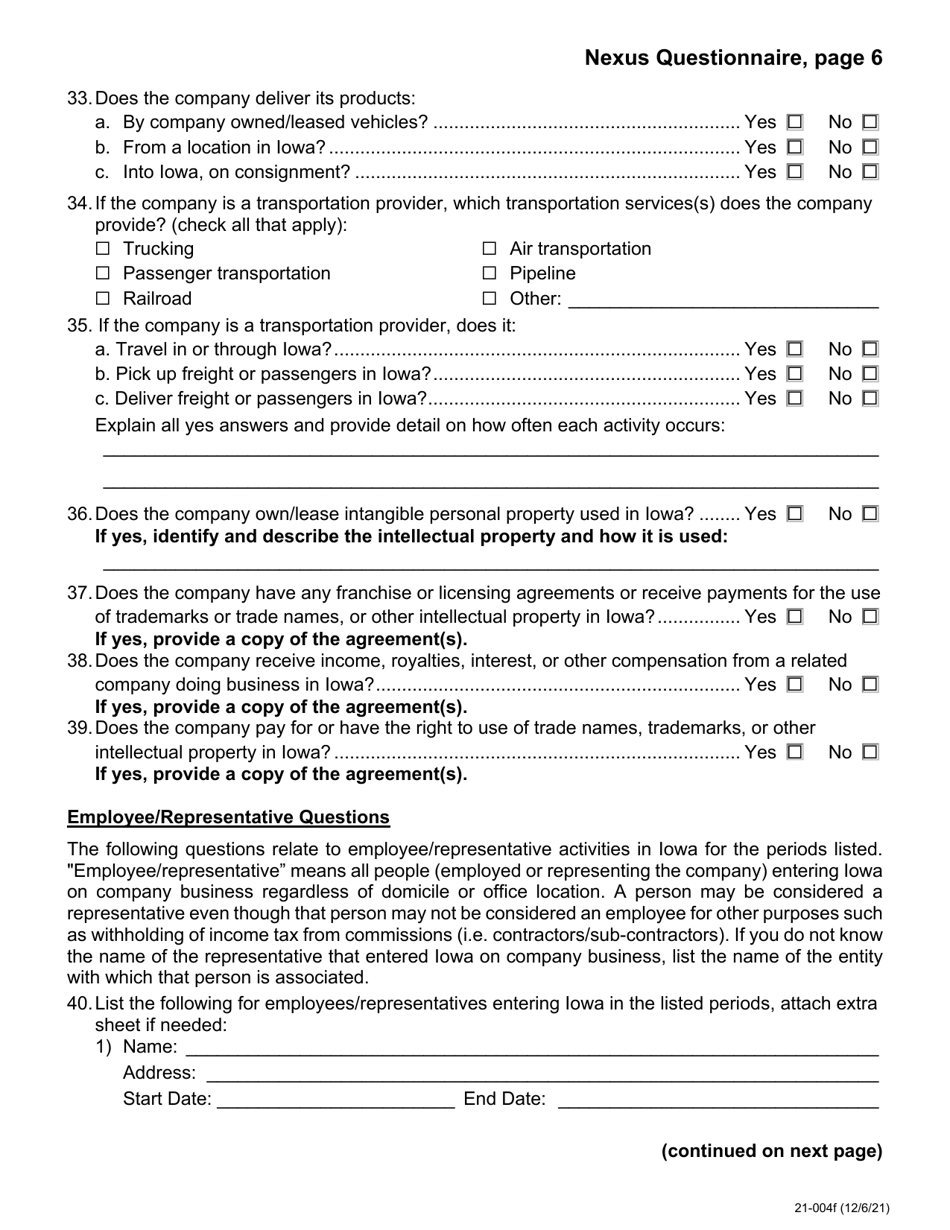

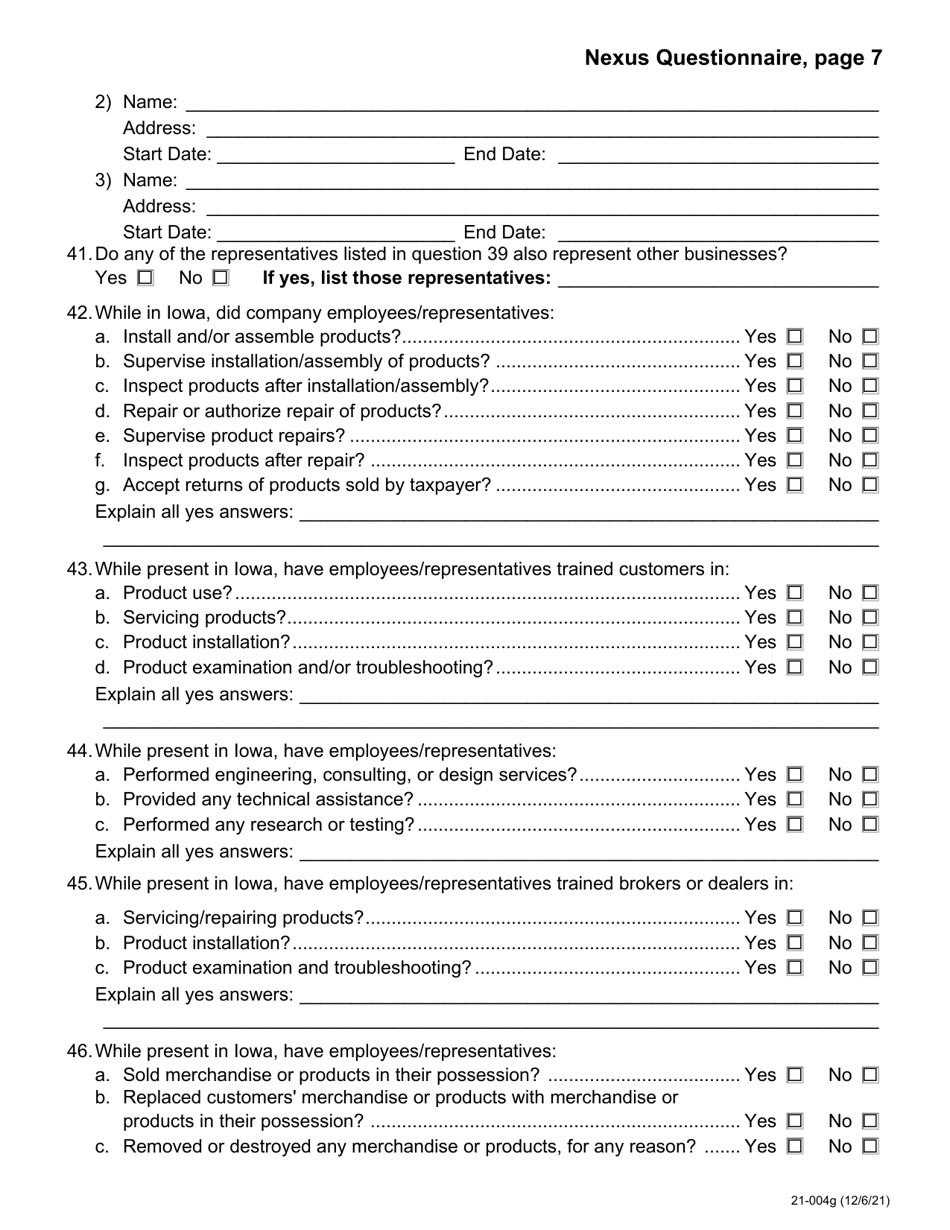

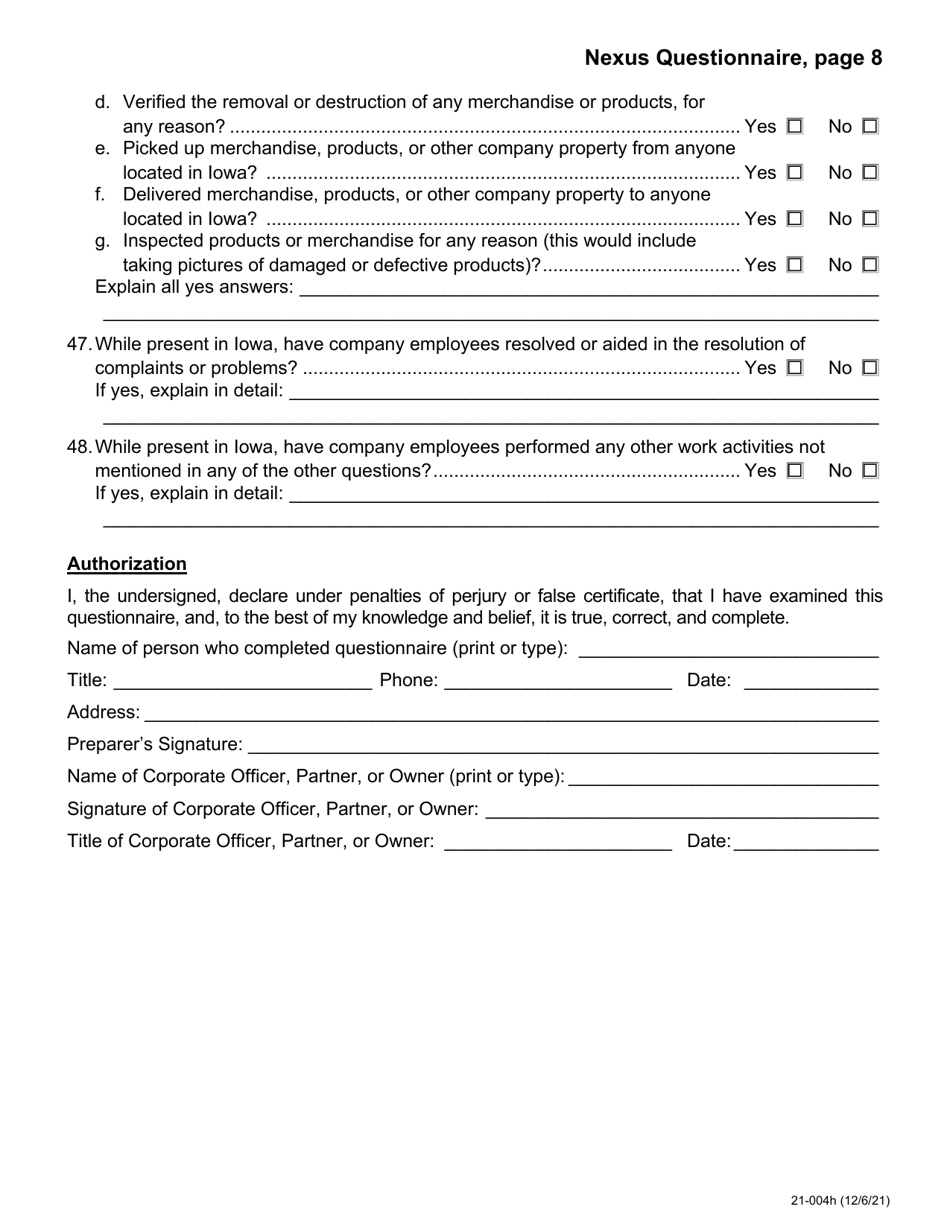

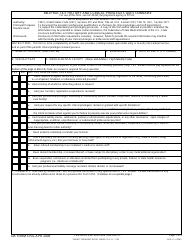

Form 21-004 Nexus Questionnaire - Iowa

What Is Form 21-004?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21-004 Nexus Questionnaire?

A: Form 21-004 Nexus Questionnaire is a questionnaire used in Iowa to determine a business's nexus or tax presence in the state.

Q: What is the purpose of Form 21-004 Nexus Questionnaire?

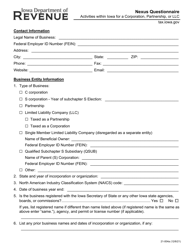

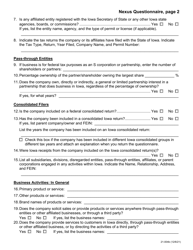

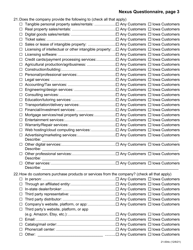

A: The purpose of Form 21-004 Nexus Questionnaire is to gather information about a business's activities in Iowa to determine if they have a tax presence in the state.

Q: Who needs to fill out Form 21-004 Nexus Questionnaire?

A: Businesses that have operations or sales in Iowa may need to fill out Form 21-004 Nexus Questionnaire to determine if they have a tax presence in the state.

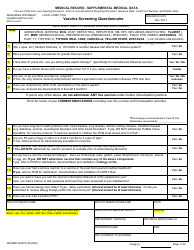

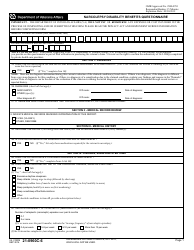

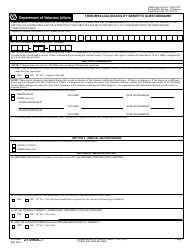

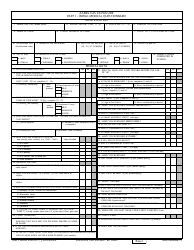

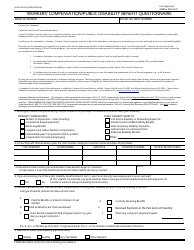

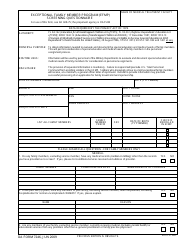

Q: What information is required on Form 21-004 Nexus Questionnaire?

A: Form 21-004 Nexus Questionnaire requires information about the business's activities, sales, and presence in Iowa.

Q: Is Form 21-004 Nexus Questionnaire mandatory?

A: While not mandatory for all businesses, Form 21-004 Nexus Questionnaire may be required by the Iowa Department of Revenue to determine a business's tax presence in the state.

Q: What are the consequences of not filling out Form 21-004 Nexus Questionnaire?

A: If a business fails to fill out Form 21-004 Nexus Questionnaire when required, they may face penalties or additional taxes for not complying with Iowa tax laws.

Q: When should I submit Form 21-004 Nexus Questionnaire?

A: The deadline for submitting Form 21-004 Nexus Questionnaire varies and depends on the specific instructions provided by the Iowa Department of Revenue.

Q: What should I do if I have questions about Form 21-004 Nexus Questionnaire?

A: If you have any questions about Form 21-004 Nexus Questionnaire, you should contact the Iowa Department of Revenue for assistance.

Form Details:

- Released on December 6, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21-004 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.