This version of the form is not currently in use and is provided for reference only. Download this version of

Form 43-005

for the current year.

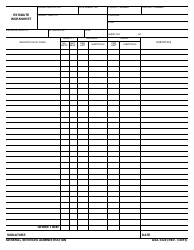

Form 43-005 Franchise Estimated Worksheet - Iowa

What Is Form 43-005?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

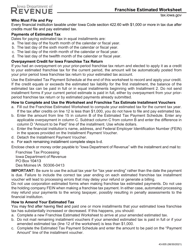

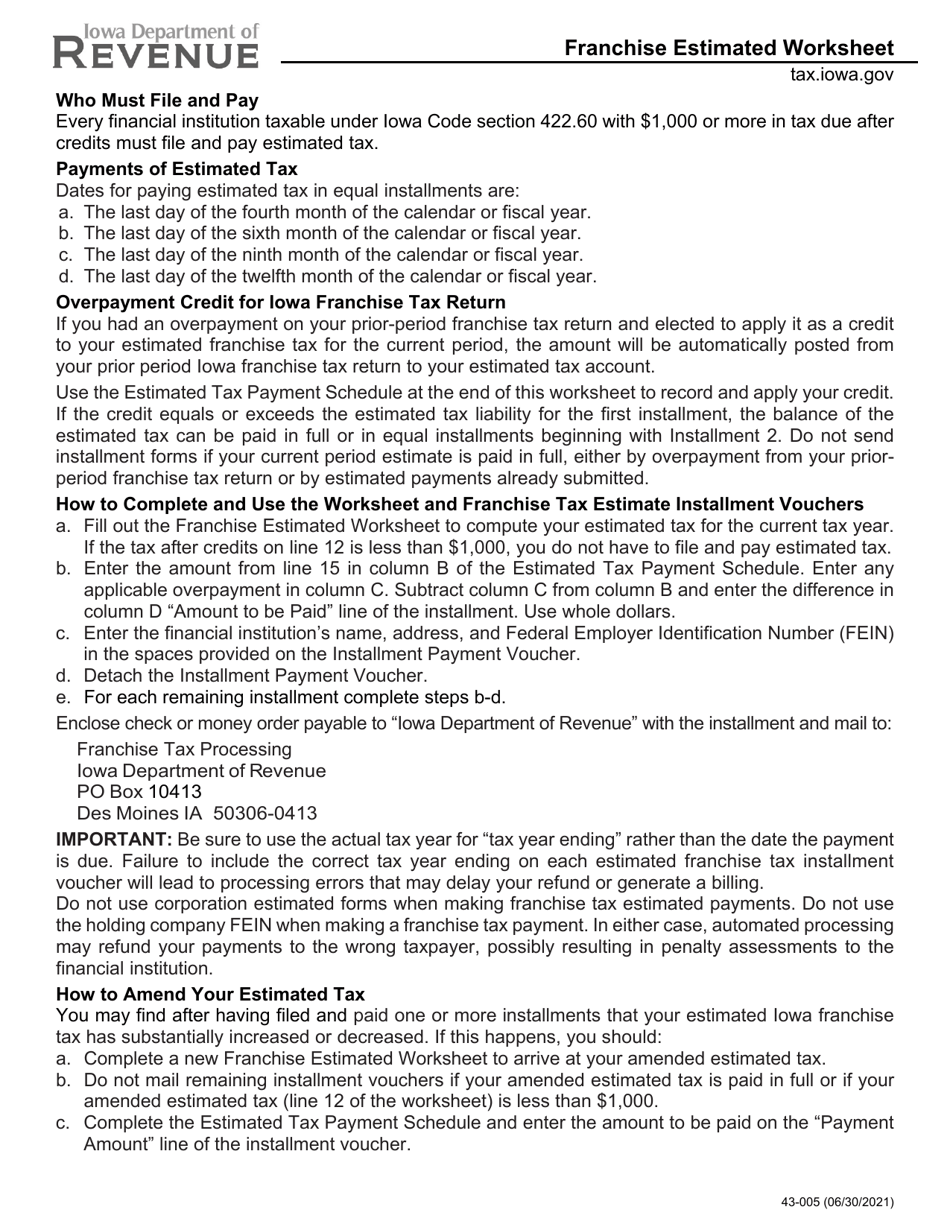

Q: What is Form 43-005?

A: Form 43-005 is the Franchise Estimated Worksheet for Iowa.

Q: What is the purpose of Form 43-005?

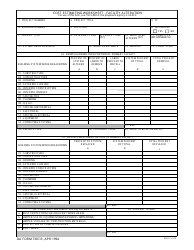

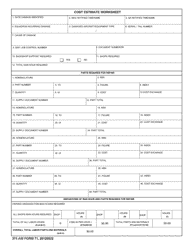

A: The purpose of Form 43-005 is to estimate the franchise tax liability for Iowa.

Q: Who needs to fill out Form 43-005?

A: Any individual or entity that is subject to the Iowa franchise tax must fill out Form 43-005.

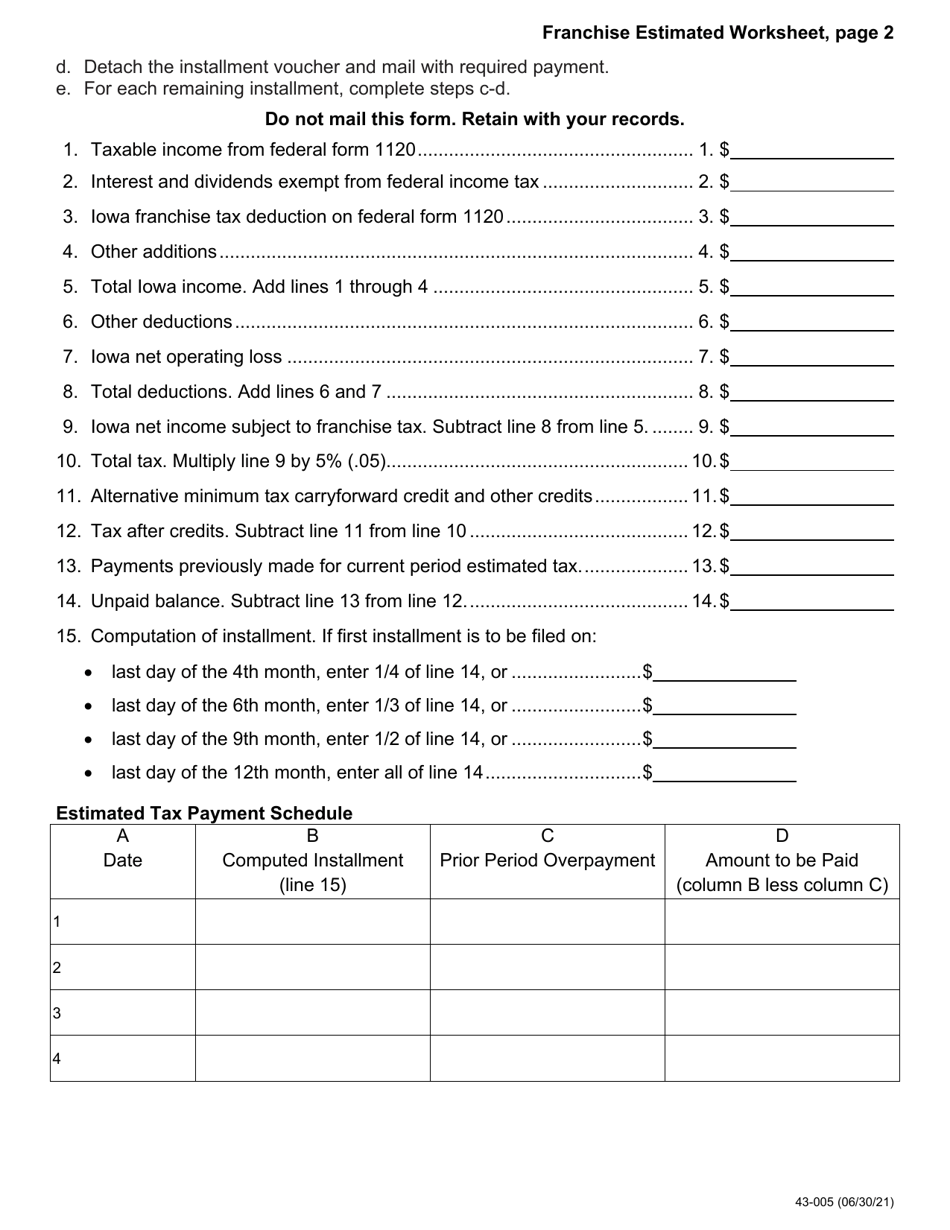

Q: What information is required on Form 43-005?

A: Form 43-005 requires information about the taxpayer's estimated gross receipts, deductions, credits, and total tax liability.

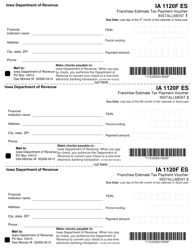

Q: When is Form 43-005 due?

A: Form 43-005 is generally due on the 30th day of the 6th month after the end of the taxpayer's fiscal year.

Q: Can Form 43-005 be filed electronically?

A: Yes, Form 43-005 can be filed electronically through the Iowa Department of Revenue's E-File system.

Form Details:

- Released on June 30, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 43-005 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.