This version of the form is not currently in use and is provided for reference only. Download this version of

Form 44-095

for the current year.

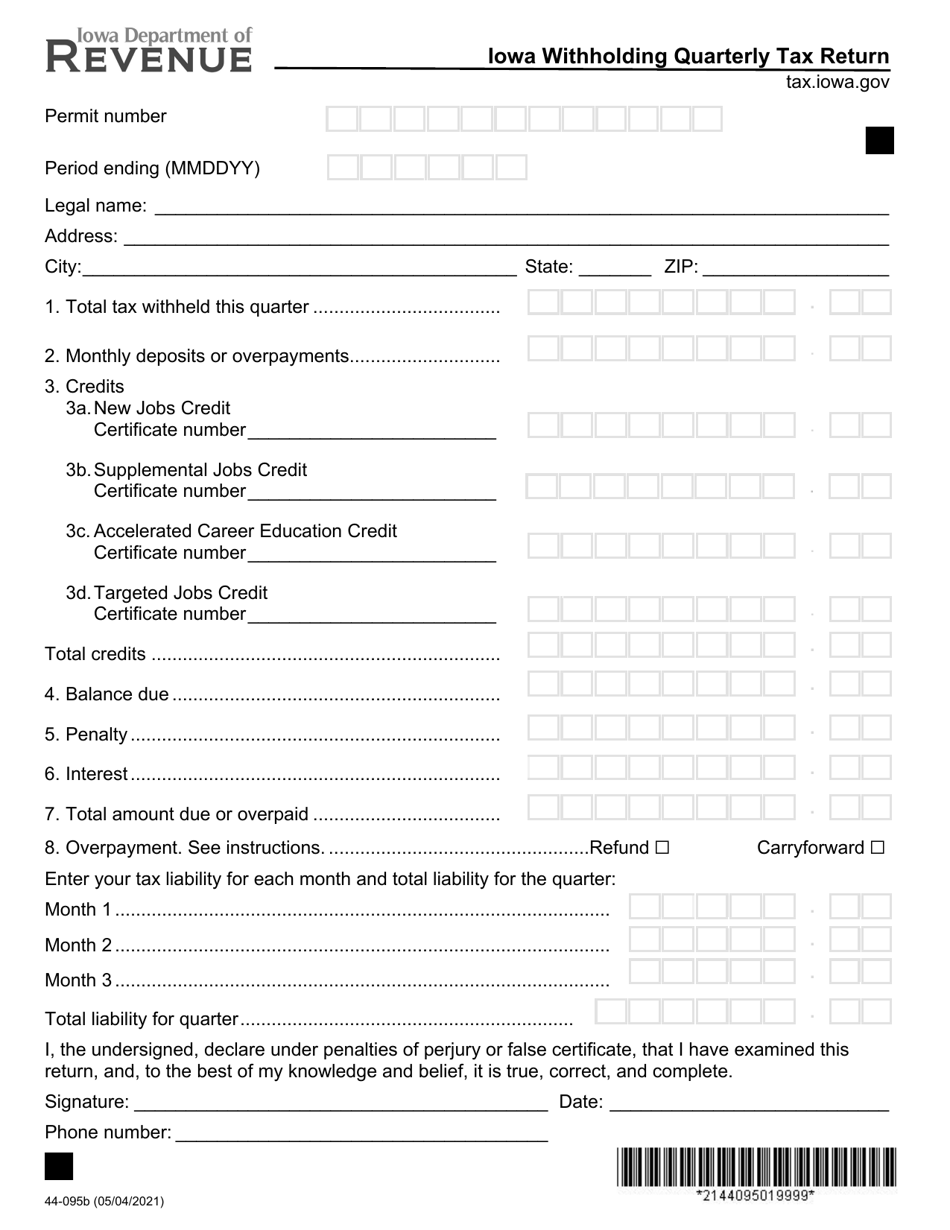

Form 44-095 Iowa Withholding Quarterly Tax Return - Iowa

What Is Form 44-095?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

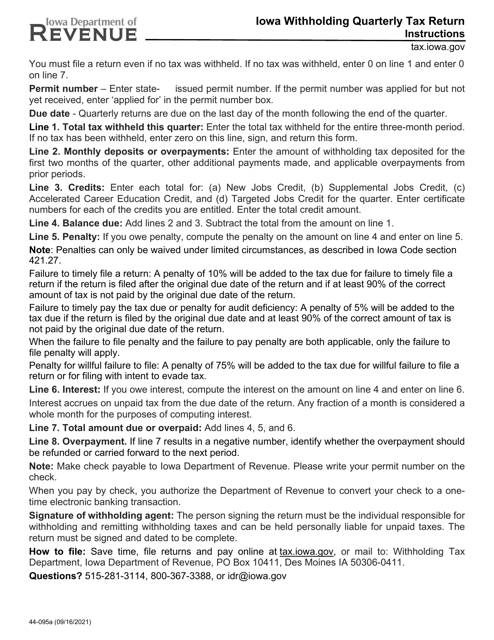

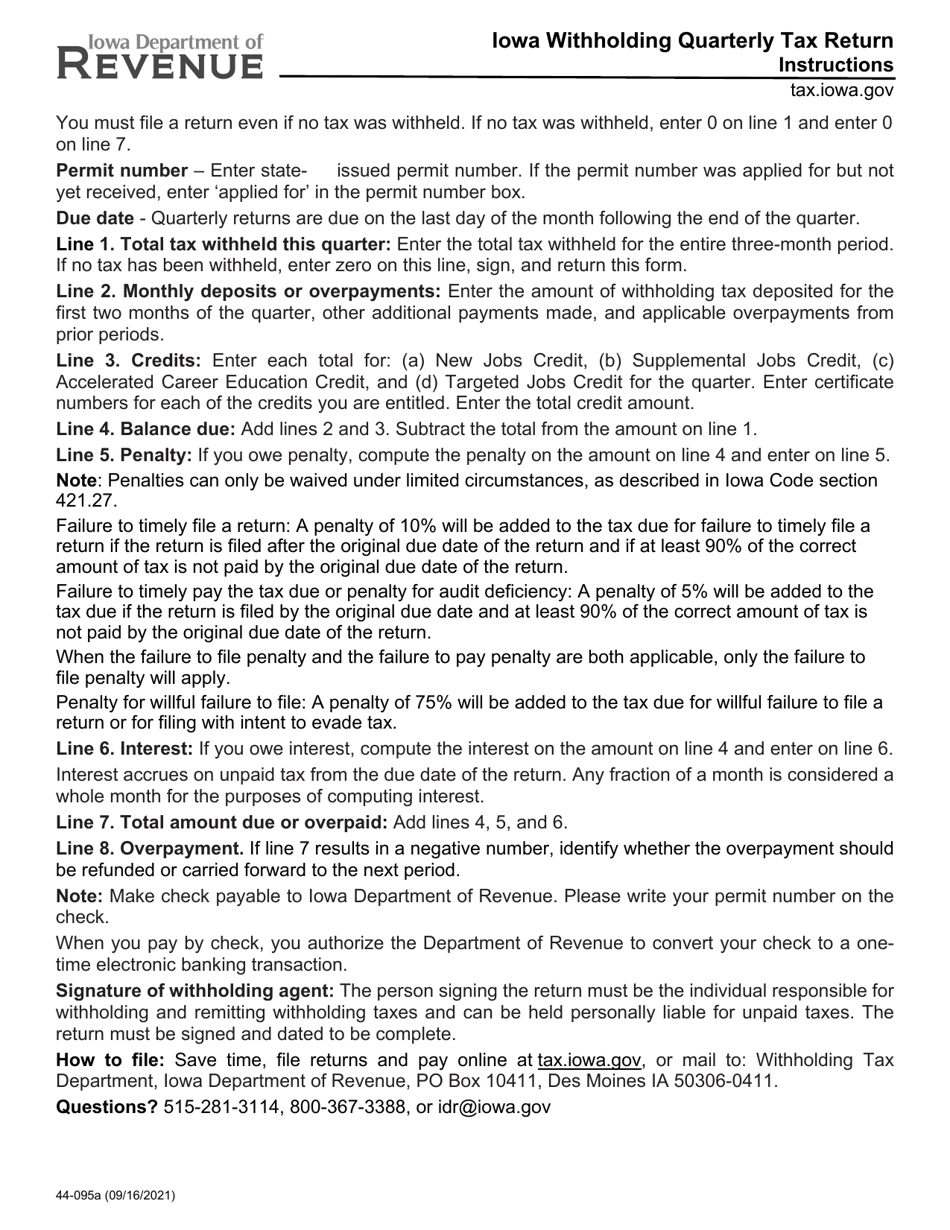

Q: What is Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Form 44-095 Iowa Withholding Quarterly Tax Return is a document used by employers in Iowa to report and remit state income tax withholdings on a quarterly basis.

Q: Who needs to file Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Employers in Iowa who withhold state income taxes from their employees' wages need to file Form 44-095 Iowa Withholding Quarterly Tax Return.

Q: When is the deadline for filing Form 44-095 Iowa Withholding Quarterly Tax Return?

A: The deadline for filing Form 44-095 Iowa Withholding Quarterly Tax Return is the last day of the month following the end of the quarter.

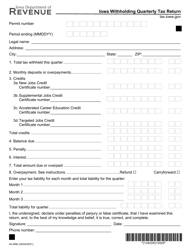

Q: What information is required to complete Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Information required to complete the form includes details about the employer, total amount of wages subject to withholding, and the amount of state income taxes withheld from employees' wages.

Q: Can Form 44-095 Iowa Withholding Quarterly Tax Return be filed electronically?

A: Yes, employers have the option to file Form 44-095 Iowa Withholding Quarterly Tax Return electronically through the Iowa Department of Revenue's eFile & Pay system.

Q: Is it mandatory to file Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Yes, employers who withhold state income taxes in Iowa are required by law to file Form 44-095 Iowa Withholding Quarterly Tax Return.

Q: What are the consequences of not filing Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Failure to file Form 44-095 Iowa Withholding Quarterly Tax Return or late filing may result in penalties and interest charges imposed by the Iowa Department of Revenue.

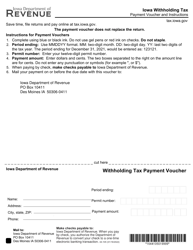

Q: Are there any additional forms or schedules related to Form 44-095 Iowa Withholding Quarterly Tax Return?

A: Employers may need to include Schedule D with Form 44-095 if they have made any corrections or adjustments to their withheld taxes during the quarter.

Form Details:

- Released on September 16, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 44-095 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.