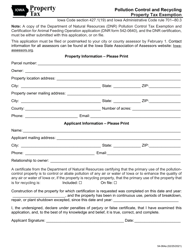

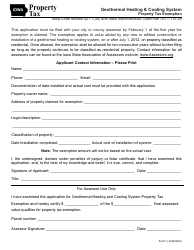

This version of the form is not currently in use and is provided for reference only. Download this version of

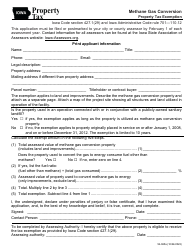

Form 54-146

for the current year.

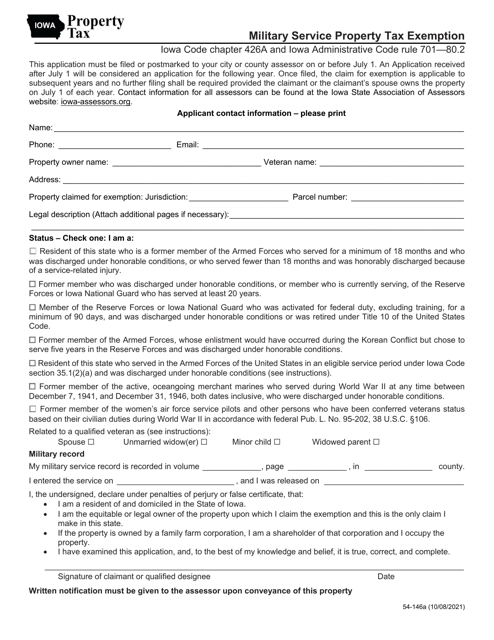

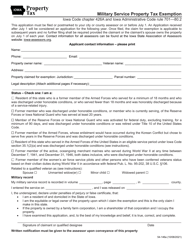

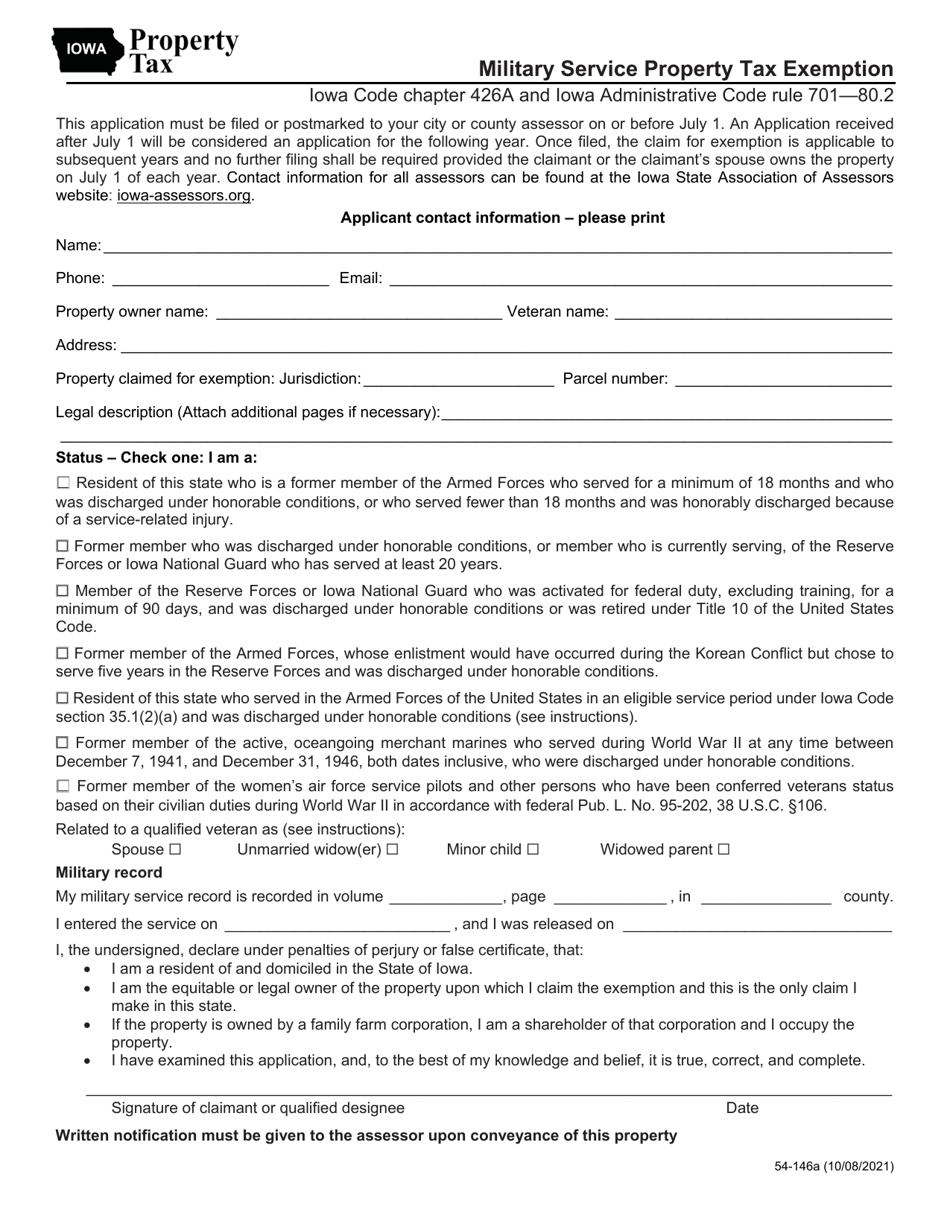

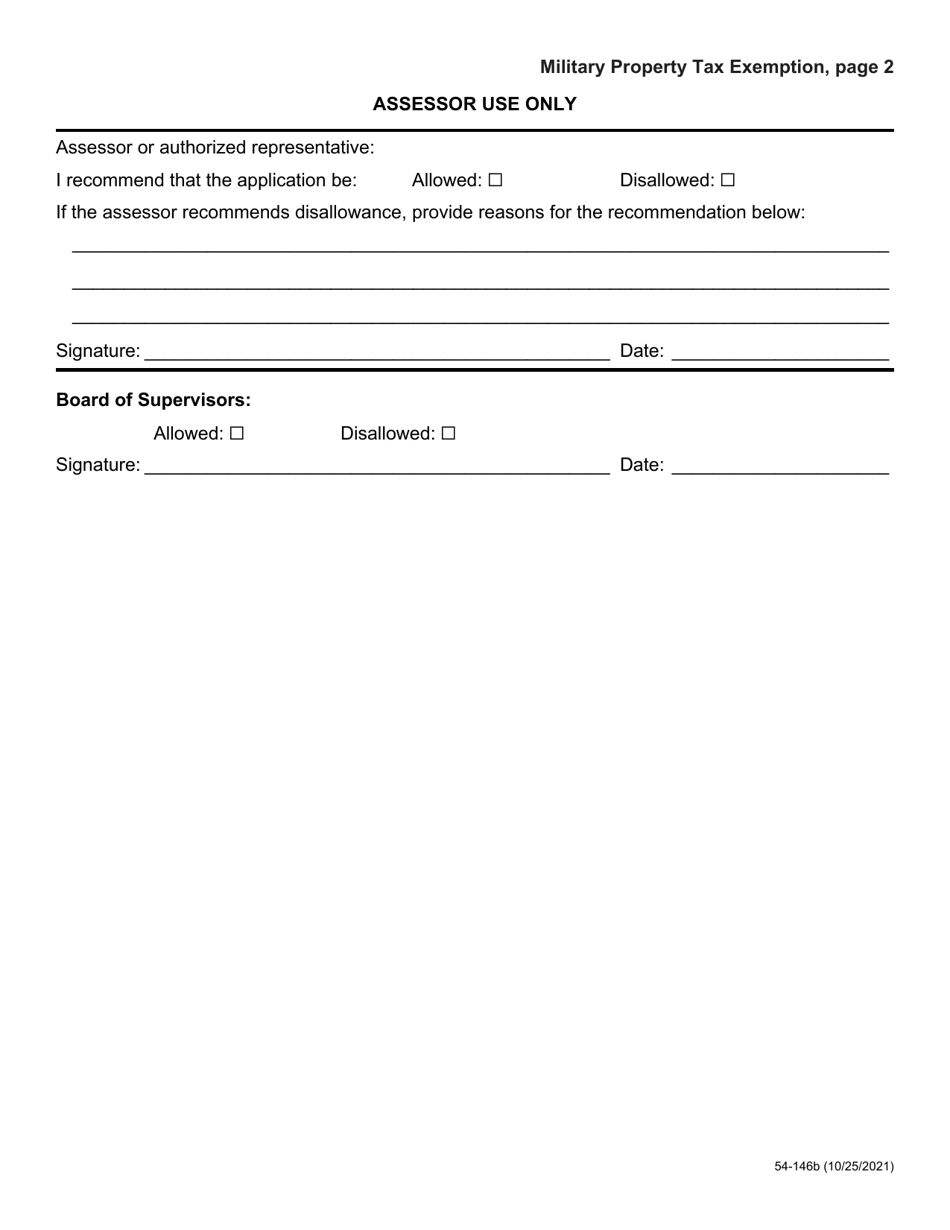

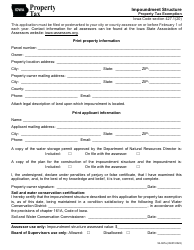

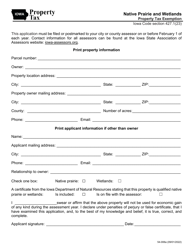

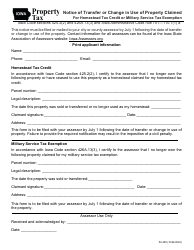

Form 54-146 Military Service Property Tax Exemption - Iowa

What Is Form 54-146?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

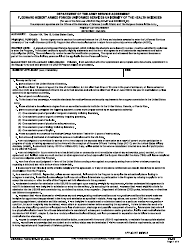

Q: What is Form 54-146?

A: Form 54-146 is the Military Service Property Tax Exemption form in Iowa.

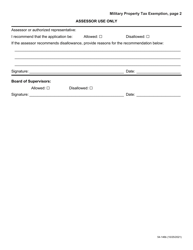

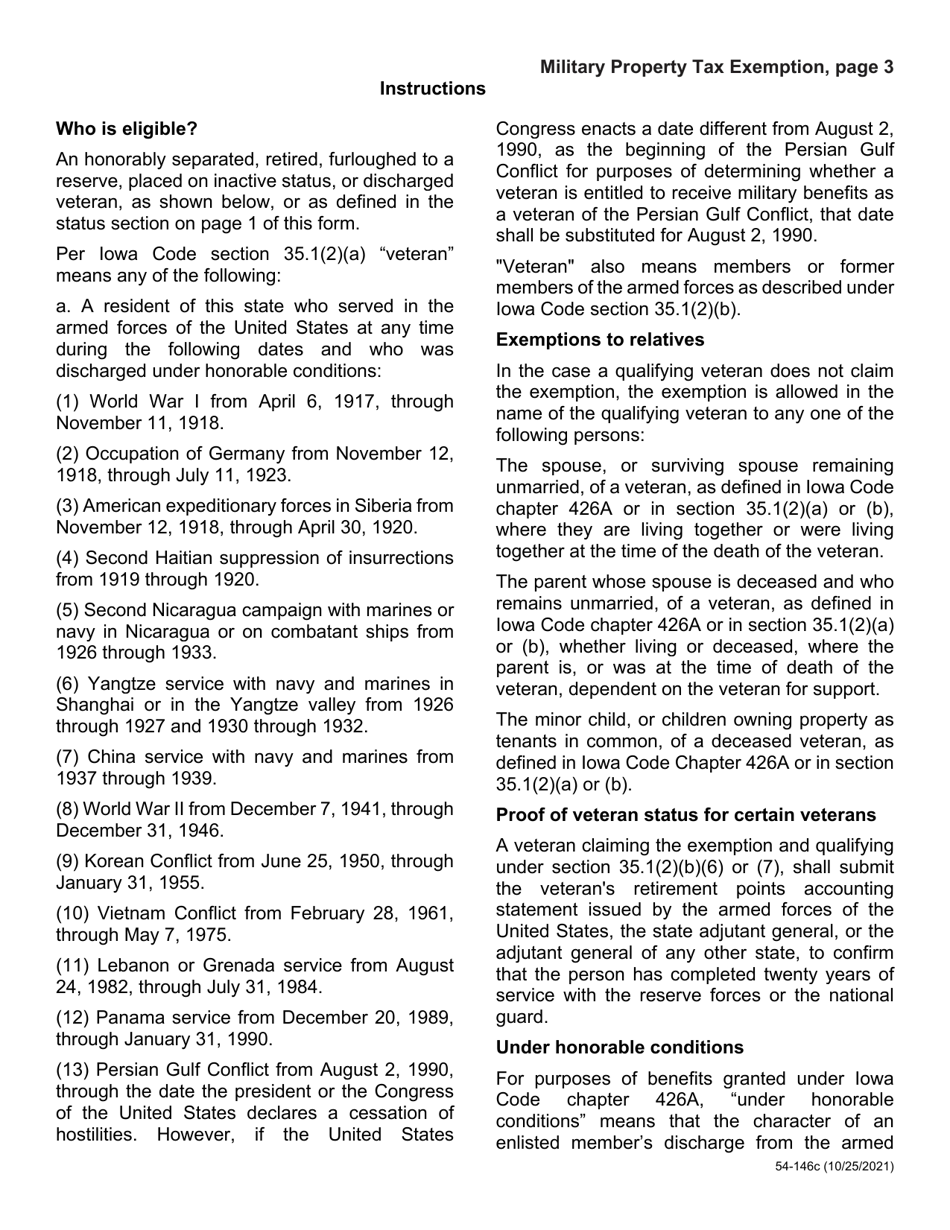

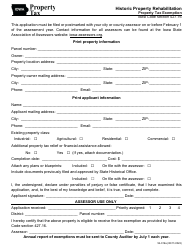

Q: Who is eligible for the Military Service Property Tax Exemption?

A: Military service members, veterans, and their surviving spouses are eligible for the exemption.

Q: What does the exemption provide?

A: The exemption reduces the taxable value of the property owned by eligible individuals.

Q: What documents do I need to submit with the form?

A: You will need to provide proof of military service, such as a DD-214 for veterans or a current military ID for active-duty service members.

Q: When is the deadline to file Form 54-146?

A: The deadline to file the form is July 1st of each year.

Q: Can I apply for the exemption if I am not a resident of Iowa?

A: No, the exemption is only available to residents of Iowa.

Q: Is there a fee to apply for the exemption?

A: No, there is no fee to apply for the exemption.

Q: What if I already receive a property tax credit for being disabled or elderly?

A: If you already receive a property tax credit, the exemption may not provide additional tax savings.

Q: Whom should I contact for more information?

A: For more information, you can contact your local county assessor's office or the Iowa Department of Revenue.

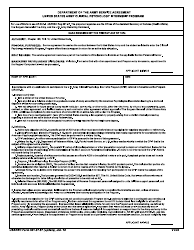

Form Details:

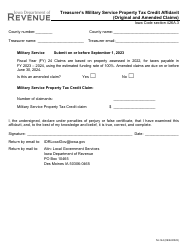

- Released on October 8, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-146 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.