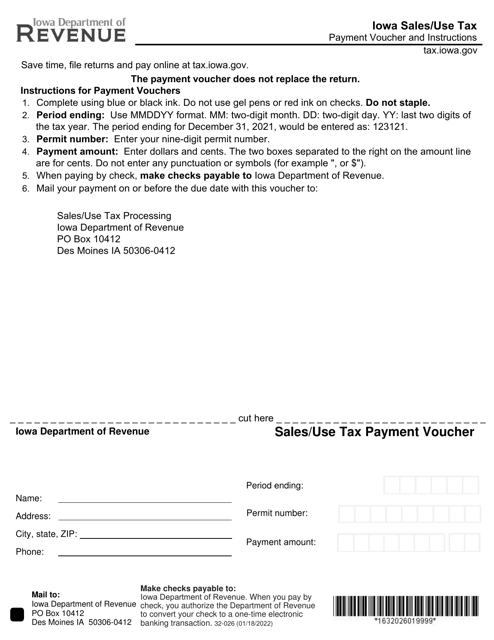

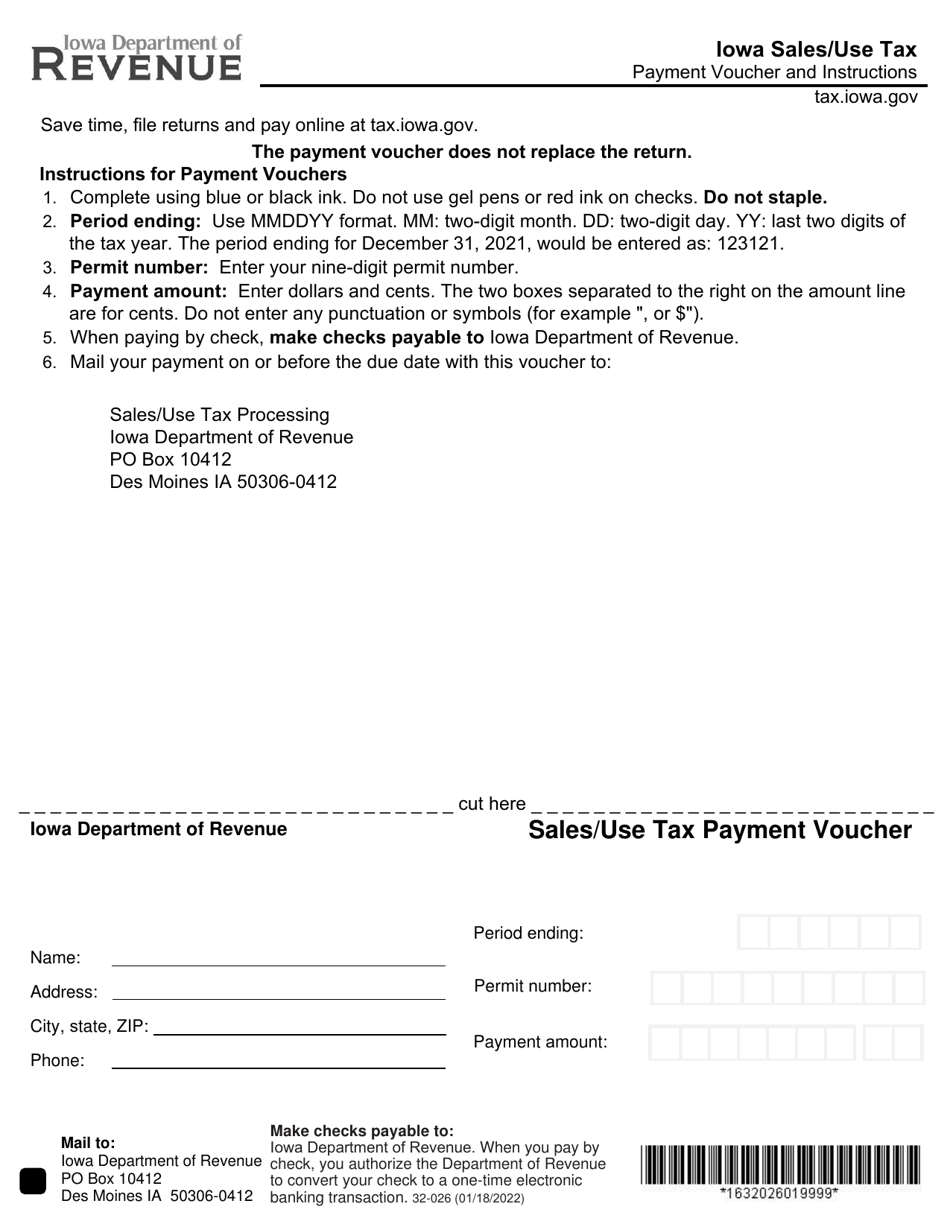

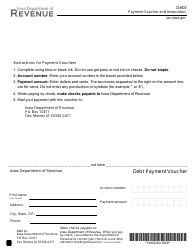

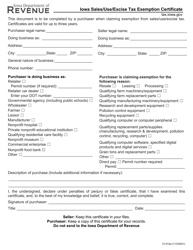

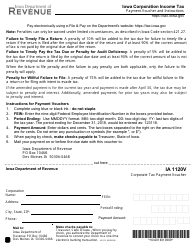

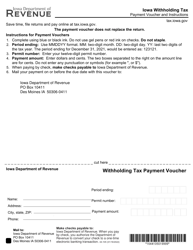

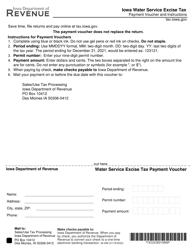

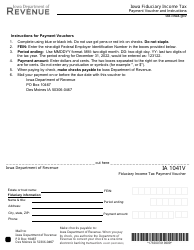

Form 32-026 Iowa Sales / Use Tax Payment Voucher - Iowa

What Is Form 32-026?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 32-026?

A: Form 32-026 is the Iowa Sales/Use Tax Payment Voucher.

Q: What is the purpose of Form 32-026?

A: The purpose of Form 32-026 is to remit sales or use tax payments to the state of Iowa.

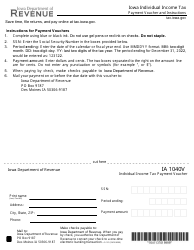

Q: Who needs to use Form 32-026?

A: Businesses or individuals who are required to collect and remit sales or use tax in Iowa need to use Form 32-026.

Q: How often should Form 32-026 be filed?

A: Form 32-026 should be filed on a monthly basis, even if no sales tax is due.

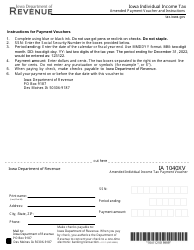

Q: Are there any penalties for late or incorrect filing of Form 32-026?

A: Yes, there may be penalties for late or incorrect filing of Form 32-026. It is important to file on time and accurately to avoid these penalties.

Form Details:

- Released on January 18, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 32-026 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.