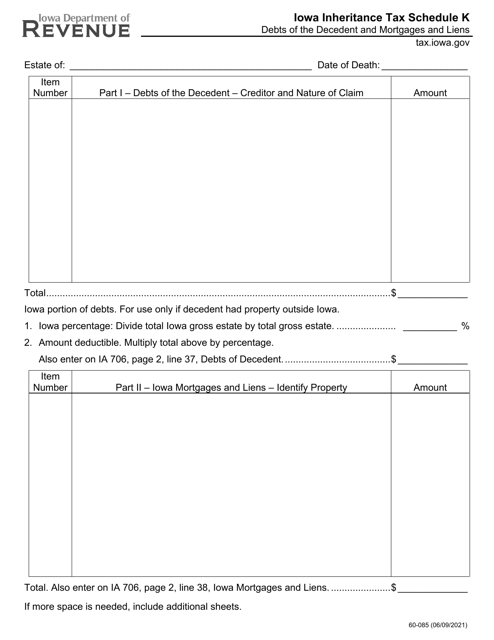

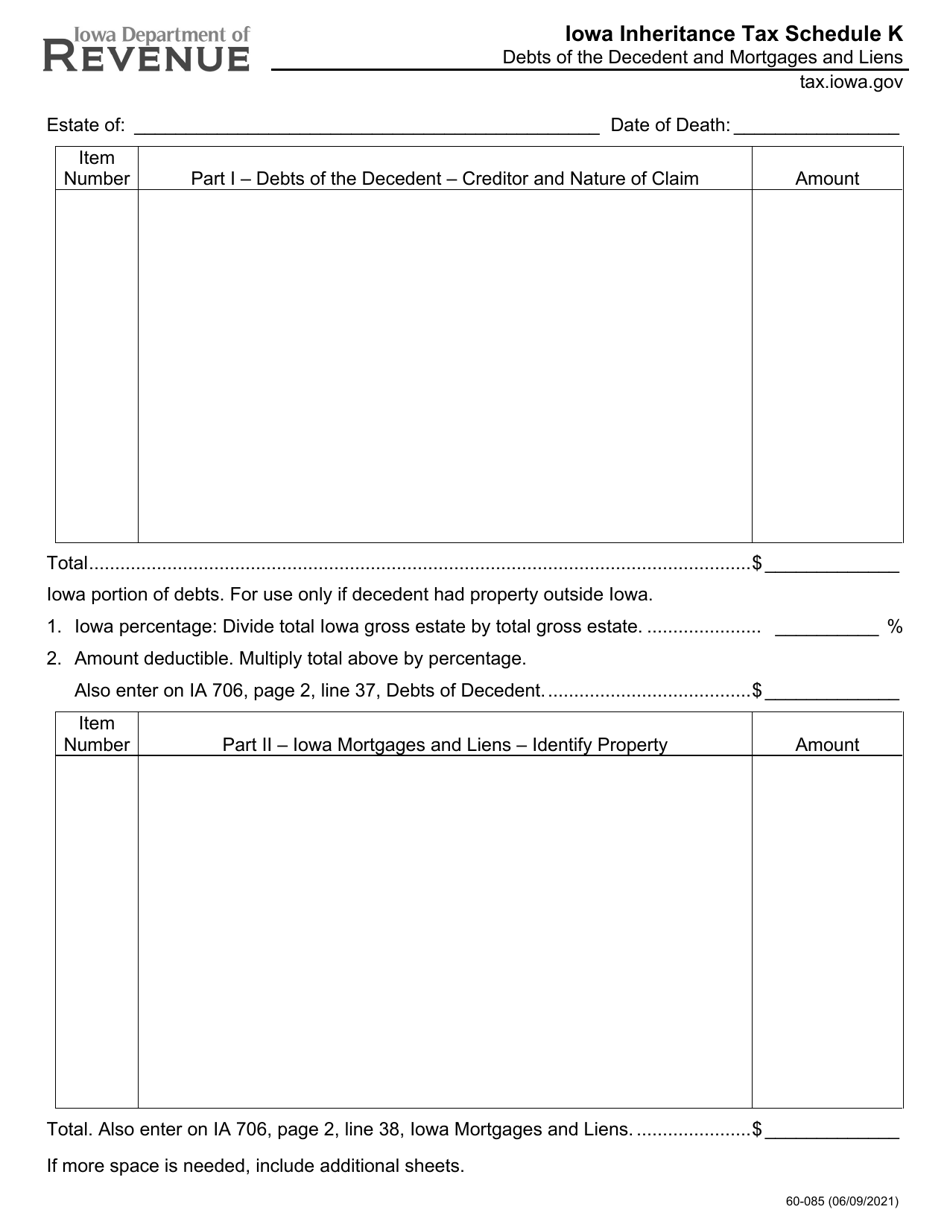

Form 60-085 Schedule K Debts of the Decedent and Mortgages and Liens - Iowa

What Is Form 60-085 Schedule K?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-085 Schedule K?

A: Form 60-085 Schedule K is a document used in the state of Iowa to list the debts, mortgages, and liens of a deceased person's estate.

Q: Who needs to file Form 60-085 Schedule K?

A: The personal representative or executor of the deceased person's estate needs to file Form 60-085 Schedule K.

Q: What information is required on Form 60-085 Schedule K?

A: Form 60-085 Schedule K requires information about the debts, mortgages, and liens that the deceased person had at the time of their death.

Q: Is there a fee for filing Form 60-085 Schedule K?

A: There is no fee for filing Form 60-085 Schedule K.

Q: When is the deadline for filing Form 60-085 Schedule K?

A: Form 60-085 Schedule K should be filed within 9 months after the date of the decedent's death.

Q: What happens after I file Form 60-085 Schedule K?

A: After you file Form 60-085 Schedule K, the information will be used to determine the value of the decedent's estate and to settle any outstanding debts.

Form Details:

- Released on June 9, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 60-085 Schedule K by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.