This version of the form is not currently in use and is provided for reference only. Download this version of

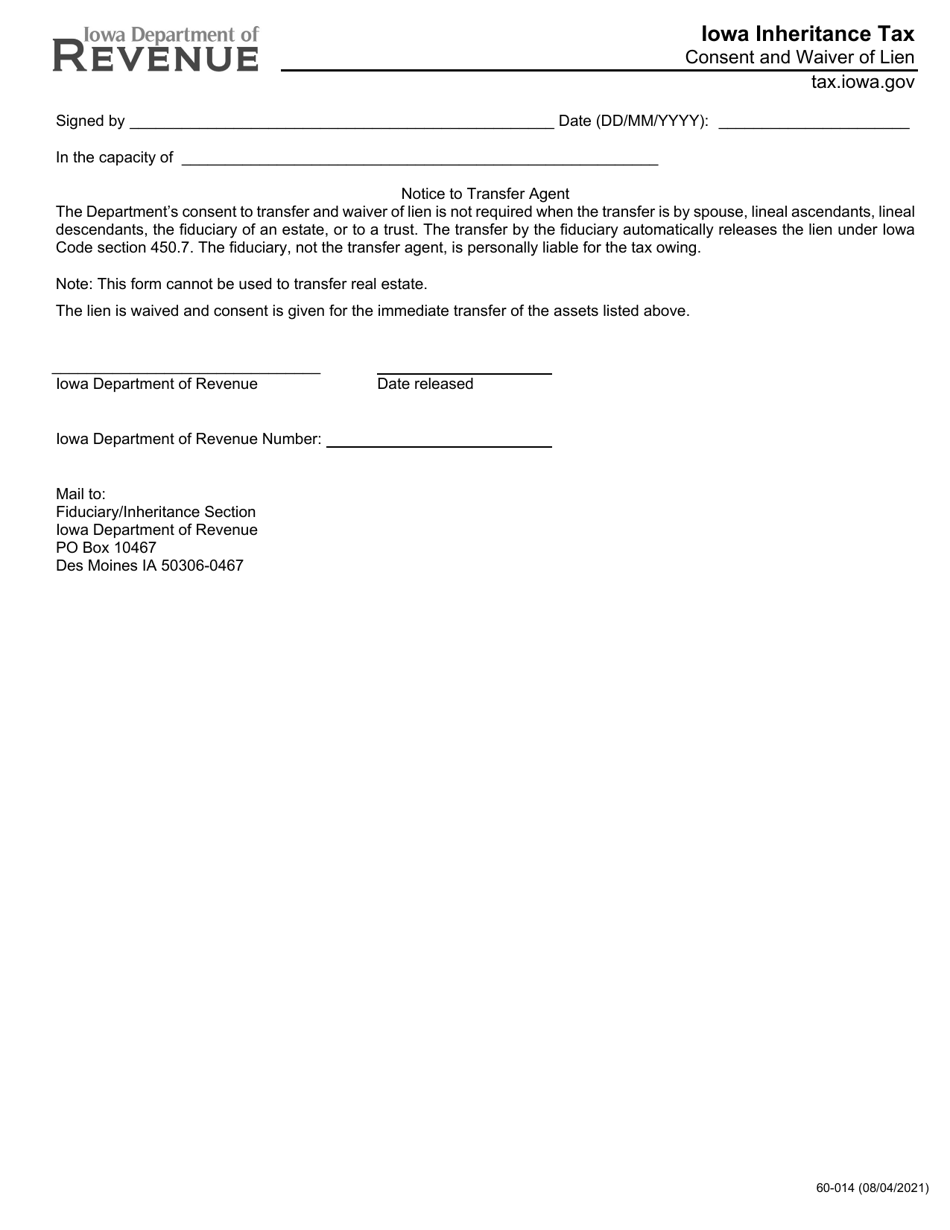

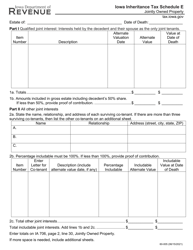

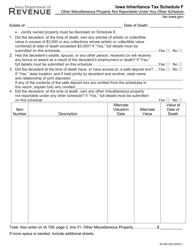

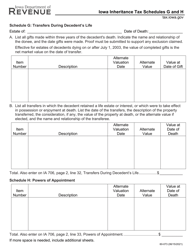

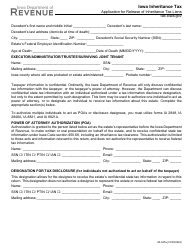

Form 60-014

for the current year.

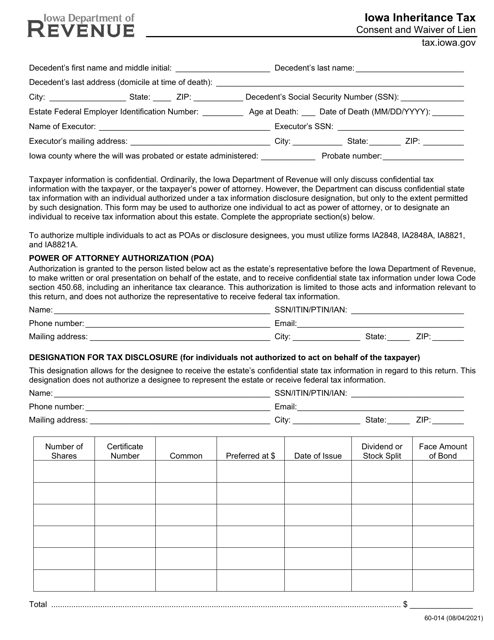

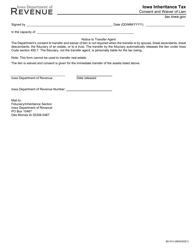

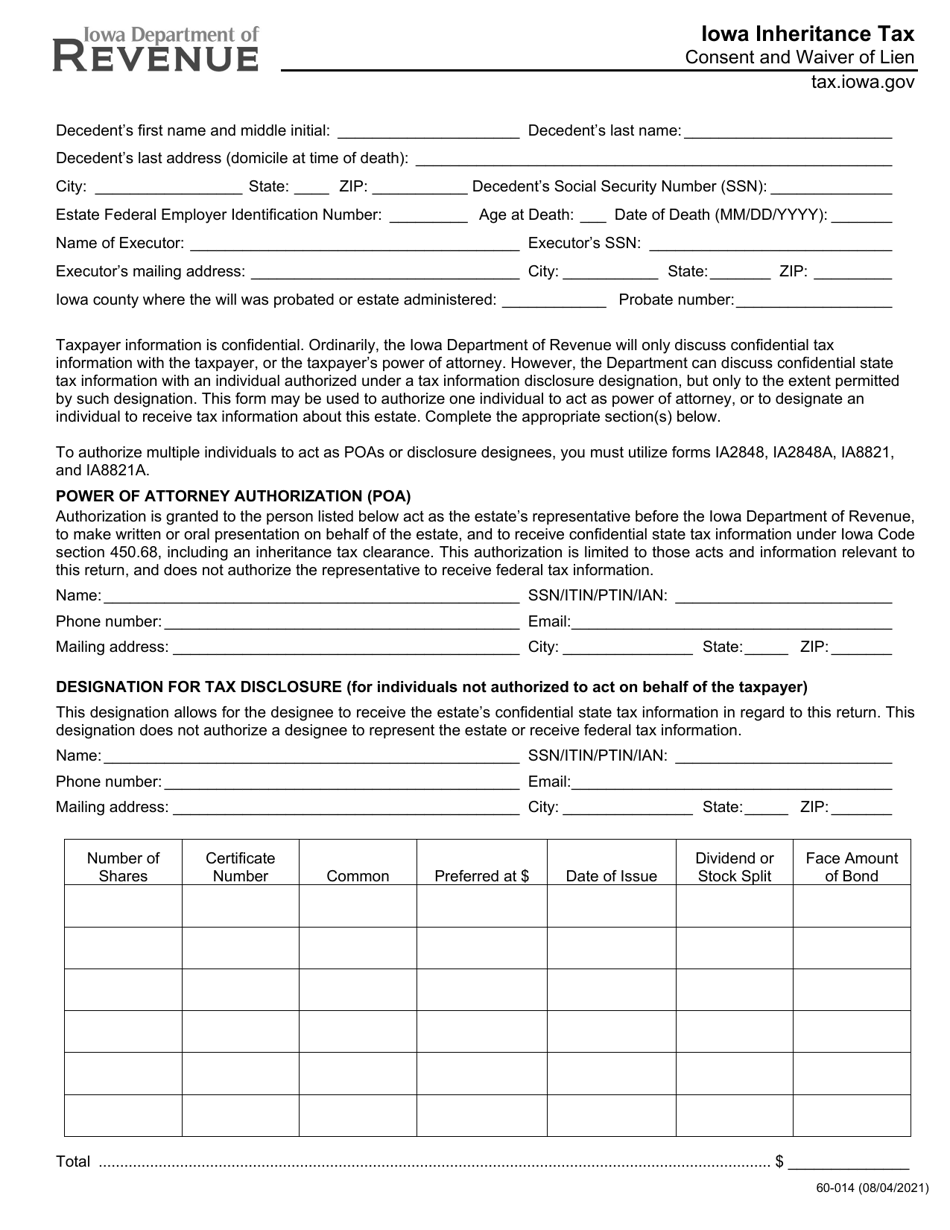

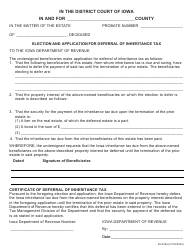

Form 60-014 Iowa Inheritance Tax - Consent and Waiver of Lien - Iowa

What Is Form 60-014?

This is a legal form that was released by the Iowa Department of Public Safety - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-014?

A: Form 60-014 is the Iowa Inheritance Tax - Consent and Waiver of Lien form.

Q: What is the purpose of Form 60-014?

A: The purpose of Form 60-014 is to obtain consent and waiver of lien for Iowa inheritance tax purposes.

Q: Who needs to use Form 60-014?

A: Anyone who is subject to Iowa inheritance tax and wants to obtain consent and waiver of lien needs to use this form.

Q: Is there a fee for filing Form 60-014?

A: No, there is no fee for filing Form 60-014.

Q: When should Form 60-014 be filed?

A: Form 60-014 should be filed within 9 months after the date of death or termination of the trust.

Form Details:

- Released on August 4, 2021;

- The latest edition provided by the Iowa Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 60-014 by clicking the link below or browse more documents and templates provided by the Iowa Department of Public Safety.