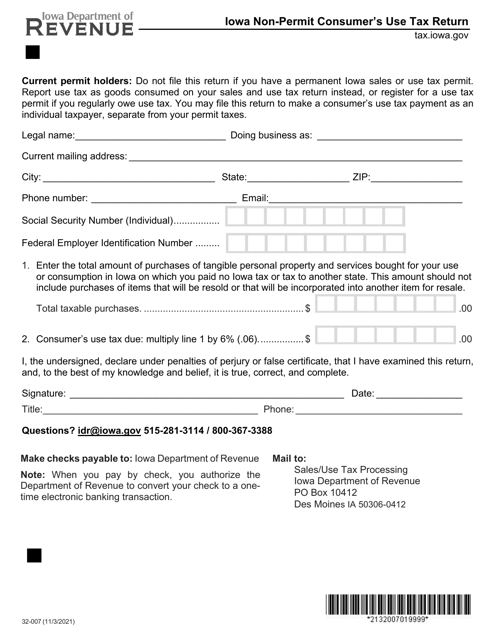

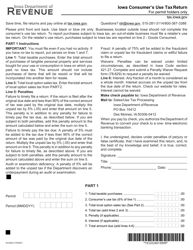

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 32-007

for the current year.

Form 32-007 Iowa Non-permit Consumer's Use Tax Return - Iowa

What Is Form 32-007?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 32-007?

A: Form 32-007 is the Iowa Non-permit Consumer's Use Tax Return.

Q: Who needs to file Form 32-007?

A: Individuals or businesses in Iowa who have made purchases without paying sales tax.

Q: When should Form 32-007 be filed?

A: Form 32-007 should be filed monthly, quarterly, or annually depending on the total use tax owed.

Q: What is the purpose of Form 32-007?

A: The purpose of Form 32-007 is to report and pay consumer's use tax on purchases made without paying sales tax.

Q: Are there any penalties for not filing Form 32-007?

A: Yes, there may be penalties for not filing or underreporting use tax on Form 32-007.

Q: What supporting documentation is required for filing Form 32-007?

A: Supporting documentation such as invoices or receipts should be retained but not submitted with Form 32-007.

Q: Can I claim a refund on Form 32-007?

A: No, Form 32-007 is for reporting and paying use tax, not for claiming sales tax refunds.

Form Details:

- Released on November 3, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 32-007 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.