This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA163 (42-039)

for the current year.

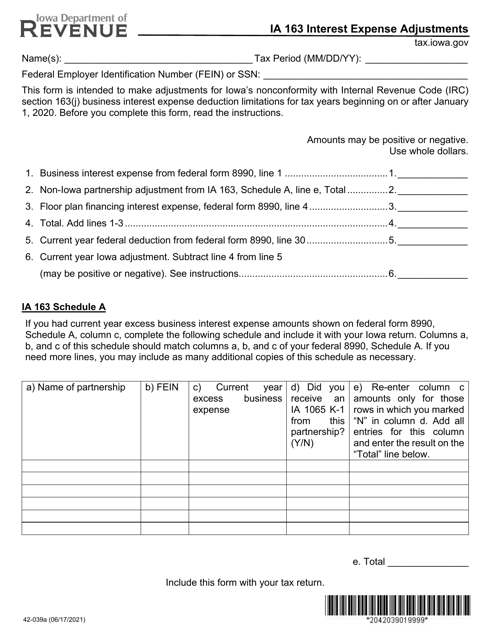

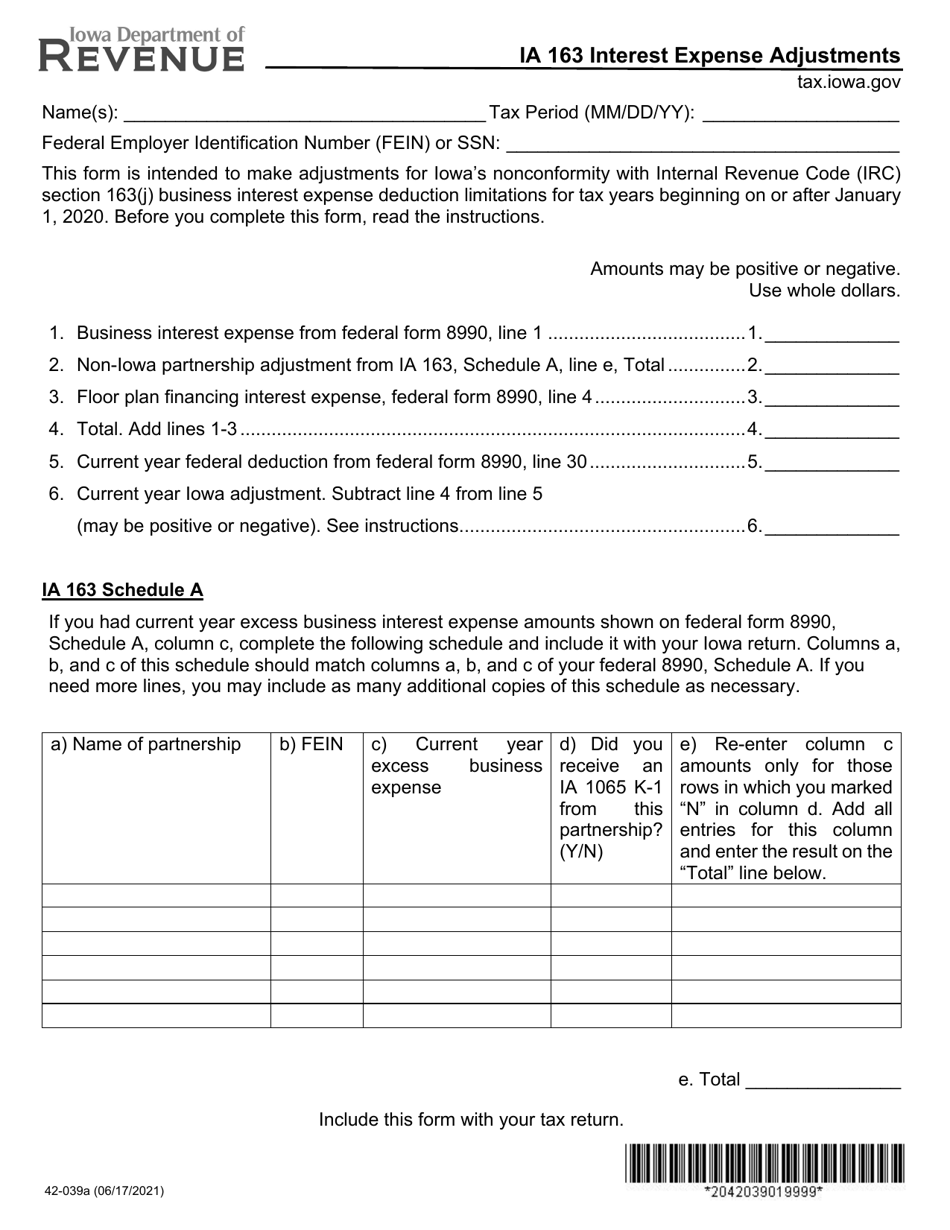

Form IA163 (42-039) Interest Expense Adjustments - Iowa

What Is Form IA163 (42-039)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IA163?

A: Form IA163 is the Interest Expense Adjustments form for Iowa.

Q: Who needs to file form IA163?

A: Taxpayers in Iowa who have interest expense adjustments to report on their state taxes.

Q: What is the purpose of form IA163?

A: The purpose of form IA163 is to report any adjustments to interest expenses that affect the taxpayer's Iowa state tax liability.

Q: When is form IA163 due?

A: Form IA163 is generally due at the same time as the taxpayer's Iowa state tax return, which is usually April 30th.

Q: Are there any eligibility criteria to file form IA163?

A: Any taxpayer in Iowa who has interest expense adjustments to report can file form IA163.

Q: Are there any penalties for not filing form IA163?

A: If a taxpayer is required to file form IA163 but fails to do so, they may face penalties and interest on any unpaid taxes.

Q: Is form IA163 only for residents of Iowa?

A: No, form IA163 is for anyone who has interest expense adjustments related to Iowa state taxes, including non-residents who earn income in Iowa.

Form Details:

- Released on June 17, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA163 (42-039) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.