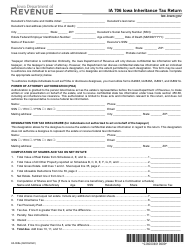

This version of the form is not currently in use and is provided for reference only. Download this version of

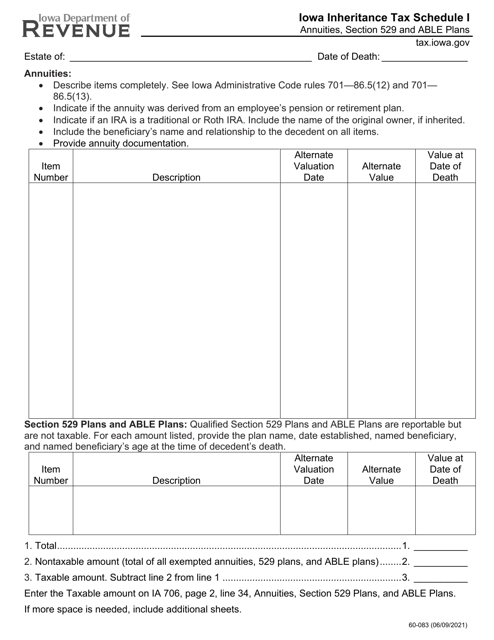

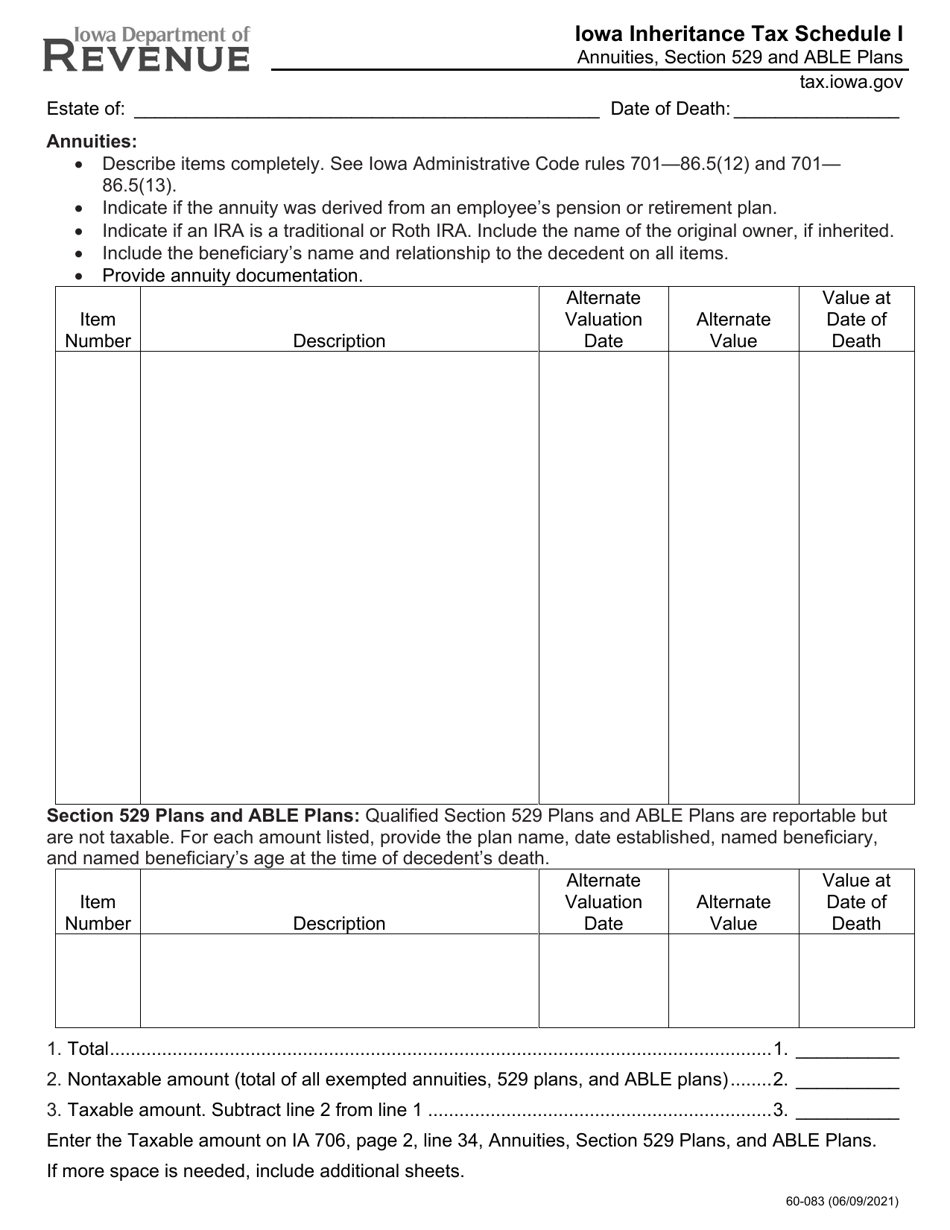

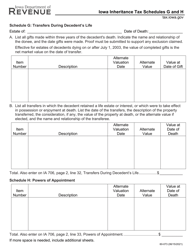

Form 60-083 Schedule I

for the current year.

Form 60-083 Schedule I Iowa Inheritance Tax - Annuities, Section 529 and Able Plans - Iowa

What Is Form 60-083 Schedule I?

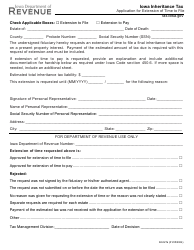

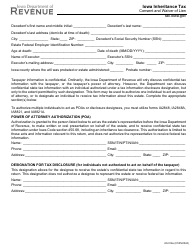

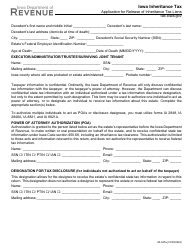

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-083 Schedule I?

A: Form 60-083 Schedule I is a tax form used in Iowa for reporting inheritance tax related to annuities, Section 529 plans, and Able Plans.

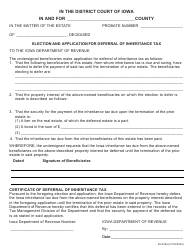

Q: What is Iowa inheritance tax?

A: Iowa inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries.

Q: What is an annuity?

A: An annuity is a type of investment that provides a stream of income over a certain period of time.

Q: What is Section 529 plan?

A: A Section 529 plan is a tax-advantaged savings plan designed to help families save for future college expenses.

Q: What is an Able Plan?

A: An Able Plan is a tax-advantaged savings account for individuals with disabilities, designed to help them save and pay for qualified disability-related expenses.

Form Details:

- Released on June 9, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 60-083 Schedule I by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.