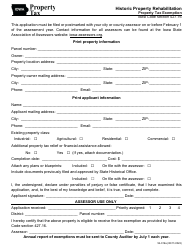

This version of the form is not currently in use and is provided for reference only. Download this version of

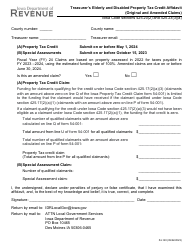

Form 54-017

for the current year.

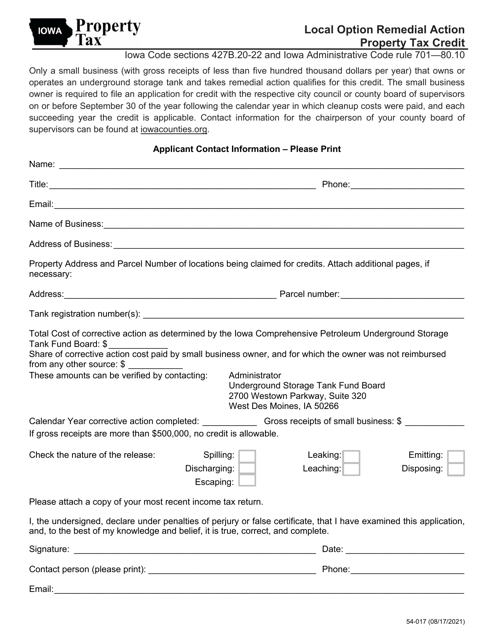

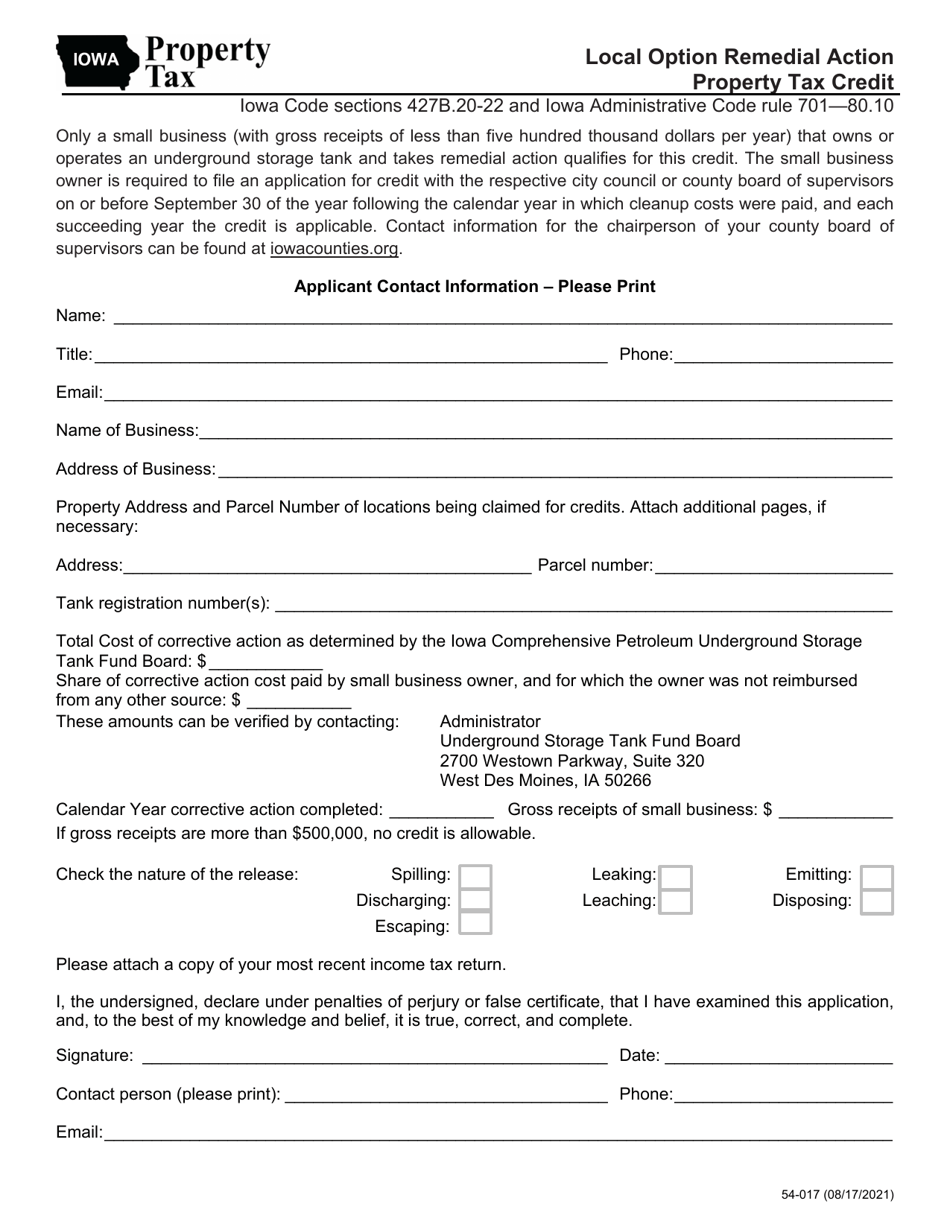

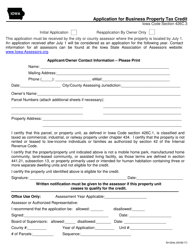

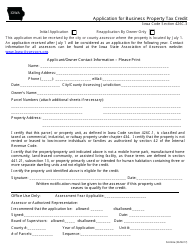

Form 54-017 Local Option Remedial Action Property Tax Credit - Iowa

What Is Form 54-017?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-017?

A: Form 54-017 is the Local Option Remedial Action Property Tax Credit form in Iowa.

Q: What is the purpose of Form 54-017?

A: The purpose of Form 54-017 is to claim the Local Option Remedial Action Property Tax Credit in Iowa.

Q: Who needs to file Form 54-017?

A: Property owners in Iowa who are eligible for the Local Option Remedial Action Property Tax Credit need to file Form 54-017.

Q: What is the Local Option Remedial Action Property Tax Credit?

A: The Local Option Remedial Action Property Tax Credit is a credit that reduces property taxes for owners of properties undergoing remediation actions in designated areas in Iowa.

Form Details:

- Released on August 17, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-017 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.