This version of the form is not currently in use and is provided for reference only. Download this version of

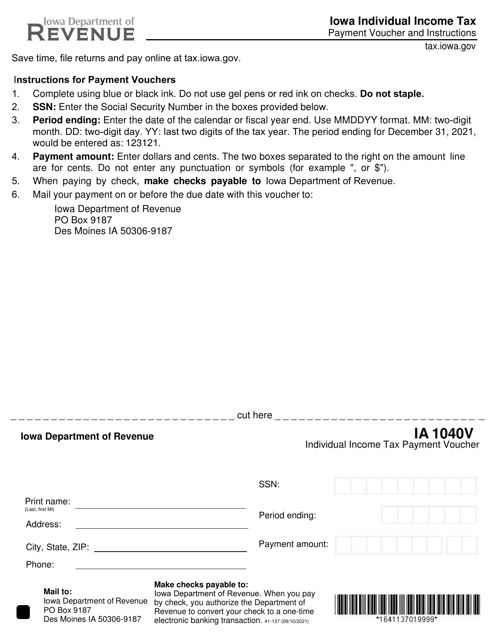

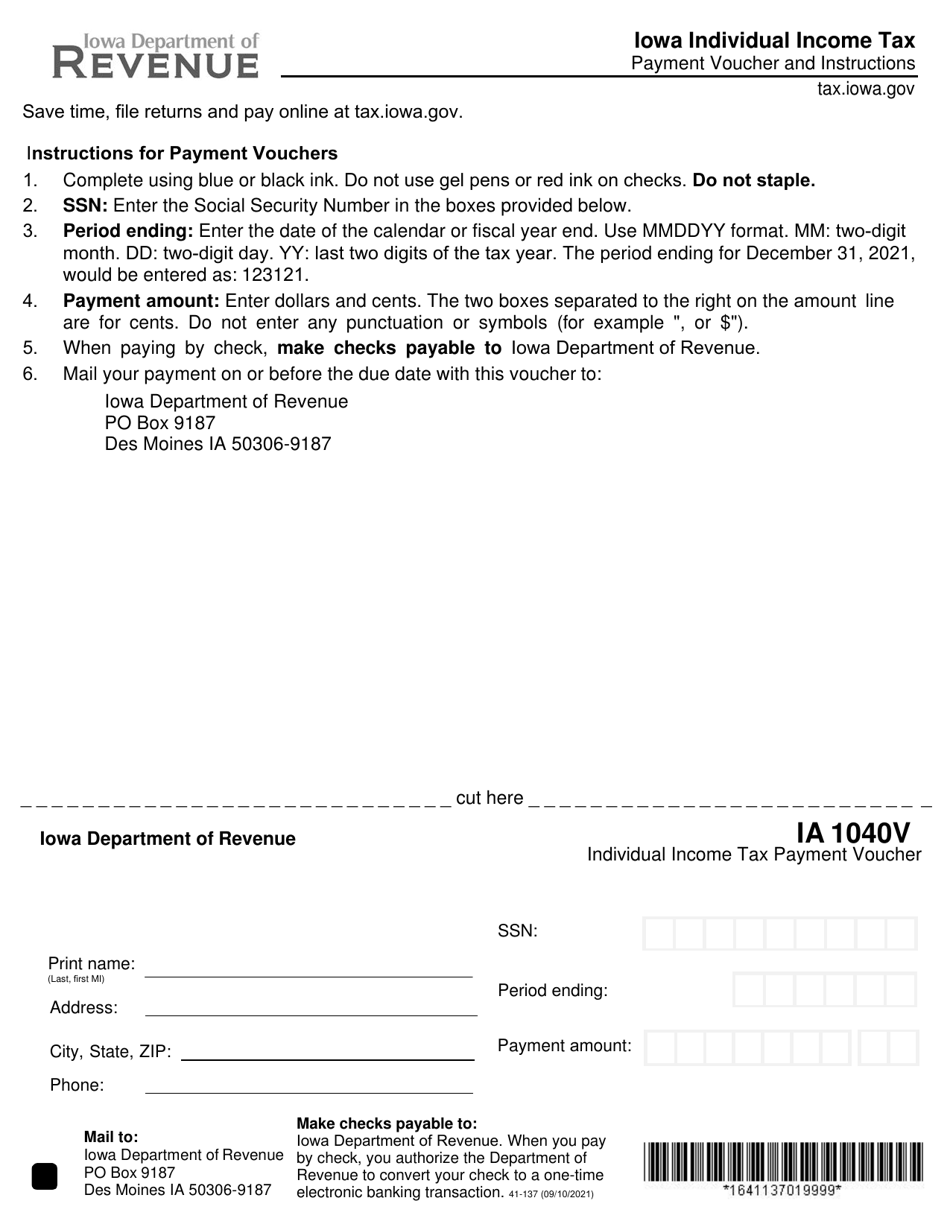

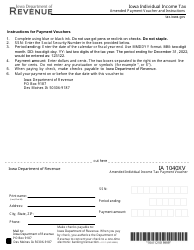

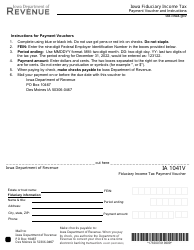

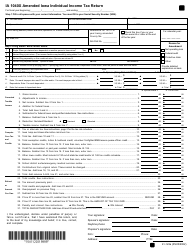

Form IA1040V (41-137)

for the current year.

Form IA1040V (41-137) Individual Income Tax Payment Voucher - Iowa

What Is Form IA1040V (41-137)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

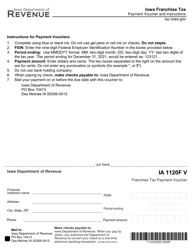

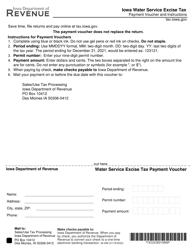

Q: What is Form IA1040V?

A: Form IA1040V is the Individual Income Tax Payment Voucher for Iowa.

Q: What is the purpose of Form IA1040V?

A: The purpose of Form IA1040V is to make a payment towards your Iowa individual income tax.

Q: Who needs to use Form IA1040V?

A: Any Iowa resident or nonresident who owes additional tax after filing their IA 1040 income tax return needs to use Form IA1040V.

Q: When is Form IA1040V due?

A: Form IA1040V is due on or before the same date as your Iowa individual income tax return.

Q: Can I send cash with Form IA1040V?

A: No, cash should not be sent with Form IA1040V. Use a check or money order payable to the Iowa Department of Revenue.

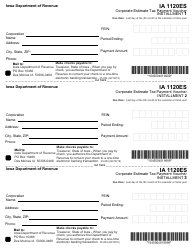

Form Details:

- Released on September 10, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1040V (41-137) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.