This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA843 (22-009)

for the current year.

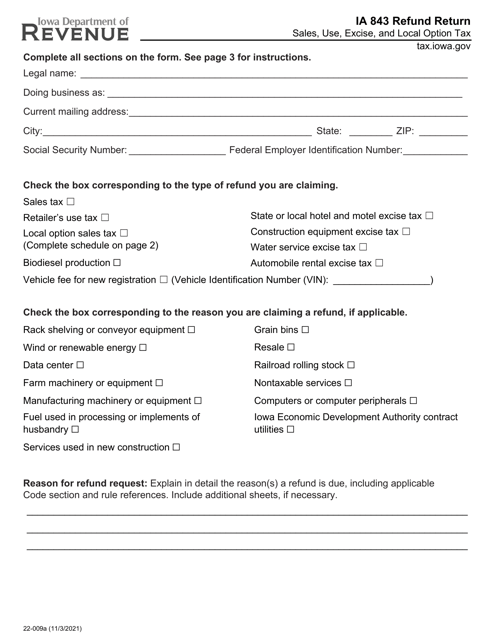

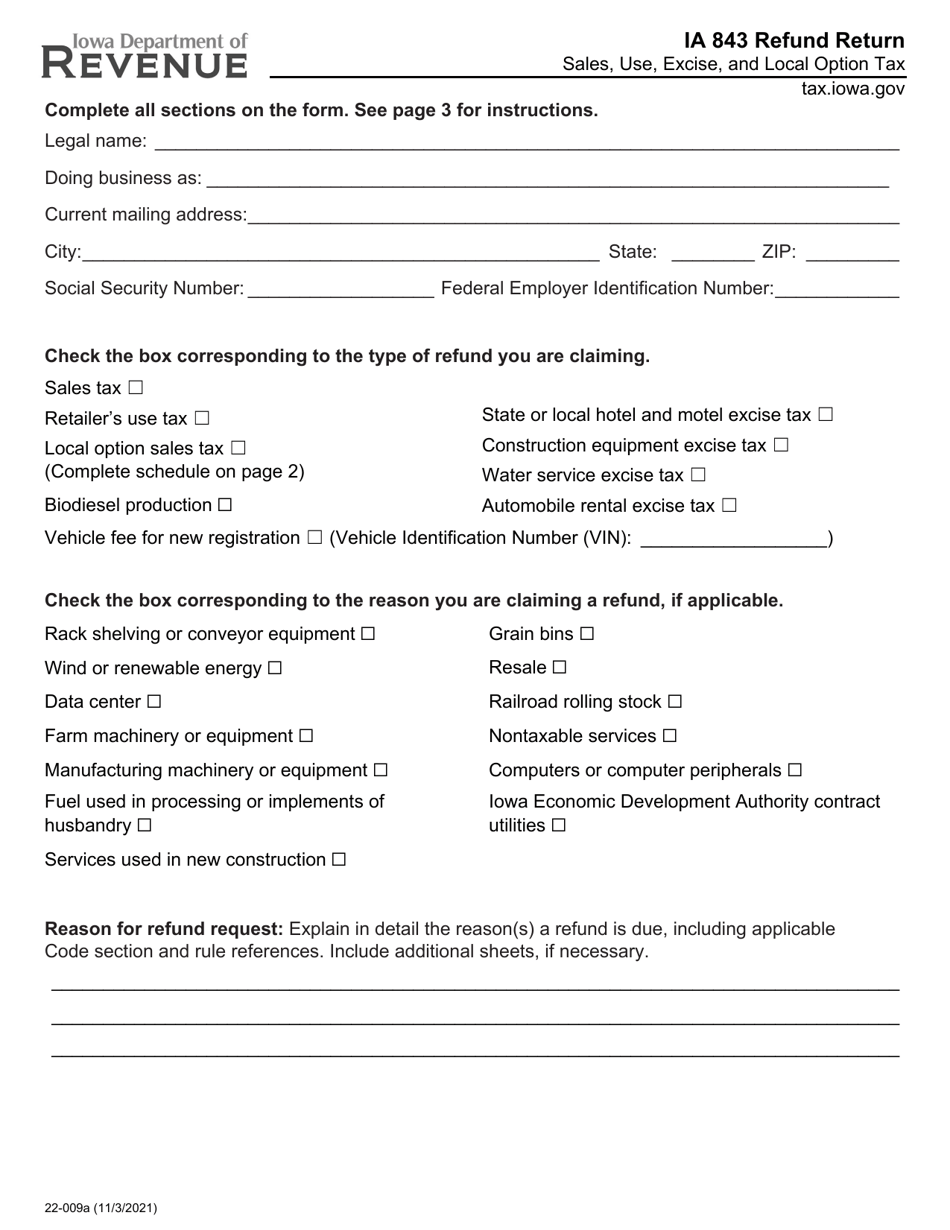

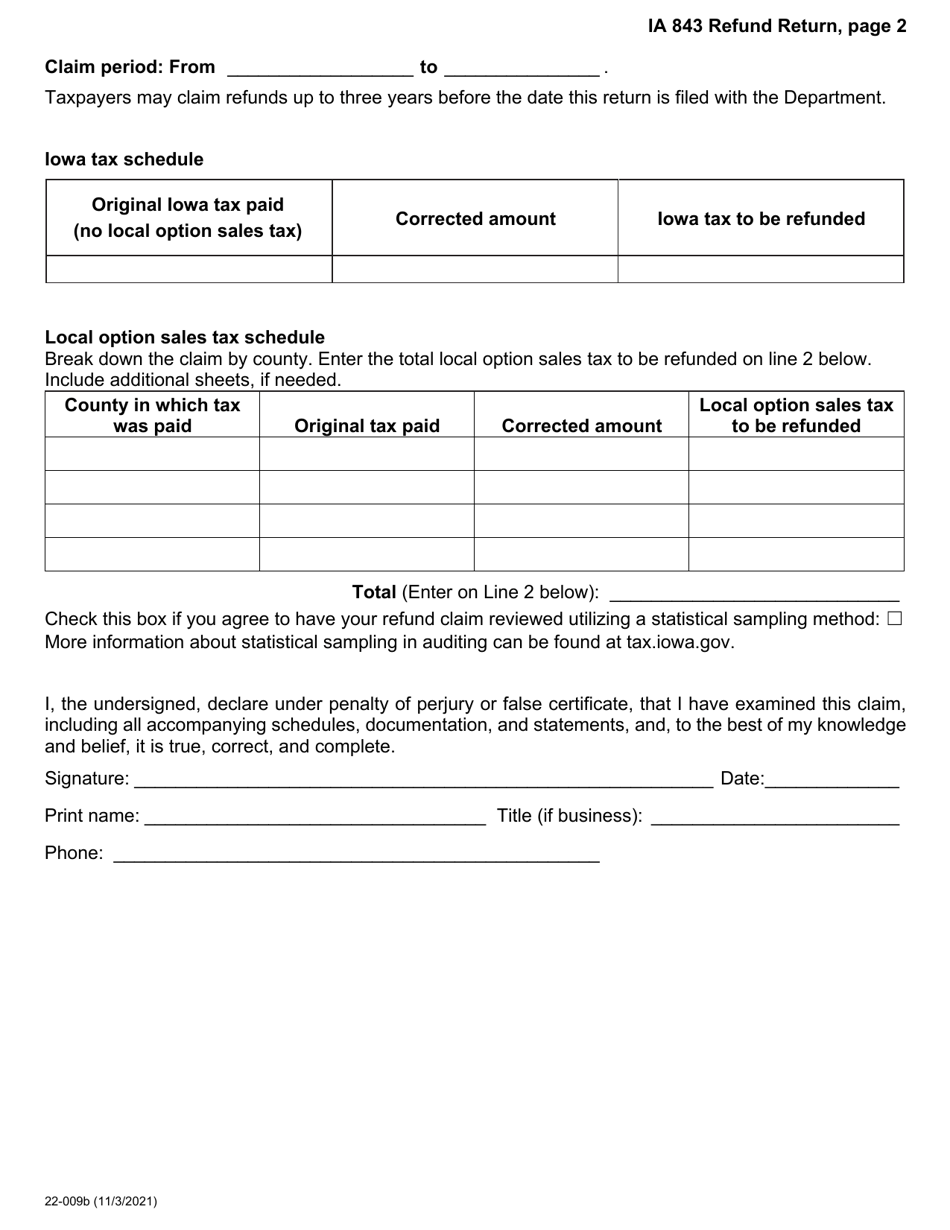

Form IA843 (22-009) Refund Return - Sales, Use, Excise, and Local Option Tax - Iowa

What Is Form IA843 (22-009)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA843?

A: Form IA843 is a refund return for sales, use, excise, and local option tax in Iowa.

Q: What taxes can be refunded using Form IA843?

A: Form IA843 can be used to request a refund for sales, use, excise, and local option taxes.

Q: Who can use Form IA843?

A: Form IA843 can be used by individuals, businesses, and organizations who want to request a refund for qualifying taxes paid in Iowa.

Q: What information is required on Form IA843?

A: Form IA843 requires information such as the taxpayer's name, contact information, tax account number, and details of the taxes being claimed for refund.

Q: How often can I file Form IA843?

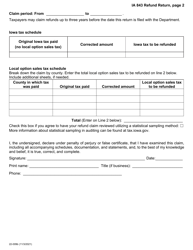

A: Form IA843 can be filed quarterly, annually, or for a one-time refund request, depending on the taxpayer's circumstances.

Q: Is there a deadline for filing Form IA843?

A: Yes, there is a deadline for filing Form IA843. The specific deadline can vary depending on the type of tax being claimed for refund.

Q: Are there any eligibility requirements for claiming a refund using Form IA843?

A: Yes, there are eligibility requirements for claiming a refund using Form IA843. The taxpayer must have overpaid or been erroneously charged the taxes being claimed for refund.

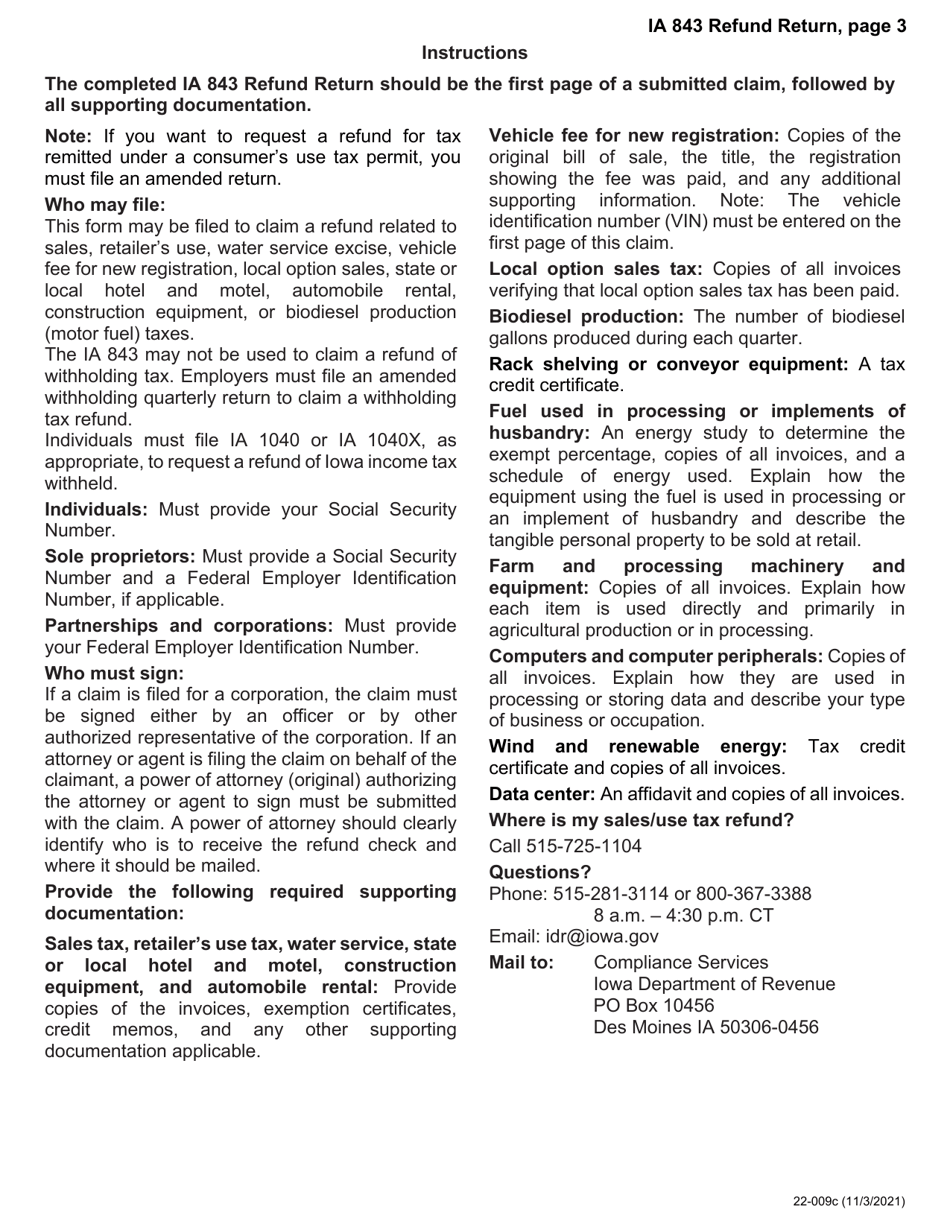

Q: What supporting documentation is required with Form IA843?

A: Supporting documentation such as sales receipts, invoices, and other proof of payment may be required to substantiate the refund claim.

Q: How long does it take to receive a refund after filing Form IA843?

A: The processing time for Form IA843 refund requests can vary. It is recommended to allow a minimum of 60 days for processing.

Q: Can I e-file Form IA843?

A: Currently, Form IA843 cannot be e-filed. It must be filed by mail or in person at the Iowa Department of Revenue.

Q: What should I do if there is an error on the Form IA843 I already submitted?

A: If there is an error on the Form IA843 that has already been submitted, you should contact the Iowa Department of Revenue to rectify the situation.

Form Details:

- Released on November 3, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA843 (22-009) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.