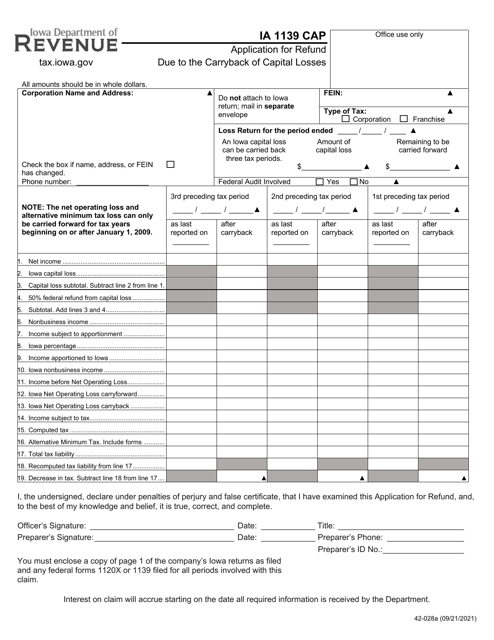

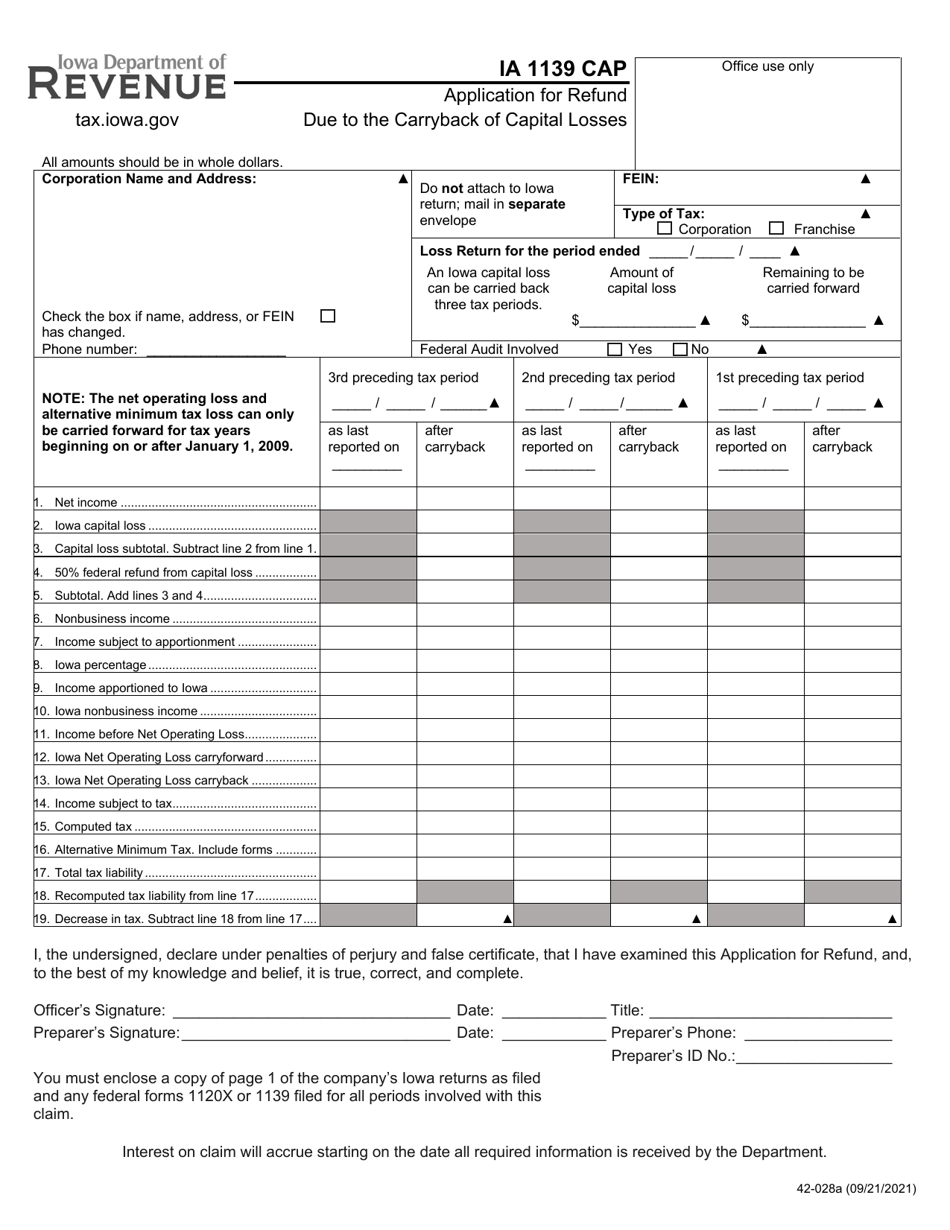

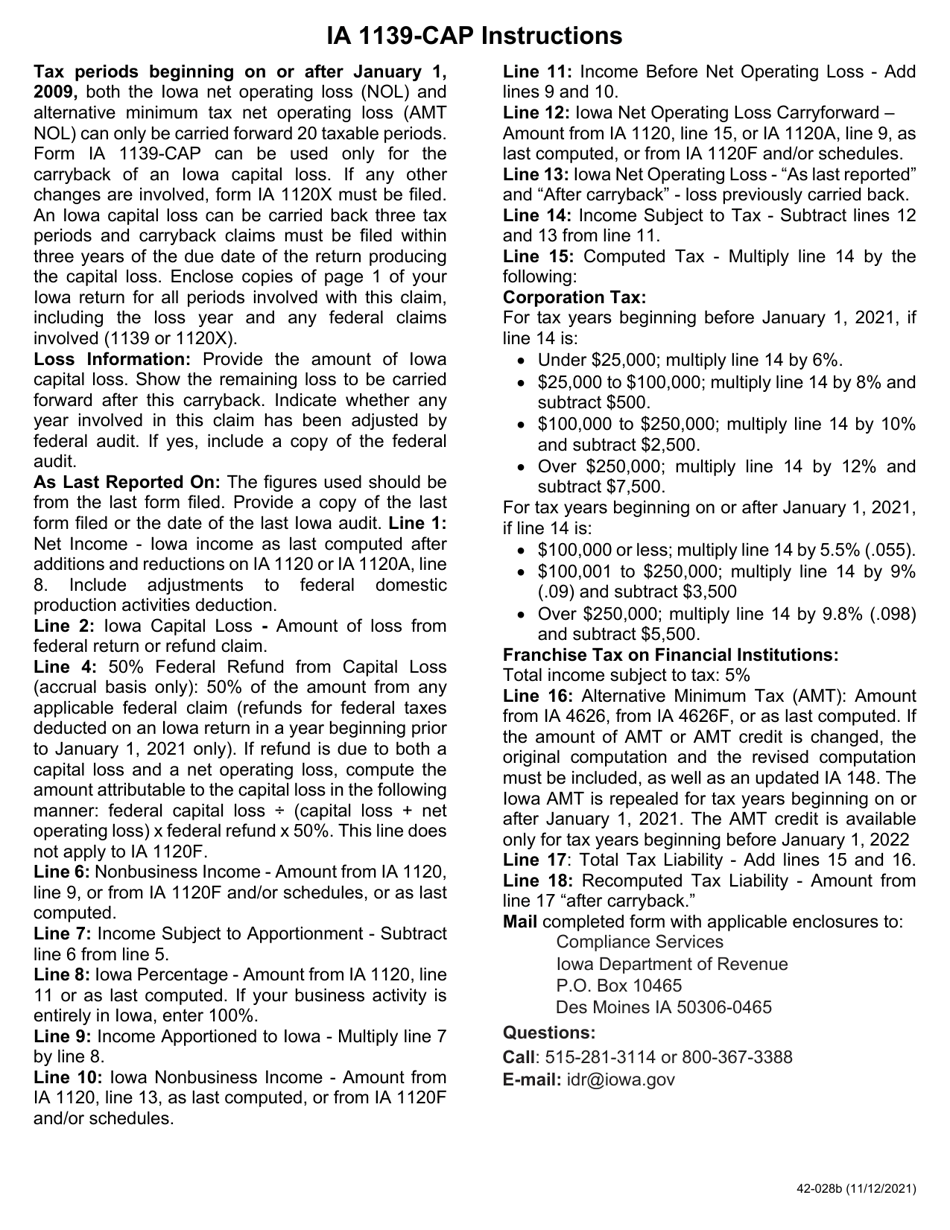

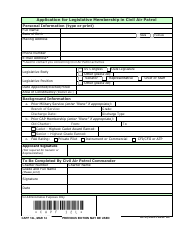

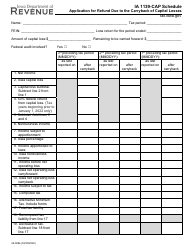

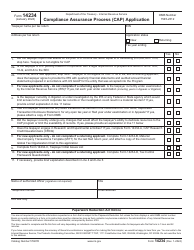

Form IA1139 CAP (42-028) Application for Refund Due to the Carryback of Capital Losses - Iowa

What Is Form IA1139 CAP (42-028)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IA1139 CAP (42-028)?

A: It is the Application for Refund Due to the Carryback of Capital Losses - Iowa.

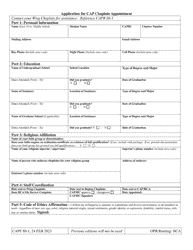

Q: Who uses the Form IA1139 CAP (42-028)?

A: Individuals or corporations in Iowa who want to apply for a refund due to the carryback of capital losses.

Q: What is the purpose of the Form IA1139 CAP (42-028)?

A: The form is used to claim a refund for a capital loss that is carried back to a prior tax year.

Q: Are there any eligibility requirements to use the Form IA1139 CAP (42-028)?

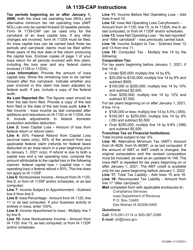

A: Yes, you must have a capital loss that can be carried back to a prior tax year and meet the other requirements outlined on the form.

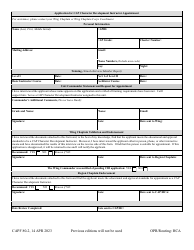

Q: Are there any fees associated with the Form IA1139 CAP (42-028)?

A: No, there are no fees associated with the form.

Q: Is there a deadline for filing the Form IA1139 CAP (42-028)?

A: Yes, the form must be filed within three years from the original due date of the tax return for the year the capital loss was incurred.

Q: Can I file the Form IA1139 CAP (42-028) electronically?

A: No, the form must be filed by mail.

Form Details:

- Released on November 12, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1139 CAP (42-028) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.