This version of the form is not currently in use and is provided for reference only. Download this version of

Form 54-023

for the current year.

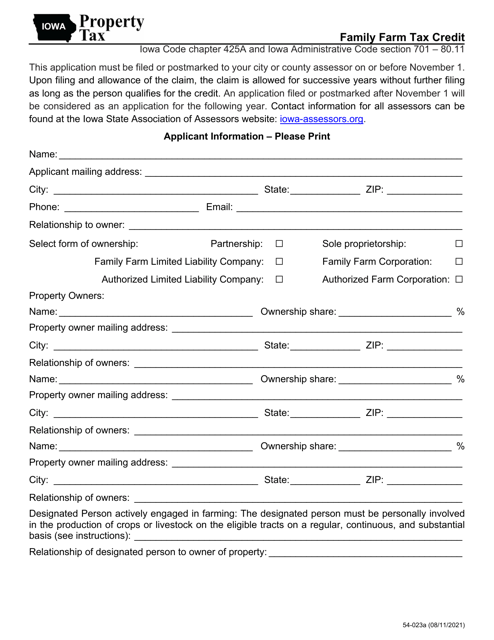

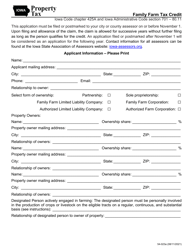

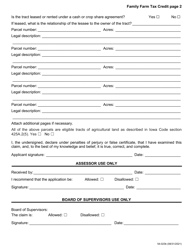

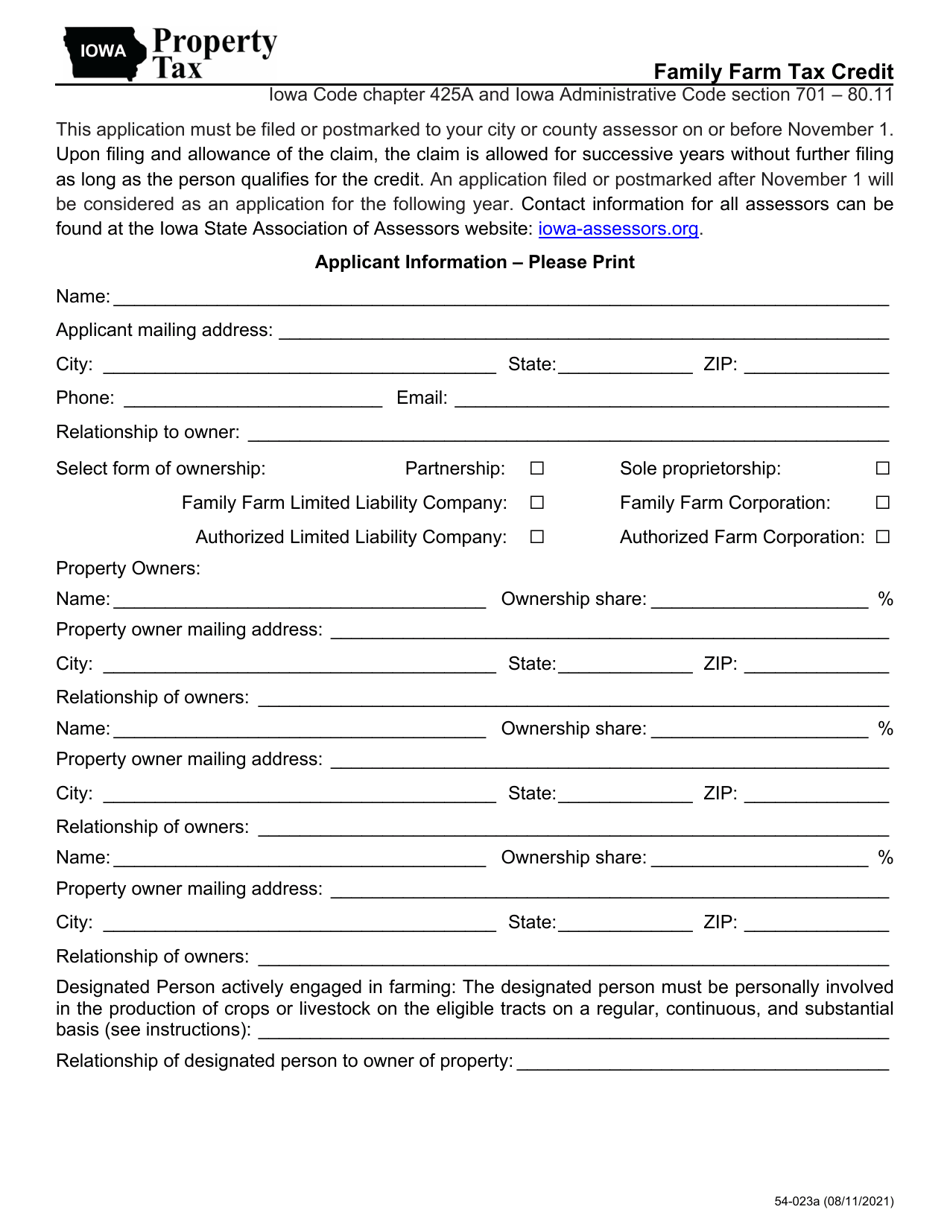

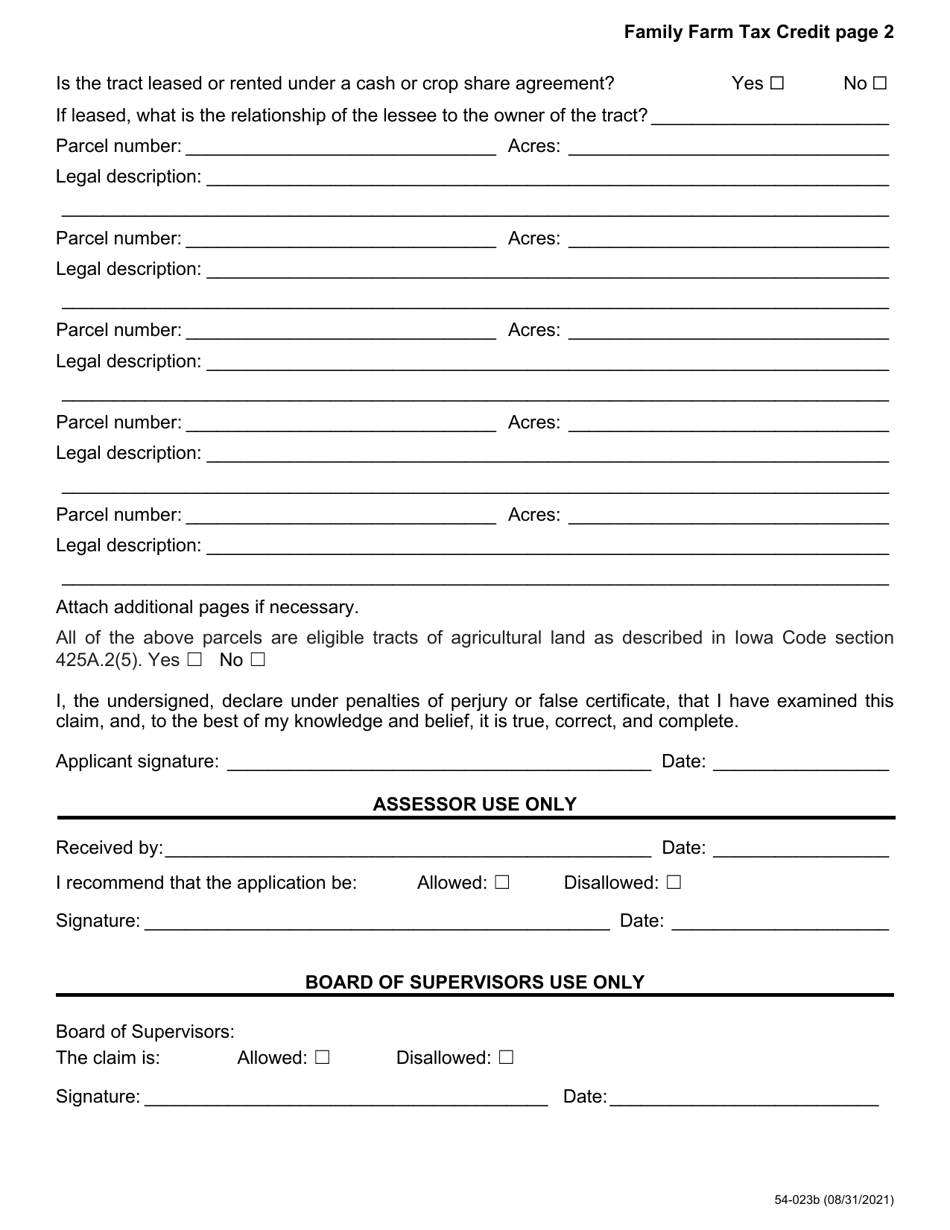

Form 54-023 Family Farm Tax Credit - Iowa

What Is Form 54-023?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 54-023?

A: Form 54-023 is the Family Farm Tax Credit form for the state of Iowa.

Q: What is the Family Farm Tax Credit?

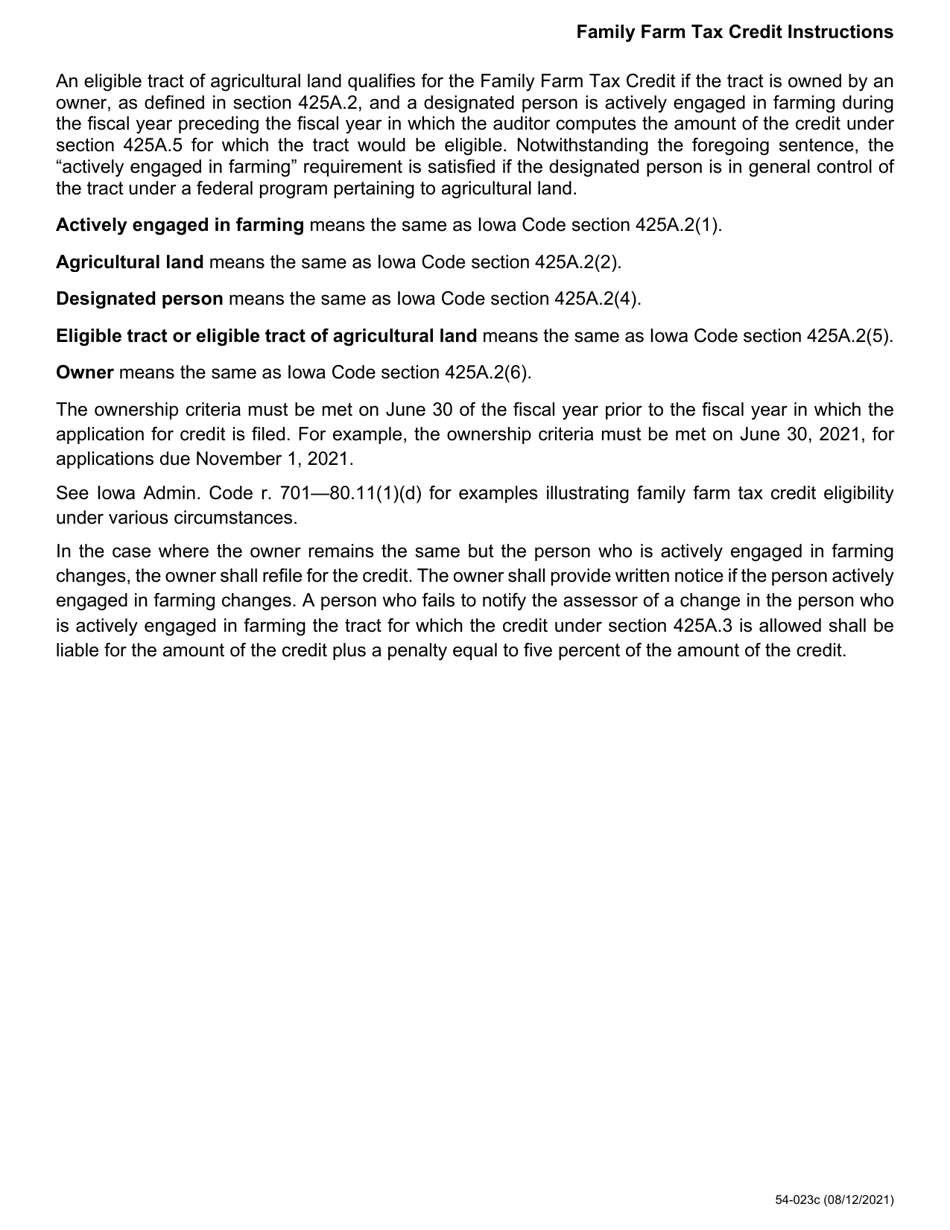

A: The Family Farm Tax Credit is a tax credit available to qualified individuals or entities who own or lease agricultural property in Iowa.

Q: Who is eligible for the Family Farm Tax Credit?

A: To be eligible for the Family Farm Tax Credit, you must meet certain criteria, including being an individual or entity engaged in farming and meeting certain income requirements.

Q: How can I apply for the Family Farm Tax Credit?

A: You can apply for the Family Farm Tax Credit by completing Form 54-023 and filing it with the Iowa Department of Revenue.

Q: What is the deadline for filing the Form 54-023?

A: The deadline for filing Form 54-023 is typically April 1st of the year following the tax year in which the credit is claimed.

Q: Are there any restrictions on the use of the Family Farm Tax Credit?

A: Yes, there are restrictions on the use of the Family Farm Tax Credit. The credit cannot exceed the individual or entity's Iowa income tax liability.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-023 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.