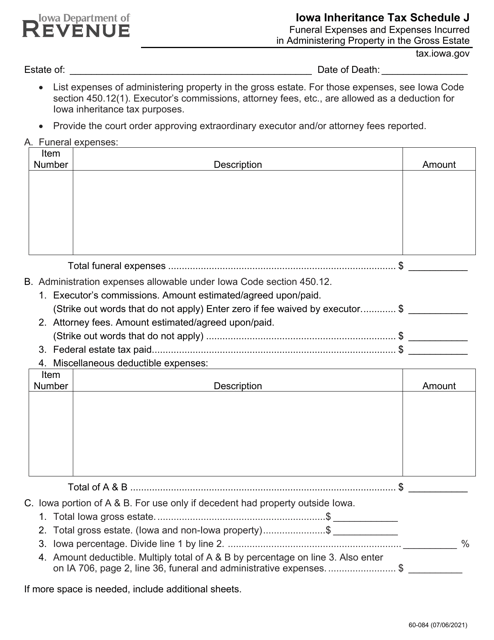

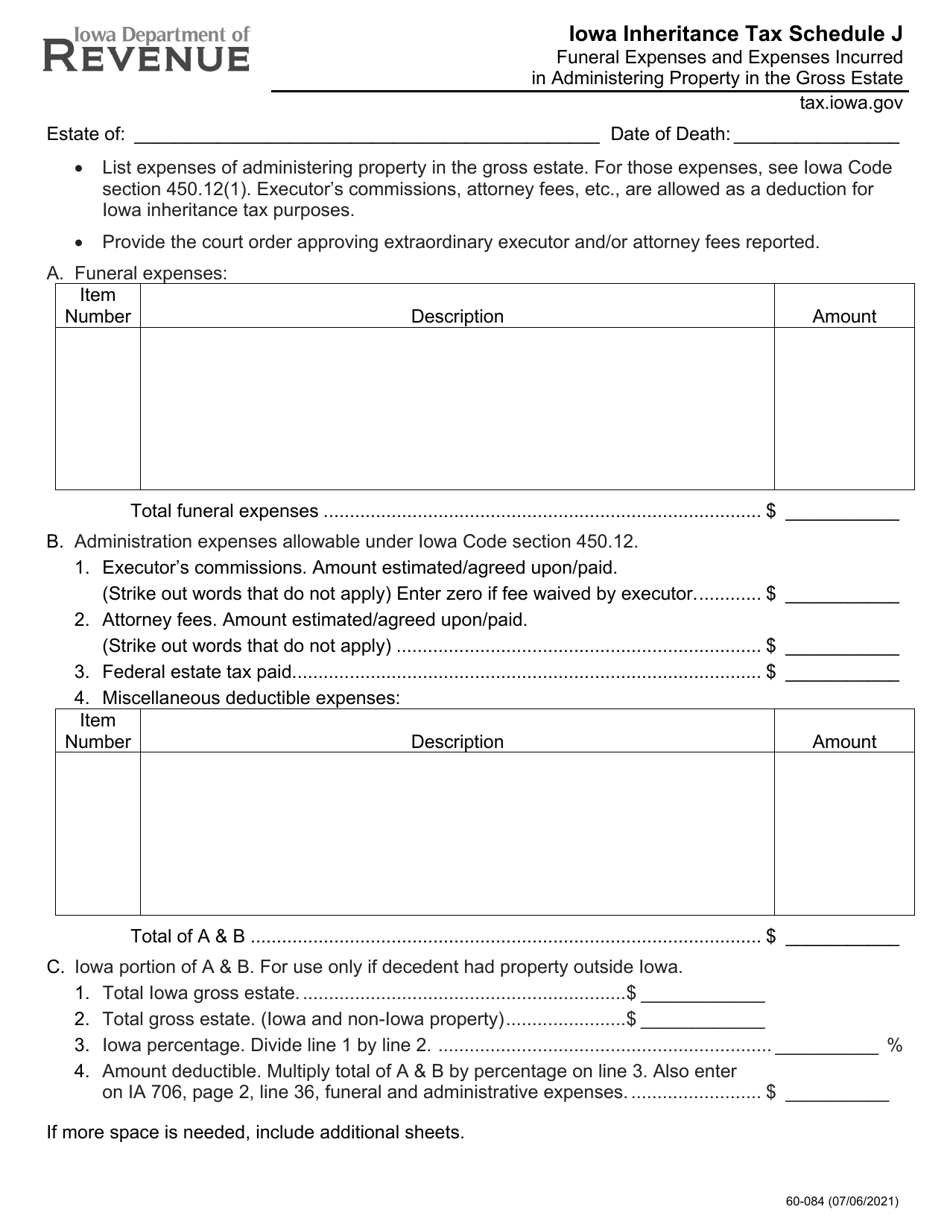

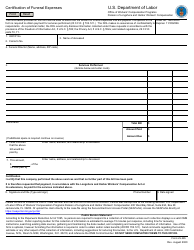

Form 60-084 Schedule J Funeral Expenses and Expenses Incurred in Administering Property in the Gross Estate - Iowa

What Is Form 60-084 Schedule J?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-084 Schedule J?

A: Form 60-084 Schedule J is a form used in Iowa to report funeral expenses and expenses incurred in administering property in the gross estate.

Q: Who needs to file Form 60-084 Schedule J?

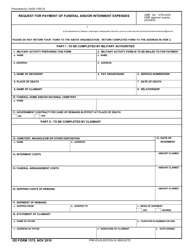

A: The executor or administrator of an estate in Iowa needs to file Form 60-084 Schedule J if there are funeral expenses and expenses related to administering the estate's property.

Q: What expenses can be reported on Form 60-084 Schedule J?

A: Form 60-084 Schedule J is used to report funeral expenses and expenses incurred in administering property in the gross estate, including legal fees and accounting fees.

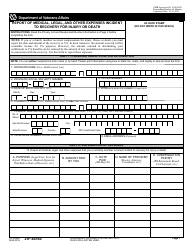

Q: Is Form 60-084 Schedule J specific to Iowa?

A: Yes, Form 60-084 Schedule J is specific to Iowa and is not used for federal tax purposes.

Form Details:

- Released on July 6, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 60-084 Schedule J by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.