This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA1120 (45-010)

for the current year.

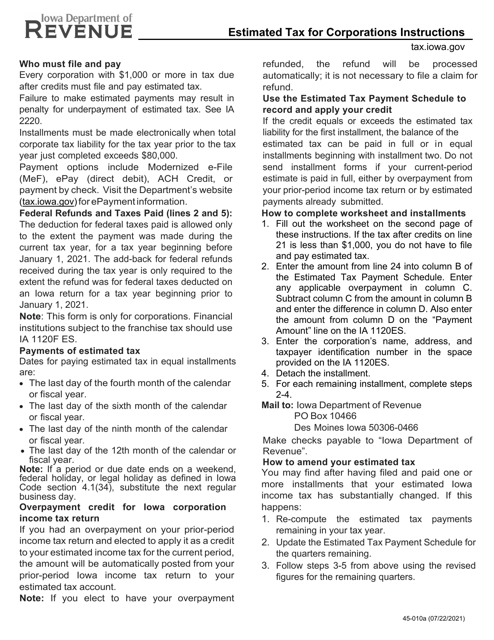

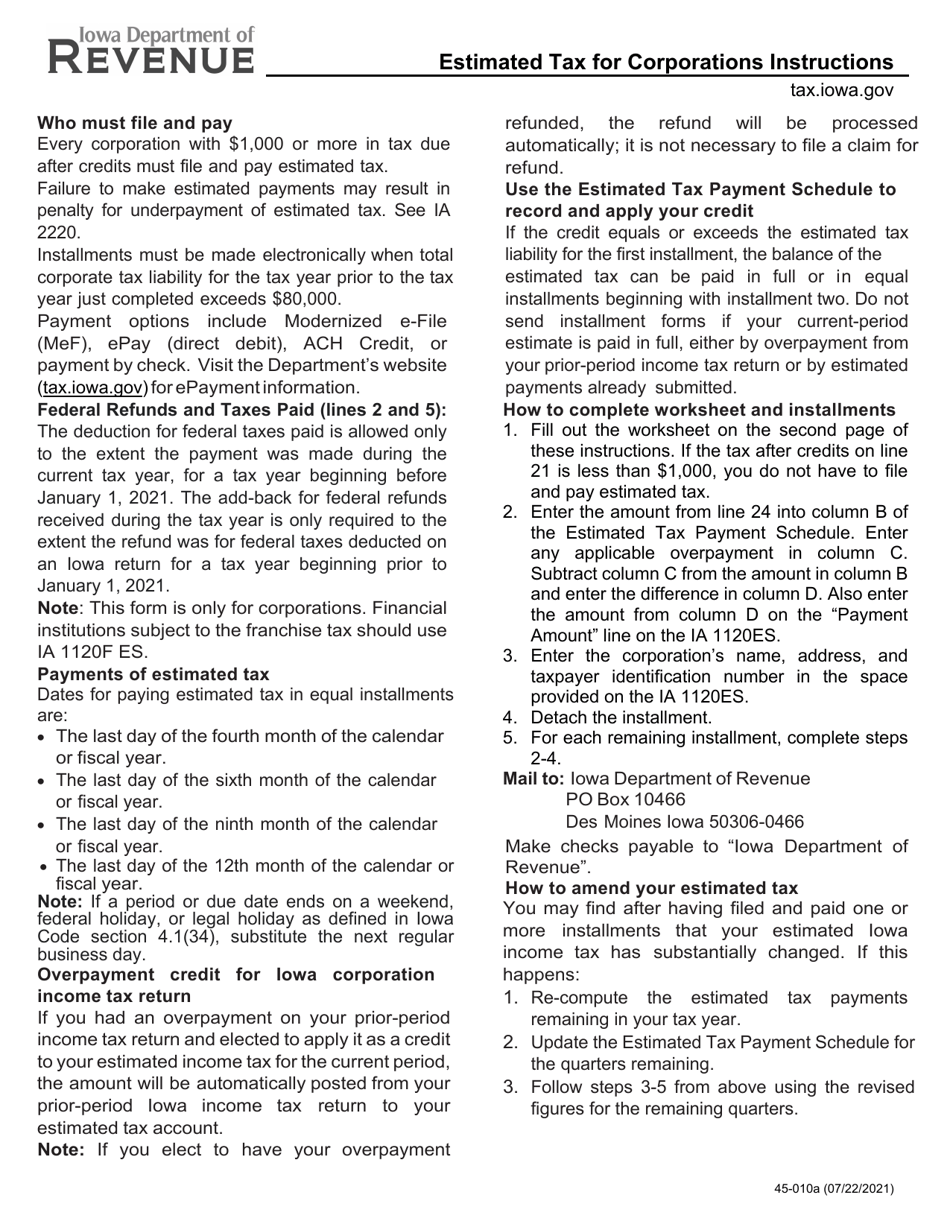

Form IA1120 (45-010) Estimated Tax for Corporations Instructions - Iowa

What Is Form IA1120 (45-010)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1120 (45-010)?

A: Form IA1120 (45-010) is a tax form used for estimating and paying taxes by corporations in Iowa.

Q: Who should use Form IA1120 (45-010)?

A: Corporations in Iowa should use Form IA1120 (45-010) to estimate and pay their taxes.

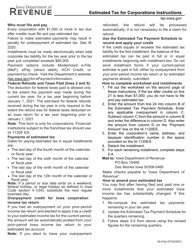

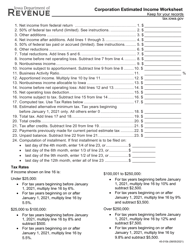

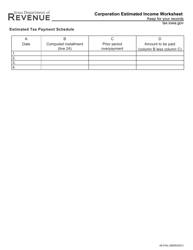

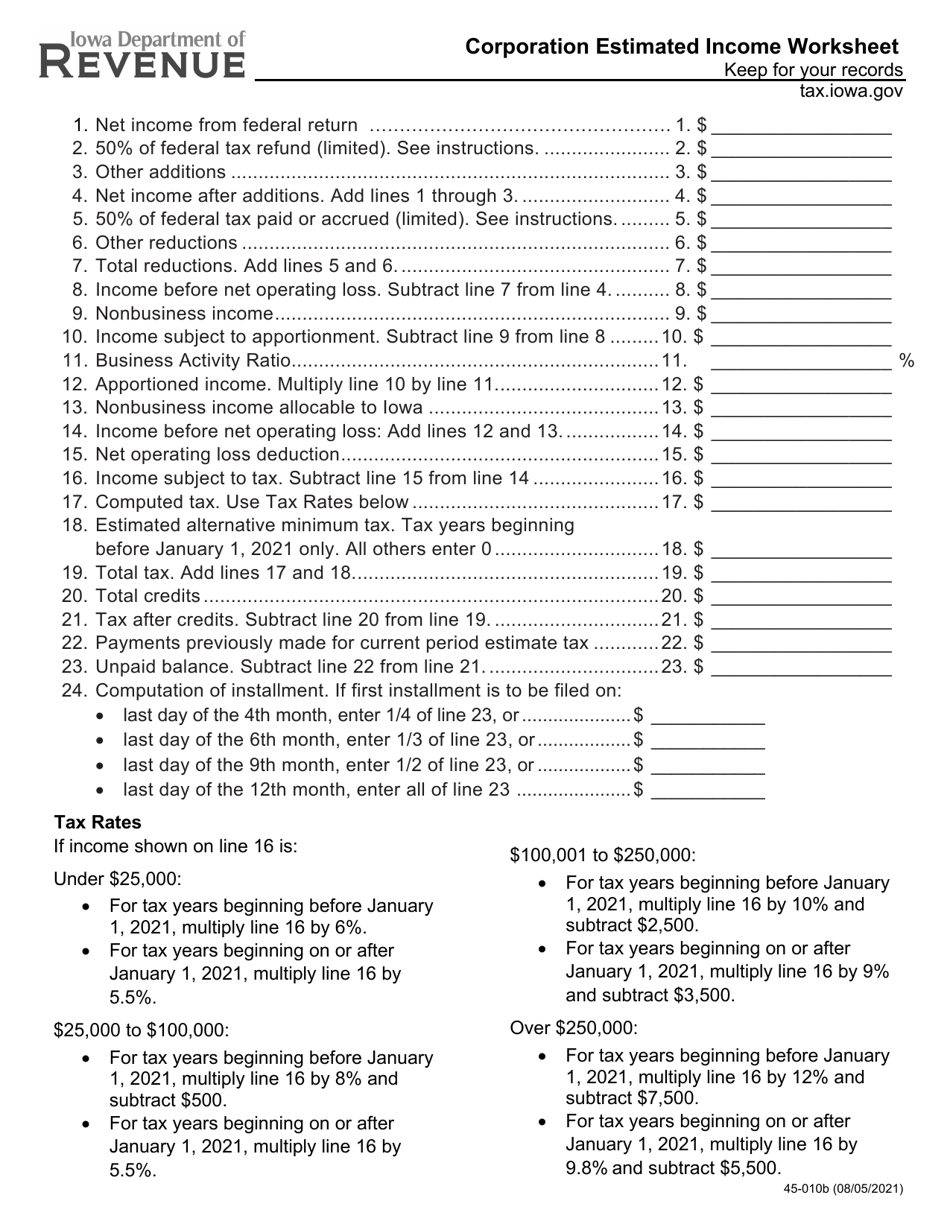

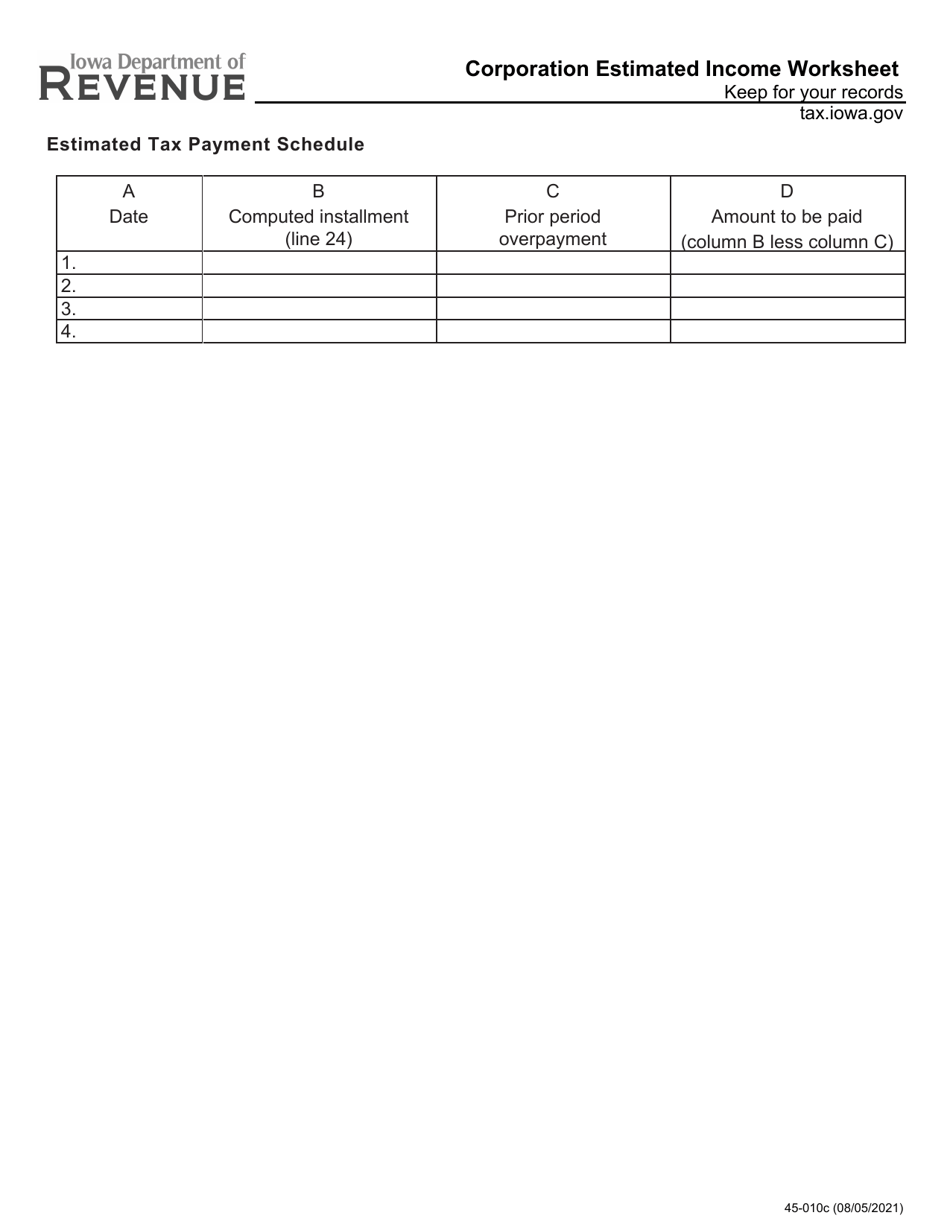

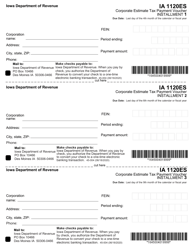

Q: What are the instructions for Form IA1120 (45-010)?

A: The instructions for Form IA1120 (45-010) provide guidance on how tofill out the form and calculate estimated taxes for corporations.

Q: When is Form IA1120 (45-010) due?

A: Form IA1120 (45-010) is due on the 15th day of the 4th month following the close of the tax year for corporations.

Q: What happens if I don't file Form IA1120 (45-010) or pay the estimated taxes?

A: If you don't file Form IA1120 (45-010) or pay the estimated taxes, you may be subject to penalties and interest charges.

Q: Are there any exceptions or special rules for filing Form IA1120 (45-010)?

A: Yes, there may be exceptions or special rules for filing Form IA1120 (45-010) depending on the specific circumstances of the corporation.

Q: Can I file Form IA1120 (45-010) electronically?

A: Yes, you can file Form IA1120 (45-010) electronically through the Iowa Department of Revenue's eFile & Pay system.

Form Details:

- Released on August 5, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120 (45-010) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.