This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA123 (41-123)

for the current year.

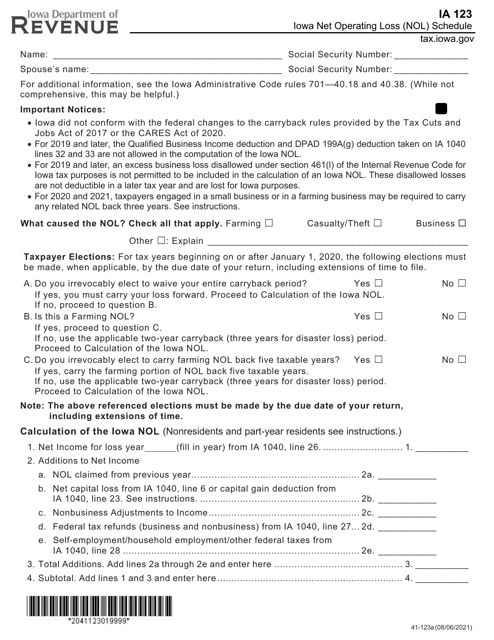

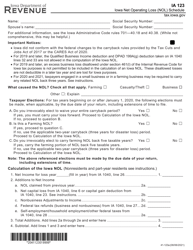

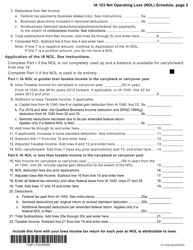

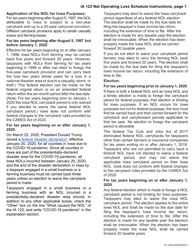

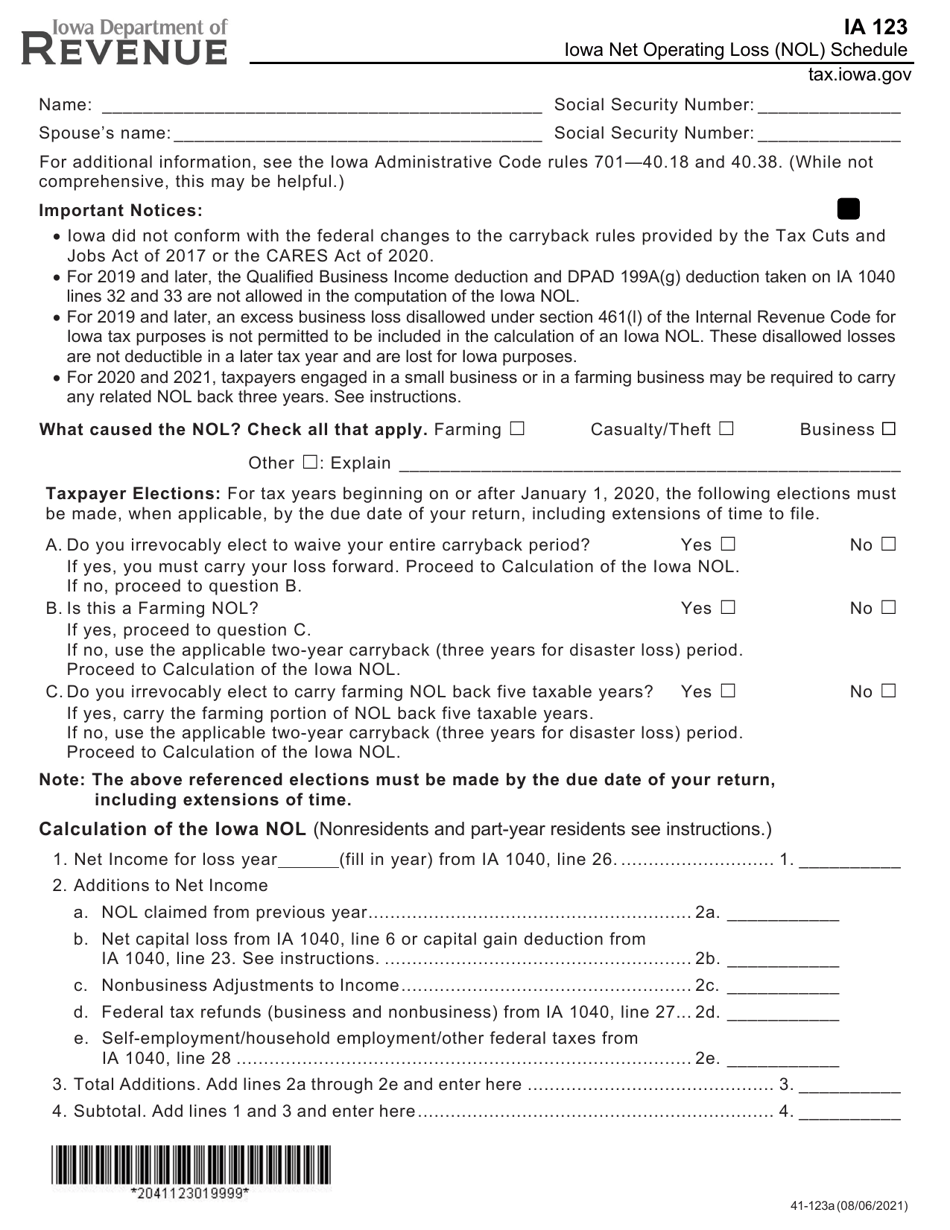

Form IA123 (41-123) Iowa Net Operating Loss (Nol) Schedule - Iowa

What Is Form IA123 (41-123)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA123?

A: Form IA123 is the Iowa Net Operating Loss (NOL) Schedule.

Q: What is the purpose of Form IA123?

A: The purpose of Form IA123 is to report and calculate the Iowa Net Operating Loss (NOL).

Q: When should I use Form IA123?

A: You should use Form IA123 if you have a net operating loss (NOL) from your Iowa business.

Q: What information do I need to fill out Form IA123?

A: You will need to gather information about your net operating loss (NOL) from your Iowa business, including income and deductions.

Q: Are there any specific instructions for filling out Form IA123?

A: Yes, you should refer to the instructions provided with the form for detailed guidance on how to fill it out.

Q: Can I e-file Form IA123?

A: Yes, you can e-file Form IA123 if you choose to.

Q: When is the deadline to file Form IA123?

A: The deadline to file Form IA123 is the same as the deadline to file your Iowa individual income tax return.

Q: Is there a fee for filing Form IA123?

A: No, there is no fee for filing Form IA123.

Q: What should I do with Form IA123 after I fill it out?

A: You should keep a copy of Form IA123 for your records and submit it along with your Iowa individual income tax return.

Form Details:

- Released on August 6, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA123 (41-123) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.